Article up to date on November twenty ninth, 2024 by Bob Ciura

Spreadsheet information up to date every day

Excessive dividend shares are shares with a dividend yield nicely in extra of the market common dividend yield of ~1.3%.

The sources on this report concentrate on really excessive yielding securities, usually with dividend yields multiples greater than the market common.

We have now created a spreadsheet of excessive dividend shares (and intently associated REITs and MLPs, and many others.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full listing of all excessive dividend shares with 5%+ yields (together with necessary monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink beneath:

This text supplies an outline of excessive dividend shares, and features a high 10 listing of excessive dividend shares that almost all revenue traders haven’t heard of.

Desk of Contents

Excessive Dividend Shares Overview

Excessive dividend shares are instantly interesting for revenue traders, as a consequence of their greater yields than the market common.

Investing in high-yield shares is an effective way to generate revenue. However it’s not with out dangers.

First, inventory costs fluctuate. Traders want to know their danger tolerance earlier than investing in excessive dividend shares. Share value fluctuations implies that your funding can (and virtually actually will) decline in worth, at the least quickly (and probably completely) do to market volatility.

Second, companies develop and decline. Investing in a inventory provides you fractional possession within the underlying enterprise. Some companies develop over time. These companies are more likely to pay greater dividends over time.

The Dividend Champions are a superb instance of this; every has paid rising dividends for 25+ consecutive years.

What’s harmful is when a enterprise declines. Dividends are paid out of an organization’s money flows. If the enterprise sees its money flows decline, or worse is dropping cash, it might scale back or get rid of its dividend.

Enterprise decline is a major danger with excessive yield investing. Enterprise declines usually coincide with and or speed up throughout recessions.

The next 10 excessive dividend shares you’ve by no means heard of have present yields above 5%, constructive anticipated returns over the following 5 years, and market caps beneath $8 billion which suggests they’re small-caps or mid-caps.

Enterprise Improvement Corporations (BDCs) and Grasp Restricted Partnerships (MLPs) had been excluded from the listing beneath, as they’ve distinctive tax conditions and danger components to think about.

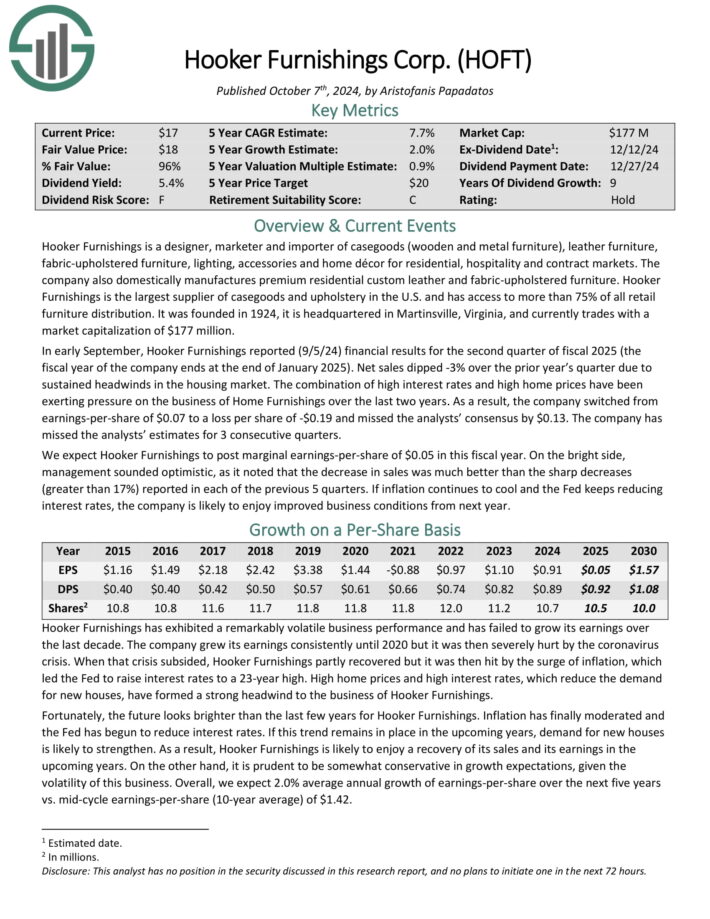

Excessive Dividend Inventory You’ve By no means Heard Of: Hooker Furnishings Company (HOFT)

Hooker Furnishings is a designer, marketer and importer of casegoods (wood and steel furnishings), leather-based furnishings, fabric-upholstered furnishings, lighting, equipment and residential décor for residential, hospitality and contract markets.

