VisionsofAmerica/Joe Sohm

Within the time that Vaalco Power (NYSE:EGY) has had for the reason that acquisition with TransGlobe Power again in fiscal 12 months 2022, this administration has finished so much in roughly one and one half years with that acquisition. Administration additionally closed on the Svenska acquisition since then as properly. Not solely is manufacturing rising on account of these actions, however the firm has additionally maintained a debt-free stability sheet with a large money stability all through the entire time. With some sizable tasks on the horizon, administration is in a great place to extend manufacturing additional whereas sustaining that sturdy stability sheet.

The final article famous that there was a dependence upon displaying a good quantity of progress by means of acquisitions. This firm has diversified by doing enterprise in areas the place the acquisition worth permits for quick paybacks. Nonetheless, diversification won’t fully offset the danger of doing enterprise in these areas.

What’s prone to occur is a few manufacturing progress in among the extra secure areas like Egypt and Canada sooner or later.

Space Of Operations

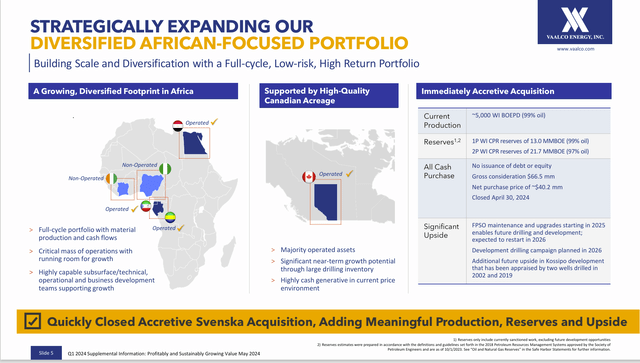

These acquisitions have made the corporate far much less dependent upon a single supply of money stream. That diversification (even amongst some elevated threat areas) has decreased the importance of every space of operation.

Vaalco Power Space Of Operations Map (Vaalco Power First Quarter 2024, Company Earnings Presentation)

The corporate now has at the least one protected space of operation in Canada. Most likely the subsequent lowest threat operation is in Egypt. Each of those are thought of way more secure than the unique supply of money stream in Gabon.

The just lately accomplished Svenska acquisition will add manufacturing to the prevailing firm manufacturing. Nonetheless, there will likely be unfavorable manufacturing comparisons subsequent 12 months when the FPSO deliberate restore schedule will mandate that manufacturing go offline for a few 12 months. After that, then will probably be again to manufacturing and inspecting progress prospects.

Administration does have the power to make up for that misplaced manufacturing elsewhere. However it’s a steep climb for a small firm like this.

This can be a small firm that engages in somewhat sizable offshore tasks. It is commonplace for these tasks so as to add hundreds of barrels to manufacturing or to have a problem that causes plenty of barrels to go offline till the difficulty is resolved.

A bigger firm has way more manufacturing, in order that one thing like this isn’t as vital. The land-based Canadian and Egyptian manufacturing might make this one thing that may be made up. These operations might be expanded comparatively cheaply in comparison with the unique offshore enterprise.

Dangerous Enterprise And Excessive Upfront Prices

Nonetheless, the offshore enterprise is a enterprise that has a number of upside potential. Administration typically appears for smaller discoveries that aren’t price it for a a lot bigger firm to develop. This firm can usually make a great residing off these discoveries. The truth that oil was found takes an entire lot of threat out of the exploration a part of the corporate’s enterprise.

Small firms like this must be very cautious with threat as a result of an offshore properly can run as a lot as $30 million. For an organization like Exxon Mobil (XOM) that’s “chump change” that disappears within the billions of {dollars} reported quarterly. So, shareholders hardly ever see something except administration does an announcement.

However with Vaalco, a $30 million dry gap (together with related prices) is a significant earnings occasion that may wreck 1 / 4 and trigger the market to revalue the entire fiscal 12 months. To this point, the debt free stability sheet factors to glorious threat administration. Not many profitable offshore operators are this small.

