Revealed on December twenty fourth, 2024 by Bob Ciura

It isn’t shocking that we favor shares that pay dividends as research have proven that proudly owning earnings producing securities is a wonderful strategy to construct wealth whereas additionally defending to the draw back.

In bull markets, dividends can add to the features from the inventory whereas additionally buying extra shares. When costs decline, dividends can scale back the losses whereas getting used to amass extra shares at a now lower cost.

With this in thoughts, we created a full record of the Dividend Kings, a gaggle of shares with over 50 consecutive years of dividend will increase.

You may see the complete downloadable spreadsheet of all 54 Dividend Kings (together with vital monetary metrics akin to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

The Dividend Kings record contains a number of mega-cap shares which have monumental companies, akin to Walmart Inc. (WMT) and Coca-Cola (KO).

These dividend development shares have been rewarding shareholders with rising earnings for many years. The next 10 shares characterize Dividend Kings that may proceed to lift their dividends for many years to come back.

The record contains 10 Dividend Kings with Dividend Danger Scores of A or B within the Certain Evaluation Analysis Database, that even have payout ratios beneath 70% to make sure a sustainable dividend payout.

Desk of Contents

Dividend King To Maintain Endlessly: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the most important publicly traded farmland product firm in america. Archer-Daniels-Midland’s companies embody processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal Yr (FY) 2024 on November 18th, 2024. The corporate reported adjusted internet earnings of $530 million and adjusted EPS of $1.09, each down from the prior yr resulting from a $461 million non-cash cost associated to its Wilmar fairness funding.

Consolidated money flows year-to-date reached $2.34 billion, reflecting sturdy operations regardless of market challenges.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADM (preview of web page 1 of three proven beneath):

Dividend King To Maintain Endlessly: Becton, Dickinson & Co. (BDX)

Becton, Dickinson & Co. is a world chief within the medical provide trade. The corporate was based in 1897 and has 75,000 staff throughout 190 international locations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

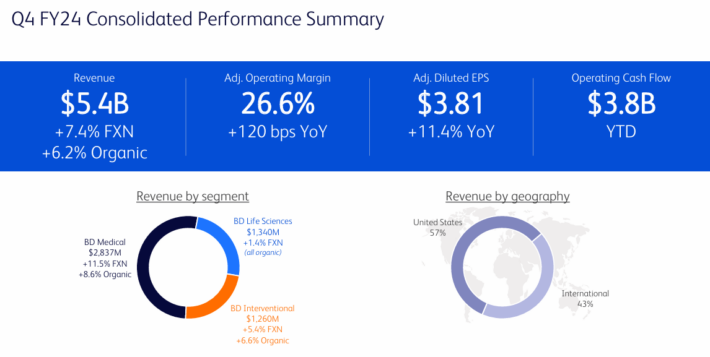

BDX reported outcomes for the fourth quarter and financial yr 2024, which ended September thirtieth, 2024. For the quarter, income grew 6.9% to $5.44 billion, which was $57 million greater than anticipated.

Supply: Investor Presentation

On a foreign money impartial foundation, income improved 7.4%. Adjusted earnings-per-share of $3.81 in contrast favorably to $3.42in the prior yr and was $0.04 forward of estimates.

For the fiscal yr, income grew 4.2% to $20.2 billion whereas adjusted earnings-per-share of $13.14 in comparison with $12.21 within the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDX (preview of web page 1 of three proven beneath):

