Revealed on December thirtieth, 2024 by Bob Ciura

Investing doesn’t get a lot easier than shopping for and holding prime quality dividend development shares for the long term.

“Every little thing must be made so simple as attainable, however not easier.”– Usually attributed to Albert Einstein

Lengthy-term dividend development inventory investing combines the first motive most individuals make investments – passive earnings – with the tried-and-true knowledge that underlies profitable investing.

For an organization to pay rising dividends year-after-year for many years, it should have favorable long-term financial traits and a fairly competent and trustworthy administration staff.

With this in thoughts, we created a downloadable record of over 130 Dividend Champions, which have raised their dividends for over 25 consecutive years.

You may obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

As well as, we’ve ranked the highest 10 prime quality dividend development shares for the long term.

The entire 10 shares under are Dividend Champions, which have elevated their payouts for over 25 years. They’re ranked so as of 5-year development charge, from lowest to highest.

Desk of Contents

You may immediately bounce to any particular part of the article by clicking on the hyperlinks under:

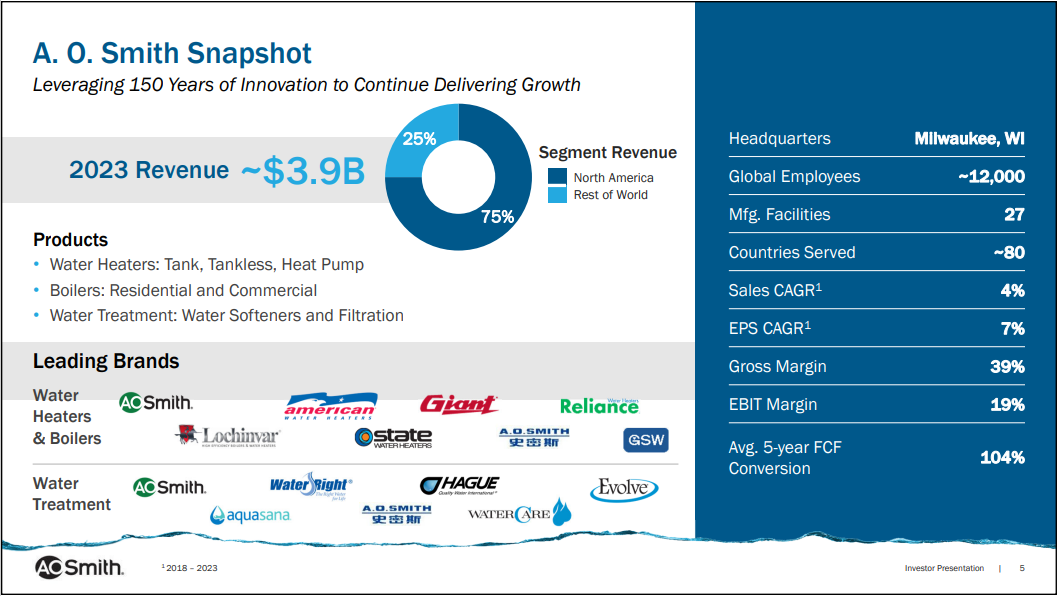

High quality Dividend Inventory For The Lengthy Run: A.O. Smith Corp. (AOS)

5-year dividend development: 8.0%

A.O. Smith is a number one producer of residential and industrial water heaters, boilers and water treatmentproducts. It generates two-thirds of its gross sales in North America, and many of the relaxation in China.

A.O. Smith has raised its dividend for 30 years in a row, making the corporate a Dividend Aristocrat. The corporate was based in 1874 and is headquartered in Milwaukee, WI.

A.O. Smith reported its third quarter earnings outcomes on October 22. The corporate generated revenues of $903 million throughout the quarter, which represents a decline of 4% in comparison with the prior yr’s quarter.

Income declined by 1% in North America, however the worldwide enterprise noticed a wider decline, primarily on account of decrease gross sales in China, which has a troubled actual property market.