Entry Into Nonetheless One other African Nation

A fabric addition to this acquisition data was introduced by administration just lately. The reserves bought elevated by 3.9 million BOE from the unique evaluation. Understand that that is nonetheless an informed guess by an out of doors get together. Nonetheless, it implies that the reserves have been bought for lower than $3 BOE, and it’s probably principally oil.

In the identical announcement, administration acknowledged that this enhance performed a major half in proved reserves climbing greater than 50% within the final fiscal 12 months. Please see the unique information for particulars on this.

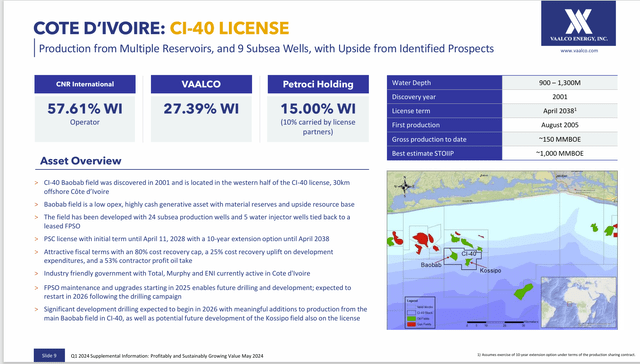

Administration has turn out to be concerned in one other manufacturing space within the nation of Cote d’Ivoire. The next will evaluation some previous discussions whereas including much more particulars to present a greater general view of this mission.

Vaalco Power Space Of Operations Map (Vaalco Power First Quarter 2024, Company Earnings Presentation)

That is the Svenska acquisition that just lately closed. It can add vital manufacturing to the corporate reporting, as famous. However subsequent 12 months, it can additionally go offline for the FPSO upkeep and repairs. Not but acknowledged is administration’s legal responsibility on this restore course of.

Whereas the market loves the addition of this mission for money as a result of it raises manufacturing, Mr. Market won’t be so pleased when these barrels of manufacturing are gone for a few fiscal 12 months (give or take so much relying upon what’s discovered as soon as the repairs start).

This can be a non-operated mission with Canadian Pure Sources (CNQ) the operator. Nonetheless, the main points of an FPSO after which planning on rising manufacturing after that would take a major period of time. Even with the money stability that the corporate maintains, the anticipated progress might be a significant money drain for the corporate when that point arrives.

The primary quarter convention name slides present manufacturing heading previous 25,000 BOED for the fiscal 12 months with this manufacturing added in. However the market is probably going extra involved in regards to the exit charge manufacturing at year-end 2024 mixed with the projected manufacturing for the primary quarter with out this quantity when the FPSO goes for repairs. Do not be stunned if there’s some inventory worth volatility due to this.

Together with this comes a partnership with Exxon Mobil (XOM) in Nigeria that has a discovery in its very early phases. This discovery probably has some years forward earlier than there could be any manufacturing. Nigeria is a spot the place the federal government is supportive of the oil and gasoline trade. However that authorities can also be very ineffective. Mitigating among the challenges of doing enterprise in Nigeria could be the presence of a significant like Exxon Mobil because the operator and the truth that that is an offshore discovery.

Egypt

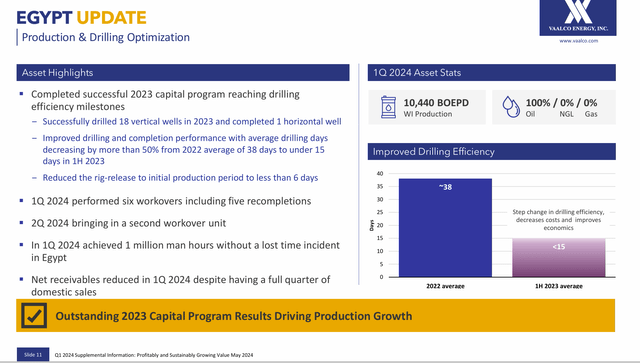

Administration famous that the primary horizontal properly was drilled in Egypt. Because the acquisition, the key change right here has been a fast pickup within the enterprise tempo. That has been mixed with a relentless effort (that continues) to get the receivables from the Egyptian authorities down. If this stays profitable, then much less working capital is required. Clearly, this administration is bringing an power stage to the Egyptian enterprise that we have now not seen in a very long time.

