Do you wrestle to guess when to commerce currencies? Foreign exchange merchants usually discover it arduous to time their trades proper. The foreign money markets may be very unpredictable, resulting in missed possibilities and large losses. However, there’s a solution to get higher: utilizing foreign exchange market cycles evaluation.

This device helps merchants discover when to change instructions, determine the place the market goes, and intention for earnings. By studying about these cycles, you possibly can commerce currencies extra confidently and precisely.

Learning patterns in monetary markets is vital to foreign money evaluation. These patterns, or market cycles, can final from a couple of months to years. By recognizing these cycles, merchants could make smarter decisions about when to purchase or promote. This methodology mixes technical evaluation with an understanding of market psychology, giving a full view of foreign money market actions.

Key Takeaways

Foreign exchange market cycles assist predict foreign money actions.

Cycles embody 4 phases: enlargement, peak, contraction, and trough.

Understanding cycles aids in timing trades successfully.

Cycle evaluation combines technical indicators and market psychology.

Efficient cycle evaluation can enhance buying and selling efficiency.

What Are Market Cycles in Overseas Alternate Buying and selling

Market cycles are key in foreign currency trading. They form how currencies transfer and have an effect on buying and selling decisions. Realizing foreign exchange cycle evaluation helps merchants guess market traits.

Definition and Primary Ideas

Foreign exchange market cycles are patterns in foreign money pair costs. They’ve 4 phases: accumulation, markup, distribution, and markdown. Every section reveals totally different market states and dealer actions.

Significance of Cyclical Patterns

Realizing market cycle phases helps merchants make sensible decisions. By determining the present section, merchants can tweak their plans. As an illustration, within the accumulation section, costs relax after falling, hinting at shopping for possibilities.

Kinds of Market Cycles

Foreign exchange cycles differ in size and power. Brief cycles final a couple of months, whereas lengthy ones final years. Day merchants see many cycles in per week with 15-minute charts. Swing merchants may not see a full cycle in weeks.

Cycle Kind

Length

Dealer Focus

Brief-term

Few months

Day merchants

Medium-term

A number of months to a 12 months

Swing merchants

Lengthy-term

A number of years

Place merchants

Understanding market cycle phases lets merchants make sensible strikes based mostly available on the market. This data is vital for profitable in foreign currency trading.

The 4 Important Phases of Foreign exchange Market Cycles Evaluation

Realizing the foreign exchange market phases is vital to buying and selling success. Cycle evaluation helps merchants spot traits and make sensible decisions. Let’s take a look at the 4 important phases of foreign exchange market cycles.

Accumulation Section Defined

The buildup section begins a brand new cycle. It’s when the market settles after a drop. Sensible buyers purchase low cost belongings, usually in foreign money pairs tied to commodities. This section can final weeks to months.

Markup Section Traits

Costs begin going up within the markup section. Extra merchants be part of, feeling constructive. Quantity goes up, and charts present costs transferring up. This section may be fast, lasting days or even weeks.

Distribution Section Indicators

The distribution section is when the market peaks. Shopping for and promoting steadiness out, with excessive hopes. Tales of success get shared within the media. Merchants would possibly use quick promoting as bearish indicators seem.

Markdown Section Alerts

Within the markdown section, sellers win, and costs drop quick. This section is commonly faster than the rise. Many merchants maintain on, pondering costs will return up, however they don’t.

Section

Length

Key Traits

Accumulation

Weeks to months

Undervalued belongings, insider shopping for

Markup

Days to weeks

Rising costs, elevated quantity

Distribution

Variable

Market peak, balanced buying and selling

Markdown

Usually fast

Value decline, elevated promoting

Understanding these phases via cycle evaluation can increase your buying and selling. Bear in mind, cycle lengths differ, from minutes to years, based mostly available on the market and time-frame.

Technical Indicators for Cycle Evaluation

Foreign exchange technical indicators and cycle evaluation instruments are key to understanding market patterns. They assist merchants spot traits, reversals, and one of the best occasions to purchase or promote.

