shaunl

Introduction

Sterling Infrastructure (NASDAQ:STRL) is an infrastructure firm in North America that is benefitting from long-term tailwinds in AI. Over the previous few years, the corporate has grown its top-line double digits whereas experiencing some margin growth over time, because the enterprise combine shifts to extra e-infrastructure. Regardless of the corporate’s shares having greater than doubled over the previous 12 months, I nonetheless see good worth right here.

Firm Overview

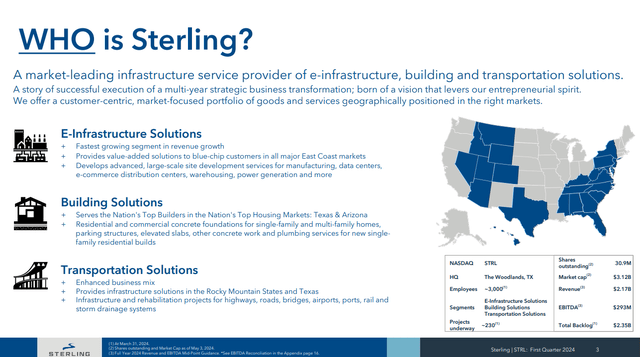

Sterling Infrastructure is a specialised development and engineering firm that is concerned in three verticals: e-infrastructure, transportation, and constructing options.

In e-infrastructure, Sterling Infrastructure is concerned in constructing out large-scale tasks for information facilities, e-commerce distribution facilities, warehouses, and vitality corporations. This would possibly sound easy at first look, however lots of its prospects typically want particular necessities that necessitate customized options tailor-made to their operational wants. Primarily, what this implies is that issues like high-capacity information storage, strong community connectivity, scalable computing energy, and energy-efficient options to reduce operational prices and environmental impression, have to be taken under consideration from starting to finish. As such, the corporate is concerned with assist its prospects, lots of that are massive, blue-chip prospects, from web site choice all over completion. As the corporate’s largest and quickest rising phase, the e-infrastructure enterprise generates 48% of the corporate’s complete gross sales.

Within the transportation phase, Sterling Infrastructure is concerned within the development of tasks like roads, bridges, highways, airports, and ports — all issues which might be needing in serving to individuals get from one place to the opposite. That is usually a decrease margin phase that does 6.6% working margins (in comparison with 15% for the e-infrastructure enterprise) and represents 32% of complete gross sales.

Lastly, within the constructing options phase, the corporate serves North America’s prime builders in Texas and Arizona, that are excessive development markets for development for single-family and multi-family houses. Whereas the constructing options is the corporate’s smallest phase at 20% of revenues, it is nonetheless rising at has good working margins of 11.4%.

Investor Presentation

Background

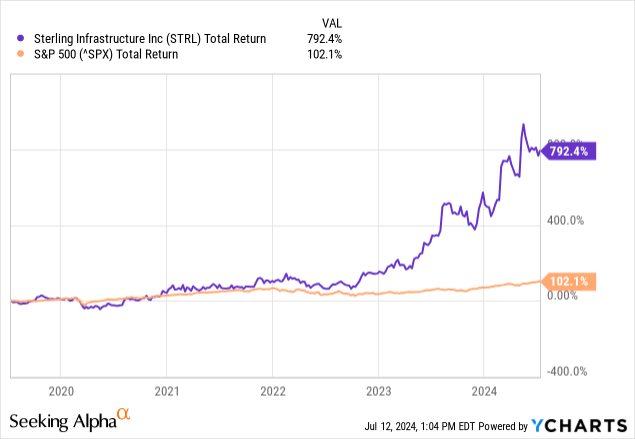

Shares of Sterling Infrastructure have been on a tear as of late, with the corporate’s shares greater than doubling over the previous twelve months. We are able to see the divergence in complete return in comparison with the S&P500, the place Sterling’s shares began ripping in early 2023. During the last 5 years, the corporate’s shares have delivered a complete return of 792%, in comparison with the S&P 500’s return of 102%.

Whereas a valuation re-rating actually performed a big position on this, as e-infrastructure for information facilities (with the emergence of AI) have develop into more and more within the highlight for traders. Nevertheless, Sterling Infrastructure has continued to ship spectacular returns for shareholders, rising each the highest and backside line.