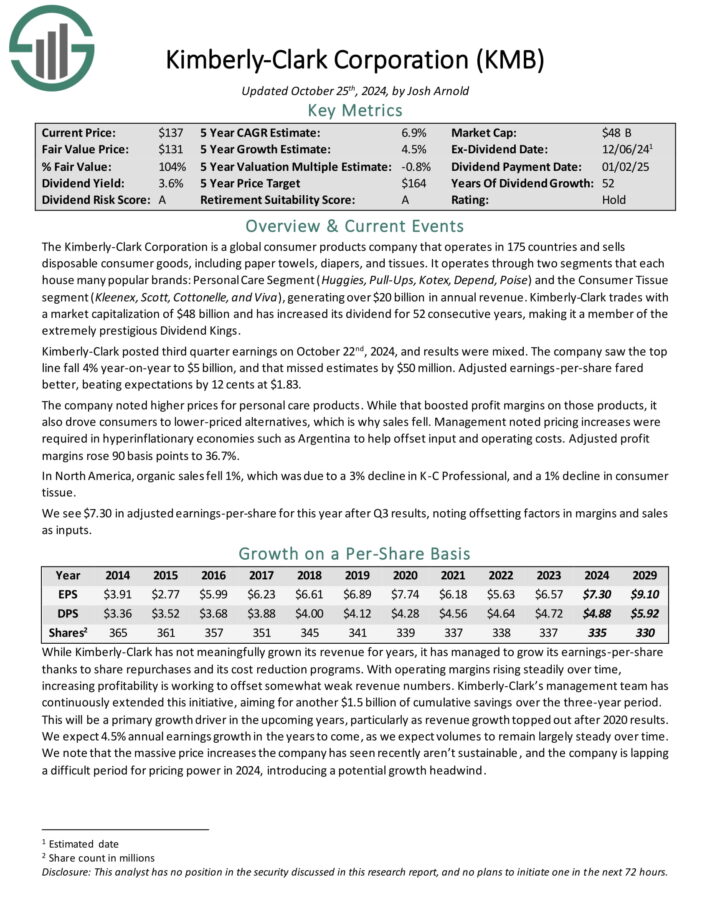

Dividend King To Maintain Endlessly: Kimberly-Clark (KMB)

Kimberly-Clark is a world client merchandise firm that operates in 175 international locations and sells disposable client items, together with paper towels, diapers, and tissues.

It operates segments that every home many fashionable manufacturers: the Private Care Section (Huggies, Pull-Ups, Kotex, Rely, Poise), the Client Tissue phase (Kleenex, Scott, Cottonelle, and Viva), and an expert phase. In all, KMB generates ~$21 billion in annual income.

Supply: Investor Presentation

Kimberly-Clark posted third quarter earnings on October twenty second, 2024, and outcomes had been combined. The corporate noticed the highest line fall 4% year-on-year to $5 billion, and that missed estimates by $50 million. Adjusted earnings-per-share fared higher, beating expectations by 12 cents at $1.83.

The corporate famous increased costs for private care merchandise. Whereas that boosted revenue margins on these merchandise, it additionally drove shoppers to lower-priced options, which is why gross sales fell.

Administration famous pricing will increase had been required in hyper-inflationary economies akin to Argentina to assist offset enter and working prices. Adjusted revenue margins rose 90 foundation factors to 36.7%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kimberly-Clark (preview of web page 1 of three proven beneath):