A.O. Smith generated earnings-per-share of $0.82 throughout the third quarter, which was down 9% on a yr over yr foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on AOS (preview of web page 1 of three proven under):

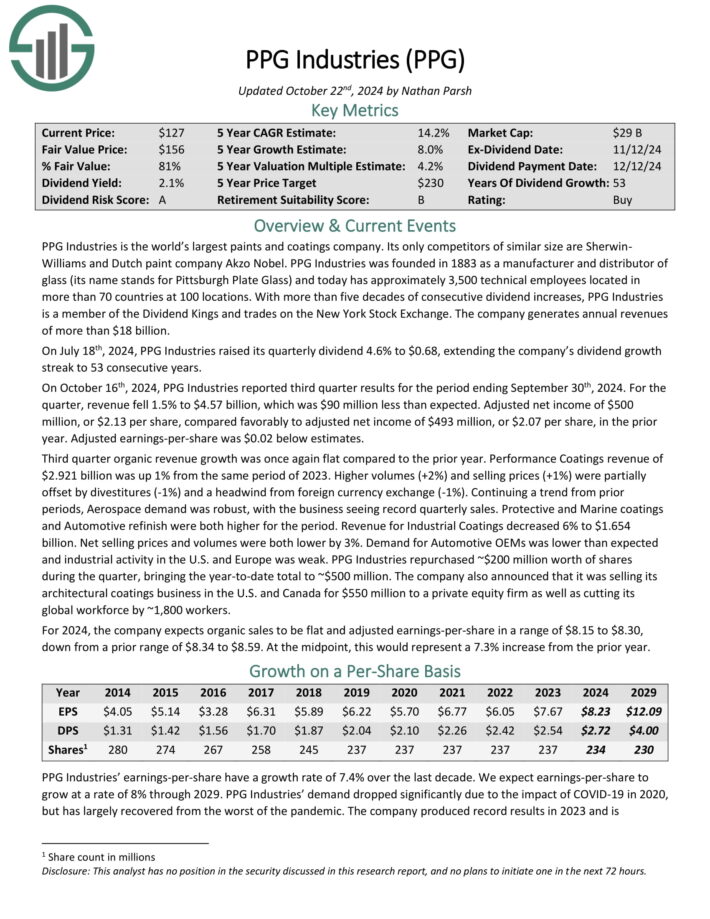

High quality Dividend Inventory For The Lengthy Run: PPG Industries (PPG)

5-year dividend development: 8.0%

PPG Industries is the world’s largest paints and coatings firm. Its solely opponents of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

On October sixteenth, 2024, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 1.5% to $4.57 billion, which was $90 million lower than anticipated.

The corporate generates annual income of about $18.2 billion.

Supply: Investor Presentation

Adjusted web earnings of $500 million, or $2.13 per share, in contrast favorably to adjusted web earnings of $493 million, or $2.07 per share, within the prior yr. Adjusted earnings-per-share was $0.02 under estimates.

Third quarter natural income development was as soon as once more flat in comparison with the prior yr. Efficiency Coatings income of $2.921 billion was up 1% from the identical interval of 2023. Greater volumes (+2%) and promoting costs (+1%) had been partially offset by divestitures (-1%) and a headwind from overseas foreign money trade (-1%).

Click on right here to obtain our most up-to-date Positive Evaluation report on PPG (preview of web page 1 of three proven under):

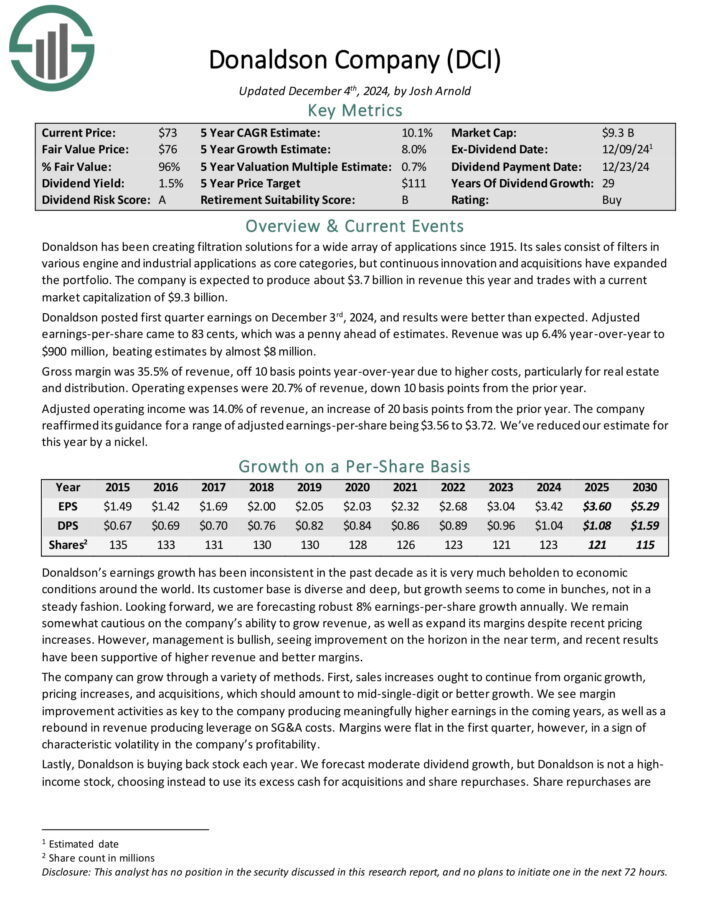

High quality Dividend Inventory For The Lengthy Run: Donaldson Co. (DCI)