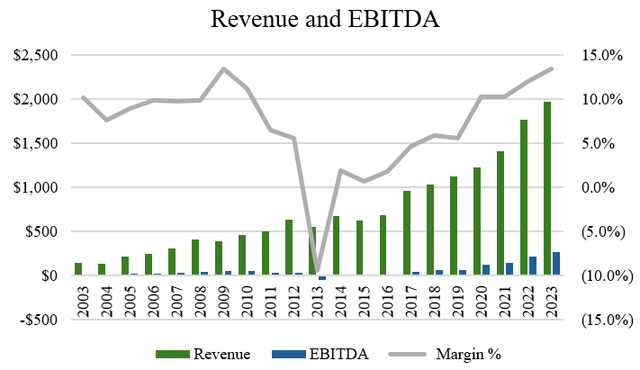

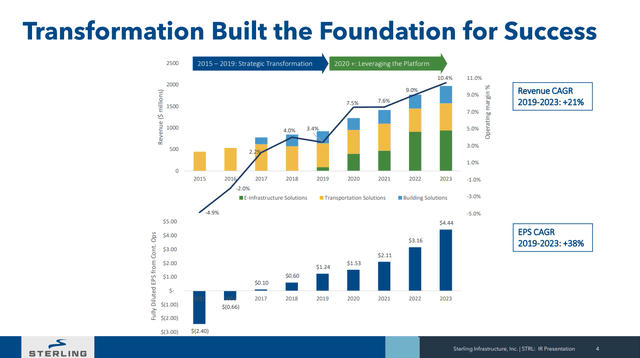

Bettering Profitability

During the last twenty years, the corporate has delivered CAGRs in income and EBITDA of 13.8% and 15.4%. Extra just lately, within the final 5 years, the corporate has compounding revenues and EBITDA at 13.7% and 33.9%, respectively (supply: S&P Capital IQ). Clearly, Sterling Infrastructure is an organization whose development charges aren’t slowing down, as evidenced by double-digit prime line development which interprets to the underside line with some margin growth.

Creator, primarily based on information from S&P Capital IQ

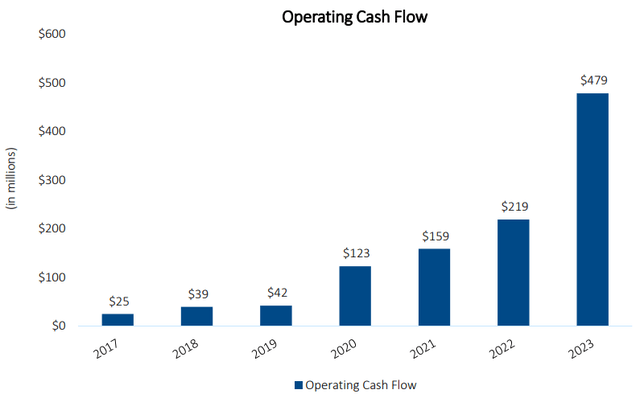

Sterling Infrastructure’s monetary efficiency (income and EBITDA development) has a big impact on free money move conversion as effectively. As illustrated by the chart under, the corporate’s working money move has been almost doubling each 2 years, offering flexibility in addition to capital for development investments.

Investor Presentation

Progress Alternatives

So what’s been driving this development? One of many largest causes is the corporate’s e-infrastructure development. Whereas this makes up almost half of the corporate’s revenues as we speak, this wasn’t at all times the case. As illustrated under, the e-infrastructure enterprise actually solely received began in 2019, and since then, it is seen large success post-pandemic.

Investor Presentation

Once we have a look at the good infrastructure market, the runway for development is very large. As a $187 billion market, the market globally is poised to develop at a 23.1% CAGR to simply underneath $1 trillion by 2032. Most of this development was triggered out of the pandemic, the place international lockdowns precipitated disruption to manufacturing and networks, highlighting the necessity for e-infrastructure to be strong. Throughout the AI vertical alone, a expertise that has seen enormous development in development at an 18.5% CAGR.

In my opinion, the spending from blue-chip corporations goes to be large Only a few months in the past in Could, Microsoft (MSFT) signed a cope with Brookfield (BN:CA), one of many world’s largest infrastructure traders, to produce 10.5 gigawatts of renewable energy capability between 2026 and 2030. This was an vital deal for Microsoft as a result of the deal will assist it meet AI demand in addition to meet its emission commitments on ESG.

As the biggest deal of its sort (virtually 8x bigger than the biggest single company PPA ever signed), I might count on extra investments like this one. Whereas Microsoft and different blue chips corporations prepared the ground for now, I might additionally count on mid-sized corporations to begin investing in e-infrastructure as effectively.

Firms like Sterling Infrastructure are virtually actually going to profit from this pattern. Notably given their robust popularity within the business working with different blue-chip corporations and the truth that present capability in information facilities solely represents a small fraction of what’s wanted to assist synthetic intelligence and different rising applied sciences.

