At this time, Indian buyers have many monetary funding asset lessons – home and overseas, to guess on. In CY24, they haven’t been let down by any of them. All delivered optimistic returns within the calendar yr, with equities topping the checklist.

So far as the long-term efficiency is anxious, small- and mid-cap shares prime the chart in 2024 and outperformed the opposite asset lessons.

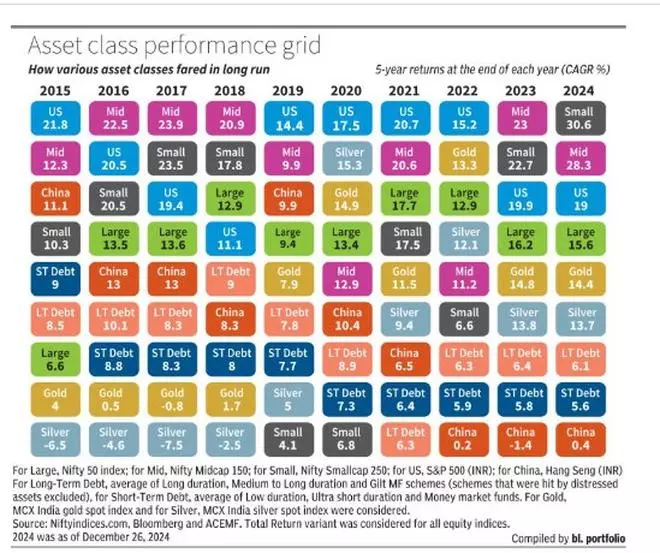

The accompanying chart displays the relative long-term efficiency of probably the most liquid monetary asset lessons accessible to Indian buyers. We thought of large-cap, mid-cap, small-cap, gold, silver, US equities, Chinese language equities, long-term debt and short-term debt and, computed the five-year returns on the finish of every yr for the final ten years. The belongings have been picked primarily based on invisibility possibility for Indian buyers by way of direct investing or mutual funds/ETFs.

Learn: Mid-cap, small-cap mutual funds appeal to ₹30,350 crore in H1 FY25

Mid-caps on prime

Total, when long-term efficiency, mid-caps outperformed large-caps and small-caps when it comes to consistency and comparatively higher returns.

Within the final five-year timeframe ended 2024, the Nifty Smallcap 250 Whole Return Index (TRI), which represents small-cap shares, produced a compound annualised return of 30.6 per cent, whereas the mid-caps as represented by Nifty Midcap 150 TRI, delivered a return of 28.3 per cent.

The home equities market demonstrated stellar present after the pandemic, regardless of short-term turbulences.

Trivesh D, COO Tradejini says, “Nonetheless, this stellar efficiency could not carry ahead into 2025. Market dynamics point out that development throughout segments is prone to reasonable, with mid-single-digit returns being a practical projection. Massive caps could proceed to supply stability however face valuation pressures, whereas mid and small caps might witness uneven efficiency as a consequence of slower earnings development and heightened regulatory scrutiny”.

Learn extra: Lively investing fares properly in small-cap area

Over the past 15 years, mid-caps have constantly outperformed large-caps and small-caps within the majority of timeframes, because the desk illustrates.

US and China

Over the past two years, US equities delivered higher returns in comparison with the large-cap shares within the home market. This development has been largely pushed by the ‘Magnificent 7 ’ — Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla — backed by robust earnings and main investments in synthetic intelligence (AI).

Additional rupee depreciation has boosted 5 yr returns for an Indian investor. For instance, whereas the final 5-year CAGR of S&P 500 whole returns (together with dividends) is 15 per cent in USD phrases, it will increase to 19 per cent in INR phrases.

“In 2024, the US market has turn out to be far more balanced,” mentioned Pratik Oswal, head of passive funds at Motilal Oswal AMC. The 450-490 firms that had not carried out properly final yr have additionally recovered in 2024 and demonstrated higher returns, he added.

Macroeconomic elements such because the US Federal Reserve’s coverage fee reduce fee and the probability of extra within the offing, and the easing of the speed of inflation have been beneficial elements, resulting in a resurgence in US shares, Oswal mentioned.

After three years of underperformance, Chinese language shares got here into the limelight because of the stimulus measures introduced by the Chinese language authorities in October 2024. The coverage measure introduced have been geared toward supporting a weak property sector, improve retail consumption and increase capital markets. A China-focussed ETF buying and selling in India returned 29 per cent this yr, though 5-year CAGR was flat.

Additionally learn:Traders flock to sectoral mid-, small-caps, regardless of uneven market

Debt – a balancing act

The years 2018–2022 weren’t so good for the home mounted earnings markets, as a consequence of a number of headwinds. Nonetheless, issues modified during the last 18-20 months as a consequence of few elements together with vital FII (overseas institutional buyers) inflows into Indian authorities bonds and expectations of a fee reduce cycle.

Devang Shah, Head Fastened Earnings, Axis Mutual Fund, mentioned, “For 2025, we imagine the RBI will reduce charges, driving efficiency of bond markets. We count on a 50-basis factors fee reduce within the subsequent six months. The explanations for this may be slower GDP development, as seen within the decrease Q2 GDP, with Q3 and This autumn additionally anticipated to be decrease. This is able to immediate the RBI to alter its course and begin slicing charges”.

Your asset allocation plan ought to embrace debt funds since they might act as a buffer when different asset lessons decline.

Each gold and silver glitter

Gold, as an asset class, is used as a retailer of worth and a hedge towards inventory market volatility amid financial uncertainties. Regardless of short-term blips, gold costs have been on the rise since October 2022. The yellow steel has delivered a strong CAGR of 14.4 per cent during the last 5 years in rupee phrases. Anticipated fee cuts by main economies and persisting geopolitical tensions led to a major surge in gold value.

Chirag Mehta, CIO, Quantum AMC mentioned, “The surge in gold costs is anticipated to persist into 2025, with the trajectory anticipated to be influenced considerably by the return of President Donald Trump to workplace, which might herald a sequence of coverage adjustments and strategic choices.” Anticipated fee cuts by main economies and persisting geopolitical tensions might additionally result in a major surge in gold value he added.

Whereas the gold has been the mainstay of buyers’ portfolio for years for diversification into commodities, the silver has additionally gained traction amongst buyers.

Silver is a key part in photo voltaic panels and different renewable power applied sciences. The growing demand for these applied sciences has pushed up the demand for silver.

Manish Banthia, CIO Fastened Earnings, ICICI Prudential AMC mentioned, “The outlook for silver in 2025 is formed by two key elements: its relationship with gold as a proxy within the treasured metals area and its industrial demand dynamics”.

The yr 2025 presents a difficult macroeconomic surroundings in the US, characterised by elevated debt ranges and a considerable fiscal deficit. Gold, historically seen as a hedge towards threat, is prone to profit from these uncertainties, and this optimistic sentiment might prolong to silver, given its twin position as a treasured and industrial steel Banthia added.

Secondly, the continued surge in energy sector investments and electrical autos (EVs) investments continues due to new age functions demand for silver could stay sturdy. Ought to these developments persist, silver’s industrial worth will probably stay robust Banthia defined.

Silver, in rupee time period, delivered a CAGR return of 13.7 per cent within the final 5 years. Nonetheless, gold outperformed silver over future in most time frames, because the desk illustrates.