KanawatTH

Abstract

Readers might discover my earlier protection through this hyperlink. My earlier ranking was a purchase, as I believed Couchbase (NASDAQ:BASE) would proceed rising by using on the trade tailwind. The inventory would react positively if BASE had been to achieve profitability as effectively. I’m reiterating my purchase ranking for BASE as I see optimistic progress catalysts that can allow BASE to fulfill administration steerage. Because it does, valuation on the present 4.2x ahead income ought to be sustainable.

Financials/Valuation

BASE reported sturdy 3Q24 outcomes once more, with ARR (annual recurring income) rising by 24% y/y to $189 million, beating the high-end of steerage. The enterprise additionally reported income of $46 million, which beat consensus as effectively. The sturdy ARR and income efficiency had been pushed by sturdy demand consumption for Capella and energy within the enterprise enterprise. As I anticipated, BASE continued to maneuver in direction of profitability as effectively, with EBIT margins coming in at -11%, which was 1000bps forward of consensus expectations.

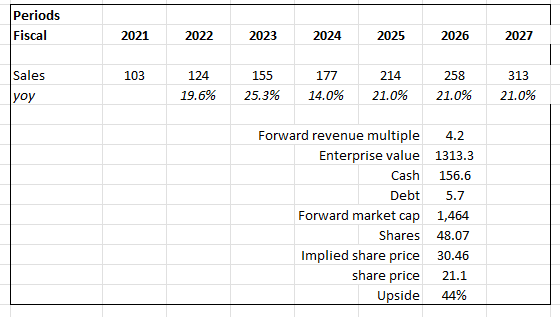

Primarily based on creator’s personal math

Whereas the inventory has reached my earlier value goal of $22, I consider there may be nonetheless enticing upside from right here given the brand new progress drivers that I anticipate to assist obtain administration’s medium-term steerage. Relative to my earlier assumptions, I’m now anticipating FY25-FY27 to develop at 21%, in keeping with the administration progress information of >20%. I might word right here that 21% is likely to be downplaying the potential progress, as BASE ARR is already rising at 24% in 3Q23. With a greater progress profile, I consider the inventory ought to be buying and selling greater than it did beforehand (3x ahead income), and it seems that the market has already mirrored this as valuation went as much as 4.2x ahead income. I’m assuming valuation will keep at this stage, provided that it’s on the historic common. Nonetheless, I might word that MongoDB is at the moment buying and selling at 13.5x ahead income, with a progress profile of >20%, and continues to be loss-making. The important thing distinction between MongoDB and BASE is that MongoDB has a a lot bigger income base ($1.6 billion vs. BASE’s $100+ million). I might anticipate BASE valuation to enhance over time and shut its hole with MongoDB because it scales, however I’m not modeling this at present for conservative sake.

Feedback

BASE introduced its Analyst Day simply 2 weeks in the past, and I’ve lastly received time to evaluation them (after all of the celebrations throughout the festive season). At a excessive stage, I actually like the data that administration introduced, and I believe the inventory ought to proceed to react favorably.

Initially, from a progress perspective, I do not see any hurdles which might be stopping BASE, as the corporate is seeing a comparatively unchanged aggressive setting. That’s to say, BASE continues to see competitors from legacy relational database distributors similar to Oracle, purpose-built NoSQL distributors similar to MongoDB, and hyperscalers like Amazon. If readers had been to recall what I wrote final 12 months in my initiation publish, I mentioned how BASE is well-positioned to seize share as its database is constructed with trendy expertise. Certainly, administration talked about within the presentation that prospects are migrating to Capella. Apparently, since prospects normally don’t consider the competitors in full throughout a transition, administration doesn’t understand a lot further danger from competitors.

When it comes to aggressive panorama, we will section our rivals into three cohorts. The legacy RDBMS techniques like Oracle and IBM. Hear, I’ve labored in a few of these corporations myself.

We do not see the door getting open from a aggressive perspective. I might say our prospects take pleasure in what they get from enterprise at present, they usually’re seeking to get the TCO that will get delivered with Capella. Analyst day

Subsequent, I believe a significant focus of the presentation was on cloud transition, which I see as a powerful catalyst for progress within the coming years. At Analyst Day, Capella, the corporate’s absolutely managed DBaaS product, accounted for greater than 10% of ARR, indicating that the early-stage cloud transition was already underneath approach. Outcomes from 3Q24 present that this transition is gaining steam, with Capella’s NRR (internet retention fee) of 167% exceeding the consolidated 115% LTM NRR by a big margin. Sequential buyer progress accelerated to 25%, a 500bps enchancment from 2Q23, making the efficiency much more commendable. There are two essential issues that can drive progress acceleration sooner or later. As a primary step, BASE will introduce an adoption mannequin that’s much less complicated compared to Couchbase Enterprise. Recall that for Enterprise, it requires a number of back-and-forth with the shopper (dialogue on customization, billing particulars, consumption, and so on.). It is a lengthy and gradual course of earlier than BASE can ebook the shopper billings. With an easier adoption course of, I see this as a powerful catalyst for brand spanking new emblem acquisition acceleration. Particularly, this encompasses a developer group self-service mannequin that may complement BASE’s standard go-to-market technique and channel distribution by serving as a conversion funnel for Capella. Secondly, to make this new adoption course of extra clean, BASE goes to roll out a function that permits shoppers to start out with a small preliminary workload and have the flexibility to subsequently develop. That is good, for my part, because it reduces the monetary burden for brand spanking new adoptees, and as soon as they understand how helpful it’s, they’ve the flexibleness to extend consumption. From a monetary perspective, it meant that NRR might keep at an elevated stage, relative to historical past, over the medium time period as these “small preliminary workload” shoppers ramped up their consumption. Past Capella’s conventional give attention to high-budget enterprise accounts, I believe the developer-led, lower-friction motion might open up extra alternatives within the downmarket.

With the factors above, it led me to be very bullish on administration’s new medium-term targets, introduced on the analyst day. The information factors to >20% ARR, income progress, and optimistic EBIT in FY27. For reference, BASE is already rising ARR at 24% in 3Q24, and income grew 19%. With the present adoption mannequin, I consider it ought to simply speed up ARR and topline progress to fulfill the steerage. The essential factor is that I believe BASE has an extended approach to go in driving the on-premise to cloud conversions that can hold the mid-term steerage supported. As for optimistic EBIT in FY27, BASE has demonstrated its capability to drive important EBIT margin as income grows (EBIT margin stepped up from -21.4% to -11% sequentially in 3Q24). If income grows as guided (20+% over 3 years), I consider reaching optimistic EBIT will not be a difficulty.

Threat & Conclusion

As a result of consumption ramping from a low base, preliminary income progress instantly after signing the Capella deal would lag behind ARR progress when a buyer migrates from Enterprise to Capella. Consequently, income progress will stay uneven, and huge buyer migrations might have a big influence on progress within the brief to medium time period. The market would possibly see this weak headline progress as an indication of weak spot and unload the inventory.

In conclusion, I reiterate my purchase ranking for BASE. The upcoming progress drivers – Capella’s cloud transition and simplified adoption fashions – ought to assist allow BASE to fulfill administration’s medium-term targets of >20% ARR and income progress, optimistic EBIT in FY27. Because it exhibits that these targets are achievable, I anticipate valuation to be effectively supported by the present 4.2x ahead income.