Up to date on November nineteenth, 2024 by Bob Ciura

Coal is essentially the most burdensome type of power for the surroundings. This has led quite a few nations to coordinate efforts to section out coal in favor of pure gasoline and renewable power sources, akin to photo voltaic and wind energy.

Because of this, coal manufacturing has steadily declined within the U.S. for the reason that 2008 peak. Fortuitously for home producers, exports have remained robust because of rising demand in rising markets.

The value of coal is round ~$122 per ounce. Some coal shares have turn into worthwhile, main a number of coal shares to return money to shareholders via dividends.

You possibly can obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

Coal shares are a subset of the broader supplies sector.

Whereas many traders have concluded that coal shares will quickly turn into irrelevant, this is probably not true.

On this article, we are going to analyze the 2 finest coal shares right now.

Desk Of Contents

You should utilize the next desk of contents to immediately bounce to a particular inventory:

The highest two coal shares are ranked primarily based on complete anticipated returns over the subsequent 5 years, from lowest to highest. These coal shares collectively signify our prime picks within the coal trade over the subsequent 5 years.

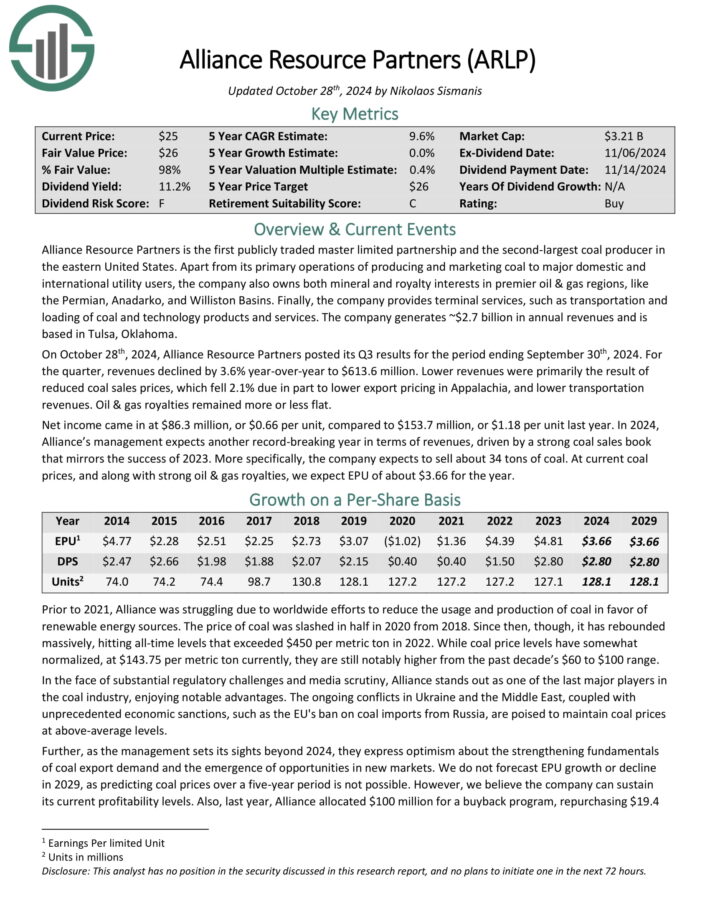

Alliance Useful resource Companions (ARLP)

5-year anticipated annual returns: 8.3%

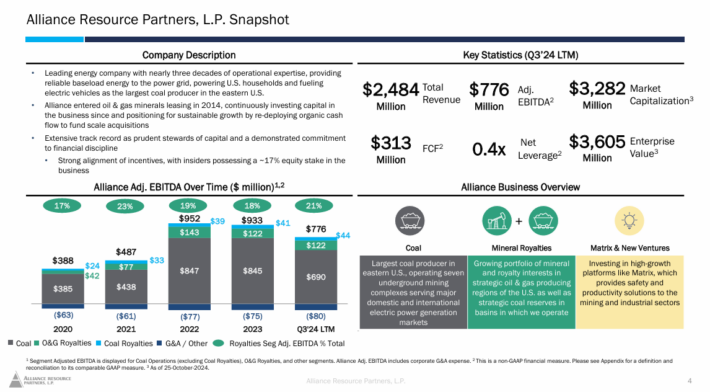

Alliance Useful resource Companions is the primary publicly traded Grasp Restricted Partnership and the second–largest coal producer in the jap United States.

Other than its major operations of manufacturing and advertising and marketing coal to main home and worldwide utility customers, the corporate additionally owns mineral and royalty pursuits in premier oil & gasoline areas, just like the Permian, Anadarko, and Williston Basins.

