JHVEPhoto

We lately observed that Moncler’s inventory value (OTCPK:MONRF) has underperformed the market (Fig 1), and this was due to some sell-side analysts who began chopping the corporate’s goal value. The group has sturdy market positions in outerwear and a top-performing group that has efficiently applied product diversification to cut back seasonality. As a reminder, Moncler was established in 1952 with a concentrate on winter objects. For that reason, wanting on the previous inventory value efficiency, Moncler has often suffered within the summertime. We also needs to report that Golden Goose postponed its €1.7 billion IPO final Tuesday, blaming dicey market circumstances and EU political uncertainty. This was seen as a chilly bathe from the EU luxurious market. That stated, Golden Goose has a decrease development fee and the next debt than Moncler.

Right here on the Lab, we imagine that is not related. We anticipate Moncler shall be resistant to the general sector slowdown. Nonetheless, contemplating a physiological slowdown in turnover in Q2, the corporate stays our favourite inventory throughout the sector. That is primarily based on 1) a supportive fairness story, 2) spectacular margins, 3) a powerful model place, significantly with Chinese language prospects, and 4) development drivers attributable to tourism publicity.

Mare Ev. Lab Ranking Replace

Fig 1

Why are we nonetheless constructive?

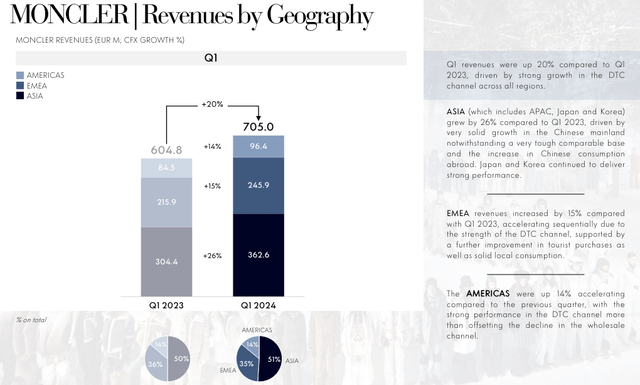

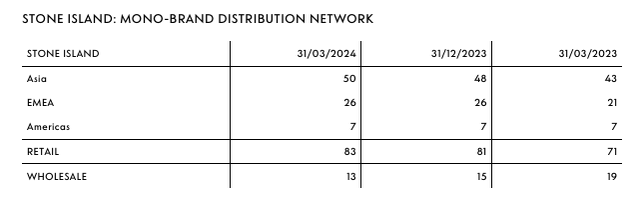

(Stable outcomes forward). Firstly, Moncler is among the few luxurious firms with a retail enlargement technique and the internalization of a direct e-commerce enterprise. Even when we assume a weaker retailer visitors impression, we count on the corporate to report a Q2 with gross sales at +6% on the model degree. This follows a +20% in Q1 2024. In the course of the analyst name, Moncler’s prime administration famous a extra normalized gross sales development with sturdy model momentum in April. In keeping with the most recent rumors, the EU luxurious firms have began making use of unprecedented reductions to the Asian market, specializing in re-gaining Chinese language clientele. Wanting on the press launch, the Kering group determined to low cost objects by a mean of 40%; this technique was adopted by different manufacturers resembling Capri Holding (Versace) and Burberry. This would possibly replicate a rising concern about unsold merchandise and a unfavorable signal that Chinese language shoppers are chopping again on luxurious bills. In our Moncler numbers, we anticipated APAC development up by 6% at fixed FX in comparison with a +26% achieved in Q1 2023, pushed by substantial development in China. Except for the APAC forecast, Moncler is ready to develop by a single digit in all areas, with a plus 3% in America and a plus 7% within the EMEA area; (Transitions in direction of an all-year-round model). Nonetheless associated to gross sales development, we already account for a unfavorable perfomance by Stone Island. Our numbers present a 5% top-line gross sales decline in Q2, reflecting lower-than-expected improvement of retail publicity and wholesale rationalization (Fig 3). Given a decrease model notion, Stone Island may also undergo a weaker macro surroundings. As a reminder, Moncler introduced Stone Island’s acquisition in December 2020, and we nonetheless see a possible turnaround story on gross sales and profitability due to an ongoing model transformation. With Milan’s males’s trend launch, the trade is targeted on new trend proposals. There shall be a return of content material and improvements, and Stone Island would possibly see help in quantity acceleration. Right here on the Lab, we’re not a trend knowledgeable; nonetheless, Stone Island will use leather-based organza and rubberized satin for a brand new city assortment. This cloth includes an ultra-thin layer of leather-based coupled with a super-light polyester, which supplies energy and a crispy end. Returning to the general group efficiency, Q2 gross sales historically symbolize lower than 15% of the group’s annual turnover and round 10% of revenue. Due to this fact, Q2 shouldn’t be indicative of the model’s enchantment. Alternatively, our group now sees Moncler as an all-year model, and Stone Island, with the brand new partnership, is a constructive affirmation of this technique; (Margin development in H1). In comparison with the sell-side common, we nonetheless see room for margin enchancment in H1. After an impressive Q1, Moncler will possible obtain working revenue margin development. That is primarily based on a good phasing of upper pricing and associated working leverage.

