The lower the Fed Funds charge by 50bps, which was according to prevailing market expectations (the likelihood of such an consequence was over 67% at the start of the week) and stunned 104 out of 113 respondents in main monetary media polls. Because the sharp lower was not absolutely priced in, we see a robust market response. This transformation sheds mild on the Fed’s method to financial coverage and will result in a chronic market correction, doubtlessly altering the principles of the sport for the greenback.

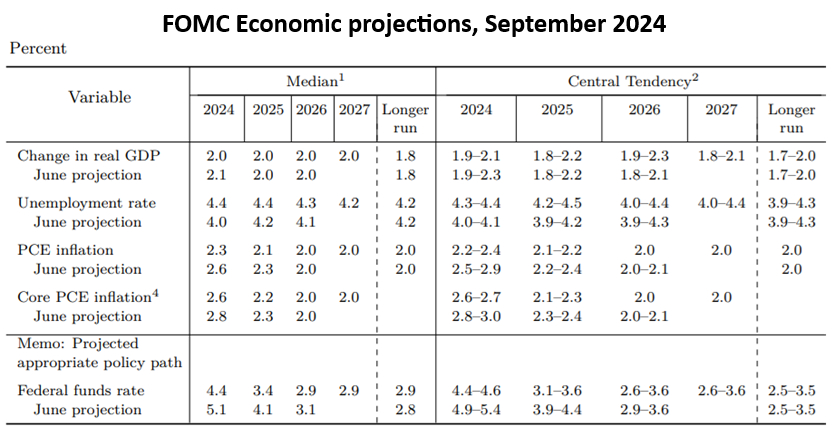

Within the official commentary, the Fed pointed to a stable tempo of financial progress, slowing employment progress and declining however nonetheless elevated inflation. The Fed expressed confidence that inflation would transfer in direction of its 2% goal and, on that foundation, moved swiftly to normalise financial coverage. Estimates for the private consumption worth index have been lowered from 2.6% to 2.3% for 2024 and from 2.3% to 2.1% for 2025, in opposition to a long-term goal of two.0%. The forecast for the unemployment charge was raised from 4.0% to 4.4% for the present yr and from 4.2% to 4.4% for 2025.

Within the new projections, the FOMC members establish 2.9% because the long-term impartial rate of interest degree (it was 2.8% in June), the place they intend to take the speed in 2026 to 4.4% by the tip of 2024 (it was 5.1% in June) and to three.4% by the tip of 2025 (it was 4.1%). One can see how way more dovish the Fed’s stance has turn into in simply three months. That is almost certainly the results of an enormous downward revision of job progress estimates for final yr by over 800K.

The dramatic easing of the coverage stance for this yr and subsequent is the principle driver of economic markets. Whereas the preliminary constructive response was tempered by profit-taking, market behaviour on Thursday clearly confirmed elevated danger urge for food as European fairness indices rallied and futures on the and hit report highs. The and have to date lagged, though the rising financial setting is doubtlessly essentially the most beneficial for corporations in these indices.

The dramatic easing of the coverage stance for this yr and subsequent is the principle driver of economic markets. Whereas the preliminary constructive response was tempered by profit-taking, market behaviour on Thursday clearly confirmed elevated danger urge for food as European fairness indices rallied and futures on the and hit report highs. The and have to date lagged, though the rising financial setting is doubtlessly essentially the most beneficial for corporations in these indices.

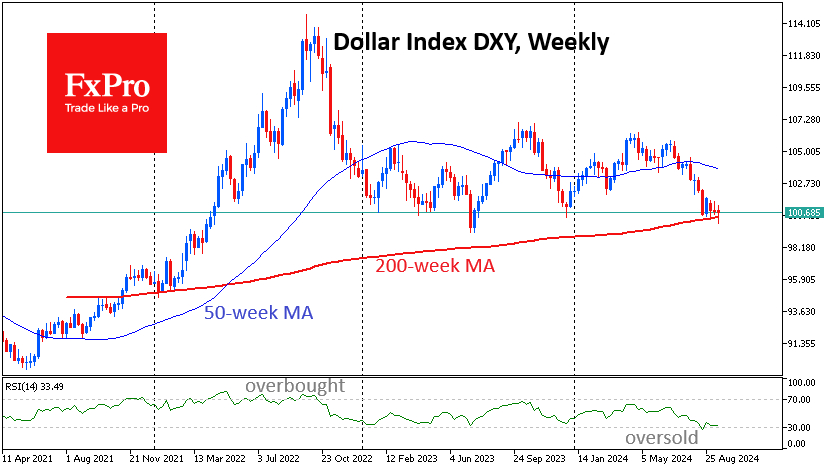

On the identical time, that is harmful information for the greenback. On publication, the slipped in direction of the July lows, though it discovered momentary assist on Thursday and struggled to remain above the important thing 100 degree and 200-week transferring common. The market approached these after a chronic decline, so a bounce is probably going however unlikely to vary the long-term image. What’s essential to know now could be whether or not the Fed’s excessive softness shall be an excuse for central banks around the globe to observe swimsuit on the identical tempo. The ECB’s Centeno, for instance, had already warned on Thursday that the financial institution might speed up the tempo of coverage easing. Nevertheless, the Financial institution of England has but to take action, leaving the bottom charge at 5.0% after reducing it in early August.

What’s essential to know now could be whether or not the Fed’s excessive softness shall be an excuse for central banks around the globe to observe swimsuit on the identical tempo. The ECB’s Centeno, for instance, had already warned on Thursday that the financial institution might speed up the tempo of coverage easing. Nevertheless, the Financial institution of England has but to take action, leaving the bottom charge at 5.0% after reducing it in early August.

The FxPro Analyst Crew