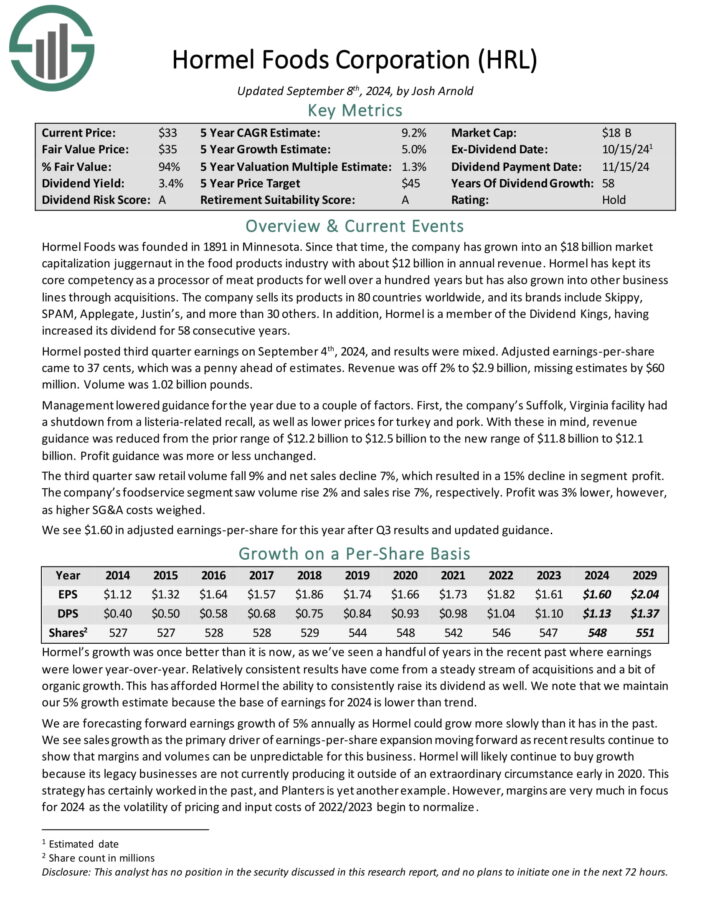

Dividend King To Maintain Endlessly: Hormel Meals (HRL)

a juggernaut within the meals merchandise trade with almost $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for nicely over 100 years, however has additionally grown into different enterprise strains via acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Only a few of its high manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Supply: Investor Presentation

Hormel Meals Company reported sturdy Q3 fiscal 2024 outcomes, with internet gross sales of $2.9 billion and adjusted working earnings of $267 million, exceeding expectations.

Key drivers included sturdy performances in retail manufacturers and worldwide markets, supported by ongoing enhancements from the corporate’s modernization initiatives.

The corporate posted diluted earnings per share of $0.32 ($0.37 adjusted) and a money circulation from operations of $218 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on Hormel (preview of web page 1 of three proven beneath):

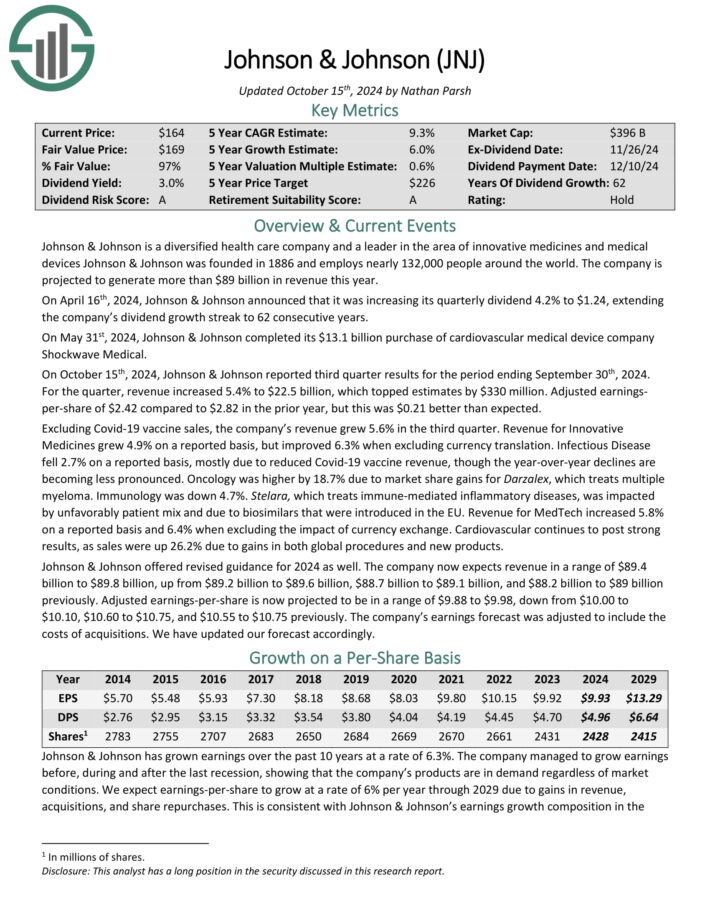

Dividend King To Maintain Endlessly: Johnson & Johnson (JNJ)

Johnson & Johnson was based in 1886 and has reworked into one of many largest firms on the earth. Johnson & Johnson is a mega-cap inventory. The corporate generates annual gross sales above $99 billion.

The corporate operates a diversified enterprise mannequin, permitting it to enchantment to all kinds of shoppers inside the healthcare sector.

J&J now operates two segments, prescription drugs and medical gadgets, after spinning off its client well being franchises.