The corporate additionally domestically manufactures premium residential customized leather-based and fabric-upholstered furnishings.

Hooker Furnishings is the most important provider of casegoods and fabric within the U.S. and has entry to greater than 75% of all retail furnishings distribution.

Supply: Investor Presentation

In early September, Hooker Furnishings reported (9/5/24) monetary outcomes for the second quarter of fiscal 2025 (the fiscal 12 months of the corporate ends on the finish of January 2025). Web gross sales dipped -3% over the prior 12 months’s quarter as a consequence of sustained headwinds within the housing market.

The mix of excessive rates of interest and excessive dwelling costs have been exerting stress on the enterprise of House Furnishings during the last two years.

Because of this, the corporate switched from earnings-per-share of $0.07 to a loss per share of -$0.19 and missed the analysts’ consensus by $0.13. The corporate has missed the analysts’ estimates for 3 consecutive quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on HOFT (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory You’ve By no means Heard Of: First Bancorp Inc. (FNLC)

The First Bancorp, which is headquartered in Damariscotta, Maine, is the holding firm for First Nationwide Financial institution, a full service group financial institution that was based in 1864.

First Nationwide Financial institution is a regional financial institution with 18 branches alongside Maine’s coast and a pair of branches within the larger Bangor space. It supplies a variety of business and retail banking providers; it has whole belongings of $3.1 billion.

The First Bancorp advantages from the financial progress of Maine’s coastal counties and downtown Bangor.

Because of the surge of rates of interest to just about 23-year highs, the online curiosity margin of The First Bancorp has pronouncedly contracted in latest quarters.

In late October, The First Bancorp reported (10/23/24) monetary outcomes for the third quarter of fiscal 2024. Loans grew 3% and deposits grew 5% sequentially.

Web curiosity margin expanded from 2.21% to 2.32%, as greater yields greater than offset excessive deposit prices amid intense competitors amongst banks.

Because of this, internet curiosity revenue grew 8% and earnings-per-share grew 24%, from $0.55 to $0.68.

Click on right here to obtain our most up-to-date Positive Evaluation report on FNLC (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory You’ve By no means Heard Of: LCNB Corp. (LCNB)

LCNB Corp. is a Ohio-based monetary holding firm offering banking and insurance coverage providers by way of its subsidiaries, LCNB Nationwide Financial institution and Dakin Insurance coverage Company, Inc. The corporate reported $2.35 billion in whole belongings as of September thirtieth, 2024.

LCNB Nationwide Financial institution gives client and industrial banking providers, together with checking and financial savings accounts, certificates of deposit, and loans for residential mortgages, industrial actual property, and private wants.

Dakin Insurance coverage Company supplies private and industrial insurance coverage merchandise and annuity providers. LCNB additionally gives belief administration, property settlement, and funding administration providers, in addition to monetary merchandise like mutual funds, annuities, and life insurance coverage.

On October twenty first, 2024, LCNB Corp. launched its third-quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, the corporate reported a internet revenue of $4.5 million, or $0.31 per diluted share, in comparison with $4.1 million, or $0.37 per diluted share, in the identical quarter final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on LCNB (preview of web page 1 of three proven beneath):

