kupicoo

Funding Thesis

Compass Diversified (NYSE:CODI) is off to an ideal begin in line with its first quarter earnings report, with adjusted EBITDA up 28% YoY. The corporate is well-diversified and has numerous ownerships in progressive but defensive companies with precious manufacturers in my view. Whereas I respect administration’s savvy acquisition observe file, I believe the inventory continues to be pretty priced and unlikely to outperform the S&P 500. If buyers need secure earnings with low volatility, nonetheless, Compass Diversified could provide a greater various to index funds as it should seemingly provide a smoother experience than the S&P 500. In the long run, nonetheless, I believe Compass Diversified as this value level is not going to outperform the broader market so I give the inventory a maintain score as we speak.

Firm Overview

Compass Diversified “is a publicly-traded holding firm that gives shareholders with distinctive entry to middle-market companies – a sexy section of the market traditionally reserved for personal fairness or different legacy gamers” in line with its web site. They aim smaller companies that earn a sexy return on capital with extremely precious manufacturers and a robust buyer base.

The corporate has a profitable observe file of making worth, as they’ve targeted on defensive corporations that may climate financial storms and carry out effectively throughout cyclical lows within the financial system. Their portfolio of corporations will be categorized into two segments: branded client companies and industrial companies.

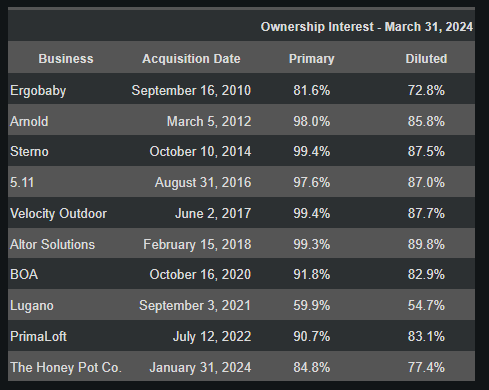

In line with the annual report, as of March 31, 2024, they personal the next companies:

Annual Report (Searching for Alpha)

Traders can see that the portfolio is fairly targeting client branded merchandise akin to attire, meals warming merchandise, high-end jewellery, and different companies. My evaluation of those portfolio corporations is that usually they’re client oriented and might cross on the price of inflation to their prospects fairly simply. Moreover, they’re comparatively defensive in nature to me and thus have monetary efficiency that’s sometimes not cyclical.

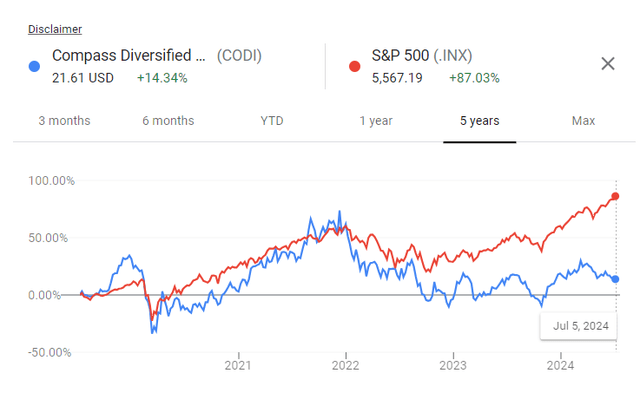

Administration’s observe file is sort of good, however total has not overwhelmed the S&P 500 when it comes to worth creation. Over the previous 5 years, the S&P 500 has elevated 87% compared to CODI’s 14%, each excluding dividends. What this implies to me is that administration has targeted on extra defensive names revolving round client manufacturers, whereas the S&P 500 has very high-flying tech names which have greater market potential and higher revenue margins.

Google Finance

Thus, because of CODI’s lack of expertise publicity, it appears to me it’s a higher defensive play, whereas the S&P 500 is extra of an aggressive, offensive play for risk-tolerant buyers. I believe administration has finished one of the best they will, however since they solely concentrate on these client manufacturers, they will solely go to this point when it comes to worth creation. My conclusion is that it is a good defensive choose that can do a superb job in preserving buyers’ capital, however unlikely to develop it considerably.

Lugano In The Highlight

CODI reported earnings on Could 1, 2024, with the next outcomes,

Internet gross sales up 8% to $524.3 million and up 4% on a professional forma foundation. Branded Shopper internet gross sales up 11% on a professional forma foundation to $375.4 million. Industrial internet gross sales down 10% to $159.6 million.

Whereas their industrial companies could also be affected by the general macroeconomic financial system extra, the branded client companies proceed to carry up the monetary efficiency. General, the primary quarter earnings revealed important development and momentum for a lot of of their portfolio companies, demonstrating the facility of these client manufacturers administration talks about persistently.

The large winner within the first quarter was the corporate Lugano, which had a 61% enhance in internet gross sales. Bought for $256 million on September 2021, this high-end producer and designer of knickknack has given shareholders important worth since its acquisition. I’m awfully stunned {that a} jewellery firm can have gross sales rise by a lot, as most buyers would assume tech names are those rising that quickly.

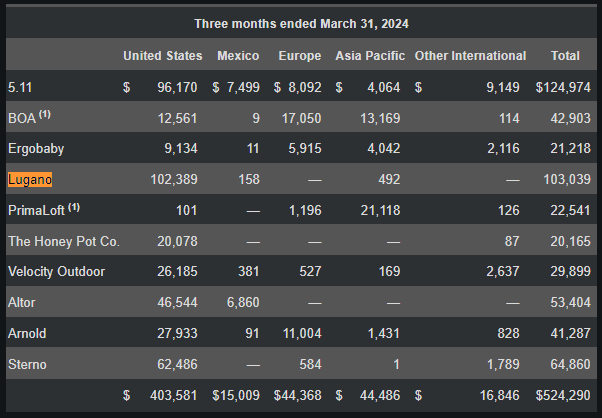

After digging into the 10-Q, I discovered that Lugano nonetheless truly has room for development internationally. The ten-Q reveals that gross sales went from $63 million in Q1 2023 to $102 million in Q1 2024, however most of it was in the USA. Traders can even see that revenues are starting to point out up for Lugano in Mexico and Asia Pacific, which indicators to me that administration is starting to drive Lugano abroad and constructed a world acknowledged model in jewellery.

