Up to date on March twelfth, 2025 by Nathan Parsh

The Dividend Aristocrats are a bunch of shares within the S&P 500 Index with 25+ years of consecutive dividend will increase. These corporations have high-quality enterprise fashions which have stood the check of time and have proven a exceptional means to boost dividends yearly whatever the economic system.

We consider the Dividend Aristocrats are a few of the highest-quality shares to purchase and maintain for the long run. With that in thoughts, we created a full listing of all 69 Dividend Aristocrats.

You may obtain the complete Dividend Aristocrats listing, together with necessary metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Disclaimer: Certain Dividend shouldn’t be affiliated with S&P World in any method. S&P World owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official info.

The listing of Dividend Aristocrats is diversified throughout a number of sectors, together with client items, financials, industrials, and healthcare.

One group that’s surprisingly underrepresented is the utility sector. Solely three utility shares, together with Consolidated Edison (ED), are on the listing of Dividend Aristocrats.

The truth that simply three utilities are on the Dividend Aristocrats listing might come as a shock, particularly since utilities are broadly considered regular dividend shares. The 2 different utilities on the listing are Atmos Power (ATO) and NextEra Power (NEE).

Consolidated Edison is about as constant a dividend inventory as they arrive. The corporate has over 100+ years of regular dividends and greater than 50 years of annual dividend will increase. This text will talk about what makes Consolidated Edison interesting for revenue buyers.

Enterprise Overview

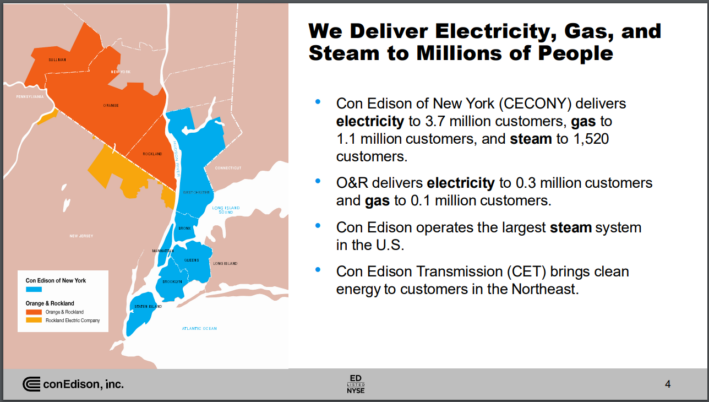

Consolidated Edison is a large-cap utility inventory. The corporate generates roughly $15 billion in annual income. The corporate serves over 3 million electrical clients, and one other 1 million fuel clients, in New York.

It operates electrical, fuel, and steam transmission companies.

Supply: Investor Presentation

On January sixteenth, 2025, Consolidated Edison introduced that it was elevating its quarterly dividend 2.4% to $0.85. This was the corporate’s 51st annual enhance, qualifying Consolidated Edison as a Dividend King.

On February twentieth, 2025, Consolidated Edison introduced its fourth-quarter and full-year outcomes. Income elevated 6.5% to $3.7 billion, beating estimates by $36 million.

Adjusted earnings of $340 million, or $0.98 per share, in comparison with adjusted earnings of $346 million, or $1.00 per share, within the earlier 12 months. Adjusted earnings-per-share had been $0.02 forward of expectations.

For the 12 months, income of $15.3 billion improved 4% year-over-year. Adjusted earnings of $1.87 billion, or $5.40 per share, in comparison with adjusted earnings of $1.76 billion, or $5.07 per share, in 2023.

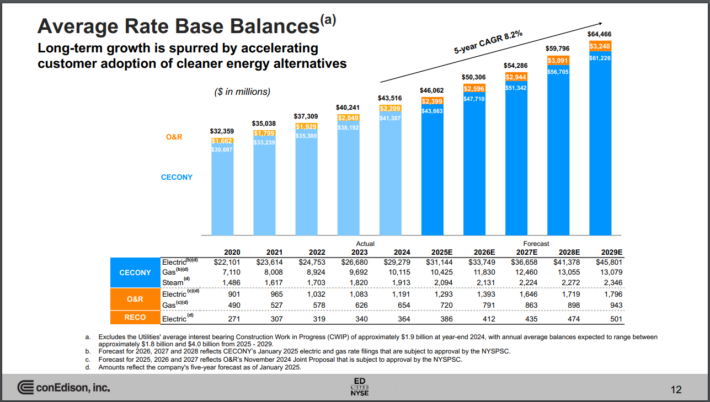

As with prior quarters, increased fee bases for fuel and electrical clients had been the first contributors to ends in the CECONY enterprise, which is accounts for the overwhelming majority of the corporate’s property. Common fee base balances are anticipated to develop by 8.2% yearly by means of 2029 off of 2025 ranges. That is up from the corporate’s prior forecast for progress of 6.4%.

