Transportation as a Service (TaaS) is quickly rising and is taken into account by many to be the way forward for transportation. By means of TaaS, automobile possession charges will finally decline. As a substitute of proudly owning a automobile, folks will have the ability to purchase journeys, miles or experiences with out having to take care of their very own car.

What’s TaaS – Transportation as a Service?

Not way back, proudly owning a automobile was a mark of maturity. It was an indication of independence, in addition to a option to get to and from work. Over time, this case has step by step began to alter. City areas have grown, which has made public transportation extra widespread. Because of carbon dioxide ranges, mankind is now looking for methods to cut back our carbon footprint. TaaS is one potential answer.

TaaS is a brand new mindset. As a substitute of specializing in automobile possession, TaaS includes renting automobiles and related practices. As an illustration, Uber and Lyft are each examples of TaaS. As a substitute of getting to personal your personal automobile, you need to use a ridesharing app to rent a automobile once you want a trip.

TaaS can be known as Mobility as a Service (MaaS). Whereas TaaS could contain an app like Uber and a human driver proper now, this is not going to at all times be the case. In only one to 2 years, Goldman Sachs expects the primary semi-autonomous automobile to turn out to be commercially obtainable.

TaaS is necessary as a result of right this moment’s vehicles spend most of their time parked. Throughout the globe, the standard car is idle throughout 95% of the day. Related vehicles and rideshares can do away with this idle time. As a substitute of a number of folks utilizing their vehicles to commute to work every day, the identical folks might hire a automobile and forego automobile possession.

What’s TaaS Expertise?

In lots of cities, TaaS automobiles will probably be obtainable 24 hours a day. Whereas the typical particular person solely makes use of their automobile about 4 % of the time, a TaaS car will sometimes be used for 10 instances extra minutes every day. TaaS will work like public transportation does right this moment, however it would mix personal transportation suppliers right into a gateway like an app. Then, folks can entry the gateway every time they should reserve and pay for a trip.

Should you drive 15,000 miles per yr, you’ll be able to count on to spend a median of $8,469 a yr in your car. You need to pay for automobile insurance coverage, gasoline, upkeep prices and automobile funds. By switching to TaaS, you could possibly save a whole lot or 1000’s of {dollars} per yr.

Aside from saving cash, many individuals select TaaS to get extra free time. Should you should not have to drive in your commute, you’ll be able to work on one thing else. Then, you’ll be able to take pleasure in spending time with your loved ones as soon as you come back house. Throughout your commute, you can too spend time studying a language, studying a guide or having fun with your favourite interest. In 2018, the typical American spent 225 hours commuting. To place this in perspective, it solely takes 480 hours to study Spanish. And It takes round 45 hours to drive from the Atlantic Ocean to the Pacific Ocean.

TaaS has already been adopted by all kinds of firms. DoorDash, GrubHub, Amazon Prime Supply and Postmates already ship merchandise to houses throughout the nation. By means of WaiveCar or Turo, you’ll be able to even lease your private car or discover a car you’ll be able to lease. Different automobile leases like Getaround, Zipcar and aGo will allow you to hire a car everytime you want it. In the meantime, Ridesharing, GoNanny, Uber, Zimride and Lyft supply rideshare companies.

What Are the Penalties of Transportation as a Service?

The primary automobile dealership in the US was established in 1898. Since that point interval, dealerships have adopted a reasonably primary enterprise mannequin. To stop car producers from competing with dealerships, many states required dealerships to function the intermediary. By means of TaaS and self-driving vehicles, this complete enterprise mannequin could change. Finally, producers could even promote automobiles on to shoppers.

If shoppers buy a car in any respect, it would solely be for a brief time frame. Whereas there are various ways in which TaaS could possibly be carried out, one possibility is for a self-driving automobile developer like Tesla or Google to personal a whole fleet of self-driving vehicles. Then, the shopper will pay per mile or minute. As a result of self-driving vehicles don’t require a human driver, the price of renting a car will drop considerably.

Decrease demand for automobiles signifies that there will probably be decreased demand for parking tons and garages as nicely. Usually, parking tons earn cash by renting out parking areas by the hour, day or month. If folks pay for rides as a substitute of proudly owning vehicles, the necessity for parking tons can be nearly eradicated.

Is TaaS a Good Funding?