10-Q

Due to this fact, I consider that corporations akin to Lugano and different names CODI has of their portfolio can nonetheless develop their gross sales internationally. Moreover, I’m very impressed that their client branded merchandise have strong development even throughout an inflationary setting, which leads me to consider their merchandise have good pricing energy and buyer loyalty. Finally, it appears like the primary quarter earnings reveal that their companies are inflation-resistant, defensive growers, and have potential for development abroad.

Leaning Into Healthcare

Lately, CODI acquired a major stake within the Honey Pot Co. for $380 million. My tackle this current purchase is that administration appears to be leaning into the healthcare section for extra traction and diversification of their enterprise. Honey Pot is a number one feminine-care model that focuses on making well being merchandise with plant-based components.

It appears to me that administration is seeking to purchase extra companies which might be doing self-care, well being, and wellness merchandise, which to me makes the enterprise extra diversified and defensive. In line with the 10-Q doc, administration explains,

We lately introduced the launch of our healthcare effort as our third grouping of corporations. We consider healthcare has a number of enticing, high-growth segments with robust trade tailwinds, is an acyclical vertical that we anticipate will deliver diversification and stability to the present group of corporations, and has robust alignment with the Firm’s present subsidiary priorities.

I like this focus and assume it matches effectively to administration’s technique of non-cyclical, defensive, and branded companies. Particularly, I believe house healthcare is interesting as a result of manufacturers can create belief and loyalty simply, individuals are keen to pay as much as shield their well being, and it’s unlikely to be simply disrupted by AI or technological traits in my opinion. One report demonstrates the worth alternative for house healthcare,

The house well being and residential care industries are poised for important development in 2024. In actual fact, the house well being care trade within the U.S. is anticipated to develop from $94 billion in 2022 to $153 billion by 2029.

Going ahead, I anticipate administration to lean in additional into healthcare, which is seeing enticing tailwinds as we speak. This Honey Pot Co. acquisition is the primary of many seemingly coming acquisitions which might be focused in direction of defending folks’s well-being. With the surge in healthcare prices lately, individuals are searching for extra reasonably priced methods to deal with themselves, and I believe high-quality healthcare merchandise that target prevention slightly than the treatment are prone to promote effectively in as we speak’s financial system. Consequently, buyers ought to anticipate extra investments on this rising sector that syncs effectively with administration’s defensive funding technique.

Valuation – Pretty Valued At $20

I shall be utilizing administration’s personal steering of adjusted earnings to do my valuation evaluation. In line with administration’s outlook within the earnings press launch,

As well as, the Firm is elevating its Adjusted Earnings steering and now expects to earn between $148 million and $163 million ($145-$160 million beforehand) (see “Notice Concerning Use of Non-GAAP Monetary Measures” beneath) for the complete 12 months 2024.

Taking a midpoint of $150 million, I apply a good earnings a number of of 10x, which is across the sector median to get a market cap of $1.5 billion. Divide by shares excellent of 75 million will get me $20 honest worth per share. Traders can see that the market agrees with my valuation at the moment, and has priced it round $20 per share.

Additionally, buyers can see that the inventory trades at 1.72x e-book worth, which is across the 5Y common of 1.76x. Its dividend yield is fairly honest at 4.63%, which is in-line with the 1-year treasury charge of ~5%, at the moment. It appears to me that the inventory is pretty priced, and can seemingly give buyers passable return with decrease volatility.

I am giving the inventory a maintain score as a result of though I just like the defensive companies CODI owns, it would not look like the inventory can create extra worth in comparison with the S&P 500. Traders who’re considering shopping for a defensive portfolio of companies which might be low-volatility, regular earners could like CODI, however others who need extra aggressive development and expertise publicity will not discover that in CODI. Whether or not the inventory is a purchase or not likely depends upon what the investor is searching for, and subsequently I charge the shares as a maintain to account for this private issue.

Dangers

Non-public fairness largely depends upon administration competence and acquisitions driving worth. If administration all of the sudden fails to create worth by specializing in value, money flows, and aggressive benefits stemming from manufacturers, the corporate could lose worth over time. Traders are betting on administration capabilities as a result of capital allocation will drive a lot of the shareholder worth right here.

Manufacturers can lose favor over time. The whims and needs of the buyer is probably the most troublesome factor to foretell, as fads and traits can put manufacturers out and in of trend. Given that the majority of those companies are depending on manufacturers, it is necessary that administration picks the suitable manufacturers to spend money on or acquisitions could face impairment costs.

Competitors is fierce for a lot of of CODI’s companies and will restrict the expansion potential of CODI. In the long run, I really feel that expertise oriented companies that the S&P 500 owns could also be quicker growers in comparison with CODI, which is another excuse I am skeptical if CODI can outperform the index.

Maintain Compass Diversified

Typically a inventory generally is a purchase for one investor, and a maintain for an additional. For a younger, risk-tolerant investor with a long-time horizon, I believe CODI is not sensible as an funding, as she or he is prone to do higher in an index fund. However, for an older investor who’s searching for security, yield, and defensive names CODI may very well be a good selection to purchase as we speak. The underside line, nonetheless, is that I don’t assume CODI can outperform the S&P 500 from right here when it comes to complete return, which justifies a maintain score in my opinion.