5-year dividend development: 8.2%

Donaldson has been creating filtration options for a big selection of purposes since 1915. Its gross sales encompass filters in numerous engine and industrial purposes as core classes. The corporate is predicted to provide about $3.7 billion in income this yr.

Donaldson posted first quarter earnings on December third, 2024, and outcomes had been higher than anticipated. Adjusted earnings-per-share got here to 83 cents, which was a penny forward of estimates. Income was up 6.4% year-over-year to $900 million, beating estimates by nearly $8 million.

Gross margin was 35.5% of income, off 10 foundation factors year-over-year on account of increased prices, notably for actual property and distribution. Working bills had been 20.7% of income, down 10 foundation factors from the prior yr.

Adjusted working earnings was 14.0% of income, a rise of 20 foundation factors from the prior yr. The corporate reaffirmed its steerage for a spread of adjusted earnings-per-share being $3.56 to $3.72.

Click on right here to obtain our most up-to-date Positive Evaluation report on DCI (preview of web page 1 of three proven under):

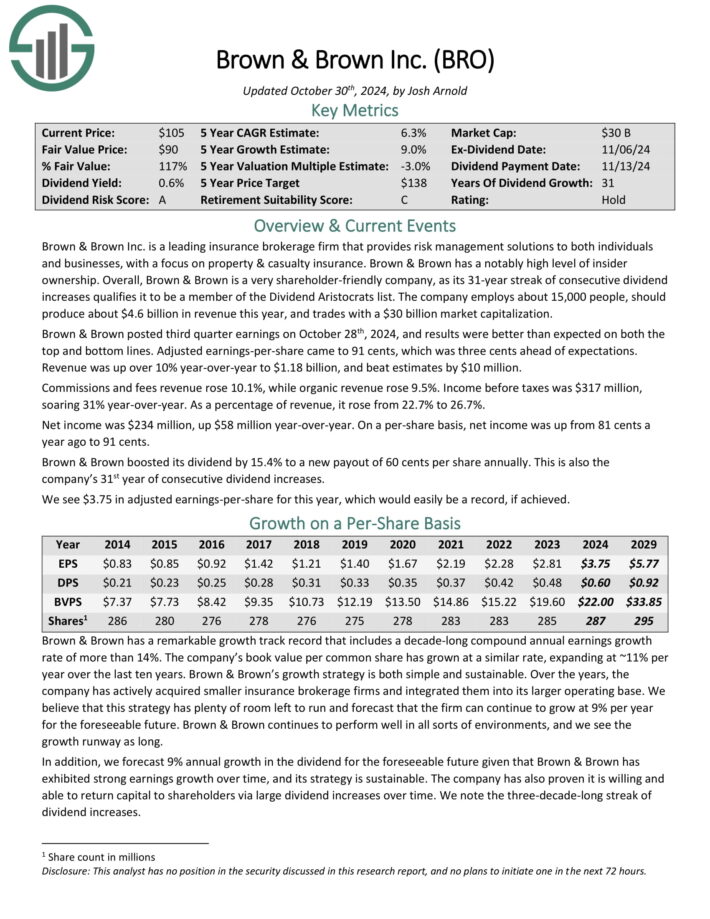

High quality Dividend Inventory For The Lengthy Run: Brown & Brown (BRO)

5-year dividend development: 8.9%

Brown & Brown Inc. is a number one insurance coverage brokerage agency that gives threat administration options to each people and companies, with a deal with property & casualty insurance coverage. Brown & Brown has a notably excessive degree of insider possession.

Brown & Brown posted third quarter earnings on October twenty eighth, 2024, and outcomes had been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 91 cents, which was three cents forward of expectations.

Income was up over 10% year-over-year to $1.18 billion, and beat estimates by $10 million. Commissions and charges income rose 10.1%, whereas natural income rose 9.5%. Earnings earlier than taxes was $317 million, hovering 31% year-over-year. As a proportion of income, it rose from 22.7% to 26.7%.