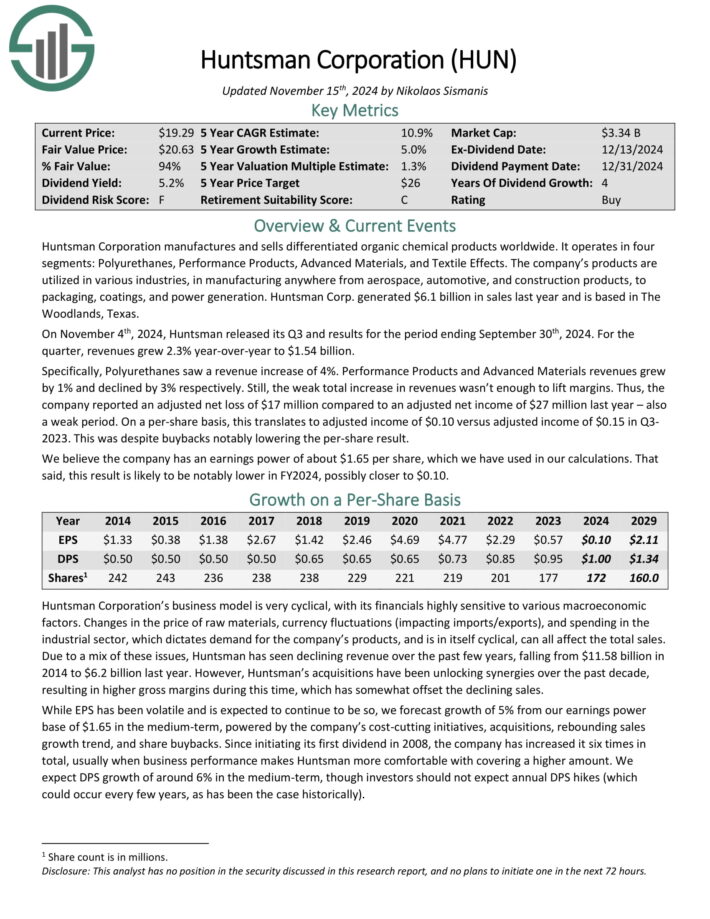

Excessive Dividend Inventory You’ve By no means Heard Of: Huntsman Corp. (HUN)

Huntsman Company manufactures and sells differentiated natural chemical merchandise worldwide. It operates in 4 segments: Polyurethanes, Efficiency Merchandise, Superior Supplies, and Textile Results.

The corporate’s merchandise are utilized in numerous industries, in manufacturing wherever from aerospace, automotive, and building merchandise, to packaging, coatings, and energy technology.

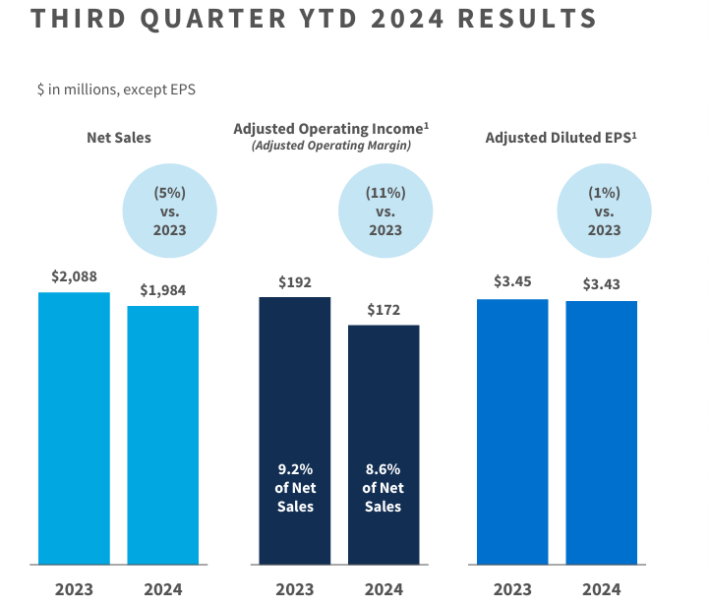

On November 4th, 2024, Huntsman launched its Q3 and outcomes for the interval ending September thirtieth, 2024. For the quarter, revenues grew 2.3% year-over-year to $1.54 billion.

Particularly, Polyurethanes noticed a income enhance of 4%. Efficiency Merchandise and Superior Supplies revenues grew by 1% and declined by 3% respectively. Nonetheless, the weak whole enhance in revenues wasn’t sufficient to elevate margins.

