Crypto costs traded inside a spread final week as crypto takes is relegated to the again burner within the wake of financial uncertainties

Change-traded fund (ETF) inflows have been unfavourable as Bitcoin ETFs logged internet outflows of $62.9 million whereas Ethereum ETFs logged $8.9 million in outflows

Bitcoin

Bitcoin’s worth motion continued buying and selling rangebound, with weekly highs and lows of $99,509 and $93,331, as uncertainty looms round inflation, US President Donald Trump’s insurance policies, and geopolitical occasions.

Zooming out, we see that worth motion has ranged on the day by day assist degree for the final three weeks as present market situations lack enough catalyst to push costs to new highs.

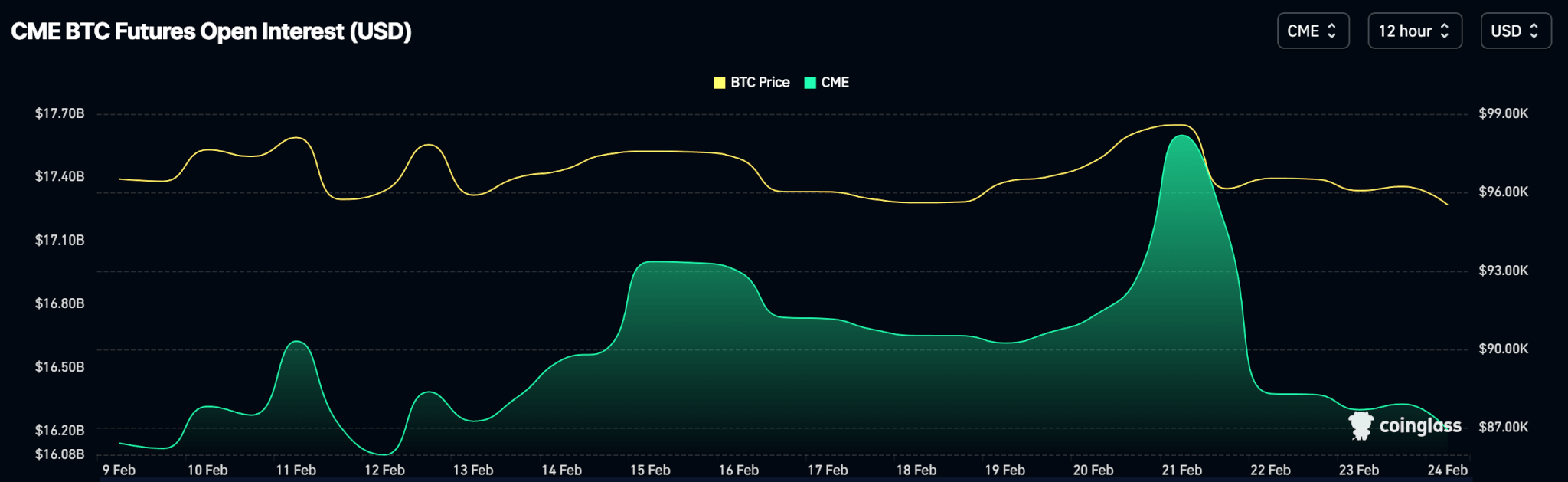

Open curiosity mimics worth motion because the week started with a discount within the quantity of open contracts which picked up on Wednesday, February 19, congruent with worth motion.

Outlook

Bitcoin should stay above the day by day assist of $90,673 to stay in bullish territory. An in depth under this degree on the day by day time-frame might set off a fall to the $84,000 degree.