Johnson & Johnson reported third-quarter 2024 gross sales development of 5.2%, reaching $22.5 billion, with operational development of 6.3%.

Supply: Investor Presentation

Nevertheless, earnings per share (EPS) decreased by 34.3%, largely resulting from a one-time particular cost and purchased in-process analysis and growth (IPR&D).

Adjusted EPS fell 9.0% to $2.42, pushed by the identical IPR&D influence. The corporate made important developments, together with approvals for therapies like TREMFYA and RYBREVANT, and the submission of a brand new basic surgical procedure robotic system, OTTAVA.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

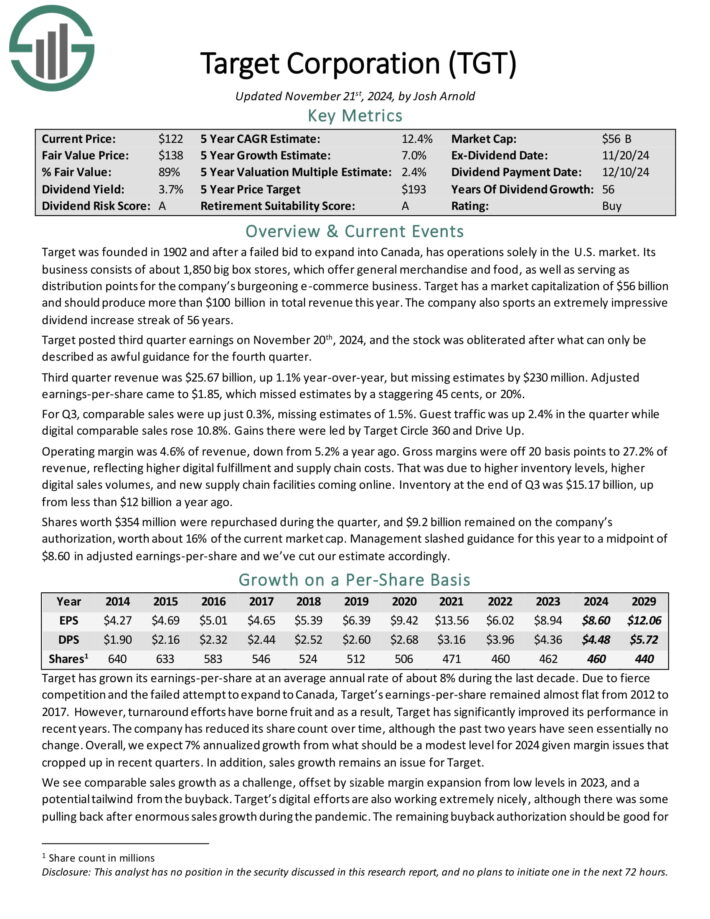

Dividend King To Maintain Endlessly: Goal Company (TGT)

Goal was based in 1902 and now operates about 1,850 large field shops, which provide basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted second quarter earnings on August twenty first, 2024, and outcomes had been fairly sturdy, sending the inventory leaping after the report. Adjusted earnings-per-share got here to $2.57, which was 39 cents forward of estimates. Income was up 2.7% year-over-year to $25.45 billion, which beat by $240 million.

Comparable gross sales had been up 2% year-over-year, making up a lot of the complete gross sales acquire. Consensus was for a acquire of 1.1%. Site visitors was up 3% year-over-year with all six core merchandising classes seeing optimistic development. Digital comparable gross sales had been up 8.7%, as soon as once more driving development.

Goal has grown its dividend for greater than 5 many years, making it a Dividend King. The corporate is investing closely in its enterprise with a purpose to navigate via the altering panorama within the retail sector. The payout is now 47% of earnings for this yr,

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

Dividend King To Maintain Endlessly: The Coca-Cola Firm (KO)

Coca-Cola was based in 1892. Right this moment, it’s the world’s largest non-alcoholic beverage firm. It owns or licenses greater than 500 non-alcoholic drinks, together with each glowing and nonetheless drinks.

Its manufacturers account for about 2 billion servings of drinks worldwide day-after-day, producing greater than $45 billion in annual income.

The glowing beverage portfolio contains the flagship Coca-Cola model, in addition to different soda manufacturers like Eating regimen Coke, Sprite, Fanta, and extra.

