Up to date on November twenty second, 2024 by Bob Ciura

Actual property funding trusts – or REITs, for brief – give traders the chance to expertise the financial advantages of proudly owning actual property with none of the day-to-day hassles related to being a standard landlord.

For these causes, REITs could make interesting investments for long-term traders seeking to profit from the earnings and appreciation of actual property.

The sheer variety of REITs implies that traders also can profit from the implementation of a basic, bottom-up safety evaluation course of.

With this in thoughts, we created a full record of over 200 REITs.

You possibly can obtain your free 200+ REIT record (together with necessary monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink under:

As a result of there are such a lot of REITs that presently commerce on the general public markets, traders have the chance to scan the trade and spend money on solely the best-of-the-best.

To do that, an investor should perceive methods to analyze REITs.

This isn’t as straightforward because it sounds; REITs have some totally different accounting nuances that make them distinctly totally different from widespread shares in terms of assessing their funding prospects (significantly with reference to valuation).

With that in thoughts, this text will talk about methods to assess the valuation of actual property funding trusts, together with two step-by-step examples utilizing an actual, publicly-traded REIT.

What’s a REIT?

Earlier than explaining methods to analyze an actual property funding belief, it’s helpful to know what these funding automobiles really are.

A REIT is not an organization that’s targeted on the possession of actual property. Whereas actual property companies definitely exist (Howard Hughes Holdings (HHH) involves thoughts), they aren’t the identical as an actual property funding belief.

The distinction lies in the way in which that these authorized entities are created. REITs are trusts, not companies. Accordingly, they’re taxed otherwise – in a method that’s extra tax environment friendly for the REIT’s traders.

How is that this so?

In alternate for assembly sure necessities which are essential to proceed doing enterprise as a ‘REIT’, actual property funding trusts pay no tax on the organizational stage.

One of the crucial necessary necessities to take care of REIT standing is the fee of 90%+ of its web earnings as distributions to its homeowners.

There are additionally different vital variations between widespread shares and REITs. REITs are organized as trusts.

Because of this, the fractional possession of REITs that commerce on the inventory alternate aren’t ‘shares’ – they’re ‘models’ as an alternative. Accordingly, ‘shareholders’ are literally unit holders.

Unit holders obtain distributions, not dividends. The rationale why REIT distributions aren’t known as dividends is that their tax therapies are totally different.

REIT distributions fall into 3 classes:

Abnormal earnings

Return of capital

Capital positive factors

The ‘extraordinary earnings’ portion of a REIT distribution is essentially the most easy in terms of taxation. Abnormal earnings is taxed at your extraordinary earnings tax fee; as much as 37%.

The ‘return of capital’ portion of a REIT distribution could be considered a ‘deferred tax’. It is because a return of capital reduces your price foundation.

Which means that you solely pay tax on the ‘return of capital’ portion of a REIT distribution once you promote the safety.

The final element – capital positive factors – is simply because it sounds. Capital positive factors are taxed at both short-term or long-term capital positive factors fee.

The share of distributions from these 3 sources varies by REIT. Typically, extraordinary earnings tends to be the vast majority of the distribution.

Anticipate round 70% of distributions as extraordinary earnings, 15% as a return of capital, and 15% as capital positive factors (though, once more, this may fluctuate relying on the REIT).

REITs are greatest fitted to retirement accounts as a result of the vast majority of their funds are taxed as extraordinary earnings. Retirement accounts take away this damaging and make REITs very tax advantageous.

This doesn’t imply you must by no means personal a REIT in a taxable account. funding is an efficient funding, no matter tax points. However when you’ve got the selection, REITs ought to undoubtedly be positioned in a retirement account.

So what are the impacts of the tax therapies of a REIT in comparison with different sorts of funding automobiles? In different phrases, how a lot does a REIT’s tax effectivity increase its traders’ after-tax earnings?

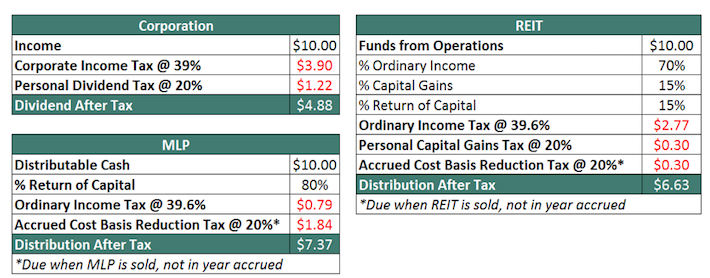

Think about an organization makes $10, pre-tax, and distributes 100% to traders. The picture under exhibits how a lot of the $10 would go to traders if the corporate was arrange in every of the three main company entity varieties (companies, actual property funding trusts, and grasp restricted partnerships):

REITs are considerably extra tax-efficient than companies, primarily as a result of they forestall double-taxation by avoiding tax on the organizational stage.

