Up to date on October ninth, 2024 by Aristofanis Papadatos

Actual estimate funding trusts, or REITS, are sometimes a favourite of traders searching for beneficiant dividend yields as these firms are required by legislation to distribute the overwhelming majority of earnings to shareholders within the type of dividends.

Even higher, plenty of REITs distribute dividends on a month-to-month fee schedule which permits for normal money flows. This could be a good alternative for these traders which can be in want of constant, month-to-month funds.

You’ll be able to see all 77 month-to-month dividend shares right here.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

Slate Grocery REIT (SRRTF) is a Canadian-based actual property funding belief that started paying a month-to-month dividend in 2014. The inventory at present yields 8.6%, which is greater than seven occasions the typical yield of 1.2% of the S&P 500 Index.

This text will consider the belief and its dividend to find out if Slate Grocery might be candidate for income-oriented traders.

Enterprise Overview

Slate Grocery is an open-ended mutual fund belief headquartered in Toronto and listed on the Toronto inventory alternate. U.S. traders can buy the inventory over-the-counter.

Though it’s based mostly in Canada, Slate Grocery really focuses on buying, proudly owning, and leasing a portfolio of actual property properties within the U.S.

Supply: Investor Presentation

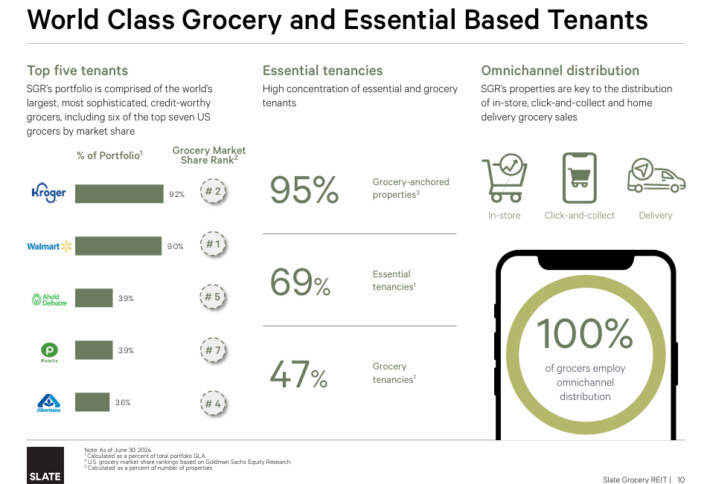

Slate Grocery’s portfolio of 116 properties is anchored nearly completely by grocery shops. The belief has greater than 15 million sq. ft of properties. As of the latest quarter, the portfolio was valued at $2.4 billion.

In the second quarter of 2024, Slate Grocery grew its rental income and its funds from operations (FFO) per share by 3% and three.5%, respectively, over the prior yr’s quarter. Occupancy remained fixed at 94.2%.

Slate Grocery benefited from the robust fundamentals surrounding the grocery-anchored sector. The REIT has been leasing excessive volumes of properties at double-digit yield spreads in latest quarters.

As well as, administration expects to continue to grow revenues and FFO, primarily because of record-low emptiness charges and minimal new provide of properties.

Development Prospects

Slate Grocery counts a few of the largest grocery shops within the nation as its tenants.

Supply: Investor Presentation

Walmart Inc. (WMT), Kroger Company (KR), and Costco Wholesale Company (COST) are Slate Grocery’s three largest tenants. The primary two names make up greater than 18% of the whole portfolio, which locations variety of properties with simply two tenants.

Past Walmart and Kroger, nevertheless, no tenant accounts for greater than 5% of the portfolio, offering Slate Grocery with quantity of diversification amongst its purchasers. Solely Walmart and Kroger contribute not less than 9.0% of annualized base rents.

As well as, Slate Grocery leases properties to 6 of the highest seven U.S. groceries by market share. Which means that the belief’s properties are visited by tens of millions of individuals every week.

Increasing past simply grocery shops, Slate Grocery has amongst its tenants 20 of the 25 largest shopper good distributors on this planet, together with Amazon.com Inc. (AMZN), Dwelling Depot (HD), Lowe’s Firms (LOW), and CVS Well being Corp. (CVS).

The rise of e-commerce buying channels has modified the character of the retail enterprise. Whereas this has impacted many varieties of retail firms, grocery shops have weathered these modifications higher than most.

The resilience of grocery shops might be attributed to their shift to on-line ordering to drive gross sales to their companies. The Covid-19 pandemic accelerated this transition, as grocery shops, together with many different companies, needed to change the way in which they operated beneath extreme social distancing pointers.

Slate Grocery’s tenants pivoted rapidly to the purpose the place 100% of the portfolio now offers omnichannel distribution, with most fulfilling e-commerce purchases from neighborhood retailer places. The belief additionally has a presence in 23 of the highest 50 metropolitan areas in nation.

Inflation has been a headwind in lots of industries, however the majority of lease agreements have inbuilt rental escalators, which have helped offset the elevated bills of the belief. Furthermore, whereas many REITs are struggling to cowl their curiosity expense amid almost 23-year excessive rates of interest, Slate Grocery has a robust curiosity protection ratio of two.3.

With prime names as tenants, a number of methods for patrons to buy items, and a robust footprint of properties, Slate Grocery ought to proceed to see stable progress charges shifting ahead.

Dividend Evaluation

That progress ought to allow Slate Grocery to proceed to pay its dividend, which at present corresponds to an annualized yield of 8.6%. Then again, Slate Grocery has frozen its dividend during the last 5 years.

Whereas these traders searching for dividend progress will doubtless be upset, it ought to be famous that the dividend has not been diminished because the second ever month-to-month distribution in 2014. Slate Grocery’s annualized dividend is $0.864.

The REIT at present has a payout ratio of 72%, which is elevated however affordable for a REIT. Given additionally the wholesome stability sheet of the REIT and its respectable progress prospects, the dividend seems to have a significant margin of security within the absence of a extreme recession.

Last Ideas

Month-to-month dividend paying shares can present extra constant money flows. Along with this, Slate Grocery provides an exceptionally excessive yield, which seems secure for the foreseeable future. The belief can also be backed by high-quality tenants in a few of the largest metropolitan areas within the U.S.

Slate Grocery’s tenants have tailored to the altering panorama in retail by embracing the usage of e-commerce to drive gross sales. Traders would possibly discover the mixture of all these traits a lovely funding alternative.

Extra Studying

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].