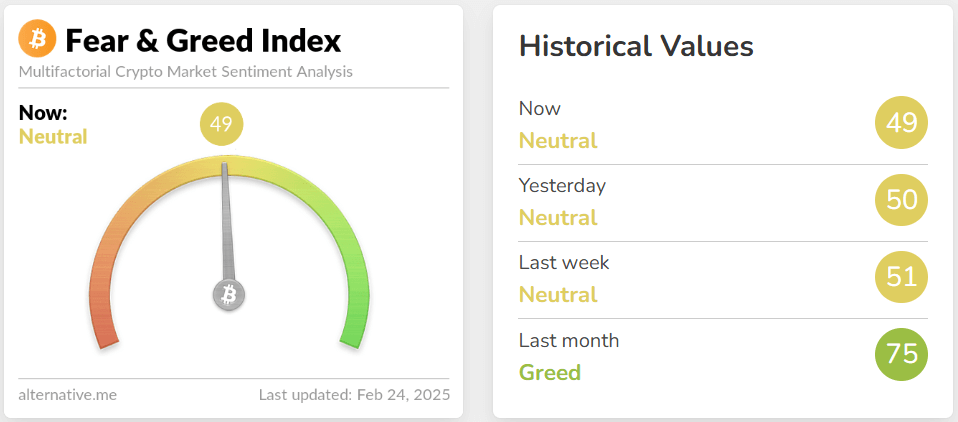

In the meantime, market sentiment has cooled considerably during the last month and is in impartial territory.

Bitcoin trades at $87,900 as of publishing.

Ethereum

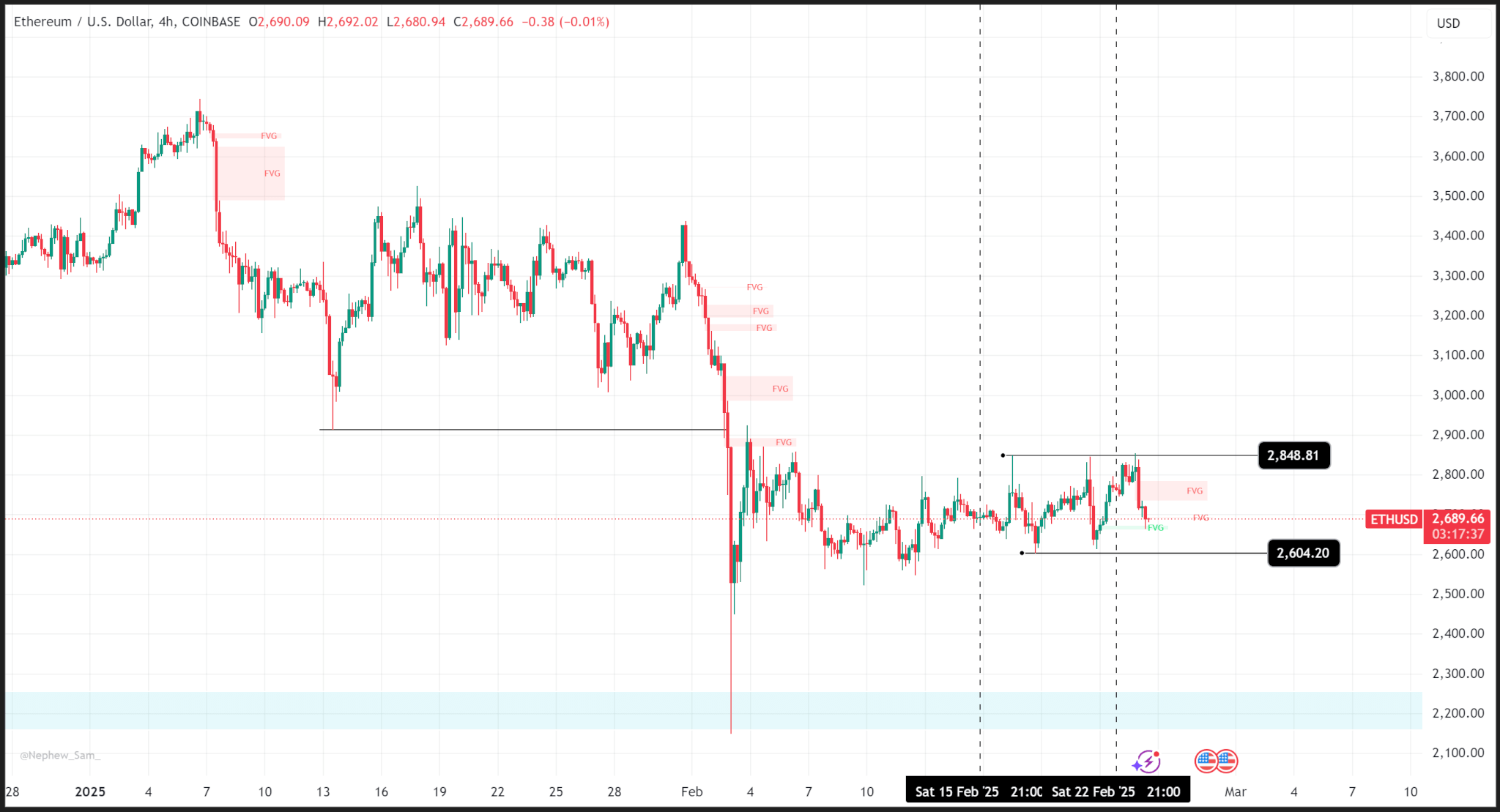

Ethereum’s worth motion ranged final week logging a weekly excessive and low of $2,848 and $2,604 regardless of final week’s information of the Bybit hack.