With that mentioned, REITs aren’t fairly as tax-efficient as Grasp Restricted Partnerships.

Associated: The Full MLP Record: Excessive-Yield, Tax-Advantaged Securities

The tax-efficiency of REITs makes them interesting in comparison with companies. The rest of this text will talk about methods to discover the most tasty REITs primarily based on valuation.

Non-GAAP Monetary Metrics and the Two REIT Valuation Methods

The final part of this text described what a REIT is, and why the tax effectivity of this funding car make them interesting for traders.

This part will describe why REITs can’t be analyzed utilizing conventional valuation metrics, and the choice strategies that traders can use to evaluate their pricing.

REITs are homeowners and operators of long-lived property: funding properties.

Accordingly, depreciation is a big expense on the earnings statements of those funding automobiles. Whereas depreciation is a actual expense, it isn’t a money expense.

Depreciation is necessary as a result of, over time, it accounts for the up-front capital expenditures wanted to create worth in an actual asset.

Nevertheless, it isn’t an expense that ought to be thought of for the aim of calculating dividend security or the likelihood {that a} REIT defaults on its debt.

Additionally, depreciation can fluctuate over time. In a standard straight-line depreciation scheme, extra depreciation is recorded (on an absolute greenback foundation) initially of an asset’s helpful life.

The fluctuations in depreciation expense over time implies that assessing the valuation of a REIT utilizing web earnings (as the normal price-to-earnings ratio does) is just not a significant technique.

So how ought to an clever safety analyst account for the actual financial earnings of a REIT?

There are two foremost alternate options to conventional valuation strategies. One assesses REIT valuation primarily based on financial earnings energy, and the opposite assesses REIT valuation primarily based on earnings era capabilities. Every might be mentioned intimately under.

As a substitute of utilizing the normal ratio of value and worth (the price-to-earnings ratio), REIT analysts usually use a barely totally different variation: the price-to-FFO ratio (or P/FFO ratio).

The ‘FFO’ within the price-to-FFO ratios stands for funds from operations, which is a non-GAAP monetary metric that backs out the REIT’s non-cash depreciation and amortization costs to provide a greater sense of the REIT’s money earnings.

FFO has a widely-accepted definition that’s set by the Nationwide Affiliation of Actual Property Funding Trusts (NAREIT), which is listed under:

“Funds From Operations: Web earnings earlier than positive factors or losses from the sale or disposal of actual property, actual property associated impairment costs, actual property associated depreciation, amortization and accretion and dividends on most well-liked inventory, and together with changes for (i) unconsolidated associates and (ii) noncontrolling pursuits.”

The calculation for the price-to-FFO ratio is similar to the calculation of the price-to-earnings ratio. As a substitute of dividing inventory value by earnings-per-share, we dividend REIT unit value by FFO-per-share. For extra particulars, see the instance within the subsequent part.

The opposite technique for assessing the valuation of a REIT doesn’t use a Non-GAAP monetary metric. As a substitute, this second technique compares a REIT’s present dividend yield to its long-term common dividend yield.

If a REIT’s dividend yield is above its long-term common, then the belief could possibly be considered as undervalued; conversely, if a REIT’s dividend yield is under its long-term common, the belief could also be overvalued.

For extra particulars on this second valuation method, see the second instance later on this article.

Now that now we have a high-level rationalization of the 2 valuation strategies accessible to REIT traders, the subsequent two sections will present detailed examples on methods to calculate valuation metrics relative to those distinctive authorized entities.

Instance #1: Realty Revenue P/FFO Valuation Evaluation

This part will function a step-by-step information for assessing the valuation of REITs utilizing the price-to-FFO ratio. For the aim of this instance, we’ll use real-world publicly-traded REIT to make the instance as helpful as attainable.

Extra particularly, Realty Revenue (O) is the safety that might be used on this instance. It is likely one of the largest and most well-known REITs among the many dividend progress investor group, which is due partly to its fee of month-to-month dividends.

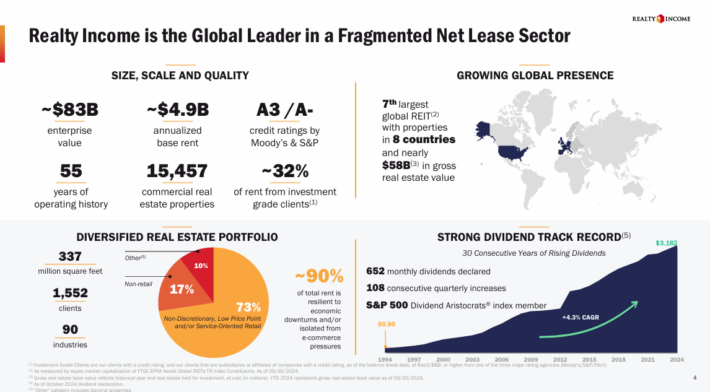

Supply: Investor Presentation

Month-to-month dividends are superior to quarterly dividends for traders that depend on their dividend earnings to pay for all times’s bills. Nevertheless, month-to-month dividends are fairly uncommon.

