Up to date on June twentieth, 2024 by Bob Ciura

Excessive-yield shares pay out dividends which are considerably in extra of market common dividends. For instance, the S&P 500’s present yield is barely ~1.3%.

Excessive-yield shares could be very useful to shore up revenue after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 month-to-month in dividends.

B&G is a part of our ‘Excessive Dividend 50’ sequence, the place we cowl the 50 highest yielding shares within the Positive Evaluation Analysis Database.

We now have created a spreadsheet of shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You may obtain your free full listing of all excessive dividend shares with 5%+ yields (together with essential monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink beneath:

The inventory provides a excessive dividend yield above 9%, however that is as a result of continued decline in share value over the previous a number of years. The corporate additionally lower its dividend by 60% in 2022.

On this article, we’ll analyze the packaged and frozen meals firm B&G Meals (BGS).

Enterprise Overview

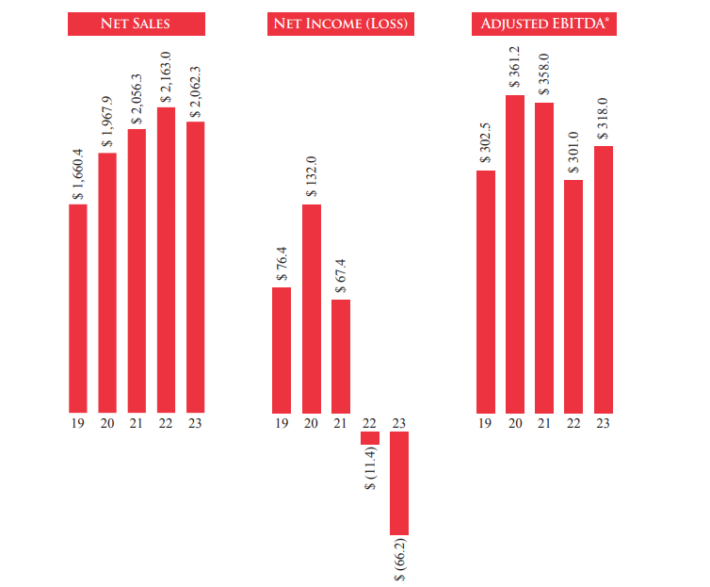

B&G Meals was created within the late Nineties with the preliminary function of buying Bloch & Guggenheimer, who bought pickles, relish, and condiments. Bloch was based in 1889. Final yr, the corporate had simply over $2 billion in gross sales.

Among the firm’s well-known manufacturers embody Inexperienced Large, Ortega, Cream of Wheat, Mrs. Sprint, and Again to Nature, with over 50 manufacturers in whole. The product portfolio focuses on shelf-stable, frozen and snack manufacturers.

B&G Meals reported first-quarter 2024 outcomes on Could eighth, 2024. Quarterly income of $475 million declined 7% year-over-year, due principally to decrease quantity and the divestiture of the Inexperienced Large U.S. shelf-stable product line.

Adjusted earnings-per-share declined 33% year-over-year, to $0.18 per share.

B&G Meals additionally diminished 2024 steerage, and now expects internet gross sales in a spread of $1.955 billion to $1.985 billion (from $1.975 billion to $2.020 billion beforehand), and adjusted EPS between $0.75 to $0.95 (from $0.80 to $1.00 beforehand).

Progress Prospects

B&G Meals has spent the final decade buying meals manufacturers in debt-financed offers, adopted by scaling these companies and elevating product costs over time.

This technique labored for a few years, persevering with by the COVID-19 pandemic, which positively impacted the corporate’s outcomes.

Nonetheless, these constructive impacts light, and outcomes prior to now 5 years point out a deteriorating enterprise. B&G Meals reported internet losses for 2022 and 2023, as a result of excessive working prices and curiosity expense.

Supply: 2023 Annual Report

In response, the corporate is reshaping its model portfolio.

For instance, in November 2023, B&G Meals bought its Inexperienced Large U.S. shelf-stable vegetable product line to Seneca Meals Company, which was the first co-manufacturer of the product line.

The online proceeds used to scale back long-term debt. B&G will proceed to personal Inexperienced Large frozen, Inexperienced Large Canada and the Le Sueur model.

Administration has said it’s accelerating the reshaping of its model portfolio, and should pursue extra divestitures which account for 10% to fifteen% of its present consolidated internet gross sales. For instance, it’s evaluating the divestiture of its Frozen & Vegetable enterprise belongings.

We imagine B&G Meals will generate roughly 7.0% earnings-per-share progress per yr over the following 5 years off this low comparability base.

As of March thirtieth 2024, the corporate had long-term debt of $2.01 billion, up barely from the earlier yr.

Moreover, curiosity expense totaled $37.8 million within the 2024 first quarter, which accounted for roughly 35% of gross revenue within the first quarter.

Aggressive Benefits & Recession Efficiency

B&G Meals has no important aggressive benefits in our opinion. The corporate doesn’t possess a robust moat, has second-tier manufacturers, and should not have the pricing energy they count on given the continuing inflationary challenges.

B&G Meals’ earnings-per-share all through the Nice Recession of 2007-2010 are listed beneath:

2007 earnings-per-share of $0.62

2008 earnings-per-share of $0.27 (56% decline)

2009 earnings-per-share of $0.61 (126% improve)

2010 earnings-per-share of $0.90 (48% improve)

B&G Meals’ earnings-per-share declined considerably in 2008. Nonetheless, the corporate went on to about totally get better by 2009. B&G’s earnings continued to develop as soon as the recession ended.

Nonetheless, as a result of a mixture of weak gross sales, price inflation, and excessive rates of interest, B&G Meals finds itself in a troublesome monetary place. This has led the corporate to chop its dividend and divest varied companies to lift money.

Dividend Evaluation

In 2023, B&G lower its quarterly dividend by 60%. Following the dividend lower, B&G Meals’ ahead annual dividend per share stands at $0.76. B&G has a really excessive yield of 9.1% on the present share value.

We count on B&G to generate adjusted EPS of $0.80 for 2024. At this EPS degree, the dividend payout ratio is anticipated to be 95% for this yr.

B&G Meals’ dividend just isn’t safe, as a result of very excessive dividend payout ratio, together with the careworn stability sheet. In a best-case situation, the corporate can keep its dividend with earnings-per-share progress and profitable divestitures.

Last Ideas

B&G Meals is a secure firm with stable revenues, however the majority of its manufacturers usually are not top-tier, which implies the corporate lacks aggressive benefits.

The corporate’s dividend payout ratio could be very excessive, and is sort of unsustainable. The payout ratio could average if the corporate can efficiently develop its earnings.

Nonetheless, excessive curiosity expense and long-term debt will weigh on earnings, which can be forcing the corporate to unload a few of its manufacturers.

Subsequently, B&G Meals could be a dangerous holding for a dividend progress portfolio at the moment.

In case you are inquisitive about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].