ISerg

Wanting previous headlines just isn’t a simple factor to do, as we regularly get bombarded with doom and gloom from mainstream media retailers. This contains the so-called retail apocalypse within the pre-2020 years, when some believed that on-line purchasing on Amazon (AMZN) was going to make in-person purchasing go the best way of the dodo.

That didn’t come true, as Class A mall proprietor Simon Property Group (SPG) and purchasing middle proprietor Kimco Realty (KIM) are actually buying and selling at or above the place they have been in pre-pandemic occasions.

This brings me to workplace REIT Kilroy Realty Corp. (NYSE:KRC), which I final coated in July of final 12 months, highlighting its high quality property profile and deep undervaluation with greater than its fair proportion of dangers priced into the inventory.

The market has responded in variety, with the inventory giving buyers a 14.4% whole return since my final piece, which isn’t unhealthy over a 13-month timeframe. On this article, I revisit KRC and talk about why it stays undervalued for earnings and worth buyers at current, so let’s get began.

Why KRC?

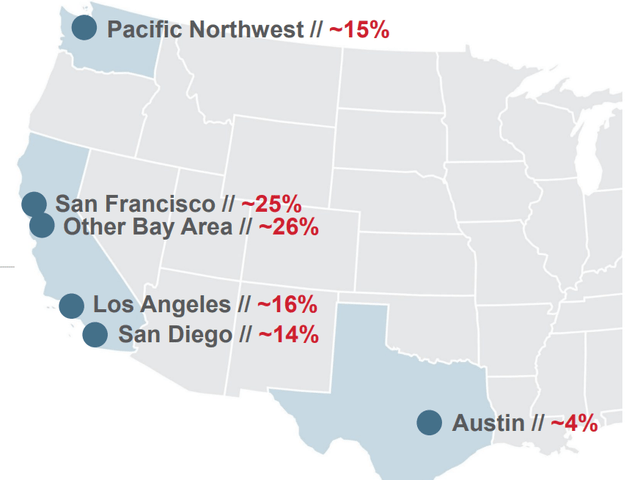

Kilroy Realty is a U.S. West coast centered workplace REIT. It has been round for over 70 years and was led by long-time CEO John Kilroy earlier than he retired on the finish of final 12 months. As proven under, KRC’s properties are positioned in tech hubs alongside the west coast like Better Seattle, SF Bay Space, Southern California, and it has a rising presence in Austin, Texas, which has been a vacation spot for tech corporations in recent times.

Investor Presentation

KRC continues to really feel the consequences of the downturn in workplace use since 2020. That is mirrored by occupancy declining from 87% within the prior 12 months interval to 84% as of Q2, 2024. FFO per share declined by 7.6% YoY to $1.10 and down by $0.01 on a sequential QoQ foundation, on account of decrease occupancy.

There are optimistic indicators, nonetheless, that KRC’s occupancy decline is popping the nook as tenants fly to top quality properties with facilities, as is the case with KRC’s comparatively younger portfolio in comparison with the workplace sector. Particularly, administration noticed leasing momentum throughout each the second quarter and into the present third quarter in progress, as mirrored by feedback throughout the latest convention name:

Over the past 60 days, we have been notably inspired by a lot of discussions with potential new tenants, with area necessities over 100,000 sq. toes.

As well as, latest high-profile return to work bulletins by main employers and a brand new discovered concentrate on the enforcement of latest and present mandates underscores the popularity that in-person connection is essential to the long-term success of each staff and group.

In San Francisco, whole tenant demand out there has doubled over the course of the final 18 months, and leasing volumes are slowly however persistently bettering, supported by rising demand for a lot of new-to-market tenants, together with these within the AI sector.

Because of this development, administration raised the identical retailer money NOI steering for the full-year from a lack of 4.25% beforehand to a lack of 3.5% on the midpoint of the vary. As well as, FFO per share steering was raised by $0.04 from the earlier goal to $4.26.

Past 2024, I do see a path for KRC to retake its 2023 FFO per shares of $4.62 with continued restoration within the workplace sector and with new developments as KRC pivots towards the fast-growing life sciences class, with $1.7 billion in in-process developments. This contains KRC’s Oyster Level venture in South San Francisco, which is garnering curiosity from a number of early-stage life sciences corporations.

In the meantime, KRC’s stability sheet is supported by BBB/Baa2 funding grade credit score rankings from S&P and Moody’s. It additionally has $1.9 billion in liquidity and a fairly secure debt to EBITDA ratio of 6.2x, with no debt maturities by means of the tip of this 12 months.

Importantly for earnings buyers, KRC at present sports activities a 6.4% dividend yield. The dividend is well-covered by a 51% payout ratio, leaving loads of retained capital to fund developments and deleverage the stability sheet. KRC has paid an uninterrupted dividend since 2009 and whereas dividend development has been missing since 2022, it might resume after occupancy stabilizes and improves.

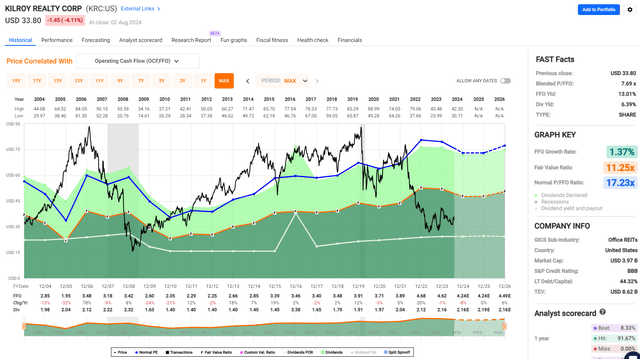

KRC stays engaging, particularly after the worth drop together with the market over the previous week, on the present worth of $33.80 with a ahead P/FFO of simply 8.0x, sitting far under its historic P/FFO of 17.2, as proven under.

FAST Graphs

KRC additionally trades at a reduction to a different Class A workplace REIT, BXP, Inc. (BXP), previously referred to as Boston Properties, which carries a P/FFO of 9.5x. At KRC’s present discounted valuation, the market is pricing in a no-growth future for the REIT, which I do not consider to be the case, contemplating its stabilizing fundamentals and early indicators of a rebound.

Promote aspect analysts who observe the corporate estimate that KRC will return to development in 2026 with a 5.6% improve in FFO per share. Over the long term, I consider that KRC can obtain at the very least a mid-single digit FFO per share annual development charge, contemplating its in-demand properties and lack of latest provide in recent times, advantages of which take time to comprehend. As such, KRC seems to be extremely interesting on the present worth.

Dangers to the thesis embrace the potential for a ‘onerous touchdown’ within the economic system, because the economic system added fewer jobs in July than beforehand anticipated. This might decrease demand within the close to time period and push out the restoration time for KRC. As well as, KRC might see its value of capital rise ought to rates of interest stay excessive as a consequence of cussed inflation.

Investor Takeaway

Kilroy Realty stays a compelling funding with its high-quality, tech-centric workplace properties alongside the U.S. West Coast, continued undervaluation, and excessive dividend yield. Regardless of ongoing challenges in workplace area demand, KRC has proven indicators of stabilizing occupancy and rising leasing momentum, notably in high-demand sectors like AI and life sciences.

With a strong stability sheet supported by investment-grade credit score rankings, and a well-covered 6.4% dividend yield, KRC is attractively priced at a major low cost to its historic valuation and friends. Whereas near-term dangers embrace potential financial downturns and excessive rates of interest, they seem like greater than baked into the share worth, presenting earnings and worth buyers with probably sturdy whole returns from right here.