US Inflation Knowledge Little Modified in June, USD and Gold Listless Publish-release

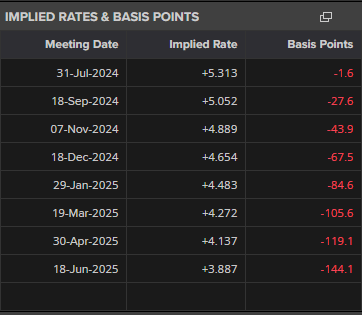

US Core PCE y/y unchanged at 2.6%, lacking estimates of two.5%.Rate of interest possibilities are unmoved with a September minimize absolutely priced in.

For all high-impact knowledge and occasion releases, see the real-time DailyFX Financial Calendar

Really helpful by Nick Cawley

Get Your Free USD Forecast

The US Core PCE inflation gauge y/y was unchanged at 2.6% in June however missed market expectations of two.5%. The PCE worth index fell to 2.5% from 2.6% in Could, whereas private earnings m/m fell by greater than anticipated to 0.2%.

Right now’s launch offers merchants little new to work with and leaves the US greenback apathetic going into the weekend. Monetary markets proceed to totally worth in a 25 foundation level rate of interest minimize on the September 18 FOMC assembly, with a second minimize seen in November. A 3rd-quarter level minimize on the December 18 assembly stays a powerful risk.

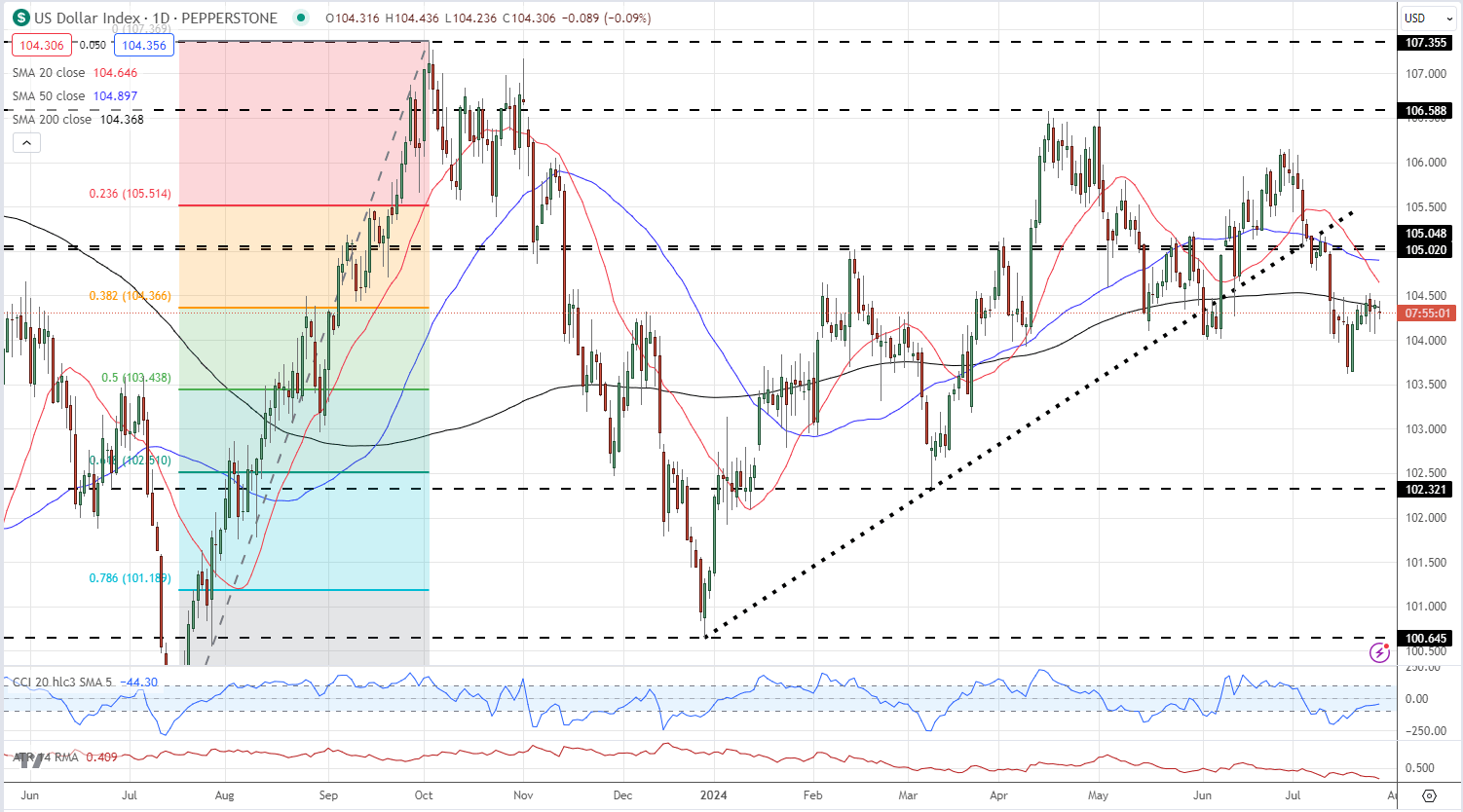

US greenback merchants will now stay up for subsequent week’s FOMC assembly to see if chair Powell offers any additional steering about upcoming charge cuts. The US greenback index (DXY) is buying and selling on both facet of the 38.2% Fibonacci retracement stage at 104.37, and the 200-day easy shifting common, and can want a brand new driver to power a transfer forward of subsequent Wednesday’s Fed assembly.

