Justin Paget

It’s been an thrilling few years for traders in photo voltaic electrical energy technology. The expertise is getting higher, and with the excessive price of conventional fossil fuels, there may be plenty of curiosity in renewable vitality proper now.

Right this moment I’d like to have a look at the world’s largest skinny movie photovoltaic photo voltaic module manufacture, First Photo voltaic (NASDAQ:FSLR), an organization which has change into a giant deal among the many photo voltaic gamers. The main focus shall be on the corporate’s development and earnings prospects with a very shut consideration paid to how their gross and working margins are going in recent times.

Why Photo voltaic?

Photo voltaic is without doubt one of the most blatant renewable vitality sources on the earth. As photovoltaic cells enhance in effectivity, photo voltaic technology turns into much less of a distinct segment manufacturing choices and, particularly for locations with a sunny surroundings, one which warrants critical consideration.

First Photo voltaic is a number one American photo voltaic producer, and this is without doubt one of the quickest rising renewable vitality choices, so that is value maintaining an in depth eye on.

Within the US and another essential markets, there are incentives for individuals to put in such renewable vitality sources. Because the expertise improves, such incentives are much less and fewer essential to make photo voltaic economical, however proper now they’re in place, and make for a very nice increase within the firm’s enterprise.

Steadiness Sheet

Money and Equivalents

$1.7 billion

Inventories

$1.0 billion

Whole Present Property

$3.9 billion

Whole Property

$11.0 billion

Whole Present Liabilities

$1.8 billion

Lengthy-Time period Debt

$419 million

Whole Liabilities

$3.8 billion

Whole Shareholder Fairness

$7.25 billion

Click on to enlarge

(supply: most up-to-date 10-Q from SEC)

For an organization in a rising business, and one that’s simply beginning to change into actually worthwhile in recent times, First Photo voltaic has an extremely accountable stability sheet. They’ve little debt, a robust money place, and with a present ratio of two.17, which provides them plenty of flexibility within the occasion of any main adjustments available in the market.

The present value/guide ratio is 3.37, which is roughly in step with the sector median. That’s not a really excessive premium when one considers how a lot the corporate is rising. It’s not a worth in and of itself, however it’s nothing to lose sleep over.

The Dangers

An thrilling sector with probably some huge cash going into it, the photo voltaic business has plenty of competitors proper now, and meaning First Photo voltaic has to maintain competing with others on each providing the perfect expertise and the perfect general price of possession.

Bettering expertise isn’t low cost. First Photo voltaic has to take a position some huge cash in analysis and improvement, and the hope is that they’ll proceed to refine their merchandise for future generations of choices.

Most of First Photo voltaic’s enterprise is in america, which is ok as a result of that’s the place plenty of the cash is correct now. The expansion, nevertheless, might be going to have to incorporate extra worldwide markets, and meaning having to out-compete native rivals in these areas.

The incentives to make use of renewable sources additionally aren’t going to final eternally, and after they cease, it’s going to be an actual query what the economics of solar energy appear like with out them. This might imply the expansion is considerably synthetic.

Lastly the large danger to the enterprise at any given time is the general financial situation. If instances are tough, individuals received’t be making such large investments in renewable sources till issues enhance. That might put the corporate in a really troublesome state when the financial system is weak.

Assertion of Operations – The Rising Margins

2021

2022

2023

2024 (1H)

Internet Gross sales

$2.9 billion

$2.6 billion

$3.3 billion

$1.8 billion

Gross Revenue

$730 million

$70 million

$1.3 billion

$845 million

Gross Margin

25.1%

2.7%

39.4%

46.9%

Working Earnings

$587 million

($27 million)

$857 million

$616 million

Working Margin

20.2%

Unprofitable

26.0%

34.2%

Internet Earnings

$469 million

($44 million)

$831 million

$586 million

Diluted EPS

$4.38

(41¢)

$7.74

$5.45

Click on to enlarge

(supply: most up-to-date 10-Okay and 10-Q from SEC)

As you may see, First Photo voltaic isn’t solely rising in income, however seeing its working and gross margins bettering 12 months over 12 months. That’s nice, as a result of it’ll actually imply one thing to the underside line if the pattern continues.

This 12 months, the estimate is that the corporate will report $4.49 billion in income and $13.50 earnings per share. That’s a P/E ratio of 16.95, which is a bit decrease than the sector median. Issues are solely anticipated to enhance within the years to come back.

Subsequent 12 months the estimate is $5.66 billion in income and earnings of $22.07 per share, that’s a ahead P/E of 10.37, which is kind of low for a corporation rising at this charge. 2026 expects to see $6.72 billion in income and earnings over $30 per share.

Clearly the cash generated by an organization on this business goes to predominantly go towards persevering with development and bettering expertise. If the earnings continues to develop like this I wish to see the corporate contemplate some dividends in some unspecified time in the future alongside the road. They need to be capable to afford it.

Conclusion

It’s thrilling to see an organization with each rising income and bettering margins, and within the subsequent couple of years it must be anticipated that First Photo voltaic shall be making some huge cash on a reasonably common foundation.

For traders, I’d preserve an in depth eye on the margins to see the place they find yourself. They’ll’t presumably pattern upward eternally, however we’re seeing a giant enchancment on the underside line being pushed by the margins as they proceed to enhance.

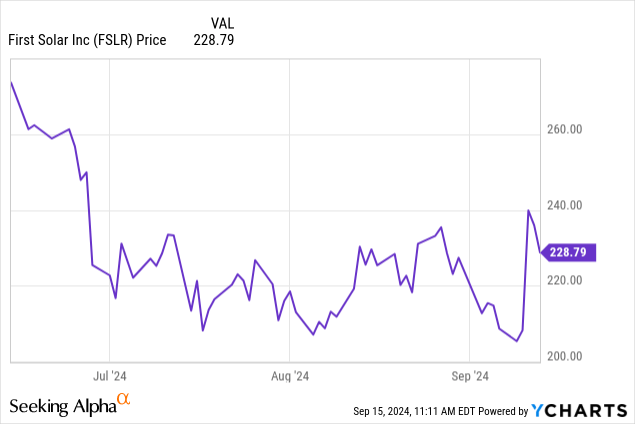

I’m going to be ranking First Photo voltaic a purchase, regardless of the corporate having gone up in value just lately. All the indications are going favorably proper now, and I consider the corporate has extra room to run. Photo voltaic vitality appears to be a robust possibility for the long run, and I’d anticipate First Photo voltaic to attain a giant a part of that market.