sturti

TransMedics’ (NASDAQ:TMDX) inventory continues to maneuver increased, supported by sturdy progress, even when a good portion of this progress is now coming from logistics. The final time I wrote about TransMedics I steered that whereas there was restricted room for additional a number of enlargement, sturdy progress would probably lead the inventory increased. This has largely been the case, with the refill round 20% since then.

Whereas I feel that there’s additional upside, warning is warranted as TransMedics operates in a comparatively small market. New indications (coronary heart and lungs) and geographies present a chance for additional enlargement, however TransMedics’ progress will decelerate meaningfully over the subsequent two years.

The corporate’s margins are additionally prone to stay beneath stress within the quick time period as a result of progress investments (logistics, scientific trials). Long term, TransMedics is prone to generate extraordinarily sturdy margins, which matches a great distance towards justifying the corporate’s present valuation.

Market Situations

TransMedics continues to profit from sturdy progress in its finish markets and fast market share beneficial properties. Coronary heart, liver, and lung organ transplant volumes elevated within the excessive single-digit vary in Q2. This seems to be a modest decline from the 9% YoY enhance registered in Q1.

Solely a teenagers proportion of transplants at present make the most of an organ preservation machine, which suggests TransMedics nonetheless has a considerable progress runway. TransMedics accomplished roughly 2,300 OCS transplants within the US in 2023 and has a goal of 10,000 transplants by 2028.

TransMedics believes that its addressable market is roughly $8 billion for lung, coronary heart, and liver transplantation mixed. This estimate is predicated on the pool of potential donors, with every donor capable of donate a couple of organ, and assumed utilization charges based mostly on the efficacy of the know-how. Transportation additionally in all probability supplies a a number of billion-dollar alternative.

Competitors is prone to enhance in coming years although, with firms like Lung Bioengineering, OrganOx, and XVIVO making an attempt to deliver units to the market. Whereas competitors will enhance, scale, NOPS and logistics ought to assist TransMedics to take care of its aggressive positioning.

XVIVO reported the outcomes of its NIHP2019 coronary heart transplantation scientific trial in April. The trial collected security and efficiency knowledge to assist CE marking: 18.8% of topics receiving a coronary heart preserved with XVIVO’s system had extreme problems after transplantation, in comparison with 30.1% of topics who obtained a donor coronary heart transported on ice. The charges of extreme main graft dysfunction after transplantation had been additionally considerably decrease for sufferers who obtained a donor coronary heart preserved with XVIVO’s system. XVIVO can also be planning a coronary heart preservation trial within the US to assist future PMA functions. XVIVO is concentrating on a industrial launch for its coronary heart perfusion machine in Europe and Australia within the second half of 2024.

TransMedics’ logistics enterprise can also be on a collision course with Blade (BLDE). I imagine that TransMedics’ vertically built-in strategy is a bonus that ought to permit it to supply prospects with increased service high quality. That being mentioned, the market is restricted in dimension and TransMedics is unlikely to pursue transportation on much less closely trafficked routes.

TransMedics Enterprise Updates

TransMedics is targeted on three areas in the mean time:

Finishing the build-out of its aviation fleet and transplant logistics community Driving transplant quantity progress and increasing its market share Launching three new cardiothoracic scientific packages

TransMedics continues to broaden its fleet and now has a complete of 17 plane. The corporate had a mean of 11 energetic planes in Q2, in comparison with 9 in Q1, and has a goal of 20 by the tip of the yr. The corporate additionally almost doubled its pilot depend within the second quarter. The eventual purpose right here seems to be enabling extra steady operations and enhancing asset utilization.

TransMedics’ plane coated roughly 59% of its NOP flight missions in Q2, up from 49% within the first quarter. The corporate is concentrating on in extra of 80% protection of NOP instances by means of its logistics community. 100 and twenty-six transplant packages within the US used TransMedics’ logistics service within the second quarter, up from 105 in Q1. TransMedics is now shifting its focus to growing penetration inside current prospects.

TransMedics stays on monitor for the initiation of three scientific packages in early 2025. The corporate has made progress with its new OCS perfusion options and seems to be pleased with the machine design. Preclinical testing demonstrates the profitable upkeep of donor lungs and hearts for greater than 24 hours. That is essential as solely round 30% of accessible donated hearts are at present utilized in transplants.

Growth for the chilly perfusion coronary heart program can also be underway. This product targets the sub three- to four-hour phase of the center preservation market that represents one thing like 20-25% of the center market. TransMedics is reportedly pleased with preclinical outcomes and expects a scientific trial to start within the second half of 2025.

Worldwide markets may even probably assist assist progress long run. Market entry exterior of the US will take time, although, with TransMedics concentrating on 2026 and past for this. The corporate is already hiring in preparation for worldwide enlargement, demonstrating its dedication.