Corporations that promote self-driving vehicles are prone to carry out nicely if TaaS leads the best way ahead. Different producers could wrestle as a result of fewer folks will probably be buying vehicles. Moreover, firms that run parking tons and garages will find yourself incomes much less. Finally, many parking tons and garages in large cities could also be offered and transformed.

TaaS is conveniently constructed round 4 macro developments. Aside from environmental, social and company governance (ESG) investing, it incorporates connectivity, the gig financial system and electrical automobiles. Finally, the TaaS business will turn out to be an $8 trillion market because it expands into areas like drone supply, freight, distribution, meals supply and private transport.

These developments are already going down. As extra folks flip to TaaS choices, automobile gross sales have fallen. World car gross sales dropped by 22% in 2020. Even with out the pandemic, auto gross sales fell by 4% in 2019. This decline was the primary time in a decade that car gross sales dropped.

TaaS Might Be 10x Cheaper

In line with some estimates, TaaS will probably be 10 instances cheaper than conventional automobile possession. In contrast to conventional automobile possession, you’ll not have to alter the oil or search for a parking spot. Already, the market is responding to those modifications. In 2009, Uber initially opened up. Inside simply seven years, Uber was already reserving extra rides than the complete American taxi business.

The iGeneration has fueled the surge in TaaS utilization. Again in 1983, greater than 50% of youngsters had a driver’s license by the age of 16. In 2016, solely 25 % of youngsters had a license by the identical age. These younger individuals are utilizing TaaS to hang around with mates, go to eating places and go to their favourite retailers.

Finally, the most important takeaway is that buyers and cities want to arrange now. Because the transportation business adapts and modifications, everybody else must alter as nicely. From fewer parking garages to lowered car gross sales, TaaS goes to have a significant affect on particular industries. Whereas the general affect of TaaS goes to be optimistic, there will probably be important rising pains alongside the best way.

Disrupters Reshape Industries

The next concepts come from Developments Skilled Matthew Carr who has been intently following (TaaS) know-how as a service and its broader affect.

Over the previous couple of a long time, we’ve witnessed disrupters utterly reshape industries. Fb (Nasdaq: FB) and Twitter (NYSE: TWTR) launched new methods for people to speak and work together. Social media is now one of the highly effective promoting platforms on the planet.

The streaming service Netflix (Nasdaq: NFLX) not solely created a mannequin that dozens of different firms now emulate but in addition produces a few of the finest content material on the market. The studio receives scores of Oscar, Golden Globe and Emmy nominations and awards annually.

E-commerce giants Alibaba (NYSE: BABA) and Amazon (Nasdaq: AMZN) are the templates that the entire retail business appears to be like to duplicate. Tesla (Nasdaq: TSLA) is pulling the complete automotive business towards mass electrical car adoption.

In actual property, there’s Opendoor Applied sciences (Nasdaq: OPEN) and Zillow Group (Nasdaq: Z). And in finance, there’s Bitcoin and the defi motion. To not point out the potential for blockchain. The record goes on and on. Many early buyers in every of those disrupters have been rewarded with life-changing returns.

What are the TaaS Shares?

Now, in TaaS, Uber (NYSE: UBER) and Lyft (Nasdaq: LYFT) have flipped the ride-hailing business on its head. In actual fact, long-coveted taxi medallions in New York and different cities have plummeted in worth. And these two stand to learn within the continued growth of TaaS over the subsequent couple a long time.

However these firms are removed from equals. Lyft posted annual income in 2021 of $3.2 billion and is projected to leap greater than 41% to $4.33 billion in 2022.

Uber – because of Uber Eats and its current acquisition of Drizly – posted income of $17.4 billion in 2021 and is projected to see 2022 income soar 28% to $22.32 billion.