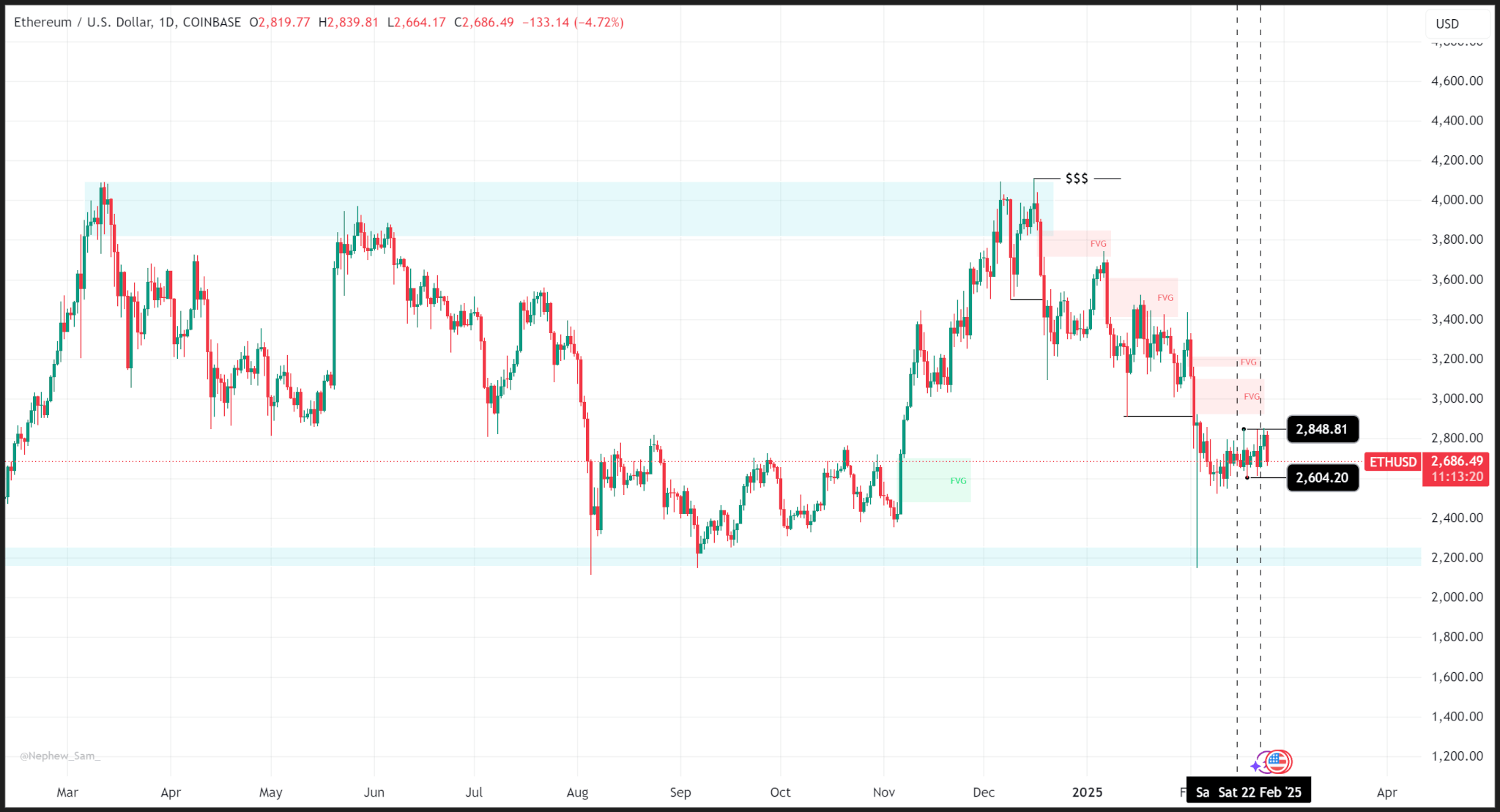

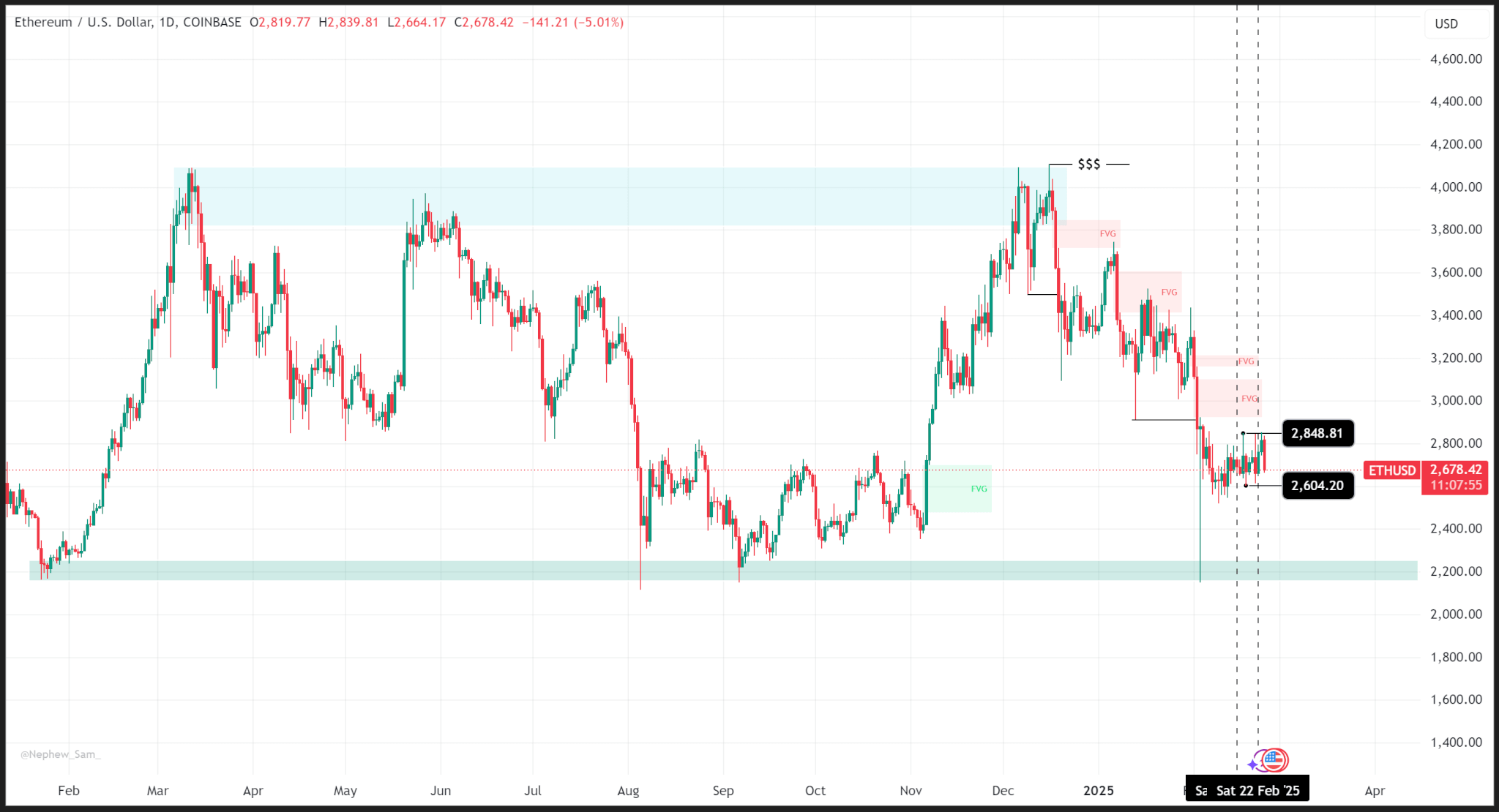

Zooming out, we see a bleaker image as ETH has been trending decrease since December 09 after failing to interrupt above its March 2024 excessive.

