By Sarupya Ganguly

BENGALURU (Reuters) – The U.S. greenback will tighten its stranglehold over world forex markets with little standing in the way in which of its exceptional run, and a big variety of international alternate forecasters polled by Reuters anticipate it to rise to parity with the euro in 2025.

The buck surged over 7% in opposition to a basket of main currencies final yr, falling simply shy of an 8% achieve in 2022 – a seven-year excessive – and driving the euro to the brink of dollar-parity and an over two-year low of $1.02 on Jan. 2.

Whereas forecasters in Reuters polls — lengthy proponents of a weaker greenback — have been largely off the mark of their median point-forecasts by final yr, extra questions, notably on dangers to these estimates, captured the forex’s relentless ascent.

A lot of that was as a result of greenback’s near-8% rise within the ultimate quarter of 2024, fueled by sustained, and sometimes surprising, U.S. financial resilience.

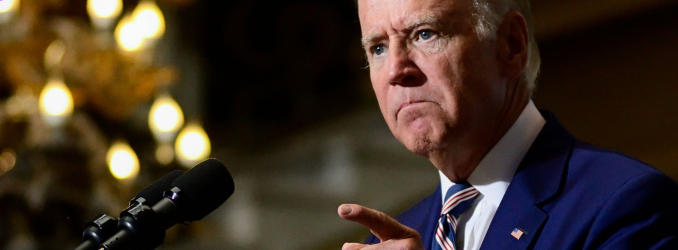

A sign from the U.S. Federal Reserve in December that it’s in no hurry to chop rates of interest additional, together with inflation fears rooted in President-elect Donald Trump’s proposed tariff and tax insurance policies, solely helped to cement these beneficial properties.

“We might sound like a damaged document, however our view for the following few months is for the greenback to nonetheless be fairly robust. Even eager about what potential new insurance policies could possibly be unveiled with the incoming administration – it ought to be favoring the greenback. In some methods, there is a flavour of ‘there is no such thing as a different,” stated Paul Mackel, world head of FX at HSBC.

Rate of interest futures are actually totally pricing in just one extra Fed charge discount by end-2025 and wavering on the opportunity of a second, in comparison with hypothesis the European Central Financial institution will reduce charges by practically 100 foundation factors by then.

That, coupled with the attract of upper longer-term U.S. Treasury yields and expectations of bigger charge reductions from different main central banks, will probably restrict greenback draw back, stated international alternate strategists in a Jan. 3-8 Reuters survey, displaying delicate indicators of a shift in stance.

The euro, presently $1.03, was seen rising a modest 1% to $1.04 over the approaching three and 6 months after which to $1.05 by year-end, in accordance with median views from over 70 strategists, markedly decrease than anticipated just a few months in the past.

The most recent positioning information from the Commodity Futures Buying and selling Fee additionally confirmed speculators had elevated their net-long greenback bets to the best since Might.

“Whenever you have a look at different currencies – their fundamentals, yields and different sources of uncertainty round them – you continue to come again to the greenback. We might get home windows the place the market is glad to hunt alternate options, however that proves to be momentary and this yr will probably be one other instance of that,” HSBC’s Mackel stated.

Story Continues