Yuuji/E+ by way of Getty Pictures

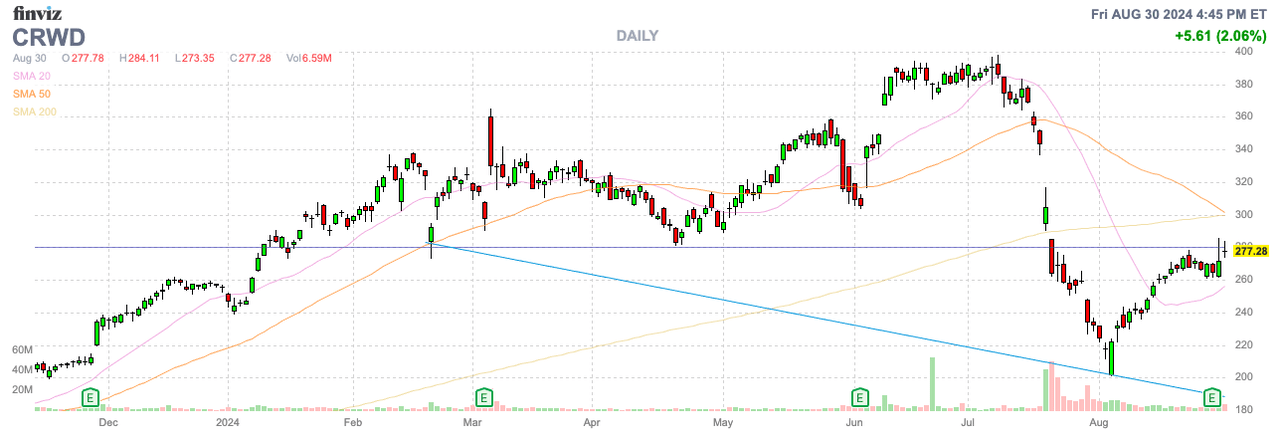

Final week, CrowdStrike Holdings, Inc. (NASDAQ:CRWD) gave preliminary steerage based mostly on the learn via from the worldwide outage precipitated in July. The cybersecurity specialist lower steerage, however the market cheered the restricted impacts to the enterprise to this point. My funding thesis stays ultra-Bearish on the inventory buying and selling at an excessive valuation, with clients already pushing again on signing new offers.

Supply: Finviz

Focus On FQ3 Steerage

Again on July 19, CrowdStrike precipitated a worldwide outage, impacting no less than 8.5 million gadgets of consumers utilizing Microsoft (MSFT) by way of a Channel File 291 incident. Most clients had been again on-line inside hours and a few inside days, however CrowdStrike is presently in a $500 million lawsuit with Delta Air Strains (DAL) as a result of an outage lasting all weekend and inflicting the cancellation of 7K flights.

The cybersecurity firm has 1 / 4 ending in July, so clearly the outage was going to have a restricted influence on the FQ2 outcomes. The actual key to the funding story is the ripple results into following quarters.

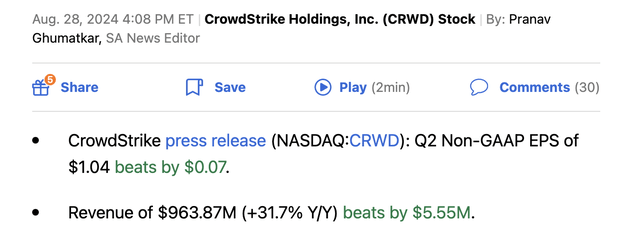

CrowdStrike reported the next outcomes for the quarter ended on July 31:

Supply: Searching for Alpha

The primary key’s that the corporate nonetheless beat consensus targets by over $5 million, much like prior quarters. On the FQ2’25 earnings name, CEO George Kurtz mentioned buyer contracts being delayed as follows:

Because the July 19 incident was within the closing two weeks of the quarter when a significant portion of our gross sales sometimes shut, it delayed offers into subsequent quarters. The overwhelming majority of those offers stay in our pipeline.

CrowdStrike nonetheless closed some very massive contracts by quarters finish with a touch that current clients had been much less hesitant, however the CFO went on to offer extra particulars on the offers pushed. In accordance with the manager, none of those offers had closed as of earnings on August 28, or practically a month following the quarter shut:

The July 19 incident had a big influence on the final two weeks of the quarter, as we quickly mobilized groups to help clients, however we continued to shut offers, together with a nine-figure in deal worth enlargement. Whereas offers can push in any given quarter, this quarter we skilled elevated ranges with greater than $60 million in offers that we had line of sight for the quarter and stay open as of Monday. We anticipate these offers to shut in future quarters.

These delayed offers influence future outcomes to the extent these clients finally enroll with CrowdStrike. If the cybersecurity specialist loses clients, like Delta Air Strains, within the course of, the numbers may get ugly, and quick.

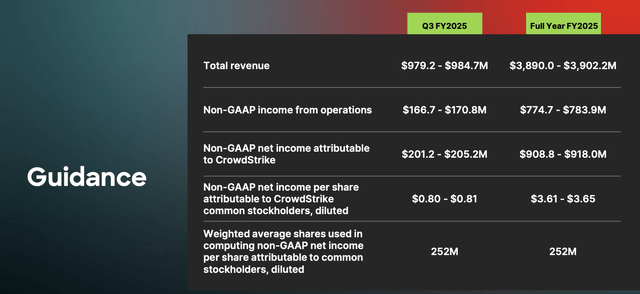

CrowdStrike guided to FQ3 revenues of $979 to $984 million for ~25% development. The steerage is for the expansion charge to decelerate by 7 proportion factors from the 32% development charge within the simply reported quarter.

