courtneyk

Introduction

The software program business just isn’t at the moment experiencing its finest second. Traders consider that the advantages of synthetic intelligence (“AI”) will both…

Take a very long time to accrue to software program companies, or

Be a internet adverse as a consequence of its disruptive power.

To this, we should add that the spending atmosphere might be higher, main many software program companies to have a considerably difficult earnings season.

Two corporations which have had a superb earnings season regardless of these headwinds had been Adobe Inc. (ADBE) and Intuit Inc. (NASDAQ:INTU). Each corporations managed to beat and lift in the latest quarter, alluding to the mission criticality of their merchandise.

A few weeks in the past, I wrote an article explaining why I used to be including to Adobe, and the objective of this text is to assessment Intuit’s two predominant dangers and perceive whether or not the present valuation is affordable. In case you might be questioning, I consider the 2 predominant “dangers” to Intuit are AI and the Authorities providing free-tax submitting. After all, I write “dangers” in citation marks as a result of I do not assume these are actual dangers. It’s best to perceive why after studying this text.

With out additional ado, let’s begin with AI.

What AI Means to Intuit

I consider that AI is not going to disrupt Intuit and can develop into a big tailwind for the corporate. Two traits of Intuit’s business make human intervention a should, however earlier than outlining these, let me briefly clarify why I consider Intuit would win even when AI had been to develop into the norm.

The primary of those causes is the inaccessibility of the coaching information. Many proliferating LLMs (Massive Language Fashions) do not require concrete coaching information units. Tens of millions of pictures, conversations, and information factors can be found on-line to coach these fashions. The panorama is totally completely different in Intuit’s industries: tax and accounting.

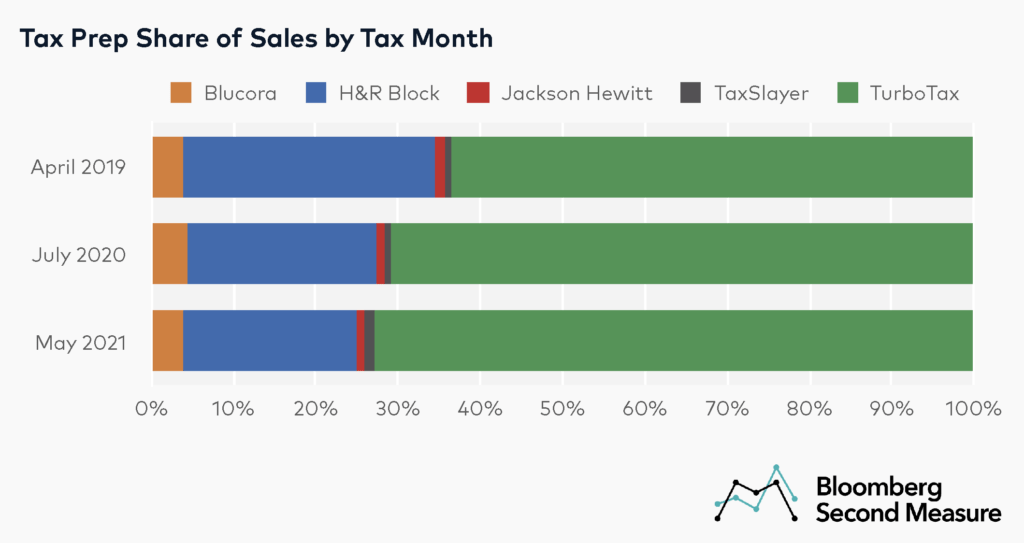

Tax and accounting AI fashions require concrete information units for coaching, with just a few gamers gaining access to this information. For instance, the tax business is at the moment dominated by a handful of gamers, of which Intuit might be the one one with entry to the info and know-how essential to coach an correct AI-based tax mannequin:

Bloomberg

In different instances, information may be readily accessible via the Web, permitting any firm to compete in AI so long as it has the cash and scale required to entry these information units (leaving copyright implications apart). That is very completely different for the tax business. Many of the tax information is confidential and saved by giant gamers akin to Intuit. If an organization needs to recreate an AI-based tax mannequin from scratch to simplify tax submitting, it might solely be capable of practice this mannequin via entry to the prevailing regulation (which frequently requires context) or hypothetical examples, none of which might warrant 100% accuracy.