Web earnings was $234 million, up $58 million year-over-year. On a per-share foundation, web earnings was up from 81 cents a yr in the past to 91 cents. Brown & Brown boosted its dividend by 15.4% to a brand new payout of 60 cents per share yearly. That is additionally the corporate’s thirty first yr of consecutive dividend will increase.

Its aggressive benefit comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition technique offers the corporate a permanent alternative to proceed rising its enterprise for the foreseeable future.

Click on right here to obtain our most up-to-date Positive Evaluation report on BRO (preview of web page 1 of three proven under):

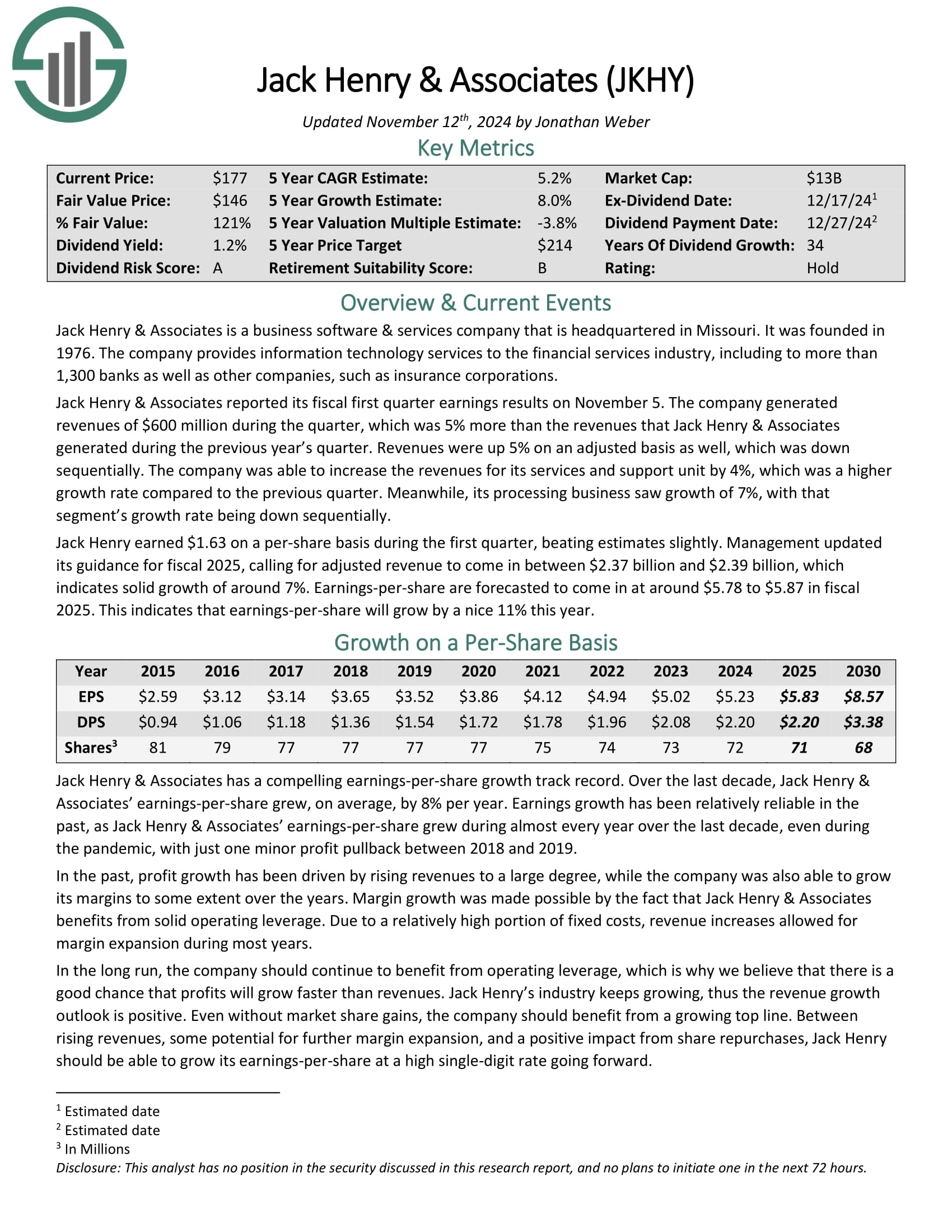

High quality Dividend Inventory For The Lengthy Run: Jack Henry & Associates (JKHY)

5-year dividend development: 9.0%

Jack Henry & Associates is a enterprise software program & companies firm. It gives info know-how companies to the monetary companies business, together with to greater than 1,300 banks in addition to different corporations, equivalent to insurance coverage companies.