Supply: CrowdStrike FQ2’24 presentation

Extra importantly, CrowdStrike missed consensus estimates of $1.01 billion by practically $20 million. Additionally key, the corporate is just forecasting income to extend ~$20 million sequentially, resulting in restricted development in future quarters.

For instance, CrowdStrike simply added practically $63 million in sequential revenues and final FQ3 the sequential income bump was practically $55 million on a income base ~$230 million decrease. Administration suggests the remaining 2 quarters have ~$30 million in subscription income reductions as a result of buyer incentives to elongate Falcon platform subscription commitments, apparently unrelated to the outage, and oddly timed.

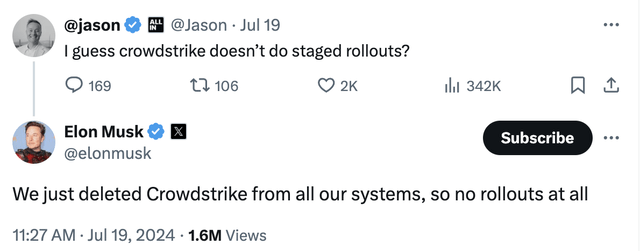

The secret’s whether or not CrowdStrike can persuade new clients to enroll in the companies, or conversely, current clients to develop companies. Although Elon Musk steered his corporations, Tesla (TSLA), SpaceX and Twitter/X, have stripped out CrowdStrike merchandise, most corporations aren’t prepared to aggressively take away companies realizing a alternative must be added, so any retention incentives could be logical for current clients.

Supply: Twitter/X

SentinelOne (S) just lately reported quarterly outcomes with an expectation of taking market share from CrowdStrike because of the outage. The cybersecurity peer did not report any main income information up, however administration did make the next assertion on the latest earnings name:

At Black Hat a couple of weeks in the past, we heard from enterprises that they wish to diversify cybersecurity applied sciences and mitigate the danger of one other world outage. There was quite a lot of pleasure and curiosity in SentinelOne.

Firms don’t make snap choices. They want to determine tips on how to make the transition, however this shift is constructive for SentinelOne within the broader enterprise safety panorama. This can play out for years as corporations dig via the net of liabilities and dangers uncovered by this historic outage.

The gross sales cycles in cybersecurity can take 9 to 12 months, so the tipple results will final all the best way till subsequent July.

Glossed Over Influence

The inventory was already falling previous to July 19 with CrowdStrike failing to high $400 only a few weeks prior and shutting July 18 at $343. The inventory fell to the late 2023 low round $200, however CrowdStrike has already rebounded aggressively to $275 the place sturdy resistance exists now.

The market cap is now again as much as $68 billion, with a $65 billion EV based mostly on a $3 billion internet money steadiness. Traders have rapidly glossed over the outage ripple results to already pay a premium value for the inventory.

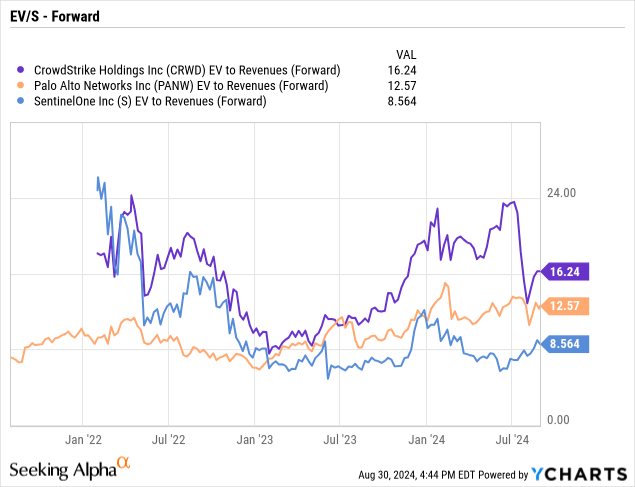

CrowdStrike is just approaching $1 billion in quarterly income, whereas the inventory has an EV of $65 billion. The inventory now trades at a ahead EV/S a number of of 16x, whereas Palo Alto Networks (PANW) trades down beneath 13x and SentinelOne is at 9x.

Even when an investor believes CrowdStrike will stabilize with development charges within the mid-20% vary, the inventory ought to commerce a lot nearer to the valuations of the friends within the cybersecurity area.

To not point out, one would not know the complete consequence of any litigation. CrowdStrike suggests contractual obligations and insurance coverage ought to restrict any monetary influence, however one should not pay a premium for an organization with unknown litigation and slower development charges.

The corporate clearly suggests new offers are prone to require CEO, and in some circumstances BoD approval, pushing offers out for possible quarters. In actuality, clients could also be unwilling to maneuver over to CrowdStrike till as much as 6 months of incident free operations take the shackles off government restrictions.

The chance is that development slows even additional in FQ4, and the market would not seem to know the weak income steerage is completely because of the decrease revenues for added buyer commitments. Even when development charges maintain round 20%, CrowdStrike ought to commerce extra within the vary of 7x to 10x EV/S targets, much like the place SentinelOne already trades regardless of even larger gross sales development targets.

Takeaway

The important thing investor takeaway is that the ripple results of the worldwide outage are solely now beginning to hit the quarterly expectations of CrowdStrike. The present quarter will see the largest influence whereas traders are nonetheless paying large premiums for the inventory. CrowdStrike nonetheless has appreciable draw back forward.