Moncler GEO gross sales replace

Supply: Moncler Q1 outcomes presentation – Fig 2

Stone Island Retailer Evolution

Supply: Moncler Q1 press launch – Fig 3

Earnings modifications and valuation

In our earlier estimates, we anticipated a mid-single digit value enhance in H1 whereas a extra muted development in H2. Q1 gross sales outcomes absolutely confirmed our monetary forecast, and contemplating the Q2 account (the smaller quarter for Moncler), we determined to have a wait-and-see strategy. We’re already above Wall Avenue estimates in our financials estimates. We arrived at 2024 gross sales of €3.22 billion, and attributable to the next CAPEX plan, we now have a decrease EBIT margin than 2023. That stated, Moncler is cash-positive, with a 30% core working revenue margin. On the underside line, we arrive at a web revenue of €632 million with an EPS of €2.41.

Wanting on the luxurious sector, the index trades at a 58% premium in comparison with the MSCI Europe. That is beneath the five-year common of 79%. Due to this fact, the trade stays structurally enticing. That stated, EPS development momentum issues, so Moncler’s valuation has room for development. In our view, the corporate is undervalued on a 12-month forward-thinking valuation; given the truth that we anticipate double-digit EPS development till 2026. The corporate has misplaced its premium valuation in comparison with the trade. In the meanwhile, Moncler trades at 24x P/E. friends resembling Ferragamo, Cuccinelli, and Prada, we arrive at a normalized P/E of 30x. This helps a purchase ranking of €73 per share. Due to this fact, we preserve our chubby ranking as we predict 1) Moncler may outperform the sector this 12 months, 2) execution interprets into stable earnings, and three) Stone Island’s profitable wholesale-to-retail transition will result in revenue development.

Dangers

Draw back dangers to Moncler embody FX modifications given the corporate’s worldwide publicity (65% of gross sales are exterior the Euro space), 2) pricing stress from competitors, 3) decrease model worth, 4) decrease notion in fairness markets about long-term luxurious development, 5) a slowdown in quantity, 6) increased duties on luxurious items, and 6) exterior influences on consumption. Associated to the final level, as reported by a number of information sources, the Chinese language authorities launched a brand new marketing campaign on wealth-flaunting influencers. This goals to cut back the showcase of “a lavish life-style constructed on wealth” on social media platforms. This information bans influencers from overly exhibiting off their luxurious items purchases. At present, we can’t estimate the P&L repercussions, however this may possible impression client sentiment, which has already been subdued.

Conclusion

Put up Q1 outcomes, though the standard debate across the firm’s enterprise seasonality on near-term investor sentiment, these outcomes are, to some extent, already weighing on the present share value. Right here on the Lab, we imagine Moncler will outgrow its sector friends with the Spring/Summer time assortment, which now represents roughly 25% of the entire firm’s gross sales. There are further upsides that Moncler would possibly capitalize on, and because of this, we’re sustaining a purchase ranking standing.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.