PavloBaliukh/iStock through Getty Photos

Titan Worldwide (NYSE:TWI) is a number one producer of specialty tires, similar to for agricultural gear, and different industries like forestry, mining, development and even ATV’s. It sells tires beneath numerous model names together with: Titan, Goodyear Farm Tires, and LSW. The farming and different sectors this firm serves has been impacted by the massive improve in rates of interest over the previous couple of years and different components. Excessive charges impression the power and need for farmers to purchase new tractors and different main gadgets, and it can also result in a slower substitute cycle for tires on current gear. All of those considerations have pushed the inventory decrease, so I assumed it could be a really perfect time to take a more in-depth look:

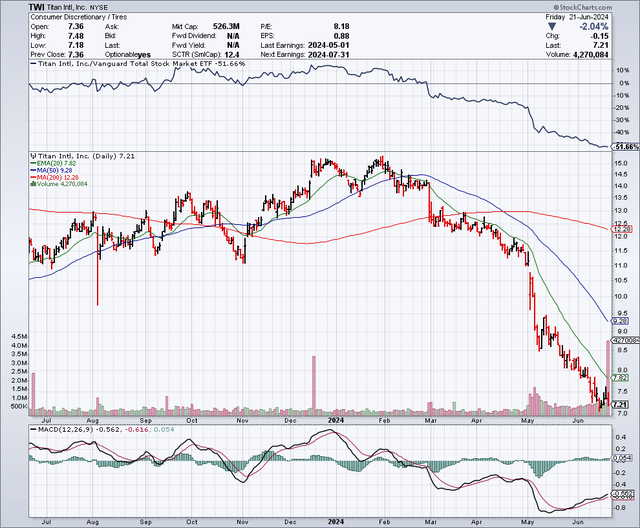

The Chart

As proven on the chart under, this inventory was buying and selling for almost $15 at the beginning of 2024, but it surely has since been lower in half and now trades within the $7 vary. These shares at the moment are deeply oversold, with the 50-day transferring common at $9.28 and the 200-day transferring common at $12.28. It looks like this inventory could possibly be due for a rebound within the brief time period.

StockCharts.com

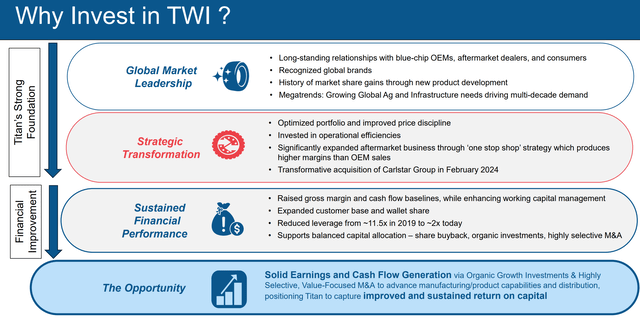

Titan Has Made A Quantity Of Strategic Strikes That Might Be Recreation Changers Going Ahead

As proven under, Titan has made a variety of strategic strikes up to now yr or so with the intention to place the corporate for a lot stronger outcomes sooner or later. These strikes embrace lowering debt and the acquisition of Carlstar in February 2024, which provides the corporate a wider vary of choices for its prospects. Carlstar affords specialty tires and wheels to industries similar to agriculture, in addition to choose area of interest markets similar to all terrain autos, trailers, forklifts and extra. This firm seems to be an important match with Titan and I imagine there might be quite a few advantages from this acquisition, though it’s going to seemingly take a number of quarters to totally implement any value and advertising synergies.

Titan-intl.com

Earnings Estimates And The Stability Sheet

Analysts count on Titan to earn $0.91 per share in 2024, with revenues coming in at $2.05 billion. Revenues are anticipated to rise greater than 8% to $2.22 billion, with earnings anticipated at $1.10 per share. This places the worth to earnings ratio at nearly 8 instances for 2024, and fewer than 7 instances for 2025. That is an exceptionally low valuation, particularly when you think about that the common value to earnings ratio for the S&P 500 Index (SPY) is properly over 20. This valuation can be low contemplating that revenues are anticipated to develop by greater than 8% and earnings are anticipated to develop almost 21% yr over yr when evaluating 2024 income estimates to 2025.