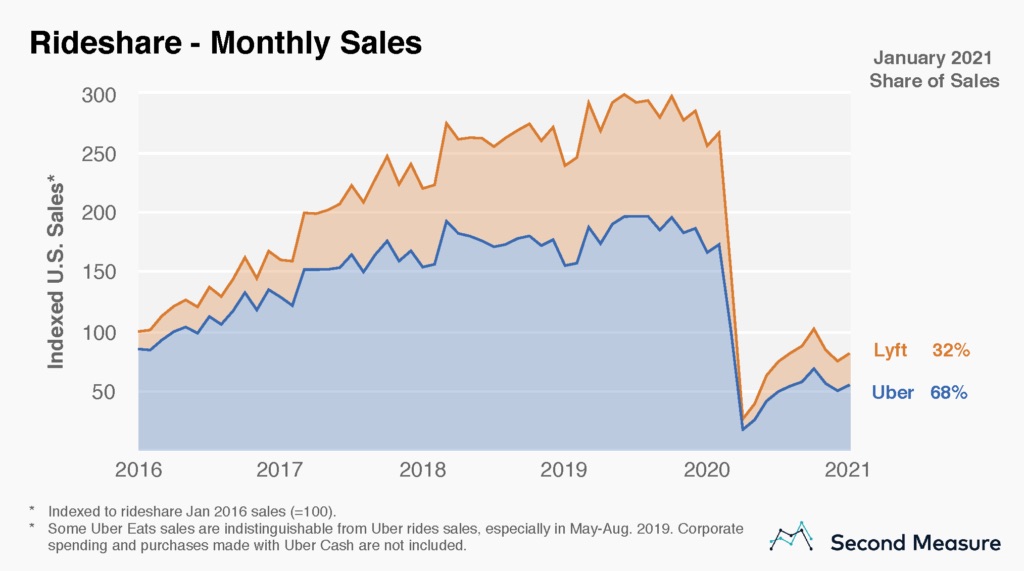

And within the American trip sharing market, Uber is the extra dominant power. It presently controls 68% of the market, whereas Lyft holds the remaining.

However what’s superb is, that only a few shoppers use each. That is an fascinating knowledge level. You see, many People depend on subscriptions to Netflix, Hulu, Disney+ and Amazon Prime Video. Although, relating to ride-sharing, solely 10% of shoppers use each Uber and Lyft.

Newest TaaS Expertise Corporations to Watch

However there’s a brand new disrupter about to go public. Joby Aviation (NYSE: JOBY) is hoping to deliver a few of this sci-fi magic to hundreds of thousands of commuters. Over the previous 10 years, the corporate has developed a zero-emission, all-electric, vertical takeoff and touchdown (eVTOL) plane designed to leapfrog visitors congestion.

Every plane will carry one pilot and 4 passengers for journeys of wherever from 5 to 150 miles at a prime pace of 200 mph. These are the taxis of the long run. The following evolution in ride-hailing after Uber and Lyft. In actual fact, Uber was engaged on this concept however offered its section to Joby in December. And it agreed to make a $75 million funding within the firm.

Joby’s eVTOL taxi idea acquired a $394 million funding from Toyota (NYSE: TM) as nicely. The corporate’s purpose is to save lots of 1 billion folks an hour of commute time every day and to perform this in an environmentally pleasant approach.

Joby plans to have industrial passenger plane in operation as early as 2024. And as soon as these are up and working, its enterprise ought to, actually, take off.

Income Forecasts

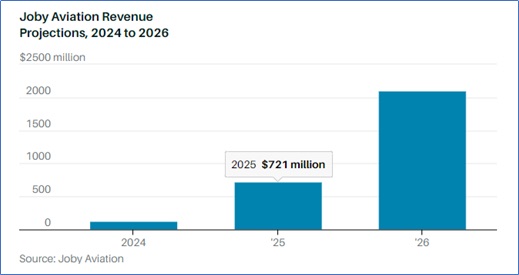

The corporate forecasts it would make $721 million in income by 2025. And it tasks that quantity will greater than double by 2026. By then, the corporate believes every plane will generate $2.2 million in annual income with roughly 850 plans in service.

Over the subsequent decade, Joby plans to have a complete of roughly 14,000 automobiles producing $20 billion in income. It expects to have a presence in at the least 20 cities worldwide, with recurring income from its plane section accounting for greater than 50% of annual gross sales.

These are lofty forecasts. However Joby is additional forward than its opponents are. Joby went public by means of a merger with the particular objective acquisition firm (SPAC) Reinvent Expertise Companions (NYSE: RTP).

This deal valued the corporate at $6.6 billion. That appears steep contemplating there isn’t a actual income but. However the alternative for the air mobility market is upward of $500 billion within the U.S. Globally, this chance is forecast to prime $1 trillion.

TaaS is just not solely the way forward for transportation, it’s one of the dominant forces available in the market proper now. However over the subsequent couple of years, it’s going to evolve quickly and you could possibly get in on the bottom ground.

Keep tuned for the most recent investing information on TaaS and different rising applied sciences.