Vaalco Abstract Of Standing Of Egyptian Enterprise (Vaalco Power First Quarter 2024, Company Earnings Presentation)

The importance of that horizontal properly is that it might be far cheaper to drill profitable horizontal wells than to do a significant manufacturing of secondary restoration through the use of the water flooding methodology.

In the US, for instance, the Austin Chalk play in Texas was revolutionized just about in a single day by the arrival of horizontal drilling mixed with fashionable completion strategies. Which may occur right here as properly.

Within the meantime, administration is clearly reducing prices all through the entire course of since buying the enterprise. The earlier administration negotiated a greater contract with the Egyptian authorities that enables for worthwhile long-term secondary restoration. The present operations look like taking full benefit of that new contract.

Word that the receivables stability has additionally been decreased for the reason that acquisition of this operation. That was a perennial challenge when TransGlobe Power operated this enterprise.

In abstract, the report not solely emphasizes manufacturing progress, nevertheless it additionally emphasizes price management to extend the profitability of that progress as properly.

Gabon

This nation is answerable for roughly 40% of the reported manufacturing. That is down significantly from 100% after I first started to observe the corporate.

Development within the offshore enterprise is usually lumpy as a result of the tasks are massive sized. Failures are sometimes massive as properly. Therefore, the necessity for diversification. Nonetheless, the monitor document has been good contemplating the “small company-big mission” nature of this enterprise.

This a part of the enterprise had a comparatively quiet 12 months. The opposite elements of the enterprise look like properly suited to smoothing over the lumpy progress right here.

Administration has turned this a part of the enterprise into fairly a money stream machine.

Canada

Administration just lately introduced a profitable drilling program. Word that administration is shifting to longer wells of two.5 to three miles in size to extend the financial viability of this specific set of leases. The understated half is that these wells are additionally producing liquids whereas (when bought) the enterprise was bought as pure gasoline producing.

Administration has since been very profitable at rising the worth of the manufacturing combine by rising the liquids share of manufacturing. In actual fact, the revenue progress prior to now two years has been a substantial acceleration from my previous protection.

This manufacturing may be very roughly 10% of the company whole manufacturing. However the progress made to date signifies that this operation may turn out to be bigger by means of natural progress and function a basis that offsets among the elevated enterprise dangers elsewhere.

Abstract

Vaalco is an organization with no debt and a comparatively massive money stability. That is probably mandatory contemplating the locations that the corporate does enterprise in. Usually, the corporate offsets the enterprise threat by requiring quick paybacks of any acquisition made. To this point, that technique seems to be working. If the worst occurs and the corporate should go away an space of operations for no matter cause, the unique buy worth has been returned for all however the latest acquisitions. Due to this fact, the danger of loss to shareholders is minimal.

Usually, firms with no debt hardly ever get into critical bother. The money stability permits the corporate to make repeated makes an attempt to succeed. A administration staff this conservative will normally succeed in consequence.

Nonetheless, due to the elevated enterprise threat, this sturdy purchase consideration might be greatest thought of as a part of a basket of firms somewhat than loading up a big place.

Worth here’s a very tough matter as a result of there are elements of this enterprise that command a really low valuation. Earlier articles coated a number of coups within the space. That type of decimates valuations for enterprise functions very quick. Most likely the perfect technique is to attend for a “quiet interval” that outcomes out there forgetting the instability current in a number of areas the place this firm does enterprise.

Dangers

As famous above, a number of of the nations through which the corporate does enterprise lack fashionable infrastructure, have stability points, or are difficult places for nonetheless extra causes. The diversification of the corporate does assist, however doesn’t get rid of the danger.

Doing enterprise in Africa is a distinct segment enterprise, extra so than many places that I observe. The lack of key personnel that know the best way to do enterprise on the continent might be extra important due to this issue. The corporate’s plans might be materially setback if a key individual’s companies have been misplaced.

Any upstream firm is topic to the low future visibility of commodity costs together with the present volatility. A extreme and sustained downturn of commodity costs may simply change the long run outlook.