This makes me consider that if Intuit had been to face competitors from an AI-based tax mannequin, this would wish to come back from a participant with entry to such confidential and particular information. This finally means the competitors should come from throughout the business, the place Intuit is the most important and most technologically superior participant. If AI turns into the norm, I consider Intuit would come out on prime.

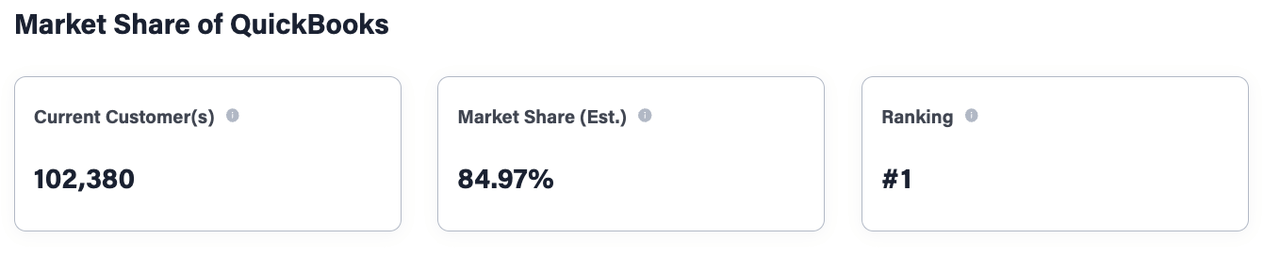

A lot of what I’ve simply mentioned additionally applies to the accounting business. Enterprise information is concrete and confidential. Intuit can also be the most important participant within the US accounting business, giving it a head begin relating to information gathering. In accordance with 6sense, Quickbooks has an 85% market share within the US SMB market:

6sense

Intuit certainly exerts dominance in each the tax and accounting US industries, however the panorama in worldwide markets is completely different. Intuit is a laggard in most worldwide markets in comparison with extra established options. With out native information units, the corporate will almost definitely have bother beating the incumbents if AI turns into the norm. That is additionally an vital attribute of those markets. ChatGPT or Dall-E are inherently international, whereas tax and accounting are inherently native as a consequence of diverging rules. This makes information units much more particular, and whereas worldwide scalability is a problem, Intuit will most absolutely be shielded from worldwide rivals keen to disrupt its home market.

This regulation just isn’t solely native, however continually altering. Politicians all the time wish to depart their mark, even when it would not make sense. They’ll enact new guidelines and rules yearly, making AI-based tax and accounting fashions extraordinarily dynamic. What the mannequin realized the yr earlier than may be outdated for this yr’s tax season. Because of this having one-time entry to the info just isn’t sufficient; an AI mannequin will need to have fixed entry to this information to adapt when adjustments are made to the regulation.

For all the explanations above, I consider Intuit would emerge as a winner if “AI-only” providers grew to become the norm. This stated, I do not assume AI will utterly substitute people neither in accounting nor tax, though it’d develop into a related complement. Let me clarify why.

The obstacles to “AI-only” tax and accounting industries

There are, in my view, two predominant obstacles to AI-only tax and accounting industries: belief and the very fact these merchandise are an “reasonably priced luxurious.”

Belief is what makes the context between Adobe and Intuit markedly completely different. In Adobe’s case, a non-accurate picture is not going to result in a pricey mistake. One can mainly edit the output of the mannequin or give the mannequin one other textual content immediate to finish up with a better outcome to what they had been searching for. This isn’t the case for both accounting or tax. Inaccurate data in these two industries can result in pricey outcomes. For instance, an incorrect tax submitting can result in fines or delayed tax refunds, which is the most important paycheck of the yr for many individuals.

Because of this clients in these industries will put quite a lot of significance on 100% accuracy and can worth belief above all else. Belief is often generated with one other particular person, not a machine, so I believe human-to-human interplay will all the time be essential to create this belief within the tax and accounting industries. Additionally, tax and accounting require context, and each state of affairs is extremely personalised, so explaining this example to an AI mannequin can be a barrier. The identical regulation will be interpreted in a different way for 2 filers, so entry to tax and accounting rules may not be sufficient.