DeMark Indicators Suite

The DeMark Indicators Suite is a best choice for recognizing when markets would possibly flip. It makes use of worth motion to forecast market adjustments. This offers merchants a greater probability to make sensible decisions.

Transferring Common Functions

Transferring averages are nice for exhibiting development power. They easy out worth information right into a single line. This makes it simpler to see the place the market is headed. Merchants usually use transferring averages to seek out help and resistance.

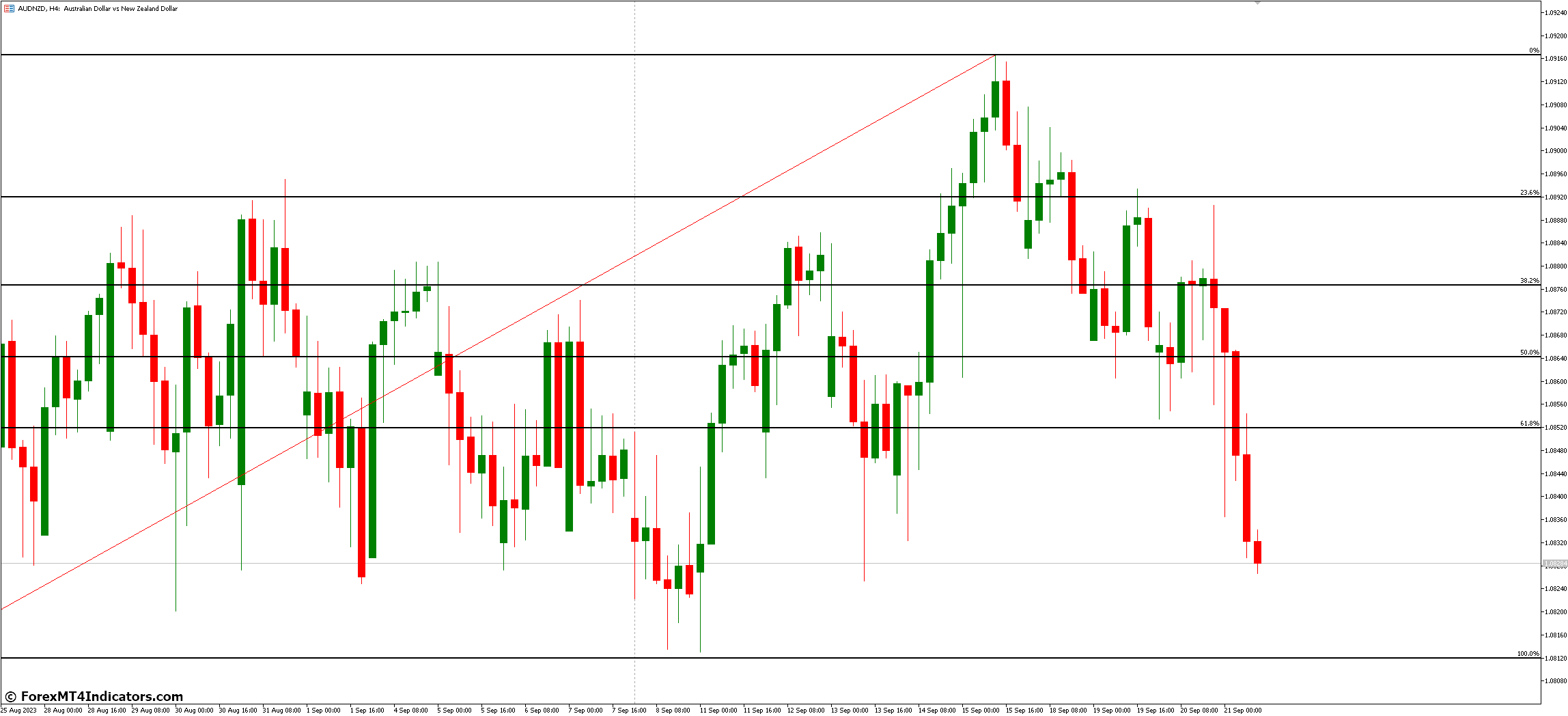

Fibonacci Retracement Instruments

Fibonacci retracement instruments are key for locating help and resistance ranges. They use the Fibonacci sequence to guess the place costs would possibly pause or change route.