On a per-share foundation, this interprets to adjusted revenue of $0.10 versus adjusted revenue of $0.15 in Q3 2023. This was regardless of buybacks notably decreasing the per-share consequence.

Click on right here to obtain our most up-to-date Positive Evaluation report on HUN (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory You’ve By no means Heard Of: United Bancorp Inc. (UBCP)

United Bancorp a monetary holding firm based mostly in the US, working primarily by way of its wholly-owned subsidiary, United Financial institution.

The corporate gives a variety of banking providers together with retail and industrial banking, mortgage lending, and funding providers.

A few of its different options embrace checking and financial savings accounts, private and enterprise loans, in addition to wealth administration.

On August twenty second, 2024, United Bancorp raised its dividend by 1.4% to a quarterly price of $0.1775. On a year-over-year foundation, this was a 4.4% enhance.

On November sixth, 2024, United Bancorp posted its Q3 outcomes for the interval ending September thirtieth, 2024. The corporate reported whole curiosity revenue of $9.94 million, which was up 3.0% year-over-year.

This progress was primarily pushed by a 13.9% rise in curiosity revenue on loans, regardless of a 32.9% decline in mortgage payment revenue and a 15.2% lower in curiosity revenue from securities.

Nonetheless, whole curiosity bills elevated by about 23.4%, resulting in a 6.5% decline in internet curiosity revenue, which fell to $6.1 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on UBCP (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory You’ve By no means Heard Of: Carters Inc. (CRI)

Carter’s, Inc. is the most important branded retailer of attire completely for infants and younger youngsters in North America. It was based in 1865 by William Carter. The corporate owns the Carter’s and OshKosh B’gosh manufacturers, two of probably the most recognized manufacturers within the youngsters’s attire area.

Carter’s acquired competitor OshKosh B’gosh for $312 million in 2005. Now, these manufacturers are bought in main department shops, nationwide chains, and specialty retailers domestically and internationally.

On October twenty sixth, 2024, the corporate reported third-quarter outcomes for Fiscal 12 months (FY)2024. The corporate reported a decline in third-quarter fiscal 2024 outcomes, with internet gross sales down 4.2% to $758 million in comparison with the earlier 12 months’s $792 million.

Supply: Investor Presentation

The corporate’s working margin decreased to 10.2% from 11.8%, attributed to greater investments in pricing and advertising, regardless of a decrease price of products.

Earnings per diluted share (EPS) dropped to $1.62 from $1.78, reflecting softer demand in key segments.

Click on right here to obtain our most up-to-date Positive Evaluation report on CRI (preview of web page 1 of three proven beneath):