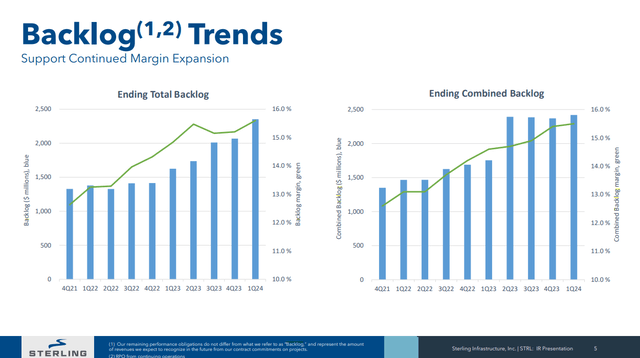

Once we have a look at the corporate’s backlog of tasks, administration believes that the rising backlog ought to assist the corporate’s future plans in addition to margin growth over time. On the finish of the newest quarter, regardless of a small 10% income decline within the quarter, the corporate’s infrastructure awards totaled $332 million, for a backlog of 961 million, a 32% enhance in comparison with Q1’23.

As for the combination of the backlog development, administration commented that information facilities had been once more the biggest contributor to awards development as prospects are feeling extra snug constructing out their AI and expertise infrastructure developments. To this point, information facilities at the moment are about 40% of the e-infrastructure backlog, highlighting simply how vital this development is.

Investor Presentation

When it comes to the outlook, administration is guiding for income of $2.125 to $2.215 billion with EBITDA of $285 to $300 million for FY’24. On EPS, administration is guiding for earnings per share of between $5.00 and $5.15 for 2024, indicating that they see margins persevering with to develop from right here together with extra awarded contracts. Given the backlog, these targets needs to be achievable for the 12 months, in my opinion.

Sturdy Capital Allocation Framework

One more reason to love Sterling Infrastructure is for its robust capital allocation framework. Whereas the corporate does not pay a dividend, the corporate invests closely into natural development initiatives, M&A, in addition to buybacks. Of the corporate’s capex, most of its investments are tilted in direction of the e-infrastructure enterprise, an space the corporate has been investing in in order that it may higher meet the demand from AI within the years to come back.

Along with M&A, Sterling Infrastructure targets tuck-in and bolt-on acquisitions, notably small and mid-sized offers the place an acquired firm would add new prospects or complement the present service choices. With respect to M&A, on the earnings name, administration commented on the varieties of offers they’re on the lookout for:

Yeah. We’re. We’ve seen a number of, we’re taking a look at a number of. One of many core issues for us is we’re very choosy. We wish actually good companies with actually good people who we predict we are able to double over a five-year or six-year interval. So it’s getting that proper match and that proper alternative put collectively. However they’re on the market, sure. And so they’re of varied sizes.

Clearly, administration could be very targeted on discovering offers with the appropriate match and never simply doing offers for the sake of development. In different investor supplies, the corporate has additionally signaled that they’ve a desire for doing margin-accretive offers with end-markets which might be engaging. Paying a good worth and discovering the appropriate match means a excessive hurdle price for the corporate, however that is what you wish to see in M&A, on condition that it reduces the chance of integration of a deal being dilutive with insufficient synergy potential.

On the subject of share repurchases, administration is taking an opportunistic method to purchasing again shares. In 2023, the corporate repurchased $9.6 million and the 12 months earlier than it bought $9.4 million price of shares (supply: S&P Capital IQ). Provided that shares have run up so much currently, I do not count on administration to be aggressive in shopping for again shares as the corporate’s shares aren’t precisely low cost neither is it possible an ideal place to allocate capital. As such, even with a $200 million authorization underneath the share repurchase program, I do not foresee important buybacks being a serious a part of the corporate’s capital allocation framework.

From a stability sheet perspective, the corporate has a little bit of debt, which incorporates $337 million in time period mortgage borrowings. It additionally has a $75 million revolving credit score facility, which is at present undrawn. With money of $480 million at quarter finish, money exceeds complete debt. Scheduled time period mortgage debt repayments are for $26.3 million in 2024, $26.3 million in 2025, and $6.6 million in 2026. With an EBITDA Debt Protection Ratio of 1.1x, the corporate has minimal leverage, however is snug taking that to 2.5x, ought to alternatives current themselves.

Valuation and Wrap Up

At present, there’s just one sellside analyst who covers Sterling Infrastructure. He has a worth goal of $130.00, which suggests about 6.4% upside from the present worth. Given the maintain ranking and restricted upside potential, shares of Sterling are possible pretty valued.