Jack Henry & Associates reported its fiscal first quarter earnings outcomes on November 5. The corporate generated revenues of $600 million throughout the quarter, which was up 5% year-over-year.

Jack Henry earned $1.63 on a per-share foundation throughout the first quarter, beating estimates barely. Administration up to date its steerage for fiscal 2025, calling for adjusted income to come back in between $2.37 billion and $2.39 billion, which signifies strong development of round 7%.

Earnings-per-share are forecasted to come back in at round $5.78 to $5.87 in fiscal 2025. This means that earnings-per-share will develop by a pleasant 11% this yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on JKHY (preview of web page 1 of three proven under):

High quality Dividend Inventory For The Lengthy Run: Lowe’s Cos. (LOW)

5-year dividend development: 9.0%

Lowe’s Corporations is the second-largest residence enchancment retailer within the US (after Residence Depot). It operates or companies greater than 1,700 residence enchancment and {hardware} shops within the U.S.

Lowe’s reported third quarter 2024 outcomes on November nineteenth, 2024. Complete gross sales got here in at $20.2 billion in comparison with $20.5 billion in the identical quarter a yr in the past.

Comparable gross sales decreased by 1.1%, whereas web earnings-per-share of $2.99 in comparison with $3.06 in third quarter 2023.

Adjusted EPS was even decrease at $2.89. The corporate continues to be negatively impacted from a discount in DIY discretionary spending.

The corporate repurchased 2.9 million shares within the quarter for $758 million. Moreover, it paid out $654 million in dividends.

The corporate narrowed its fiscal 2024 outlook and now expects to earn adjusted diluted EPS of $11.80 to $11.90 (from $11.70 to $11.90 beforehand) on complete gross sales of $83.0 to $83.5 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on LOW (preview of web page 1 of three proven under):

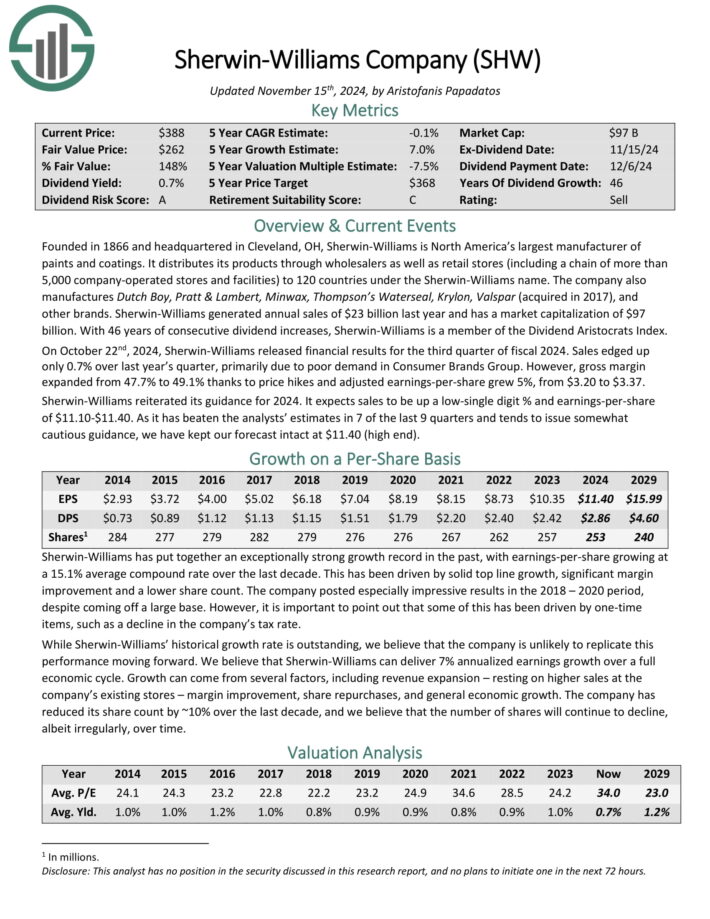

High quality Dividend Inventory For The Lengthy Run: Sherwin-Williams Co. (SHW)

5-year dividend development: 10.0%

Sherwin-Williams, based in 1866, is North America’s largest producer of paints and coatings.

The corporate distributes its merchandise by wholesalers in addition to retail shops (together with a sequence of greater than 4,900 company-operated shops and amenities) to 120 international locations below the Sherwin-Williams title.

The corporate additionally manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and different manufacturers.

On October twenty second, 2024, Sherwin-Williams launched monetary outcomes for the third quarter of fiscal 2024. Gross sales edged up solely 0.7% over final yr’s quarter, primarily on account of poor demand in Shopper Manufacturers Group.