To belief is the #1 requirement for purchasers, we should add that these providers sometimes represent “reasonably priced luxuries.” The rationale is that if we calculate how a lot we spend on tax submitting or accounting (SMB homeowners), we might almost definitely observe that it satisfies a number of traits:

It constitutes a low portion of our complete finances.

It is mission-critical.

We won’t do it on our personal.

This, in my view, makes these merchandise price-insensitive and thus much less possible to be disrupted by AI. Notice, for instance, that TurboTax permits clients to outsource this process totally to an knowledgeable for as little as $219. That $219 is a yearly one-time cost that ensures you do your taxes appropriately and that you may clarify your state of affairs absolutely to an knowledgeable. I believe these traits pose a robust barrier for AI to meaningfully worsen the business’s economics.

For the explanations mentioned above, I do not consider AI poses a possible threat for Intuit. The query is…

Will it profit the corporate?

That is a subject for an additional article, however for now, it appears to be positively impacting retention and onboarding, two important variables for any software program enterprise.

Can the federal government disrupt Intuit?

A bit greater than a yr in the past, information surfaced concerning the IRS getting ready a free tax submitting choice to be rolled out within the 2024 tax season. The market didn’t like this information, and Intuit’s inventory initially reacted badly to this data, dropping greater than 5% at one level.

The preliminary response was short-lived, however indicative of the market being concerned about potential competitors for TurboTax from the IRS. This “risk” shouldn’t have taken Intuit shareholders shocked, although. It was one of many dangers I mentioned with subscribers after I revealed my detailed analysis on the corporate:

So the specter of the IRS providing free tax-filing software program is there, however we’re not extraordinarily anxious by this competitors, despite the fact that it is government-funded. Intuit already presents fundamental tax submitting free of charge, and its focus has now shifted to assisted choices. We extremely doubt that the IRS will supply a service that helps US residents pay fewer taxes, it simply would not make sense.

A few years later, I nonetheless stand by these phrases. This stated, now that the “risk” is already right here, I believed it might be a good suggestion to “replace” my ideas.

The shift to assisted choices

Intuit shifted the main focus of TurboTax from DIY to assisted choices way back. Whereas DIY is important in constructing the highest of the funnel, the corporate understood that the true cash is made in assisted choices. These not solely generate extra belief and, subsequently, a greater buyer expertise, but additionally larger ASPs (‘Common Promoting Costs’). Administration almost definitely made this shift as a consequence of fears of DIY competitors and for monetary causes.

The shift is underway and occurring rapidly, which ought to additional scale back the fears of DIY competitors. DIY nonetheless makes up most of TurboTax’s income, however I do not anticipate this to be the case for lengthy. TurboTax Stay is predicted to generate $1.4 billion in income this yr, or round 30% of the corporate’s Client section income, and is considerably outpacing total Client Group progress. The differing focus and progress charges point out the place the business and Intuit’s Client Phase are going. In administration’s phrases:

I imply our future in TurboTax is all TurboTax Stay. And we’re simply at the start of that curve. The penetration may be very small in comparison with what’s doable. And out of the 88 million, greater than 70 million are keen to make use of a platform with experience, and that is what we have now. So the upside and the runway might be 10 years nonetheless forward of us.

Supply: Sasan Goodarzi, Intuit’s CEO, throughout an investor convention.

The query right here is:

Will the federal government be capable of match an assisted providing that lives as much as buyer requirements?

To be sincere, I’m skeptical concerning the IRS’ capacity to do that. There’s quite a lot of forms in any authorities, and I do not assume the IRS can be keen to place the time and money essential to construct this, particularly since there are important conflicts of curiosity (extra on this later).

Because of this the moat is strengthened as TurboTax Stay turns into a extra important a part of Intuit’s shopper section. After all, income progress and resiliency will not be all the story right here; what are this shift’s implications for margin?