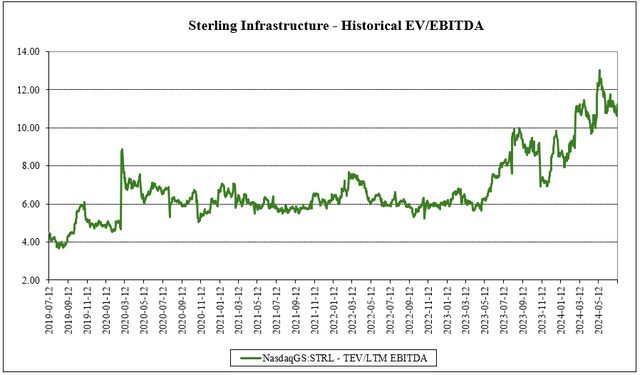

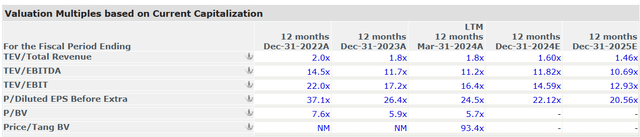

I’d disagree with the analyst right here. Once we have a look at the historic EV/EBITDA a number of, it is clear that the corporate would possibly look costly at 11.2x EV/EBITDA, a close to doubling of the place it was buying and selling earlier than 2023 at round 6.0x EV/EBITDA (supply: S&P Capital IQ).

Creator, primarily based on information from S&P Capital IQ

In my opinion, what I believe most have valued to understand about Sterling Infrastructure is that the corporate’s enterprise combine has modified tremendously in simply the final three years. In comparison with 2021, when the e-infrastructure enterprise made up solely 32% of revenues, Sterling’s margins had been vastly inferior at round 10% EBITDA margins (supply: S&P Capital IQ). Given the transition to raised development markets, the shift in enterprise combine to larger margin companies, and the truth that the corporate can possible proceed rising within the mid-teens for the foreseeable future (consistent with the business development price), I do not see why paying 11.2x EV/EBITDA could be costly. When trying on the ahead multiples of the corporate, Sterling Infrastructure appears to be like even cheaper.

S&P Capital IQ

On the subject of the dangers to the funding thesis, the principle ones could be a slowdown in AI spending. Macroeconomic pressures like larger pursuits charges are usually poor for infrastructure spending, as the price of borrowing/ financing makes funding tasks dearer. For e-infrastructure particularly, I am not too apprehensive given that there’s a enormous runway for development with AI having long-term secular tailwinds, which will show to be a number of many years, slightly than just some years. One other threat could be competitors. Extra market entrants into the market would imply that Sterling Infrastructure would wish to sacrifice worth so as to win enterprise, probably offering a headwind to margins. With respect to the corporate’s aggressive benefit, CEO Joseph Cutillo had this to say on the corporate’s This fall’23 earnings name:

Our aggressive benefit is basically, once more on the finish of the day, I have a look at us as an insurance coverage coverage, and the larger the challenge, the higher the coverage, and our potential to get very massive difficult web site growth finished in a really brief time period for our prospects. As you possibly can think about, if our challenge, which was a giant challenge, could be $100 million, as an instance that is a part of a $2.5 billion to $3.5 billion challenge.

And if we are saying, we’ll get it finished in six months and we’re two weeks late, that challenge will likely be six months to eight months late on the again finish with the domino impact or snowball impact of the trades. And the price of capital on the remainder of that, and the lack of income and profitability related to incremental six months is a really, very small worth to pay a slight premium to us over the remainder to make sure that they get it.

Given the corporate’s measurement and scale, I believe this is not a threat to be too involved with. My estimation is that given the excessive calls for of shoppers (notably advanced blue chip tasks), prospects would slightly pay extra for a trusted firm like Sterling to work on their tasks for them, finish to finish.

So to summarize, Sterling Infrastructure actually is a picks and shovels firm to the AI business, piggybacking off of the long-term tailwinds of e-infrastructure buildout, notably in information facilities. Over time, the corporate has grown at a good clip with margin growth over time, that ought to proceed because the enterprise combine shifts to extra e-infrastructure. Due to the upper margin and sooner rising end-markets that the corporate is positioned in, I believe the current re-rating within the firm’s valuation is warranted. So regardless of 100%+ rise within the firm’s shares over the past 12 months, I believe it is a firm that has solely now beginning to get found and getting the valuation it deserves. As such, I price the corporate’s shares as a ‘purchase’.