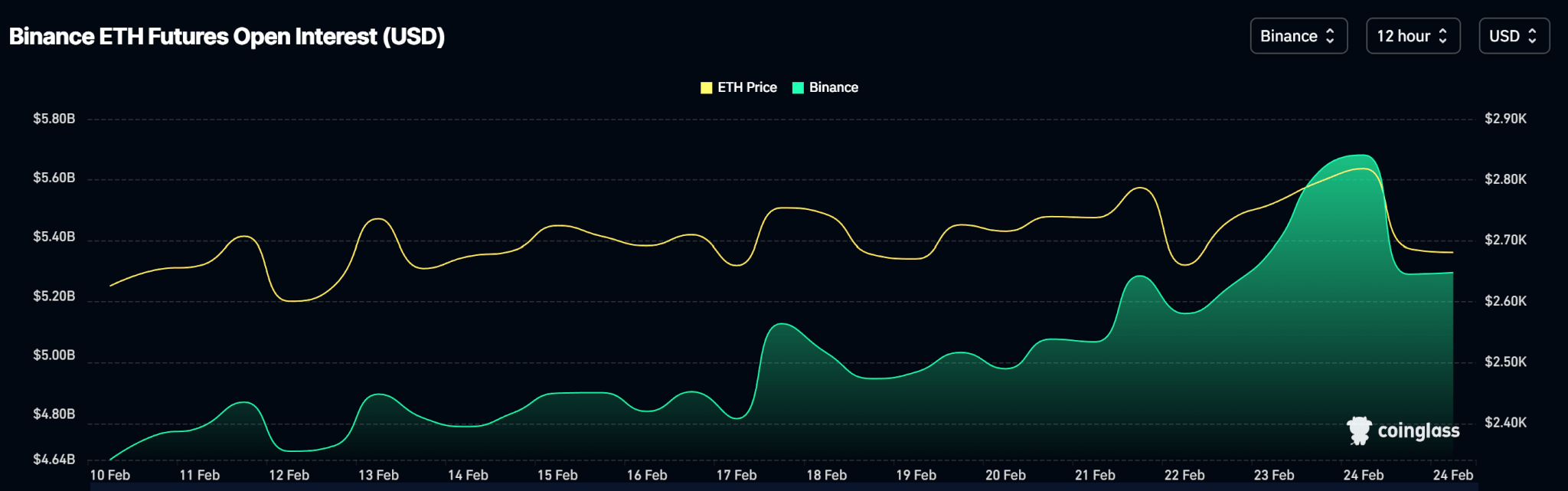

Open curiosity information reveals a gentle rise in contract quantity all through the week although worth traded rangebound.

Outlook

We reckon the following main assist zone for ETH is the $2,500 degree which has confirmed to be a robust liquidity degree prior to now.

ETH trades at $2,384 as of publishing.

