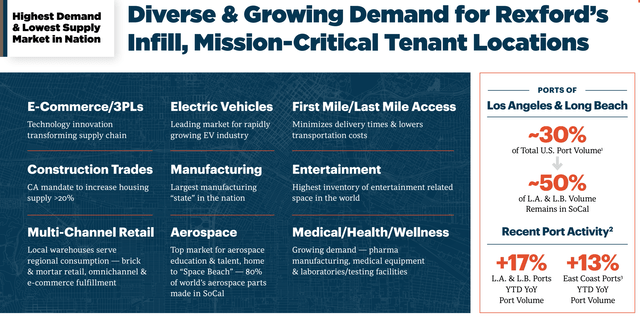

ISerg

Many REITs stay bargains regardless of the current uptick in value in anticipation of a price minimize in September. That’s possible as a result of the market remains to be latched onto high-flying development shares that pay buyers little to no yield for holding on to them.

A greater thought could also be to get each significant revenue and development on the identical time. This brings me to Rexford Industrial (NYSE:REXR), which presently affords a 3.3% yield and development prospects in addition.

I final lined REXR in February, noting its sturdy observe report of worth creation, fortress stability sheet and undervaluation by historic requirements. It seems the market hasn’t but agreed with my thesis, because the inventory has declined by 3% since my final piece (-1.5% complete return together with dividends), surpassed by the 12% rise within the S&P 500 (SPY) over the identical timeframe.

On this article, I revisit REXR together with its enterprise efficiency, outlook, and focus on whether or not the inventory and its most well-liked stay enticing, so let’s get began!

REXR: A Nice Cut price With Up To six.4% Yield

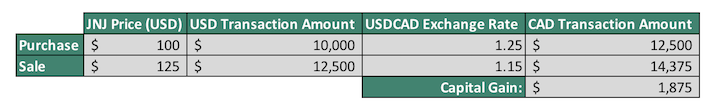

Rexford Industrial stays one in all my favourite industrial REITs attributable to its distinctive deal with the infill Southern California market, which has a low emptiness price of simply 3.9%. This market additionally carries far greater base rents than different Tier 1 markets across the U.S., at $17.11 per sq. foot, as proven under.

Investor Presentation

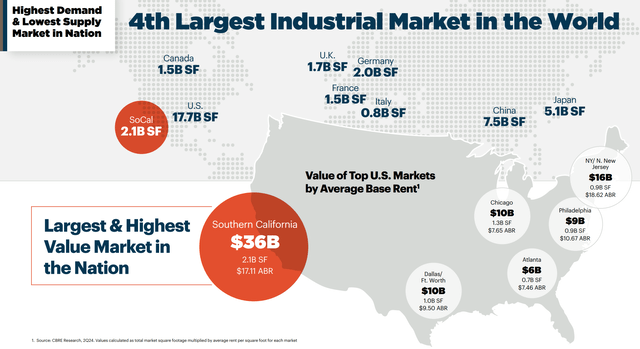

This ends in obstacles to entry for brand new entrants, making the market accessible solely to well-capitalized gamers like REXR. At current, its high-quality portfolio consists of 422 properties with 49.7 million sq. toes of rentable house. REXR’s technique has labored out effectively with sector main NOI development of 31% annualized over the previous 5 years, beating the 16% peer common, as proven under.

Investor Presentation

This was pushed largely by excessive lease spreads and working leverage by an economic system of scale. It’s achieved persistently excessive lease spreads of over 60% since 2021, and has grown its NOI margin by 220 foundation factors to 77.7% since 2018.

In the meantime, REXR has continued to show sturdy working fundamentals, attaining 2.3 million sq. toes of leasing throughout Q2 2024 at a 68% on a web efficient foundation (49% money foundation), sitting forward of the 66% common since 2021. Occupancy rose by 70 foundation factors on a sequential QoQ foundation (unchanged YoY) to 97.3%.

Additionally encouraging, REXR is demonstrating optimistic working leverage, with web working margin rising by 50 bps YoY to 77.7%. These components contributed to Consolidated NOI development of 21% from the prior yr interval and FFO per share development of 11% YoY to $0.60.

Administration is guiding for full yr FFO per share of $2.33 on the midpoint of vary, representing 7% development from 2023. That is based mostly on the expectation that same-property money NOI will develop at a wholesome 7.5% price this yr. Over the subsequent three years, REXR expects to drive money NOI development by 35% due largely to value-add initiatives.

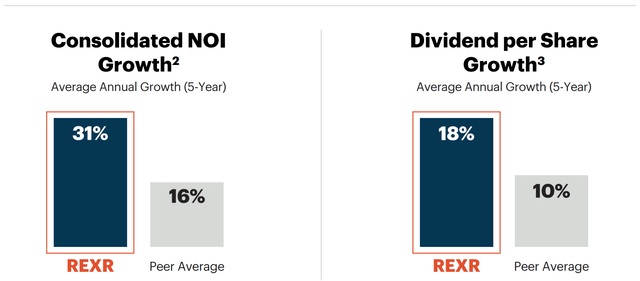

This contains the modernization, repositioning, and redevelopment of older, underutilized properties in SoCal to suit the wants of multitude of industries starting from E-commerce to Aerospace, as proven under.

Investor Presentation

Plus, provide and demand developments are anticipated to proceed to be in favor of REXR, as famous by administration in the course of the current convention name:

The long-term outlook for our infill Southern California market stays very optimistic attributable to a nearly incurable long-term provide/demand imbalance. The near-term outlook for market rents could proceed to replicate a nominal degree of volatility.