Indicator

Energy

Weak point

Greatest Use

DeMark Indicators

Exact reversal factors

Complicated for newcomers

Pattern exhaustion

Transferring Averages

Straightforward to know

Lag in quick markets

Pattern route

Fibonacci Retracement

Works in all timeframes

Subjective interpretation

Assist and resistance ranges

Utilizing these indicators collectively helps merchants develop a powerful cycle evaluation technique. This technique aids in making sensible choices based mostly on market cycles and worth actions.

The best way to Establish Market Cycle Positions

Realizing the way to spot market cycles is vital for foreign exchange success. Merchants use technical evaluation and sample recognition to seek out cycle phases. This helps them make sensible buying and selling decisions.

Value motion evaluation is necessary for locating patterns. By taking a look at candlestick formations and chart patterns, merchants can see when the market would possibly change. These adjustments usually mark the beginning of a brand new cycle section.

Momentum indicators are nice for checking cycle traits and adjustments. The Relative Energy Index (RSI) may be very useful. It reveals when the market is overbought or oversold. This helps merchants know if the market is in a sure section.

Taking a look at buying and selling quantity additionally helps perceive market cycles. Excessive quantity when costs go up means consumers are sturdy, like in markup phases. However excessive quantity when costs drop reveals sellers are sturdy, like in markdown phases.

Cycle Section

Value Motion

Quantity

RSI

Accumulation

Sideways motion

Low

Beneath 30

Markup

Greater highs and lows

Rising

30-70

Distribution

Value stagnation

Excessive

Above 70

Markdown

Decrease highs and lows

Lowering

30-70

Through the use of these strategies, merchants can discover market cycle positions. This helps them make sensible buying and selling decisions within the foreign exchange market.

Timing Methods in Foreign exchange Market Cycles Evaluation

Foreign exchange timing methods are key in cycle-based buying and selling. They assist merchants discover one of the best occasions to purchase and promote. This manner, they’ll make more cash and take much less danger.

Entry Level Identification

Sensible merchants know when to purchase. They search for the buildup section. That is when costs begin going up after falling.

For promoting, they watch the distribution section. That is when costs are falling and the market is bearish.

Exit Technique Improvement

Good exit methods are necessary. Merchants shut lengthy positions when the markup section turns to distribution. They shut quick positions when the markdown section goes again to accumulation.

This makes their trades extra correct and worthwhile.

Danger Administration Throughout Cycle Transitions

Managing dangers is essential throughout cycle adjustments. The foreign exchange market is open 24/5. The U.S./London overlap is the busiest time, with 58% of all trades occurring then.

This time is filled with liquidity but in addition danger. Keeping track of financial indicators helps merchants handle these dangers higher.

Cycle Section

Motion

Danger Degree

Accumulation

Enter lengthy positions

Low to average

Distribution

Enter quick positions

Reasonable to excessive

Markup to Distribution

Exit lengthy positions

Rising

Markdown to Accumulation

Exit quick positions

Lowering

Integration of Basic Evaluation with Cycle Buying and selling

Foreign exchange merchants usually use elementary evaluation in foreign exchange to know the market higher. They combine totally different evaluation strategies to know market cycles and make higher decisions. This methodology combines financial indicators with technical patterns for a full buying and selling plan.

Issues like rates of interest, GDP progress, and political occasions have an effect on foreign money values. These are key in checking if cycle phases are proper. For instance, sturdy financial information in a rustic would possibly present a bullish development within the foreign exchange market.

Merchants who get good at mixing evaluation strategies have a bonus. They will discover possibilities that others would possibly miss. This manner, they’ll deal with the market’s complexity with extra confidence.