Initially, buyers thought assisted choices, as a people-intensive enterprise, can be much less worthwhile than DIY choices, that are purely software program. This reasoning is smart, however Intuit has managed to defy enterprise legal guidelines and has improved its margins regardless of the continued progress in assisted choices. Administration argued this was doable because of AI in routing, so tax consultants might be extra productive.

So, with the shift to assisted choices, Intuit protects income from rivals and supplies a greater service whereas increasing margins concurrently. This shift to assisted is already good safety towards any DIY efforts by the IRS, however I’ll go one step additional and focus on why the personal business can win within the DIY house, too.

The issue just isn’t the software program; it is the complexity

Many consider that TurboTax’s DIY worth proposition resides within the underlying software program, however that is unfaithful. The true worth proposition resides within the simplification of tax legal guidelines. Client-facing tax software program is fairly ineffective if it isn’t coupled with assist to fill within the clean areas. Not everyone seems to be a tax knowledgeable, and contemplating that the Tax Act has hundreds of pages, it is truthful to say that not many individuals shall be keen to undergo it to grasp how they need to file their taxes.

Along with this, legal guidelines are continually altering. If a person had been to decide on to file their taxes, their data may develop into out of date a number of years down the street. Consequently, many tax consultants consider that the atmosphere just isn’t solely going to remain as complicated and dynamic, however that these developments shall be extra pronounced going ahead:

Greater than 40% of tax professionals consider that the tax adjustments will develop into extra complicated and extra frequent.

As mentioned above, one other related variable is belief. Tax submitting is obligatory, and the filers have little to realize however a lot to lose. No person needs to make a mistake submitting their taxes and have the IRS knocking at their entrance door. Not making errors is a problem when merely confronted with clean areas to fill in. Complexity and belief may be liable for a great deal of DIY tax submitting software program utilization, no matter the free and lower-quality choices on the market. Why is the FreeFile program getting such poor traction if the underlying software program is the one consideration?

The FreeFile program with the IRS for federal taxes additionally is not extensively used-it served simply 3% of 100 million taxpayers final yr. The vast majority of electronically filed tax returns had been accomplished by paid preparers, in response to the IRS.

Supply: Barron’s.

What’s going to the IRS do in a different way to realize penetration? It is tough to inform, but when belief and complexity stay important subjects within the tax submitting business, software program is not going to be sufficient to distinguish an providing.

Conflicts of curiosity: Will the federal government show you how to pay much less taxes? What concerning the refund?

One other subject that ought to fear filers who wish to file with the IRS is battle of curiosity. Intuit has no incentive to make you pay essentially the most taxes doable, however the IRS does. Taxes are the federal government’s income, and I nonetheless have to come back throughout an organization that proactively tries to scale back its income base, particularly with a debt downside looming within the background.

Whereas TurboTax will show you how to pay as little taxes as doable (all the time contained in the legislation), the IRS is not going to proactively suggest deductions so you may pay fewer taxes. Because of this even when it is free, the IRS is not going to all the time provide the cash you might be entitled to, which is a price that might be understood as the value of doing enterprise with them. Let me give an instance.

Think about {that a} buyer information with the IRS free of charge however misses deductions or exemptions that might make them eligible for a $500 larger refund. Was that exercise actually free? Nicely, it would not appear so. However, however, if the identical filer had been to make use of TurboTax and get these $500 in the next refund, they need to rationally be able to pay something underneath $500 to make use of TurboTax, as they’d be higher off than utilizing the free possibility.