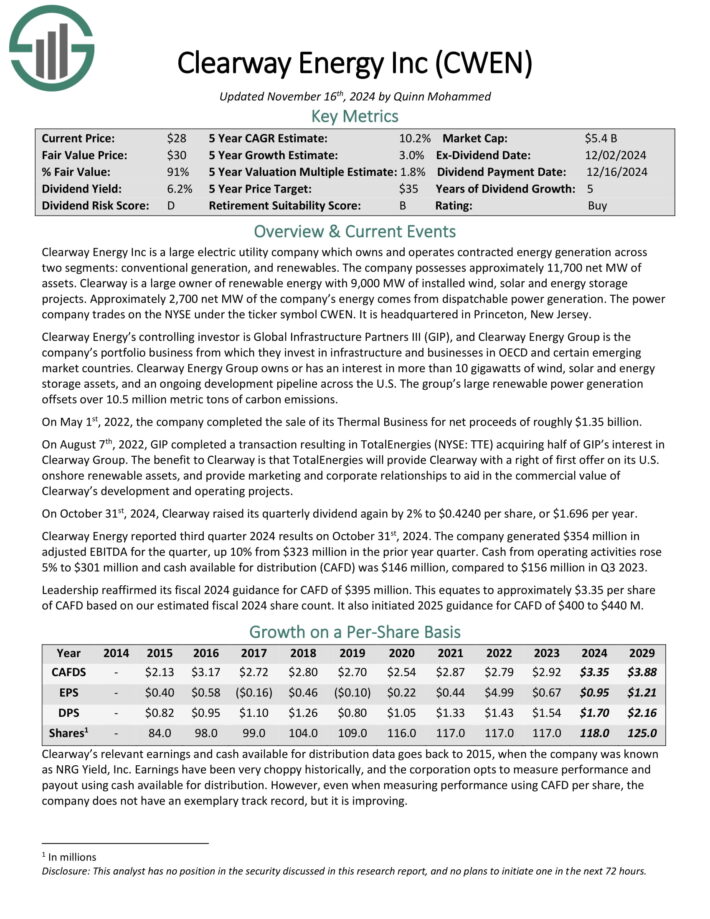

Excessive Dividend Inventory You’ve By no means Heard Of: Clearway Power (CWEN)

Clearway Power Inc is a big electrical utility firm which owns and operates contracted vitality technology throughout two segments: standard technology, and renewables. The corporate possesses roughly 11,700 internet MW of belongings.

Clearway is a big proprietor of renewable vitality with 9,000 MW of put in wind, photo voltaic and vitality storage tasks. Roughly 2,700 internet MW of the corporate’s vitality comes from dispatchable energy technology. The ability firm trades on the NYSE below the ticker image CWEN. It’s headquartered in Princeton, New Jersey.

Clearway Power’s controlling investor is International Infrastructure Companions III (GIP), and Clearway Power Group is the corporate’s portfolio enterprise from which they spend money on infrastructure and companies in OECD and sure rising market nations.

Clearway Power Group owns or has an curiosity in additional than 10 gigawatts of wind, photo voltaic and vitality storage belongings, and an ongoing growth pipeline throughout the U.S. The group’s massive renewable energy technology offsets over 10.5 million metric tons of carbon emissions.

On October thirty first, 2024, Clearway raised its quarterly dividend once more by 2% to $0.4240 per share, or $1.696 per 12 months. Clearway Power reported third quarter 2024 outcomes on October thirty first, 2024. The corporate generated $354 million in adjusted EBITDA for the quarter, up 10% from $323 million within the prior 12 months quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on CWEN (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory You’ve By no means Heard Of: Fortitude Gold (FTCO)

Fortitude Gold Company was spun-off from Gold Useful resource Company right into a separate public firm in December 2021. Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining-friendly jurisdictions.

The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or larger. Its property portfolio presently consists of 100% possession in six high-grade gold properties.

All six properties are inside an approximate 30-mile radius of each other inside the prolific Walker Lane Mineral Belt. The corporate generated $73.1 million in revenues final 12 months, virtually the vast majority of which had been from gold, and is predicated in Colorado Springs, Colorado. It pays dividends on a month-to-month foundation.

On November fifth, 2024, Fortitude Gold launched its Q3 outcomes for the interval ending September 30st, 2024. For the quarter, revenues got here in at $10.2 million, 52% decrease in comparison with final 12 months.

The decline in revenues was primarily as a consequence of a 62% drop in gold gross sales quantity and a 54% lower in silver gross sales quantity. Nonetheless, these reductions had been partially offset by a 26% enhance in gold costs and a 23% rise in silver costs.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven beneath):