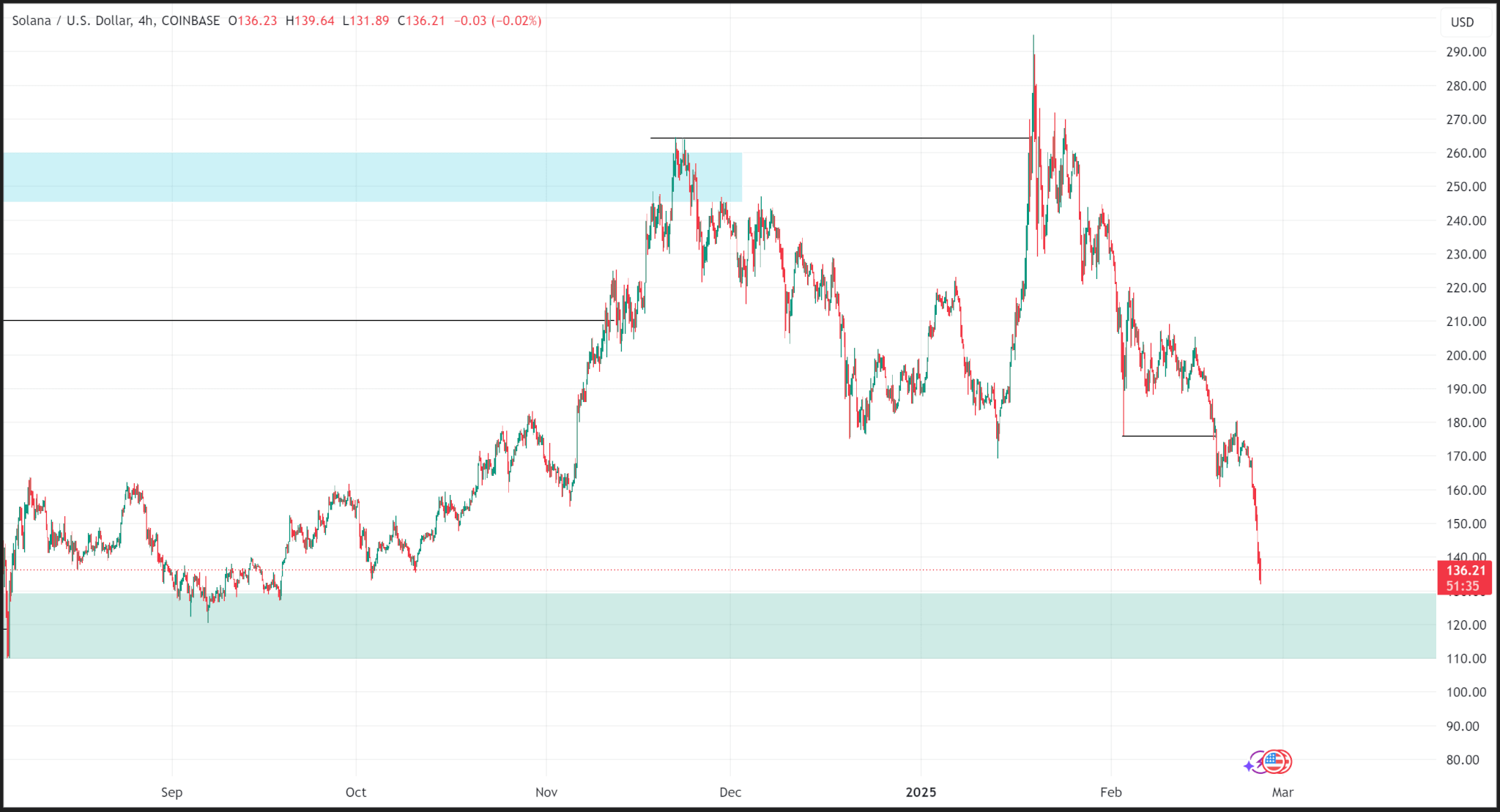

Solana

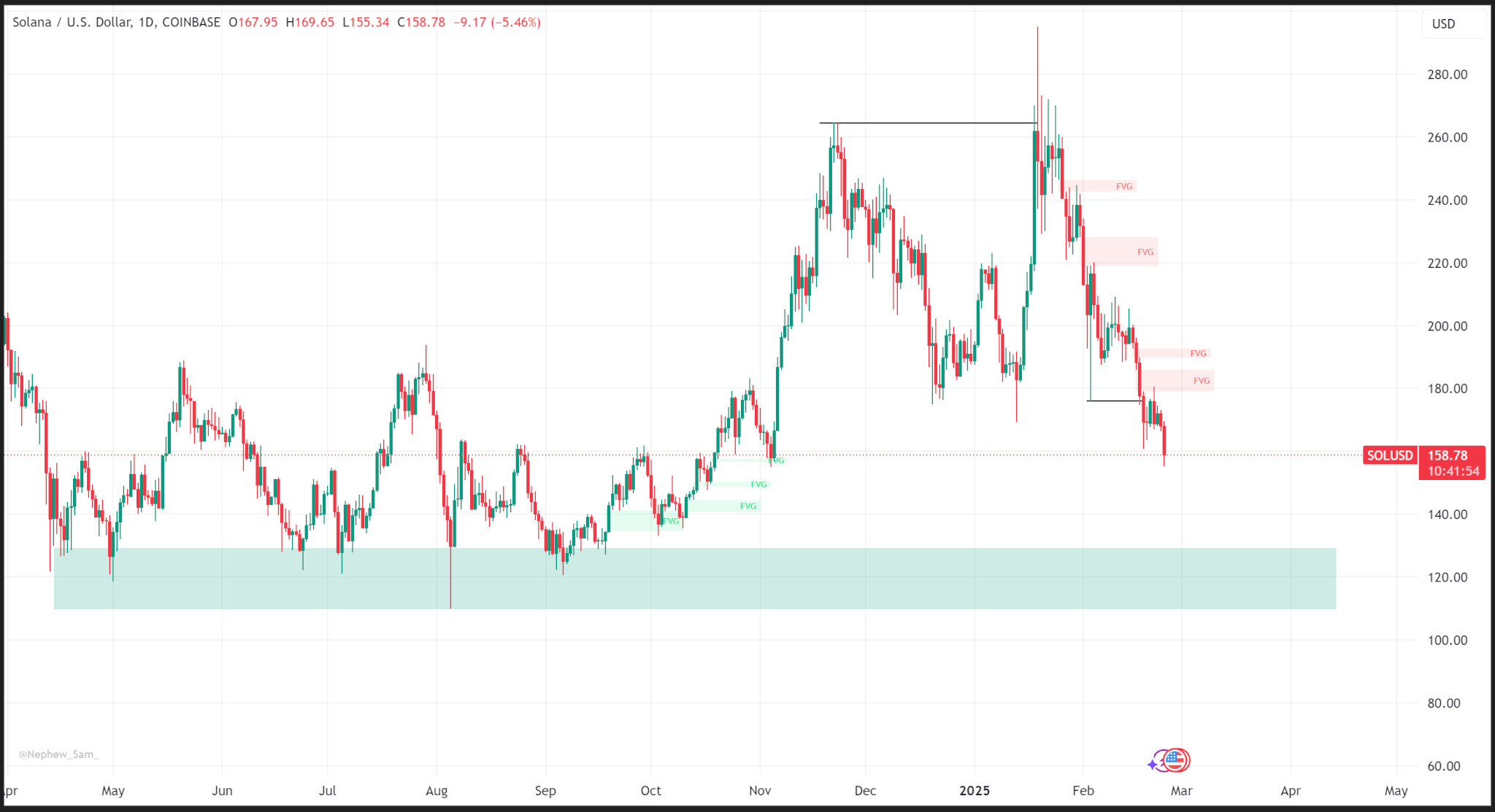

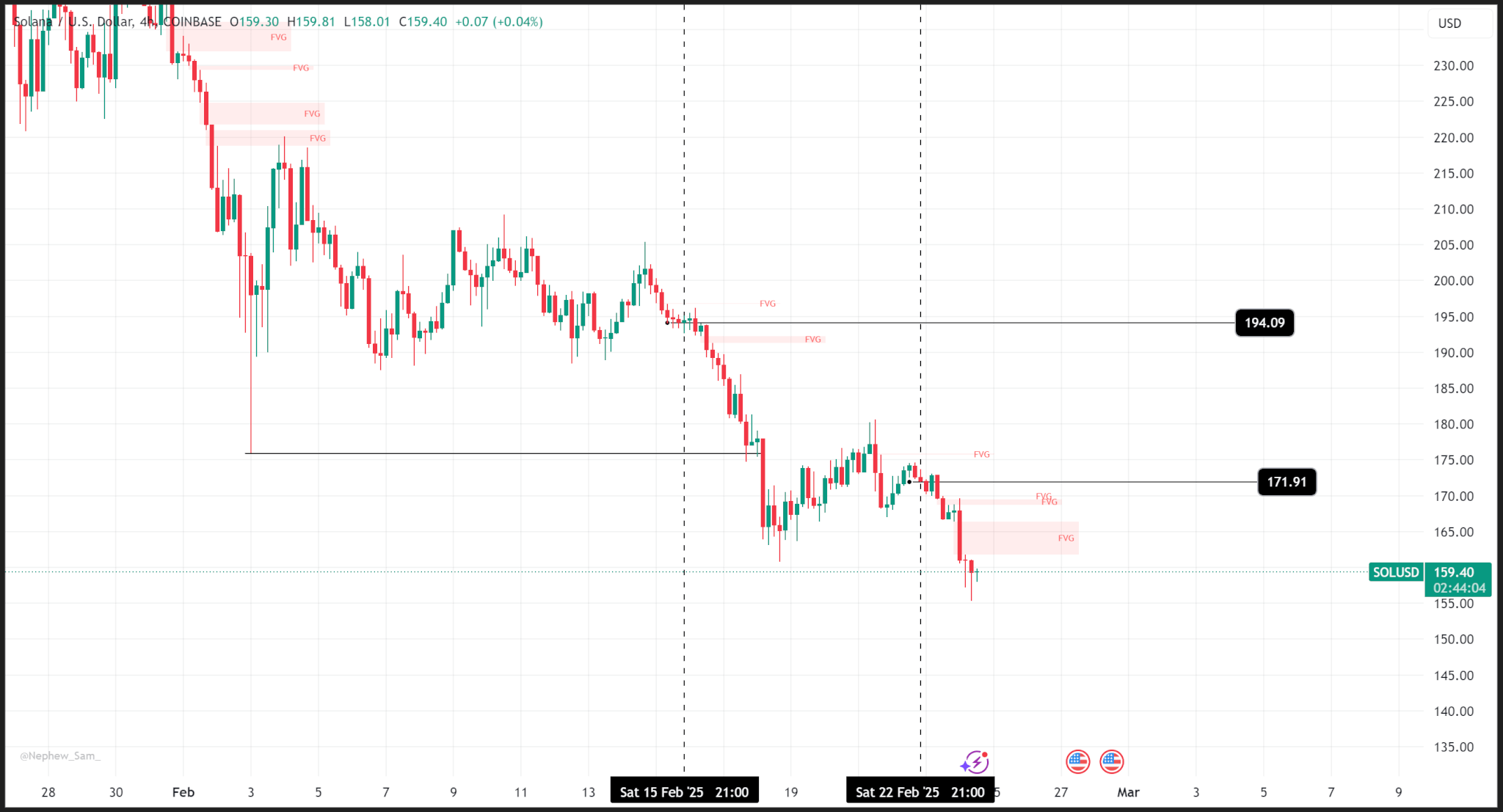

Like Ethereum, Solana’s worth has been declining because it didn’t swing larger and kind new candles above the