Nevertheless, gross margin expanded from 47.7% to 49.1% thanks to cost hikes and adjusted earnings-per-share grew 5%, from $3.20 to $3.37.

Sherwin-Williams reiterated its steerage for 2024. It expects gross sales to be up a low-single digit % and earnings-per-share of $11.10-$11.40.

Because it has crushed the analysts’ estimates in 7 of the final 9 quarters and tends to concern considerably cautious steerage, we’ve saved our forecast intact at $11.40 (excessive finish).

Click on right here to obtain our most up-to-date Positive Evaluation report on SHW (preview of web page 1 of three proven under):

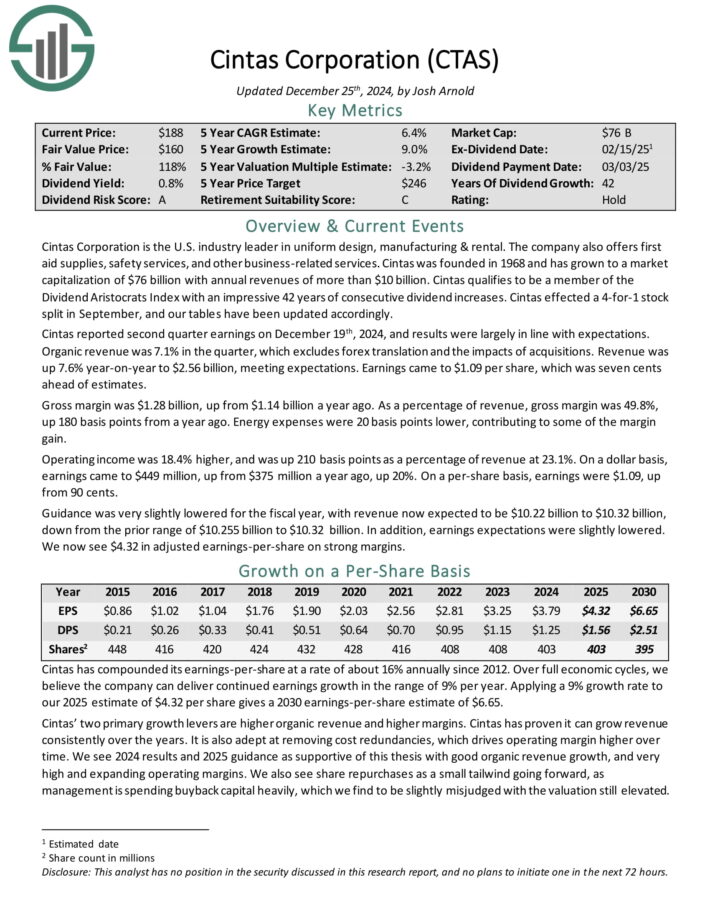

High quality Dividend Inventory For The Lengthy Run: Cintas Company (CTAS)

5-year dividend development: 10.0%

Cintas Company is the U.S. business chief in uniform design, manufacturing & rental. The corporate additionally presents first assist provides, security companies, and different business-related companies.

Cintas qualifies to be a member of the Dividend Champions with a formidable 42 years of consecutive dividend will increase.

Cintas reported second quarter earnings on December nineteenth, 2024, and outcomes had been largely in keeping with expectations. Natural income was 7.1% within the quarter, which excludes foreign exchange translation and the impacts of acquisitions.

Income was up 7.6% year-on-year to $2.56 billion, assembly expectations. Earnings got here to $1.09 per share, which was seven cents forward of estimates.

Gross margin was $1.28 billion, up from $1.14 billion a yr in the past. As a proportion of income, gross margin was 49.8%, up 180 foundation factors from a yr in the past. Vitality bills had been 20 foundation factors decrease, contributing to a few of the margin achieve.

Working earnings was 18.4% increased, and was up 210 foundation factors as a proportion of income at 23.1%. On a greenback foundation, earnings got here to $449 million, up from $375 million a yr in the past, up 20%. On a per-share foundation, earnings had been $1.09, up from 90 cents.