Consolidated Edison is predicted to supply earnings-per-share of $5.63 in 2025. The corporate expects 5% to 7% earnings progress from 2025 by means of 2029.

Development Prospects

Earnings progress throughout the utility trade sometimes mimics GDP progress, plus a few factors. Over the following 5 years, we anticipate Consolidated Edison to extend earnings-per-share by greater than 6% per 12 months, which is in step with the corporate’s steerage.

New clients and fee will increase are Consolidated Edison’s progress drivers. ConEd forecasts 8.2% annual fee base progress by means of 2029.

Supply: Investor Presentation

One potential risk to future progress is excessive rates of interest, which might enhance the price of capital for corporations that make the most of debt, akin to utilities. Luckily, the market isn’t anticipating the Federal Reserve to boost rates of interest any additional, with the added potential for fee cuts sooner or later that might decrease the corporate’s value of capital. Reducing charges helps corporations that rely closely on debt financing, akin to utilities.

Consolidated Edison is in sturdy monetary situation. It has an investment-grade credit standing of A-, and a modest capital construction with balanced debt maturities over the following a number of years.

Aggressive Benefits & Recession Efficiency

Consolidated Edison’s foremost aggressive benefit is the excessive regulatory hurdles of the utility trade. Electrical energy and fuel providers are mandatory and very important to society.

Consequently, the trade is very regulated, making it nearly not possible for a brand new competitor to enter the market. This supplies a large moat for Consolidated Edison.

As well as, the utility enterprise mannequin is very recession-resistant. Whereas many corporations skilled vital earnings declines in 2008 and 2009, Consolidated Edison held up comparatively properly. Earnings-per-share through the Nice Recession are proven beneath:

2007 earnings-per-share of $3.48

2008 earnings-per-share of $3.36 (3% decline)

2009 earnings-per-share of $3.14 (7% decline)

2010 earnings-per-share of $3.47 (11% enhance)

Consolidated Edison’s earnings fell in 2008 and 2009, however recovered in 2010. The corporate nonetheless generated wholesome income, even through the worst of the financial downturn. This resilience allowed Consolidated Edison to proceed growing its dividend every year.

The identical sample held up in 2020 when the U.S. economic system entered a recession as a result of coronavirus pandemic. Final 12 months, ConEd remained extremely worthwhile, which allowed the corporate to boost its dividend once more.

Valuation & Anticipated Returns

Utilizing the present share value of ~$102 and EPS estimates for 2025, the inventory has a price-to-earnings ratio of 18.1. That is simply forward of our truthful worth estimate of 18.0, which is in step with the 10-year common price-to-earnings ratio for the inventory.

Consequently, Consolidated Edison shares look like barely overvalued. If the inventory valuation retraces to the truthful worth estimate, the corresponding a number of contractions would scale back annualized returns by 0.1% over the following 5 years.

Luckily, the inventory might nonetheless present optimistic returns to shareholders, by means of earnings progress and dividends. We anticipate the corporate to develop earnings by 6% per 12 months over the following 5 years. As well as, the inventory has a present dividend yield of three.3%.

Utilities like ConEd are prized for his or her steady dividends and protected payouts. The corporate’s anticipated payout ratio for 2025 is 60%, beneath the 10-year common payout ratio of 67%.

Placing all of it collectively, Consolidated Edison’s whole anticipated returns might appear to be the next:

6% earnings progress

-0.1% a number of reversion

3.3% dividend yield

Consolidated Edison is predicted to return 8.6% yearly over the following 5 years. It is a modest fee of return, however not excessive sufficient to warrant a purchase advice presently.

Earnings buyers might discover the yield enticing, as it’s meaningfully increased than the yield of the S&P 500 Index.

Ultimate Ideas

Consolidated Edison could be a invaluable holding for revenue buyers, akin to retirees, resulting from its 3%+ dividend yield. The inventory presents safe dividend revenue, and can also be a Dividend Aristocrat, which means it ought to increase its dividend every year.

General, with anticipated returns of 8.6%, we fee the inventory as a maintain at at this time’s present value.

Moreover, the next Certain Dividend databases comprise probably the most dependable dividend growers in our funding universe:

Should you’re in search of shares with distinctive dividend traits, contemplate the next Certain Dividend databases:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].