Monetary Evaluation

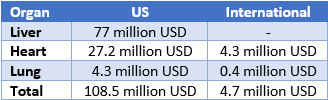

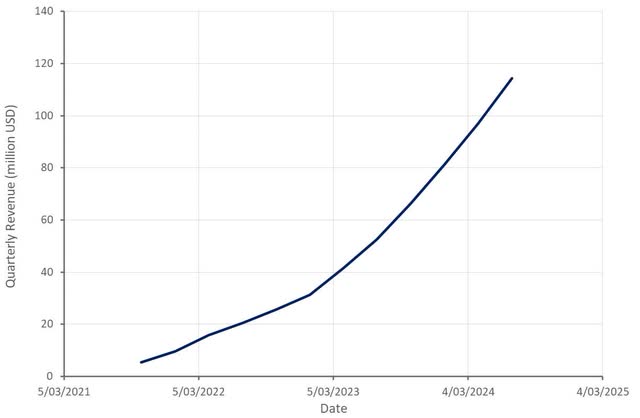

TransMedics generated $114.3 million in income within the second quarter, a rise of 118% YoY. Whereas OCS product progress stays sturdy, transplant logistics providers has turn out to be a progress driver. Logistics service income was $19.1 million in Q2, up 32% sequentially. Solely $1.1 million was associated to TransMedics’ flight faculty within the quarter.

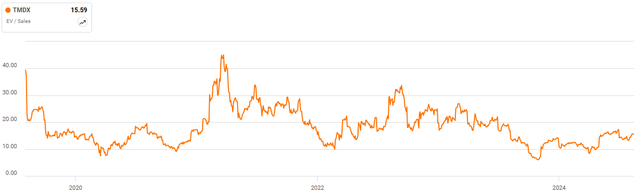

Desk 1: TransMedics Q2 2024 Income (Created by creator utilizing knowledge from TransMedics)

TransMedics is guiding to $425-445 million within the third quarter, a rise of 76-84% YoY. This steering implies one thing like 50-60% progress within the second half, which seems extraordinarily conservative, though I feel that is already effectively understood by the market.

TransMedics has said that a number of of its plane shall be out of service for scheduled upkeep within the second half, limiting logistics progress. Worldwide income can also be anticipated to be variable.

Determine 1: TransMedics Income (Created by creator utilizing knowledge from TransMedics) Determine 2: TransMedics Logistics Income (Created by creator utilizing knowledge from TransMedics)

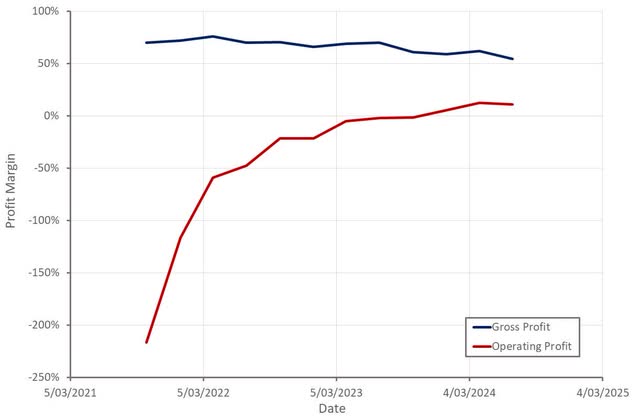

TransMedics’ gross margin was 61% within the second quarter, persevering with its latest slide. Product margin was 80% in Q2, up 3% sequentially. TransMedics expects its product gross margins to stay round this stage going ahead. Service margin was 28%, declining as a result of pilot hiring and coaching and funding in aviation upkeep. TransMedics expects its gross margins to enhance over the subsequent 12-18 months although, pushed primarily by scale, which appears optimistic given the present fast progress of service income.

TransMedics’ working revenue margin was roughly 11% within the second quarter. Complete working bills for the quarter had been $56.8 million, pushed by R&D associated to product improvement, personnel prices, and general company infrastructure. Working expense progress is anticipated to average within the second half of the yr.

Determine 3: TransMedics Revenue Margins (Created by creator utilizing knowledge from TransMedics)

Conclusion

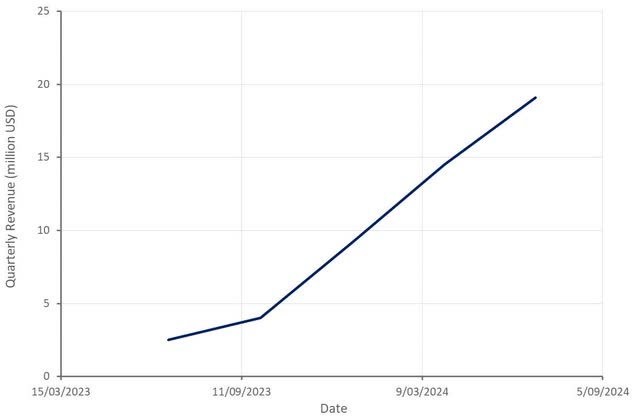

I’d not depend on additional a number of enlargement at this level, however TransMedics’ share worth ought to proceed to maneuver increased, pushed by income progress. Moderating progress will finally weigh on TransMedics’ income a number of, though it may very well be later in 2025 earlier than this actually begins to happen. Whereas progress will average, worldwide enlargement and the potential for accelerated progress inside coronary heart and lung transplants ought to guarantee TransMedics’ progress stays sturdy for at the very least a number of extra years.

The reasonableness of TransMedics’ present valuation largely will depend on what margins the corporate can finally maintain. Assuming TransMedics achieves a 30% working revenue margin, the corporate will in all probability commerce on an earnings a number of consistent with the market inside three years whereas persevering with to develop at a wholesome double-digit tempo. There are questions round finish market dimension and rising competitors, however this looks like an inexpensive valuation given the power of TransMedics’ enterprise.

Determine 4: TransMedics EV/S Ratio (Searching for Alpha)