Nonetheless, we consider the muse for market lease development is inherent inside our markets. Our tenants are indicating by their behaviors that they count on to pay greater rents sooner or later.

They’re expressing its expectations by their proactive renewal exercise and thru the common compounding 4% annual contractual rental price will increase we’re embedding inside our leases.

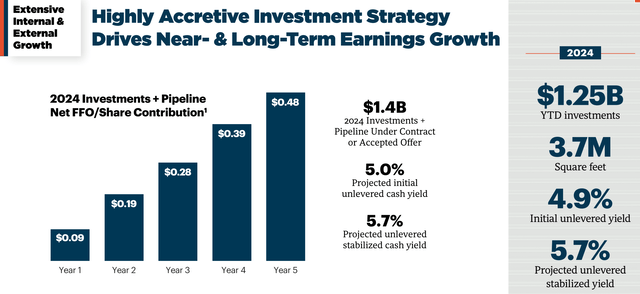

As proven under, REXR has $1.4 billion in investments plus pipeline beneath contract that’s anticipated to generate $0.48 web FFO per share acquire by yr 5, in comparison with $2.33 per share anticipated this yr. This FFO per share accretion could be on high of the 4% common embedded lease steps in YTD executed leases and lease spreads on new and renewal leases.

Investor Presentation

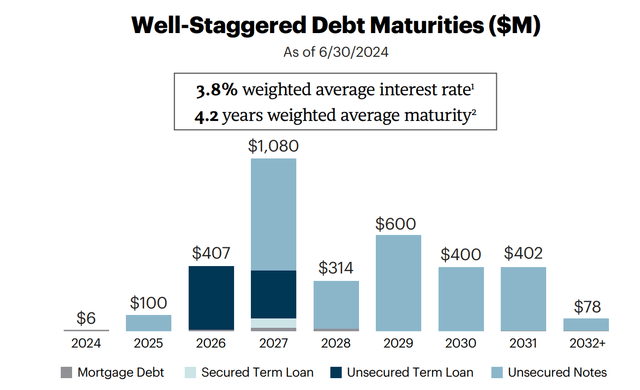

Importantly, REXR carries a fortress stability sheet with BBB+/Baa2 credit score scores from S&P and Moody’s to execute on its long-term plan. That is supported by a web debt to enterprise worth of simply 24% and a low web debt to adjusted EBITDA ratio of 4.6x. REXR additionally has $2.0 billion of liquidity, and as proven under, it has simply $6 million of debt maturing and simply $100M maturing subsequent yr.

Investor Presentation

On the present value of $50.92, REXR carries a decent 3.3% dividend yield that’s well-covered by a 71% payout ratio. The dividend has a 5-year CAGR of 18% and was raised by 10% this yr.

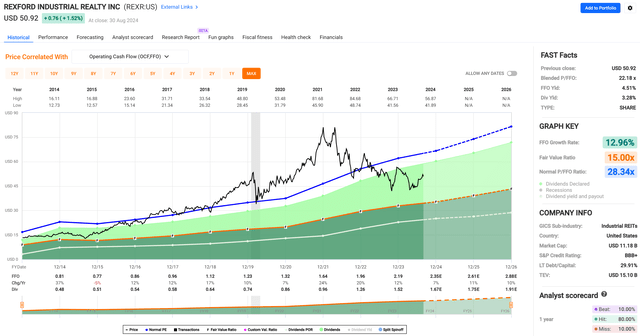

Whereas REXR isn’t low cost on the floor with a ahead P/FFO of 21.6, it does sit far under its historic P/FFO of 28.3, as proven under.

FAST Graphs

I consider REXR’s present valuation stays enticing contemplating analyst ahead expectations for 10-14% annual FFO per share development within the 2025-2027 timeframe, which, I consider, is affordable contemplating the excessive lease spreads, exterior development, and inner growth alternatives as famous earlier.

Extra conservative buyers could wish to contemplate the Most popular Collection C Inventory (NYSE:REXR.PR.C), which presently trades at $22.10 and yields 6.4%. This sequence is cumulative, which signifies that any missed funds have to be made up as long as the corporate is financially solvent.

Whereas it does have a name date of 9/20/24, the market doesn’t seem to consider that it will likely be referred to as contemplating the 12% low cost to par worth of $25, with lower than 30 days earlier than the decision date. Within the meantime, buyers get to gather a 6.4% yield on this problem at a reduction to name worth.

Dangers to REXR’s widespread and most well-liked inventory embody the potential for greater rates of interest, which may make exterior acquisitions dearer from a price of capital perspective. Greater charges may additionally put down downward stress on each the widespread and most well-liked inventory, with the latter being extra considered a bond proxy. As well as, close to time period industrial property pricing could possibly be softer than anticipated, resulting in rental value volatility within the brief time period.

Investor Takeaway

Rexford Industrial affords an honest mix of revenue and development potential, supported by its distinctive deal with the high-barrier, low-vacancy Southern California industrial market. REXR continues to show sturdy operational efficiency, with sturdy NOI development, excessive lease spreads, and a well-covered dividend with a formidable development trajectory.

Whereas the inventory is not low cost on the floor, its present valuation stays enticing relative to its historic P/FFO ranges and powerful ahead development prospects. Moreover, the popular Collection C inventory affords a excessive yield with a fair safer dividend than the widespread shares, making it an interesting possibility for extra conservative buyers.