Nirmala Sitharaman, Nirmala, Sitharaman

The subsequent fortnight will likely be a unstable section for the Indian inventory markets as they put together after which digest finance minister Nirmala Sitharaman’s price range proposals for fiscal 2024-25 (FY25).

June quarter company earnings season (Q1-FY25), too, analysts counsel, is prone to see inventory particular strikes and have some bearing on the general market sentiment.

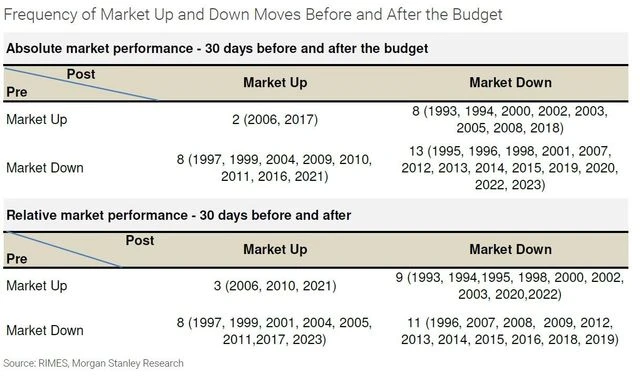

Expectations (as measured by pre-budget fairness market efficiency), wrote analysts at Morgan Stanley in a observe, are essential in figuring out what the market does instantly after the price range. The market, they stated, falls on two of three events within the 30 days publish the price range.

)

Market efficiency round price range

Here’s what main brokerages count on from Nirmala Sitharaman’s Modi 3.0 price range scheduled to be introduced on July 23.

BofA Securities

The Centre could elevate the earnings threshold for zero tax from Rs 3-lakh to Rs 5-lakh within the upcoming price range. Consideration to decrease earnings tax charges for people incomes annual earnings of Rs 10-lakh can also be underway. Provided that the federal government is making an attempt to encourage the taxpayers to undertake the Simplified Tax Regime, a change within the 80C is probably going. There’s additionally a rising demand for the growth of the HRA exemption to incorporate extra non-metro cities.

The upcoming price range may suggest adjustments within the tax therapy of earnings from futures and choices (F&O) segments with an goal to discourage retail participation within the derivatives buying and selling.

Morgan Stanley

Count on the fiscal deficit goal to be retained at 5.1 per cent of GDP in FY25, according to the interim price range. Job creation supported by way of capex, focused social sector spending and concentrate on ‘Viksit Bharat’ plan are prone to be the important thing themes. The price range may additionally give a road-map for a medium-term plan for fiscal consolidation past FY26.

We don’t assume a discount in private earnings tax charges (base case); nevertheless, there are expectations that the federal government may use among the fiscal house to offer tax reduction to center earnings taxpayers.

Brief-term capital features (STCG) tax fee could possibly be raised from 15 per cent. A hike within the efficient long-term capital features (LTCG) tax on equities both through lengthening of the holding interval from 12 months to 2 or three years to qualify for long-term capital, or a rise within the tax fee from 10 per cent to fifteen per cent could possibly be a serious dampener for shares, particularly within the broad market. Neither the market nor we count on this.

Goldman Sachs

Finances will transcend simply fiscal numbers, and sure make an overarching assertion about long-term financial coverage of the federal government in the direction of 2047. Thrust on rural economic system, job creation by way of labor-intensive manufacturing, assist for MSMEs, skilling and top quality companies jobs. A lowered political mandate would require extra political capital to be spent behind passing structural reforms like land reform and farm sector reforms.

Nomura

Motilal Oswal Securities

Whereas tax estimates could not change, record-high RBI dividends may assist the federal government to spend a further quantity of about Rs 1.1 trillion this yr, whereas lowering the fiscal deficit goal to five per cent of GDP in FY25.

First Revealed: Jul 11 2024 | 10:44 AM IST