The current correction within the broader market has left the portfolios of retail buyers within the purple, largely attributable to stretched valuations.

Are you one of many grieving retail buyers who misplaced 30-40 per cent on this market correction?

Do you assume you could possibly’ve exercised higher discretion and been a bit smarter? What if we advised you ‘You aren’t alone’ and that one other set of buyers, who’re presumed good, could possibly be considering alike?

Sure, they’re the institutional buyers, the likes of mutual funds and FPIs, a.ok.a. ‘good cash’, who poured in crores of rupees in QIPs (certified institutional placement) in calendar 2024 (CY24).

A grand sum of ₹78,679 crore was raised by 54 firms (mainboard, that’s, non-SMEs) in CY24. Zomato’s ₹8,500-crore share subject, Adani Vitality Options’ ₹8,373-crore IPO and a ₹5,000-crore subject every by Status Estates and Punjab Nationwide Financial institution high the chart. The worth of this near-₹80,000-crore fund increase, in at this time’s costs, is ₹66,090 crore. That’s a 16 per cent erosion.

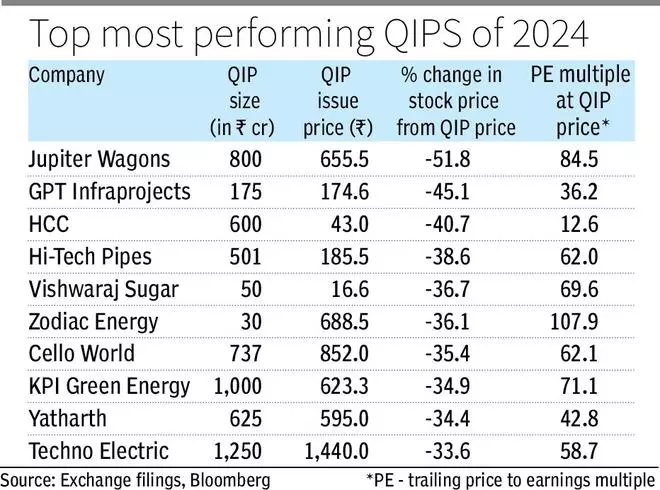

Whereas on the mixture stage this may occasionally not appear overwhelming, the scenario is worse when analysed on the particular person QIP transaction stage (see infographic).

Prime losers

There was a complete of 54 QIP points in CY24. Of those, solely 9 have made cash for the establishments that subscribed to those QIPs thus far.

The remaining have resulted in losses (distinction between the present and the problem worth of the QIP) starting from 2.8 per cent all the way in which as much as 51.8 per cent, at a median of twenty-two.2 per cent.

You wouldn’t precisely name that good, would you? In fact, in some instances the smarter establishments would have exited at revenue or decrease losses earlier than the deeper crash, however our evaluation discovered many situations of establishments holding on to the shares.

Three QIPs resulted in losses above 40 per cent, 11 between 30 per cent and 40 per cent, 10 of 20-30 per cent, and 21 QIPs misplaced lower than 20 per cent.

Taking a look at particular person QIPs, to checklist down the largest losses by share and dimension of the QIP, Adani Vitality Options’ ₹8,373-crore subject misplaced 23.4 per cent, Status Estates’ ₹5,000-crore subject 31.7 per cent, Samvardhana Motherson’s ₹4,938-crore subject 32.7 per cent, Adani Enterprises’ ₹4,200 crore subject misplaced 24.2 per cent, and Sona BLW’s ₹2,400 crore subject has misplaced 25.1 per cent.

Disregarding the dimensions of the QIP, going purely by the proportion of loss, these firms high the checklist — Jupiter Wagons 51.8 per cent, GPT Infraprojects (45.1 per cent), HCC (40.7 per cent), Hello-Tech Pipes (38.6 per cent) and Vishwaraj Sugar Industries (36.7 per cent).

Double whammy

On the brighter facet, although, positive aspects of 102.7 per cent, 98.1 per cent, 65.3 per cent and 37.8 per cent from the QIPs of Pearl International Industries, Ami Organics, Lloyds Metals & Vitality and Sky Gold, respectively, are noteworthy.

After a profitable QIP, firms report a listing of establishments (allottees) to whom greater than 5 per cent of the shares issued within the QIP are allotted.

Going by these experiences, home mutual funds characteristic prominently, subscribing to over 40 per cent of the shares provided on a median. It is a double whammy for retail buyers, as it’s their cash at stake, although via mutual funds.

Life insurance coverage firms, too, have thrown their hats within the ring.

What’s price noting is that these establishments have subscribed to QIPs even at triple-digit PE (price-earnings) multiples (at QIP subject worth) and it confirmed within the under-performance in case of firms similar to Zodiac Vitality (PE/inventory returns since QIP in share: 108x/ -36.1), Zaggle (130x/ -29.6), Adani Enterprises (109x/ -24) and Adani Vitality Options (123x/ -23.4).

Whereas QIPs of firms similar to Ami Organics, Transformers & Rectifiers and PG Electroplast have fared higher with returns of 98.1 per cent, 26.6 per cent and 25.5 per cent, respectively, albeit subscribed at PE multiples of 116x, 245x and 155x, respectively, it stays to be seen whether or not such excessive valuations can be sustainable, given the present uncertainty rocking international markets.