Basic Issue

Potential Impression on Cycle

Curiosity Charge Hike

Might set off the buildup section

Weak GDP Report

May sign the beginning of the markdown section

Constructive Commerce Stability

May help the continuing markup section

Political Instability

Can provoke or lengthen the distribution section

By mixing elementary evaluation with cycle buying and selling, foreign exchange merchants can construct a stronger technique. This methodology helps spot necessary market adjustments and handle dangers effectively in all market conditions.

Frequent Pitfalls and Challenges in Cycle Evaluation

Foreign exchange evaluation may be robust, even for consultants. Realizing market cycles is vital, but it surely comes with its personal set of issues. Let’s take a look at some widespread points and the way to get previous them.

Avoiding False Alerts

False indicators are a giant downside in foreign currency trading. They arrive from market noise or sudden occasions. As an illustration, the VIX hit over 82 in March 2020, its highest in years.

This excessive volatility can confuse merchants about market cycles. To keep away from this, use many indicators and test indicators in numerous timeframes.

Managing Overlapping Cycles

Markets don’t at all times observe a easy sample. Cycles can overlap, making it arduous to investigate. The S&P 500 grew 300% from 2009 to early 2020 however had many mini-cycles.

Merchants should spot these smaller cycles inside greater traits. This helps make higher decisions.

Coping with Market Noise

Market noise can disguise actual cycle actions. The 32.9% GDP drop in Q2 2020 made issues much more complicated. To see via the noise, take a look at long-term traits and use transferring averages.

Additionally, keep in mind, that an RSI above 70 means overbuying, and beneath 30 means overselling. These indicators might help spot actual cycle adjustments amidst all of the market discuss.

By understanding these challenges, merchants can higher deal with the advanced world of foreign exchange market cycles. This improves their evaluation abilities.

Superior Cycle Buying and selling Methods

Foreign exchange merchants can enhance their methods with superior strategies. These embody utilizing multi-timeframe evaluation. This helps perceive market cycles higher and makes buying and selling choices extra knowledgeable.

A number of Timeframe Evaluation

Taking a look at foreign money pairs on totally different time frames is vital. This methodology provides a full view of market traits. For instance, EUR/USD acts in a different way than GBP/USD, GBP/JPY, and USD/JPY.

By checking these pairs on numerous time frames, merchants can discover distinctive patterns. This helps them see the market’s cycles extra clearly.

Cycle Synchronization Strategies

It’s necessary to sync cycles throughout time frames for correct predictions. Fibonacci time zones are nice instruments for this. Merchants usually watch for the third and fourth cycles earlier than making massive strikes.

This methodology helps make sure the development is powerful and ongoing. It’s a solution to verify the route of the market.

Momentum-Primarily based Cycle Buying and selling

Momentum indicators are important in cycle buying and selling. The RSI Heatmap, for instance, reveals medium-term cycles. Purple areas present lows and inexperienced areas present highs.

This visible device makes it simpler to investigate cycles. It helps merchants discover one of the best occasions to enter and exit the market.

Approach

Software

Profit

Multi-timeframe Evaluation

Analyzing foreign money pairs throughout timeframes

Complete market view

Cycle Synchronization

Utilizing Fibonacci time zones

Improved development prediction

Momentum-Primarily based Buying and selling

Using RSI Heatmap

Enhanced cycle identification

Utilizing these superior strategies, merchants can construct stronger methods. This will result in extra success within the fast-paced foreign exchange market.

Conclusion

Foreign exchange market cycle evaluation is a key device for merchants. It helps them perceive the advanced world of foreign money buying and selling. Realizing these cycles results in higher choices and danger administration.

By recognizing the 4 important phases, merchants can match their methods with market traits. This consists of the buildup, markup, distribution, and markdown phases.

Utilizing cycle evaluation goes past simply recognizing traits. It helps merchants time their trades higher. For instance, taking lengthy positions within the accumulation section may be worthwhile.

Foreign exchange cycles are quick, lasting weeks or months. However, they provide priceless insights when mixed with different evaluation strategies. Through the use of cycle evaluation with technical indicators and danger administration, merchants can commerce extra successfully.

This strategy helps merchants cope with market adjustments extra confidently. It makes their buying and selling technique stronger and extra exact.