DNY59

CROX’s Reversal Might Be Right here, As HEYDUDE Bottoms

We beforehand lined Crocs, Inc. (NASDAQ:CROX) in June 2024, discussing why we had reiterated our Purchase ranking, as the corporate reported double beat FQ1’24 incomes name whereas elevating its FY2024 steering.

This was attributed to the sturdy Crocs gross sales domestically/ internationally, nicely balancing HeyDude’s ongoing stock correction.

We have been additionally inspired by the brand new administration introduced in to revitalize the HeyDude model, regardless of the lately lowered FY2024 HeyDude steering.

Mixed with the more healthy steadiness sheet and the rising bullish help noticed in its inventory motion, we believed that it remained a compelling development funding.

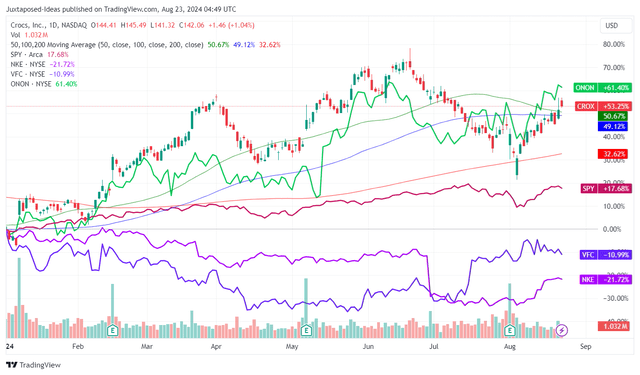

CROX YTD Inventory Worth

Buying and selling View

For now, CROX has had a promising YTD efficiency certainly, with it nicely exceeding the broader market and plenty of of its Shopper Discretionary inventory friends, akin to Nike (NKE) and V.F. Company (VFC), with the exception being On Holding AG (ONON).

A lot of CROX’s tailwinds are attributed to the sturdy shopper spending developments regardless of the unsure macroeconomic surroundings, with it additionally mirrored within the firm’s double beat FQ2’24 incomes outcomes.

That is with revenues of $1.11B (+19.3% QoQ/ +3.7% YoY), increasing gross margins of 61.3% (+5.7 factors QoQ/ +3.4 YoY), and accelerating adj EPS development to $4.01 (+32.7% QoQ/ +11.6% YoY).

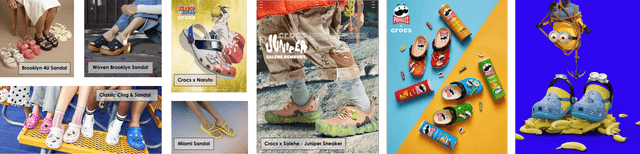

CROX’s New Fashions

CROX

A lot of CROX’s successes have been constructed on the extremely strategic model partnerships, akin to with designer Salehe Bembury for the model’s first ever sneaker mannequin – Salehe Juniper sneaker, permitting the corporate to enter a wholly new footwear section.

That is whereas constructing upon its iconic footwear, the Traditional Clog, via the IP partnership with SpongeBob/ Patrick, Pringles, Naruto, Minions, and a Ok-pop band – Treasure.

It’s obvious from these developments why CROX has outperformed lots of its friends, whom have been fighting development headwinds, with the administration additionally elevating the FY2024 income steering to +4% YoY and adj EPS to +5.3% YoY.

That is in comparison with the unique steering of +4% YoY and +1.9% YoY supplied within the FQ4’23 earnings name, respectively.

The accelerated development alternative is of course attributed to CROX’s core model, Crocs, which generated sturdy revenues of $914M (+11.2% YoY fixed forex) notably within the Worldwide markets at $425M (+22% YoY fixed forex).

The administration’s intensified efforts to drive development via native e-commerce platforms have labored as supposed in any case, particularly in China, the place its gross sales develop by over +70% YoY in FQ2’24 – constructing on the +100% YoY development reported in FQ2’23:

For the primary time ever, Crocs emerged as a prime 10 general style model on Tmall throughout the pageant and was one in all solely two footwear manufacturers talked about within the prime 10 style rankings. (Searching for Alpha)

Whereas CROX’s Crocs development continues to decelerate within the North American area at +3.2% YoY in FQ2’24, in comparison with the +12.5% reported in FQ2’23, we’re not overly involved certainly, for the reason that administration’s aggressive investments within the Worldwide market, together with double digit growths within the UK and Germany, have paid off handsomely.

