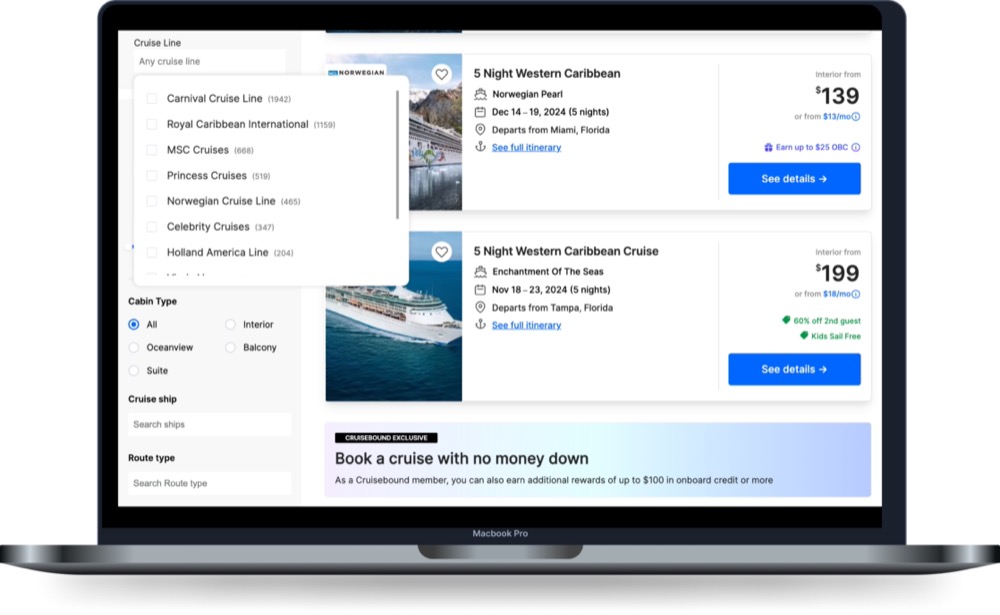

The cruise {industry} is experiencing a resurgence in recognition, with notably robust efficiency within the post-pandemic setting. Key development drivers embrace important penetration into youthful demographic segments, complete multi-destination itineraries, aggressive worth factors, and diversified onboard experiences. Nonetheless, reserving a cruise expertise will be extra advanced than different varieties of journey because of the number of choices like cabin classes, eating choices, and onboard actions. Cruisebound addresses this by its complete comparability and reservation platform, aggregating choices throughout all main cruise strains. In an {industry} the place roughly 80% of bookings are facilitated by journey companies, Cruisebound has developed a streamlined digital answer that delivers agency-level service by each internet and cellular interfaces. The platform eliminates reserving charges whereas considerably lowering analysis time for customers. With an intensive stock of over 27,000 itineraries, customers will be assured that they won’t solely be choosing their ultimate itineraries but in addition obtain clear pricing. Within the final two years, the corporate has skilled triple-digit income development.

AlleyWatch caught up with Cruisebound Cofounder and CEO Pierre-Olivier Lepage to be taught extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the corporate’s complete funding raised to $25.7M, and far, way more…

Who had been your buyers and the way a lot did you elevate?Cruisebound closed a $13M financing spherical led by Thayer Ventures with participation from Hyperlink Ventures, former Reserving Holdings Chairman and CEO Jeff Boyd, PAR Capital Ventures, Tripadvisor cofounder and former CEO Steve Kaufer, Flybridge, Plug & Play Ventures, and several other others. The contemporary capital will speed up Cruisebound’s already-popular cruise reserving merchandise.That is the second time Cruisebound has bought fairness. Cruisebound introduced a Collection A funding in January 2023. We’re thrilled in regards to the progress we’ve revamped the previous 2 years and these funds will permit us to gasoline our development.

Inform us in regards to the services or products that Cruisebound presents.Cruisebound, based in 2022, helps customers discover and evaluate cruises from each main cruise line to seek out the most effective match for trip wants. Our complete stock contains over 27,000 world itineraries, from the highest 19 cruise strains. Options like an AI chatbot educated to reply cruise associated questions, a customer support staff of brokers out there to reply questions, and no reserving charges units Cruisebound other than opponents. Whether or not it’s a multigenerational household journey to Mexico with Royal Caribbean, an anniversary celebration within the Mediterranean on Virgin Voyages or a once-in-a-lifetime Alaska journey with Norwegian Cruise Line, Cruisebound makes it straightforward to find and e-book your good cruise.