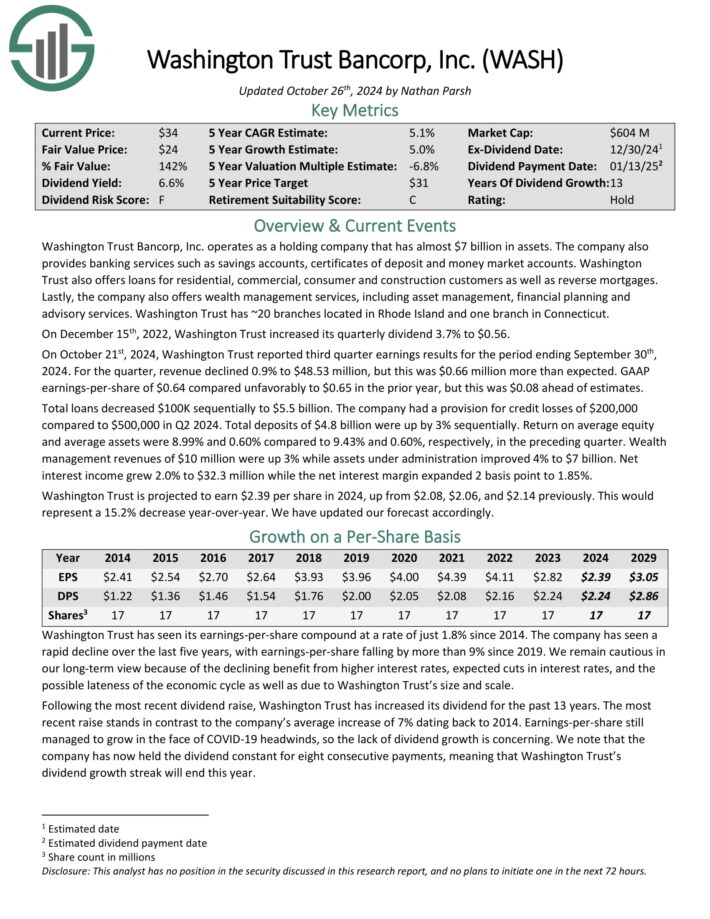

Excessive Dividend Inventory You’ve By no means Heard Of: Washington Bancorp (WASH)

Washington Belief Bancorp, Inc. operates as a holding firm that has virtually $7 billion in belongings. The corporate supplies banking providers comparable to financial savings accounts, certificates of deposit and cash market accounts.

Washington Belief additionally gives loans for residential, industrial, client and building prospects in addition to reverse mortgages.

Lastly, the corporate additionally gives wealth administration providers, together with asset administration, monetary planning and advisory providers. Washington Belief has ~20 branches situated in Rhode Island and one department in Connecticut.

On October twenty first, 2024, Washington Belief reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. For the quarter, income declined 0.9% to $48.53 million, however this was $0.66 million greater than anticipated. GAAP earnings-per-share of $0.64 in contrast unfavorably to $0.65 within the prior 12 months, however this was $0.08 forward of estimates.

Complete loans decreased $100K sequentially to $5.5 billion. The corporate had a provision for credit score losses of $200,000 in comparison with $500,000 in Q2 2024. Complete deposits of $4.8 billion had been up by 3% sequentially.

Return on common fairness and common belongings had been 8.99% and 0.60% in comparison with 9.43% and 0.60%, respectively, within the previous quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on WASH (preview of web page 1 of three proven beneath):

Excessive Dividend Inventory You’ve By no means Heard Of: Haverty Furnishings Corporations (HVT)

Haverty Furnishings Corporations was based in 1885 in Atlanta, GA by J.J. Haverty. Since then, the corporate has grown to greater than 120 shops in 16 U.S. states. Haverty is a specialised retailer of residential furnishings and equipment.

The corporate’s merchandise are used all through the house, together with in dwelling rooms, bedrooms, eating rooms, workplace, and out of doors areas. The corporate generates annual income of greater than $860 million.

Supply: Investor Presentation

On November 1st, 2024, Haverty reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 20.2% to $175.9 million, which was $18.8 million lower than anticipated. GAAP earnings per-share of $0.29 in contrast very unfavorably to $1.02 within the prior 12 months and was $0.18 beneath estimates.

Comparable gross sales for the interval decreased 20.2%. Because of the year-over-year weak point, gross margins contracted 60 foundation factors to 60.2%. SG&A bills decreased $11.8 million to $100.9 million, however represented 57.4% of whole gross sales in comparison with 51.1% within the prior 12 months as a result of decrease gross sales whole.

Haverty ended the interval with $127.4 million in money and equivalents. The corporate has no excellent debt and credit score availability of $80 million..

Click on right here to obtain our most up-to-date Positive Evaluation report on HVT (preview of web page 1 of three proven beneath):

Further Studying

In case you are taken with discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].