As for the stability sheet, Titan has $683.5 million in debt and round $203.63 million in money. This stability sheet appears cheap to me, and according to an organization with over $2 billion in annual revenues.

The Points Going through The Agricultural Trade Is Impacting Many Corporations

Whereas it’s straightforward to be dismissive of a small firm that’s at the moment going through challenges, it would not make sense to take action when the complete business is being impacted. Even the heavy-weights on this enterprise are going through the pressures of excessive rates of interest and likewise seeing share value declines. This consists of the likes of Deere & Co (DE) which is buying and selling properly under its 52-week excessive. A lot of this has to do with the truth that the agricultural enterprise is cyclical and this cyclicality tends to tug all of the business gamers up and down relying the place we’re within the cycle.

Within the Q1 2024 earnings name transcript, administration recommended that the business is on the cyclical trough and that issues would possibly enhance considerably when the uncertainty of the U.S. Presidential election is over and when the Federal Reserve decrease rates of interest. In response to the USDA, farm sector incomes hit document highs in 2022, and are anticipated to say no by about 27% in 2024 from 2023 ranges. That is prompted partly, due to decrease authorities funds to the farm business and decrease ag costs. That is clearly having a huge impact on the business, however the excellent news is that (as proven within the chart under), farm incomes at the moment are again down close to ranges the place the underside has usually been discovered earlier than. Moreover, I imagine an upcycle in new gear purchases and tire replacements is only a matter of time since gear and tires do not final endlessly.

USDA Financial Analysis Service

Potential Upside Catalysts For Titan

The Federal Reserve is anticipated to decrease rates of interest later this yr and in keeping with their very own forecasts, charges could possibly be poised to say no by means of 2026. This could be very constructive for the agricultural gear business as decrease rates of interest would scale back financing prices and increase income for farmers.

Titan’s current acquisition of Carlstar seems to be a superb strategic transfer and one that might result in stronger monetary outcomes sooner or later. Administration mentioned a number of the anticipated advantages within the Q1 2024 earnings name transcript which acknowledged:

“Carlstar brings to us a one-stop store that diversifies our buyer base with a superb stability between OEM and aftermarket. So utilizing that as a foundation together with our current monetary efficiency of Titan and Carlstar, we have mentioned with our Board that the mixed firms in a typical yr would have earnings energy of $250 million to $300 million of adjusted EBITDA that additionally would produce free money move of not less than $125 million.”

Potential Draw back Dangers

Commerce points similar to import bans and tariffs between international locations can have a huge impact on the agricultural sector, which might create potential draw back. Climate can be a possible draw back danger as a result of broken or low-yielding crops can negatively impression farm income and trigger budgets for gear and tires to decrease. A discount in authorities spending and subsidies on farm packages might negatively impression this sector.

If the Federal Reserve retains charges larger for longer, this might additional dampen demand for farm gear and tires. As well as, if charges are saved too excessive for too lengthy, the financial system might sink right into a recession and put extra stress on farmers.

As well as, it is value noting that this inventory has plunged to very low ranges throughout instances of precise or perceived financial misery. For instance, Titan shares dropped to about $1, throughout the Covid inventory market correction. That was an important shopping for alternative and the inventory ended up buying and selling to round $20 nearly 18 months later. Nevertheless, it exhibits volatility danger and that this inventory can go manner under a seemingly cheap stage, and for that cause, I might not purchase a big place.

In Abstract

I feel the current selloff in Titan shares is overdone and that this can be a shopping for alternative for a small starter place within the inventory. I see no elementary cause for the inventory to be down about 50% from the place it traded earlier this yr. Nevertheless, I’m involved that the Federal Reserve could have already waited too lengthy to chop charges and this might result in a recession. If there’s a recession, I imagine this inventory might go decrease, so I feel it is smart to solely purchase a small place for every now and then maybe preserve some funds prepared for what could possibly be a a lot larger shopping for alternative. If the Federal Reserve cuts charges and pulls off a comfortable touchdown, this inventory might rebound quickly together with the complete agricultural sector. For that cause and due to a budget valuation, I felt I had to purchase some shares now.

No ensures or representations are made. Hawkinvest isn’t a registered funding advisor and doesn’t present particular funding recommendation. The knowledge is for informational functions solely. You must at all times seek the advice of a monetary advisor.