What impressed the beginning of Cruisebound?When reserving my first cruise, I used to be stunned at how troublesome it was to analysis and e-book on-line–and almost unattainable on a cellular machine. My go-to journey websites for reserving flights and resorts are usually not designed to promote an advanced cruise product. After a bit of extra analysis, I discovered I used to be not alone in feeling this fashion. Though ~80% of cruise bookings are accomplished with the help of a journey agent, two-thirds of current cruisers state that they would favor to e-book on-line on their very own if there was a easy method to do it. Cruisebound is providing that easy and frictionless reserving expertise whereas providing the identical nice offers journey brokers supply.

How is Cruisebound totally different?Cruisebound was designed to resolve the ache factors of researching and reserving a cruise on-line. As a result of Cruisebound solely sells cruises, we proceed to innovate and launch new options vacationers want to decide on the proper cruise together with:

Multi-cabin reserving for as much as 5 cabins: 90% of cruisers journey with household or mates and 28% sail along with a minimum of 3 generations, in keeping with CLIA. Cruisebound has developed a easy, industry-leading, characteristic for holding and reserving as much as 5 cabins in a single session.

24-hour cabin maintain, freed from cost: Cruise bookings usually require coordination of advanced itineraries amongst a number of vacationers. With Cruisebound, cruisers can maintain a cabin for as much as 24 hours, on-line and freed from cost, to verify the small print with their family and friends.

AI chatbot for first-level customer support: Cruisebound educated an LLM-based suggestion engine to assist its brokers give in-depth recommendation on cruise itineraries and actions. The instrument makes the brokers extra environment friendly as a result of it understands the shopper’s concern and suggests the appropriate reply or recommends the proper cruise in a matter of seconds. The bot is routinely answering 42% of customer support requests. Cruisebound is planning to check different AI-powered options within the close to future.

Versatile fee choices together with installments and industry-first deferred deposits (i.e. $0 deposits) on choose sailings.

Staff of world-class assist brokers for purchasers wanting help. Though we’re targeted on on-line conversion, our staff of brokers is able to reply any questions our prospects could have. What we discover nonetheless, is that the majority cruisers don’t wish to speak to us and 83% of our reservations are accomplished with none buyer help. This hybrid on-line/offline strategy has struck a chord with prospects, with 92% of reviewers on Trustpilot ranking them 5 of 5 stars.

What market does Cruisebound goal and the way massive is it?In keeping with Cruise Market Watch, Cruise {industry} is anticipated to achieve $66B in income by the tip of 2024. 2023 cruise passenger quantity reached 31.7 million— surpassing 2019 by 7%. The variety of new-to-cruise is rising – 27% of cruisers over the previous two years are new-to-cruise, a rise of 12% over the previous yr.

What’s your enterprise mannequin?Cruisebound makes cash from reserving commissions.

How has the enterprise and cruise {industry} modified since we final spoke at your launch in 2023?Over the previous two years, Cruisebound loved triple-digit annual income development, making it one of many world’s fastest-growing nationwide cruise companies. We proceed so as to add new companions and stock. At the moment, Cruisebound presents 27,000+ cruise itineraries, from 19 of the highest cruise strains. We’re additionally targeted on enhancing the product by simplifying the reserving course of, and dealing relentlessly to supply the absolute best deal to our prospects.

What was the funding course of like?Plenty of corporations are competing for funding proper now, and VCs appear to deal with fundamentals like path to profitability. We targeted on the progress we’ve revamped the previous 2 years, together with buyer development, monetary development, and our deliberate sustainable development shifting ahead.

What are the largest challenges that you simply confronted whereas elevating capital?The fundraising setting remains to be recovering from the shock it skilled ~2 years in the past. There may be capital to be invested on the market, however buyers have grow to be extra disciplined at deploying it. Our deal with driving sustainable development with as little capital as potential resonated with buyers.

What components about your enterprise led your buyers to jot down the verify?Our revolutionary strategy to the cruise {industry}, the purchasers’ response to our product to this point, and our observe document of development and improved unit economics since launching in January 2023.

What are the milestones you propose to realize within the subsequent six months?Q1 is Wave Season, the cruise {industry}’s busiest time for bookings, so our focus over the following six months is to assist as many cruisers as potential e-book their dream trip.

What recommendation are you able to supply corporations in New York that don’t have a contemporary injection of capital within the financial institution?Concentrate on execution, driving outcomes, and stay conservative with capital. This may lengthen your runway and make your enterprise extra engaging for buyers.

The place do you see the corporate going within the close to time period?We’ve got a transparent path to proceed on our development trajectory which can finally assist us to achieve profitability.

What’s your favourite fall vacation spot in and across the metropolis?After I’m not boarding a Southbound cruise from considered one of our three cruise ports, I like to go to Beacon, NY. It’s a simple practice journey from the town. There’s so much to do on the town and tons of climbing choices round.