Click on right here to obtain our most up-to-date Positive Evaluation report on CTAS (preview of web page 1 of three proven under):

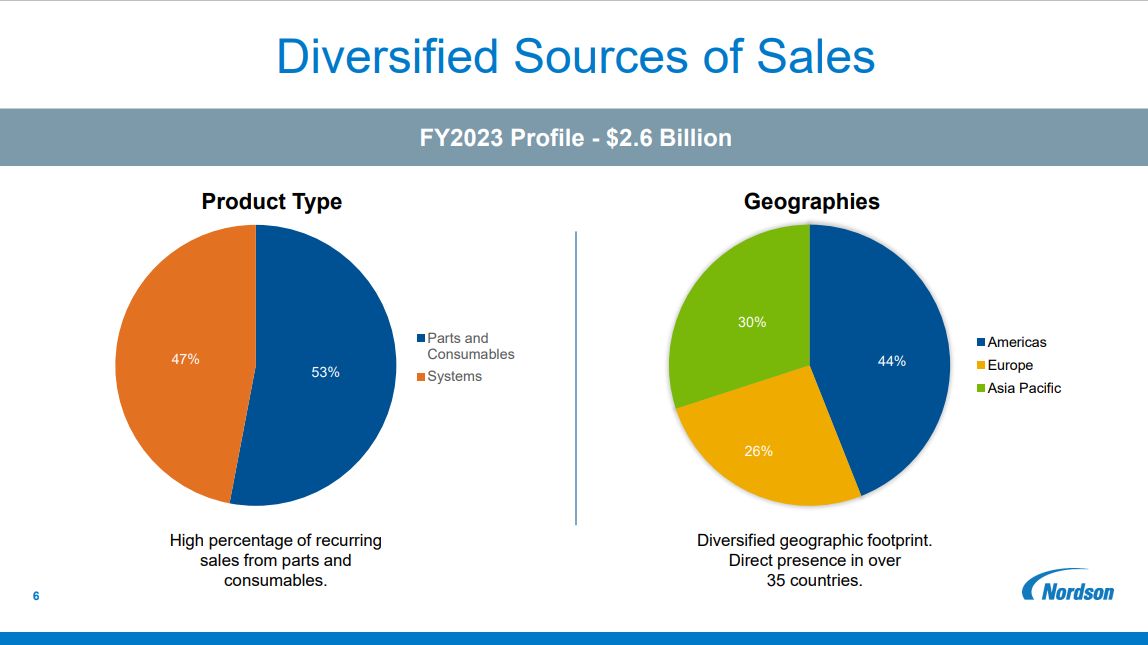

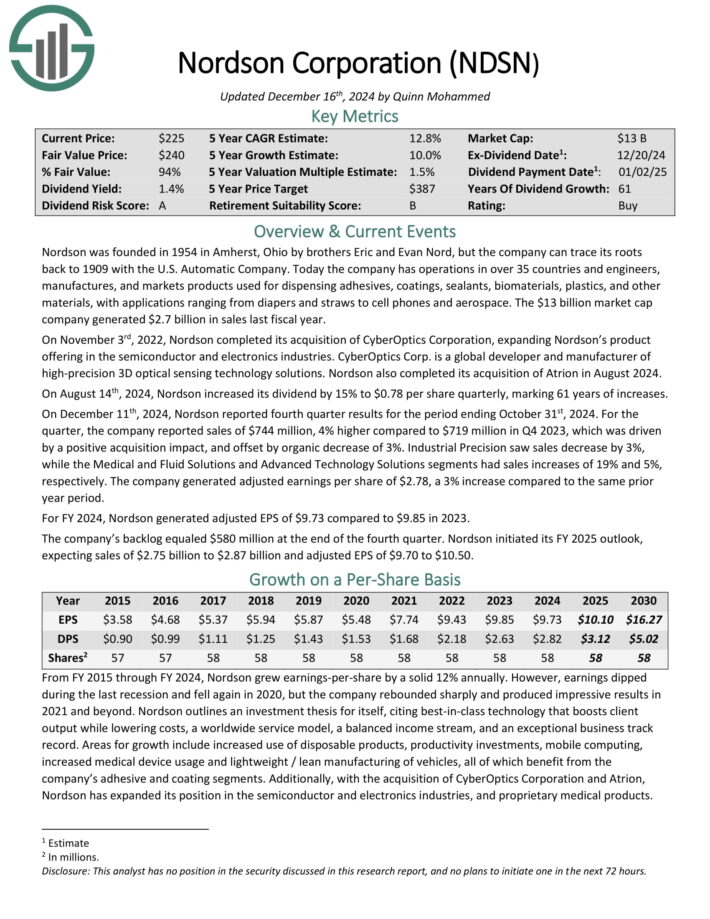

High quality Dividend Inventory For The Lengthy Run: Nordson Corp. (NDSN)

5-year dividend development: 10.0%

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Automated Firm.

In the present day the corporate has operations in over 35 international locations and engineers, manufactures, and markets merchandise used for meting out adhesives, coatings, sealants, biomaterials, plastics, and different supplies.