On the similar time, the administration has hinted on the potential restoration of HEYDUDE’s gross sales, with FQ3’24 gross sales anticipated to be at roughly $209.86M (+5.9% QoQ/ -15% YoY).

The sequential enchancment within the gross sales hints at higher issues to return in H2’24 certainly, with it additionally constructing on the +1.5% QoQ development noticed in FQ2’24 HEYDUDE gross sales, naturally exemplifying why CROX has reiterated the FY2024 HEYDUDE gross sales steering at solely -9% YoY.

These developments could display why the market is more and more bullish about its reversal as nicely, as noticed within the inventory’s sturdy YTD efficiency, regardless of HEYDUDE’s lower than spectacular efficiency to date.

Lastly, the influence of HEYDUDE’s $2.5B acquisition has been moderated on CROX’s steadiness sheet with a net-debt-to-EBITDA ratio of 1.12x within the newest quarter, in comparison with 3.73x recorded in FQ1’22 after the HEYDUDE completion by February 2022 and 0.97x in FQ4’21 pre-acquisition.

Consequently, whereas HEYDUDE’s lackluster efficiency continues to dilute the general firm’s monetary and inventory efficiency, we imagine that the worst could already be over, with H2’24 prone to convey forth sequential enhancements.

So, Is CROX Inventory A Purchase, Promote, or Maintain?

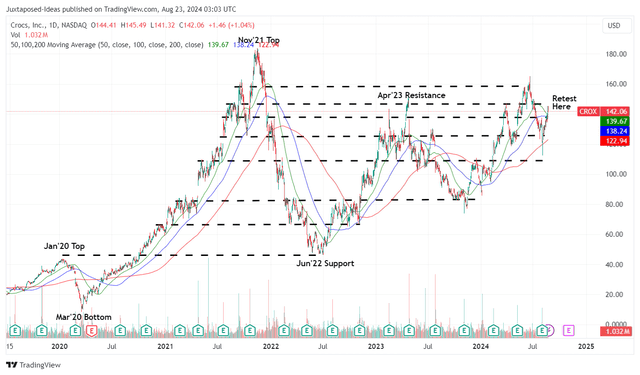

CROX 5Y Inventory Worth

Buying and selling View

For now, CROX has had a terrific bounce by +17.3% from the August 2024 backside of $120s, whereas buying and selling above its 50/ 100/ 200 day shifting averages.

Primarily based on the inventory costs of $142.06 on the time of writing and the administration’s raised FY2024 adj EPS steering to $12.67 (+5.3% YoY) on the midpoint, it seems that the inventory at FWD P/E of 11.21x remains to be buying and selling close to to its 1Y imply of ~10.20x.

With the market constantly upgrading CROX’s prospects from the 2022 P/E imply of seven.76x and 2023 P/E imply of 9.23x, we imagine that our earlier conjecture is just not overly aggressive certainly, with the inventory’s rising bullish help doubtlessly triggering a speculative re-rating in its FWD P/E nearer to the 5Y common of ~15x.

This improvement could set off a bull-case long-term worth goal of $220.30, based mostly on the consensus FY2026 adj EPS estimates of $14.69, with it implying a sturdy upside potential of +55% from present ranges.

Whereas CROX doesn’t pay a dividend, its shareholder returns have been sturdy as nicely, with -1.84M or the equal -2.9% of its float retired over the LTM and -9.07M/ -12.9% since FY2019, respectively.

With the administration nonetheless reporting a sturdy Free Money Move era and steadiness sheet well being, we imagine that it stays nicely positioned to train the remaining $700M on its share repurchase authorization.

On account of the engaging threat/ reward ratio at present ranges, we’re reiterating our Purchase ranking for the CROX inventory right here.