The nonetheless beverage portfolio contains water, juices, and ready-to-drink teas, akin to Dasani, Minute Maid, Vitamin Water, and Sincere Tea.

Supply: Investor Presentation

Coca-Cola dominates glowing smooth drinks, however the firm is trying to keep up and even enhance this dominant place with product extensions of present fashionable manufacturers, together with decreased and zero-sugar variations of manufacturers like Sprite and Fanta.

Coca-Cola posted third quarter earnings on October twenty third, 2024, and outcomes had been higher than anticipated on each income and earnings. The corporate noticed adjusted earnings-per-share of 77 cents, which was two cents higher than estimates.

Income was off fractionally year-over-year to $11.9 billion, however did beat estimates by $290 million. Natural revenues had been up by 9%. That included 10% development in value and blend, a 2% decline in focus gross sales, and a 1% acquire in case volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven beneath):

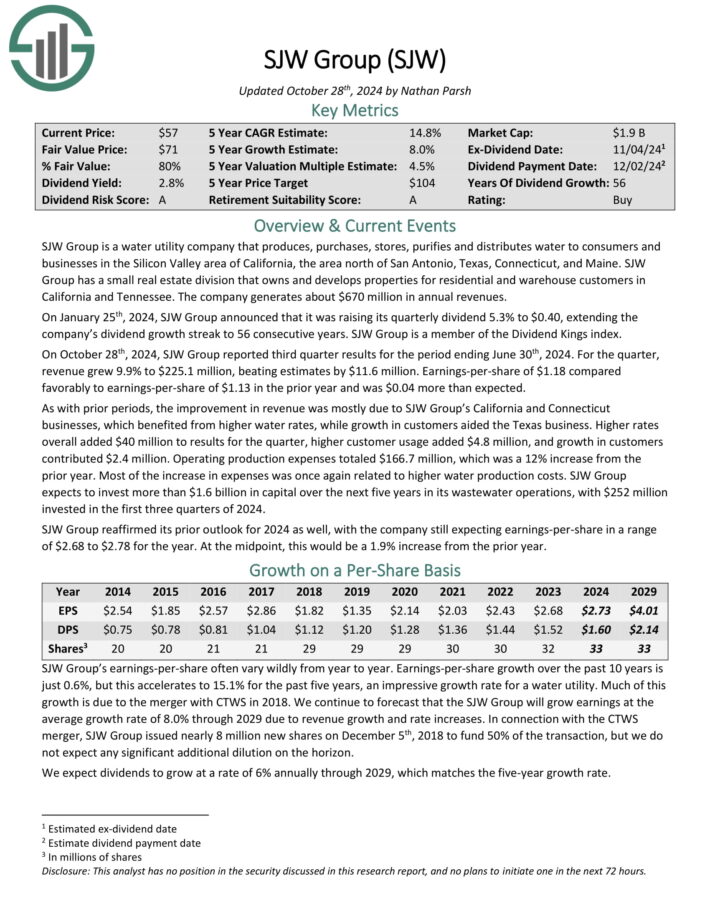

Dividend King To Maintain Endlessly: SJW Group (SJW)

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

Supply: Investor Presentation

On October twenty eighth, 2024, SJW Group reported third quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 in contrast favorably to earnings-per-share of $1.13 within the prior yr and was $0.04 greater than anticipated.

As with prior durations, the development in income was principally resulting from SJW Group’s California and Connecticut companies, which benefited from increased water charges, whereas development in clients aided the Texas enterprise.

Greater charges general added $40 million to outcomes for the quarter, increased buyer utilization added $4.8 million, and development in clients contributed $2.4 million. Working manufacturing bills totaled $166.7 million, which was a 12% improve from the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJW (preview of web page 1 of three proven beneath):

Dividend King To Maintain Endlessly: Nationwide Gasoline Fuel (NFG)

Nationwide Gasoline Fuel Co. is a diversified vitality firm that operates in 5 enterprise segments: Exploration & Manufacturing, Pipeline & Storage, Gathering, Utility, and Vitality Advertising. The biggest phase of the corporate is Exploration & Manufacturing.