Supply: Investor Presentation

On August 14th, 2024, Nordson elevated its dividend by 15% to $0.78 per share quarterly, marking 61 years of will increase.

On December eleventh, 2024, Nordson reported fourth quarter outcomes for the interval ending October thirty first, 2024. For the quarter, the corporate reported gross sales of $744 million, 4% increased in comparison with $719 million in This autumn 2023, which was pushed by a optimistic acquisition influence, and offset by natural lower of three%.

Industrial Precision noticed gross sales lower by 3%, whereas the Medical and Fluid Options and Superior Know-how Options segments had gross sales will increase of 19% and 5%, respectively.

The corporate generated adjusted earnings per share of $2.78, a 3% enhance in comparison with the identical quarter final yr. For FY 2024, Nordson generated adjusted EPS of $9.73 in comparison with $9.85 in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on NDSN (preview of web page 1 of three proven under):

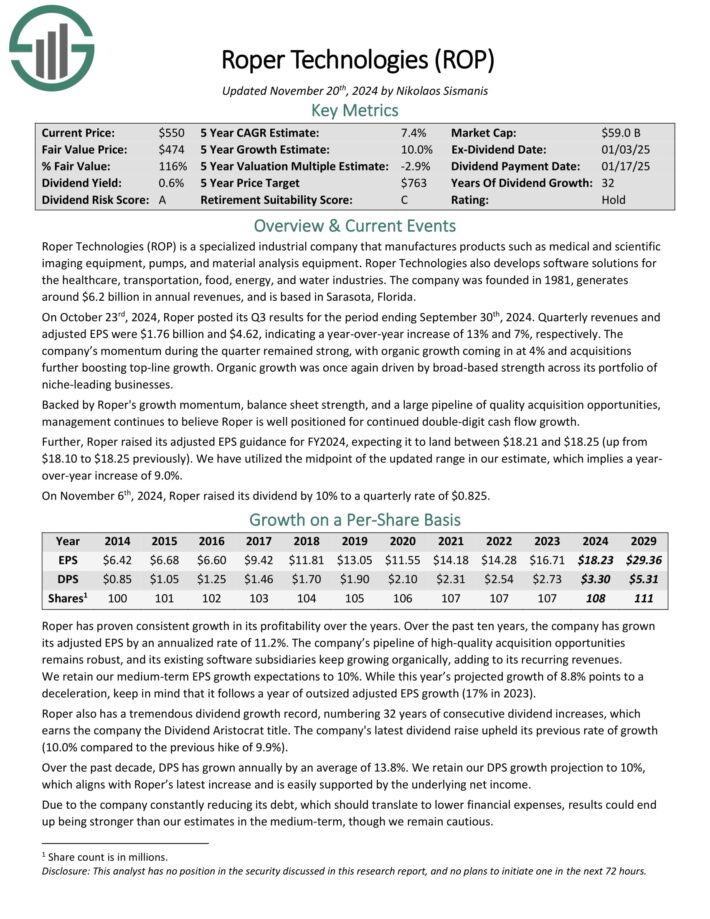

High quality Dividend Inventory For The Lengthy Run: Roper Applied sciences (ROP)

5-year dividend development: 10.0%

Roper Applied sciences is a specialised industrial firm that manufactures merchandise equivalent to medical and scientific imaging tools, pumps, and materials evaluation tools.

Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, vitality, and water industries.

The corporate was based in 1981, generates round $5.4 billion in annual revenues, and is predicated in Sarasota, Florida.

On October twenty third, 2024, Roper posted its Q3 outcomes for the interval ending September thirtieth, 2024. Quarterly revenues and adjusted EPS had been $1.76 billion and $4.62, indicating a year-over-year enhance of 13% and seven%, respectively.

The corporate’s momentum throughout the quarter remained sturdy, with natural development coming in at 4% and acquisitions additional boosting top-line development.

Natural development was as soon as once more pushed by broad-based power throughout its portfolio of niche-leading companies.

Click on right here to obtain our most up-to-date Positive Evaluation report on ROP (preview of web page 1 of three proven under):

Further Studying

The Dividend Champions record will not be the one method to shortly display for shares that frequently pay rising dividends.

The Dividend Kings Listing is much more unique than the Dividend Aristocrats. It’s comprised of 53 shares with 50+ years of consecutive dividend will increase.

The Excessive Dividend Shares Listing: shares that attraction to buyers within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Listing: shares that pay dividends each month, for 12 dividend funds per yr.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].