US Greenback Index Day by day Chart

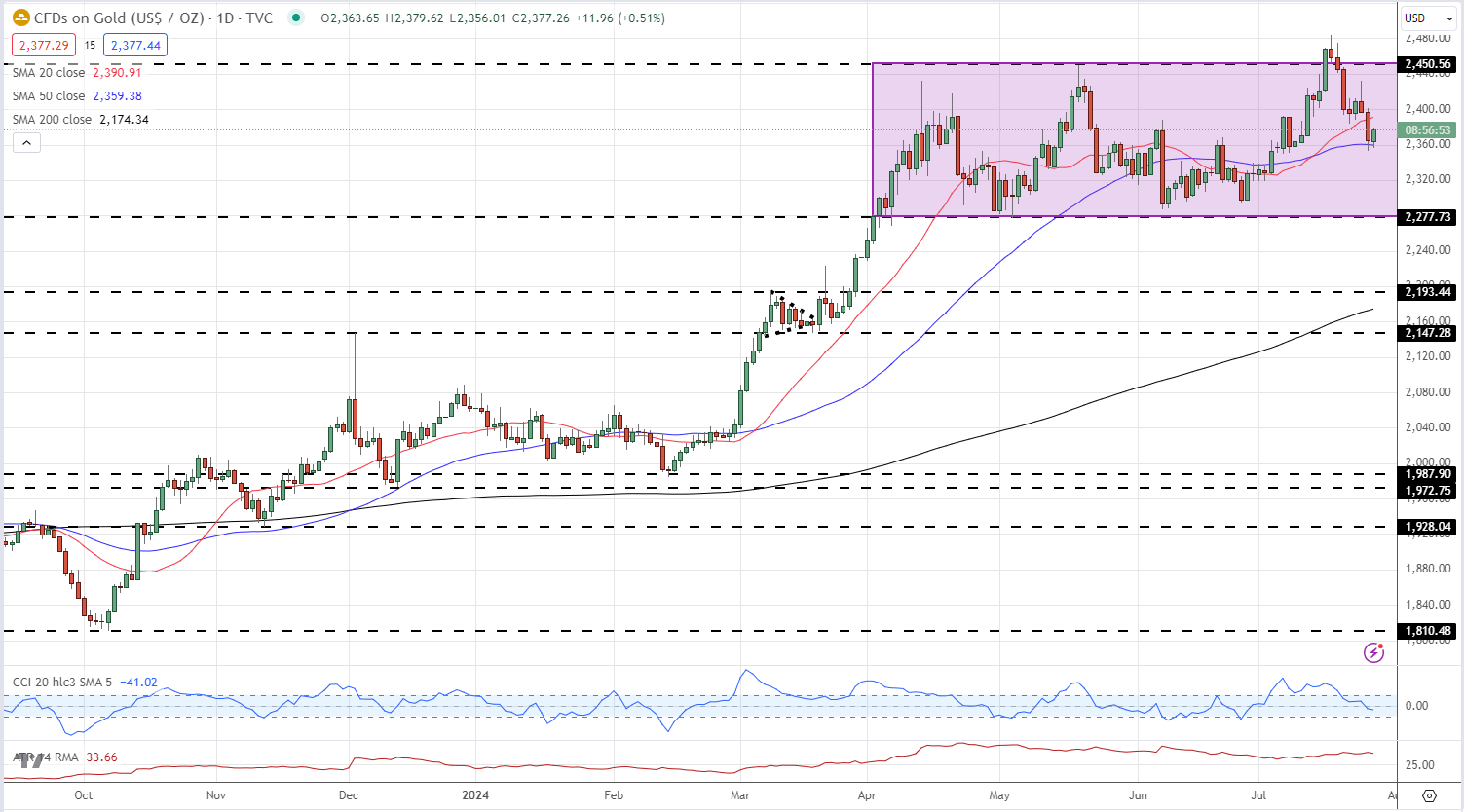

The value of gold nudged round $5/oz. larger after the inflation report and stays caught in a multi-month vary. The valuable metallic briefly broke resistance two weeks in the past however shortly slipped again into a spread that began in early April.

Really helpful by Nick Cawley

Commerce Gold

Gold Value Day by day Chart

Retail dealer knowledge reveals 61.36% of merchants are net-long with the ratio of merchants lengthy to brief at 1.59 to 1.The variety of merchants net-long is 11.61% larger than yesterday and 16.13% larger than final week, whereas the variety of merchants net-short is 8.68% decrease than yesterday and 20.13% decrease than final week.

We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-long suggests Gold costs could proceed to fall. Merchants are additional net-long than yesterday and final week, and the mix of present sentiment and up to date modifications offers us a stronger Gold-bearish contrarian buying and selling bias.

Change in

Longs

Shorts

OI

Day by day

1%

-3%

-1%

Weekly

2%

-8%

-2%

What are your views on the US Greenback – bullish or bearish?? You may tell us through the shape on the finish of this piece or contact the writer through Twitter @nickcawley1.

aspect contained in the aspect. That is most likely not what you meant to do!

Load your software’s JavaScript bundle contained in the aspect as a substitute.

Source link