final all-time excessive on the day by day time-frame.

In contrast to Ethereum, final week’s worth motion was bearish as the worth fell from a weekly open round $194 to an in depth round $171.

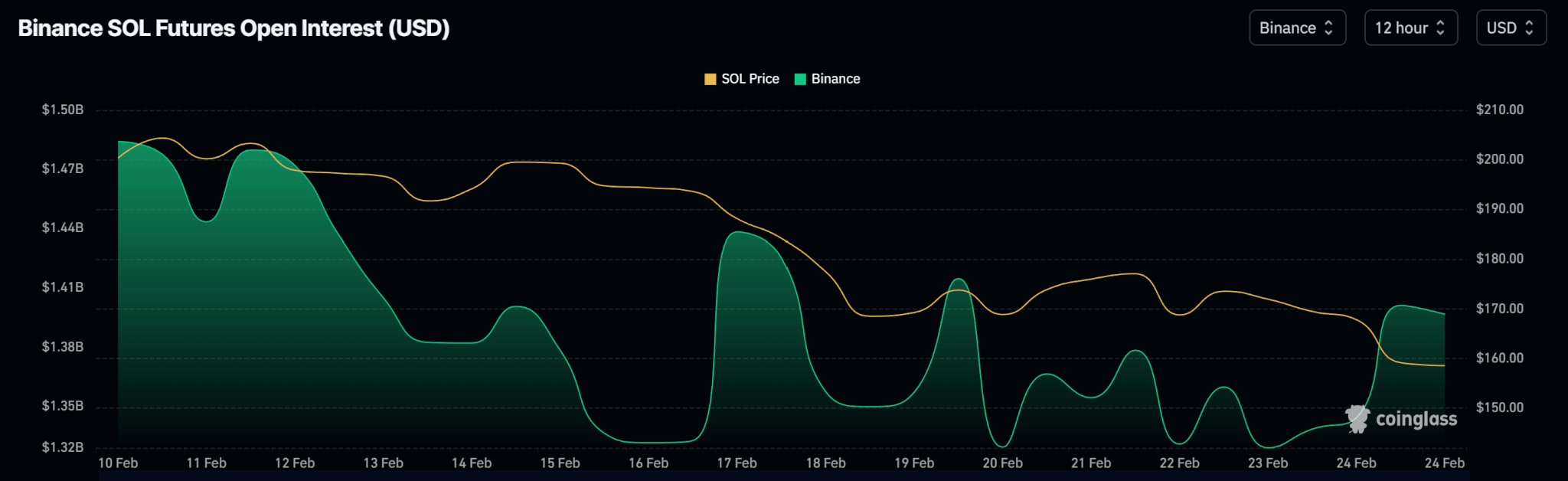

Open curiosity charts present topsy-turvy motion in open contract volumes as the worth falls.

Outlook

The following main assist zone for Solana is on the $129 degree. Nevertheless, we might even see smaller rallies as worth traits decrease total.