For that reason, we created an inventory of almost 80 month-to-month dividend shares.

Simply as with shares, REIT traders have to decide on whether or not they’d like to make use of ahead (forecasted) funds from operations or historic (final fiscal 12 months’s) funds from operations when calculating the P/FFO ratio.

To search out the funds from operations reported within the final fiscal 12 months, traders have to establish the corporate’s press launch asserting the publication of this monetary information.

Be aware: Adjusted FFO is superior to ‘common’ FFO as a result of it ignores one-time accounting costs (often from acquisitions, asset gross sales, or different non-repeated actions) that may artificially inflate or scale back an organization’s noticed monetary efficiency.

Alternatively, an investor may additionally use forward-looking anticipated adjusted funds from operations for the upcoming 12 months.

For instance, we anticipate Realty Revenue to generate adjusted FFO-per-share of $4.17 in 2024. The inventory presently trades for a share value of $58, which equals a P/FFO ratio of 13.9.

So how do traders decide whether or not Realty Revenue is a pretty purchase as we speak after calculating its price-to-FFO ratio?

There are two comparisons that traders ought to make.

First, traders ought to evaluate Realty Revenue’s present P/FFO ratio to its long-term historic common. If the present P/FFO ratio is elevated, the belief is probably going overvalued; conversely, if the present P/FFO ratio is decrease than regular, the belief is a pretty purchase.

Prior to now 10 years, Realty Revenue inventory traded for a mean P/FFO ratio of roughly 18.6, indicating that shares seem undervalued as we speak.

The second comparability that traders ought to make is relative to Realty Revenue’s peer group. That is necessary: if Realty Revenue’s valuation is enticing relative to its long-term historic common, however the inventory remains to be buying and selling at a big premium to different, comparable REITs, then the safety might be not a well timed funding.

One of many troublesome components of a peer-to-peer valuation comparability is figuring out an affordable peer group.

Luckily, massive publicly-traded firms should self-identify a peer group of their annual proxy submitting with the U.S. Securities & Trade Fee.

This submitting, which exhibits as a DEF 14A on the SEC’s EDGAR search database, comprises a desk just like the one under:

Supply: Realty Revenue 2024 Definitive Proxy Assertion

Each publicly-traded firm should disclose an analogous peer group on this proxy submitting, which is tremendously useful when an investor needs to check a enterprise’ valuation to that of its friends.

Instance #2: Realty Revenue Dividend Yield Valuation Evaluation

As mentioned beforehand, the opposite technique for figuring out whether or not a REIT is buying and selling at a pretty valuation is utilizing its dividend yield.

This part will present a step-by-step information for utilizing this system to evaluate the valuation of REITs.

On the time of this writing, Realty Revenue pays an annual dividend earnings of $3.16 per unit. The corporate’s present unit value of $58 means the inventory has a dividend yield of 5.5%.

Realty Revenue’s 10-year common dividend yield is 4.5%. Once more, Realty Revenue’s higher-than-average dividend yield signifies shares are undervalued proper now.

For the reason that belief’s dividend yield is greater than its long-term common, it seems that as we speak’s value is a pretty alternative so as to add to or provoke a stake on this REIT.

A peer group evaluation would possible yield an analogous end result, as most REITs in its peer group have yields exceeding 4%. Directions for figuring out an affordable peer group for any public firm could be discovered within the earlier part of this text.

The dividend yield valuation method for actual property funding trusts will not be as sturdy as a bottom-up evaluation utilizing funds from operations.

Nevertheless, this system has two foremost benefits:

It’s faster. Dividend yields can be found on most Web inventory screeners, whereas some lack the potential to filter for shares buying and selling at low multiples of funds from operations.

It may be generalized to different asset courses. Whereas REITs (and a few MLPs) are the one safety varieties that report FFO, it’s clear that each dividend-paying funding has a dividend yield. This makes the dividend yield valuation method an applicable technique for valuing REITs, MLPs, BDCs, and even companies (though the P/E ratio remains to be the most effective technique for firms).

Ultimate Ideas

Surely, there are definitely benefits to investing in actual property funding trusts.

These securities permit traders to learn from the financial upside of proudly owning actual property whereas additionally having fun with a very passive funding alternative.

Furthermore, REITs are very tax-advantageous and often supply greater dividend yields than the common dividend yield of S&P 500 securities.

REITs even have analytical nuances that make them tougher to investigate than companies. That is significantly true in terms of assessing their valuations.

This text supplied two analytical strategies that may be utilized to REIT valuation:

The P/FFO ratio

The dividend yield valuation method

Every has its advantages and ought to be included within the toolkit of any dividend progress investor whose funding universe consists of actual property trusts.

You possibly can see extra high-quality dividend shares within the following Positive Dividend databases, every primarily based on lengthy streaks of steadily rising dividend funds:

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].