Because of its vertically built-in enterprise mannequin, it enjoys important synergies.

Supply: Investor Presentation

In early November, Nationwide Gasoline Fuel reported (11/1/23) monetary outcomes for the fourth quarter of fiscal 2023. The corporate grew its manufacturing 7% over the prior yr’s quarter due to the event of core acreage positions in Appalachia. Nevertheless, the common realized value of pure gasoline fell -18%, from $2.84 to $2.33.

Consequently, adjusted earnings-per-share declined -34%, from $1.19 to $0.78, and missed the analysts’ consensus by $0.07. The corporate has overwhelmed the analysts’ estimates in 15 of the final 18 quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on NFG (preview of web page 1 of three proven beneath):

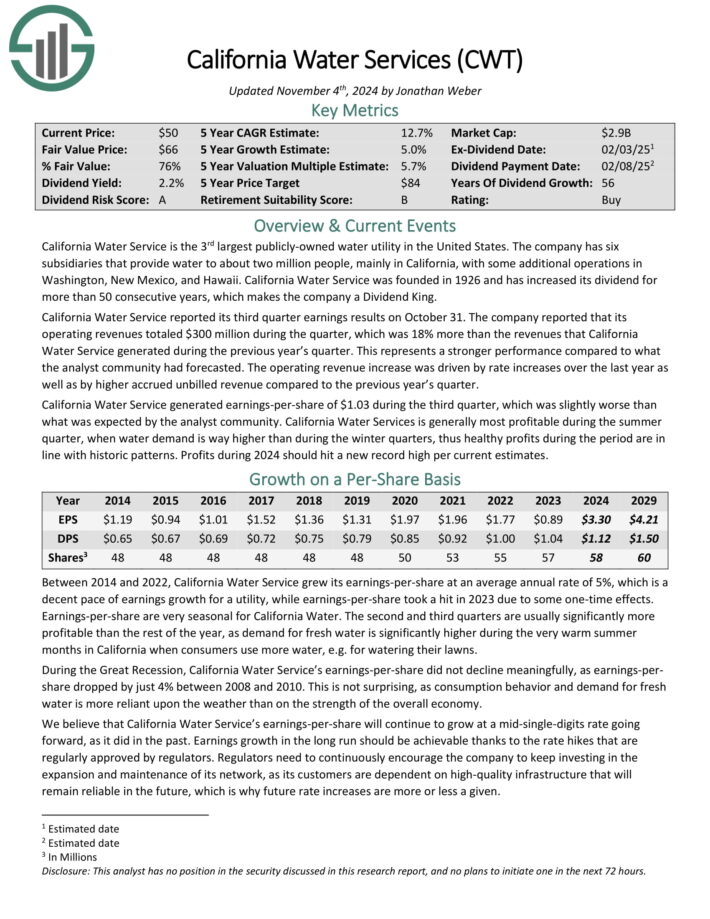

Dividend King To Maintain Endlessly: California Water Service Group (CWT)

California Water Service is a water inventory and is the third-largest publicly-owned water utility in america.

It was based in 1926 and has six subsidiaries that present water to roughly 2 million folks in 100 communities, primarily in California but in addition in Washington, New Mexico and Hawaii.

Supply: Investor Presentation

California Water Service reported its third quarter earnings outcomes on October thirty first. Working revenues totaled $300 million throughout the quarter, which was 18% increased than the identical quarter final yr. This represents a stronger efficiency in comparison with what the analyst neighborhood had forecasted.

The working income improve was pushed by charge will increase over the past yr in addition to by increased accrued unbilled income in comparison with the earlier yr’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on CWT (preview of web page 1 of three proven beneath):

Last Ideas

Screening to search out one of the best Dividend Kings is just not the one strategy to discover high-quality dividend development shares to carry without end.

Certain Dividend maintains comparable databases on the next helpful universes of shares:

There’s nothing magical about investing within the Dividend Kings. They’re merely a gaggle of high-quality companies with shareholder-friendly administration groups which have sturdy aggressive benefits.

Buying companies with these traits–at truthful or higher costs–and holding them without end, will seemingly lead to sturdy long-term funding efficiency.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].