Supply: Investor Presentation

On October twenty eighth, 2024, Alliance Useful resource Companions posted its Q3 outcomes for the interval ending September thirtieth, 2024. For the quarter, revenues declined by 3.6% year-over-year to $613.6 million.

Decrease revenues have been primarily the results of diminished coal gross sales costs, which fell 2.1% due partially to decrease export pricing in Appalachia, and decrease transportation revenues. Oil & gasoline royalties remained roughly flat.

Internet revenue got here in at $86.3 million, or $0.66 per unit, in comparison with $153.7 million, or $1.18 per unit final yr. In 2024, Alliance’s administration expects one other record-breaking yr when it comes to revenues, pushed by a robust coal gross sales e book that mirrors the success of 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on Alliance Useful resource Companions (preview of web page 1 of three proven under):

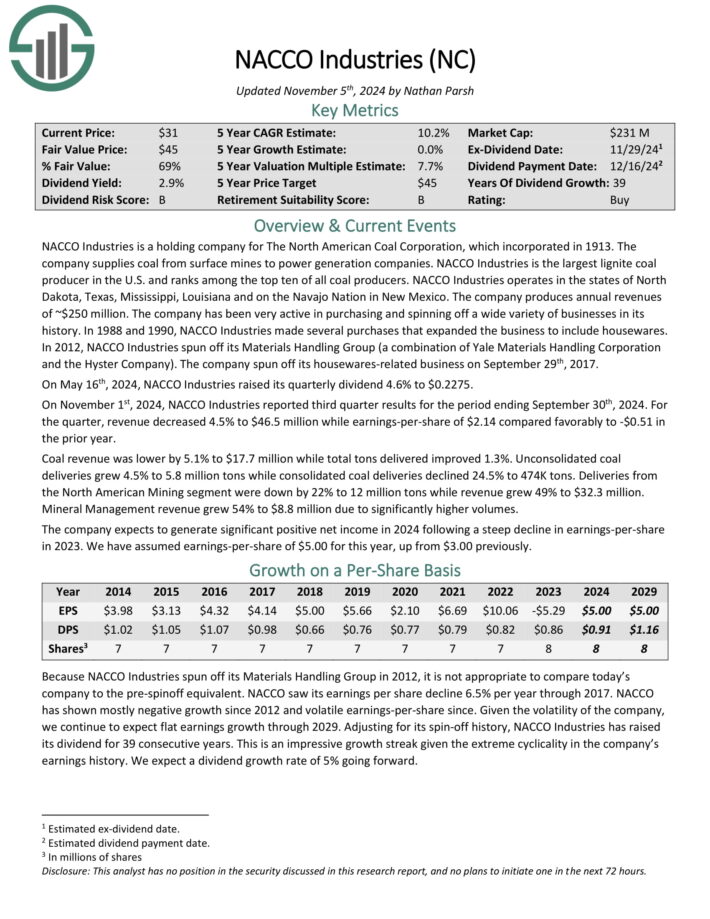

NACCO Industries (NC)

5-year anticipated annual returns: 10.2%

NACCO Industries is a holding firm for The North American Coal Company, which was included in 1913. The firm provides coal from floor mines to energy technology corporations.

NACCO Industries is the most important lignite coal producer within the U.S. and ranks among the many prime ten of all coal producers. NACCO Industries operates within the states of North Dakota, Texas, Mississippi, Louisiana and on the Navajo Nation in New Mexico.

Supply: Investor Presentation

On November 1st, 2024, NACCO Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 4.5% to $46.5 million whereas earnings-per-share of $2.14 in contrast favorably to -$0.51 within the prior yr.

Coal income was decrease by 5.1% to $17.7 million whereas complete tons delivered improved 1.3%. Unconsolidated coal deliveries grew 4.5% to five.8 million tons whereas consolidated coal deliveries declined 24.5% to 474K tons.

Deliveries from the North American Mining section have been down by 22% to 12 million tons whereas income grew 49% to $32.3 million. Mineral Administration income grew 54% to $8.8 million because of considerably greater volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on NACCO Industries (preview of web page 1 of three proven under):

Remaining Ideas

Coal shares are extremely cyclical and function in an trade that has been affected by a secular decline. Due to this fact, traders ought to contemplate the elevated dangers of investing in such a troubled trade.

With that mentioned, a number of coal shares nonetheless pay dividends to shareholders and have affordable valuations. Because of this, the very best coal shares might nonetheless generate robust returns within the years forward.

Total, whereas risk-averse traders ought to keep away from coal shares on the whole, these snug with the dangers may contemplate buying the above coal shares.

The Dividend Champions record just isn’t the one option to shortly display screen for shares that recurrently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].