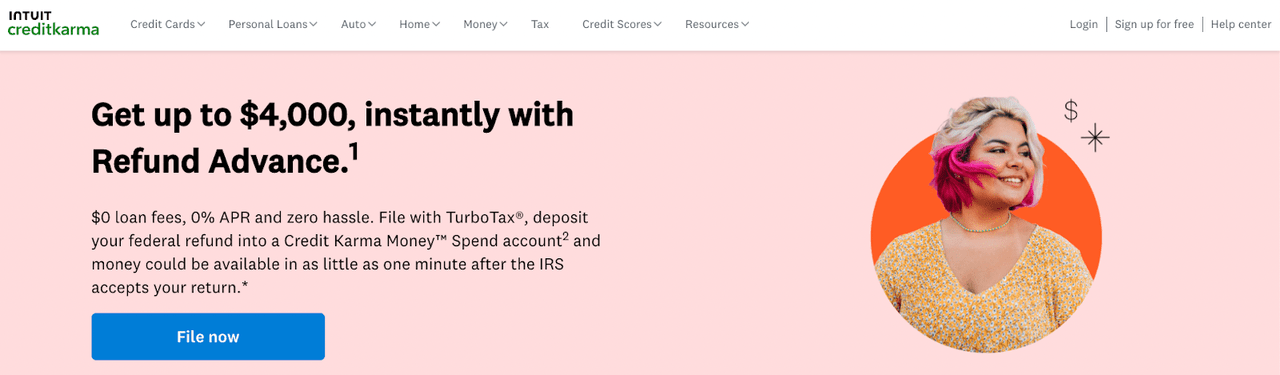

One other subject is the timing of the refund. What’s the IRS’ incentive to offer a taxpayer their refund rapidly? This cash is mainly free financing for the federal government and an amazing supply of adverse working capital. Then again, personal companies akin to Intuit have the other incentive: to offer clients their cash as quickly as doable to enhance their expertise. Intuit is doing this by integrating TurboTax with Credit score Karma Cash, the place clients can obtain their refund as rapidly as quarter-hour after the IRS accepts their return:

Intuit

This pace issues as a result of the tax refund is often the most important paycheck for many individuals within the US, in order that they depend on it. So, what is the incentive for the IRS to pay you quick? I would say there isn’t any incentive in anyway. After all, the IRS remains to be on the finish of the cost chain, even when there is a personal firm appearing as an middleman. Nonetheless, personal corporations akin to Intuit advance these refunds, one thing that won’t occur if they’re disintermediated.

Residing in a rustic with free tax-filing: my POV

I used to be born and dwell in Spain, the place the tax authorities already present tax submitting software program free of charge, so I’ve a good deal of expertise utilizing a authorities providing. This has most likely helped me have robust views relating to the IRS threat.

Suppose you will have a easy return the place you’re employed for an organization that pays you a month-to-month wage and isn’t topic to any deductions or exemptions. On this case, you wouldn’t need assistance from different software program suppliers. You’d go into the draft of your return, all the knowledge is preloaded there, and also you simply ship it.

Nevertheless, if among the two situations above will not be happy, then it is extremely probably you’ll need the assistance of a tax advisor. Increasingly more persons are investing in Spain, and the federal government continually enacts completely different deductions and exemptions. This panorama is making tax software program corporations proliferate. Discovering somebody utilizing such software program a few years in the past was robust, however issues are altering now. A free tax providing by the federal government just isn’t stopping the pattern.

I’ve a reasonably complicated return, so I used tax submitting software program this yr, and I believe my case clearly portrays why the federal government won’t be able to match assisted choices. Firstly, I didn’t should do something. I simply gave all the knowledge to my tax advisor who did my return. Secondly and most significantly, I came upon I certified for a deduction that saved me €1,000 in taxes. I paid €200 for assisted providing, so my internet acquire was €800. Powerful to see a situation the place the federal government would’ve helped me discover that deduction.

The chance remains to be regulatory

By now, it ought to be clear that I do not anticipate a competing product to the IRS to considerably eat away TurboTax’s income and progress path. That stated, I nonetheless consider the primary threat is regulatory. That is merely a results of Intuit getting bigger and working in a number of important government-related subjects akin to accounting and tax.

Based mostly on latest lawsuits and authorities officers’ phrases, it is fairly apparent that Intuit just isn’t held within the highest esteem by authorities officers, so we must always intently monitor any future lawsuits. That is arguably a threat for all massive tech, with regulatory our bodies rising more and more anxious about monopolistic practices that goal to dampen competitors.

The federal government may affect Intuit’s enterprise sooner or later, I simply do not see how that occurs with a DIY software program competitor.

Wanting on the firm’s valuation

To look at Intuit’s valuation, I’ll use a way I prefer to name the “Adjusted FCF yield” technique. After all, I did not invent this technique, however the objective is solely to grasp what adjusted FCF yield Intuit is at the moment buying and selling and whether or not the valuation is affordable.

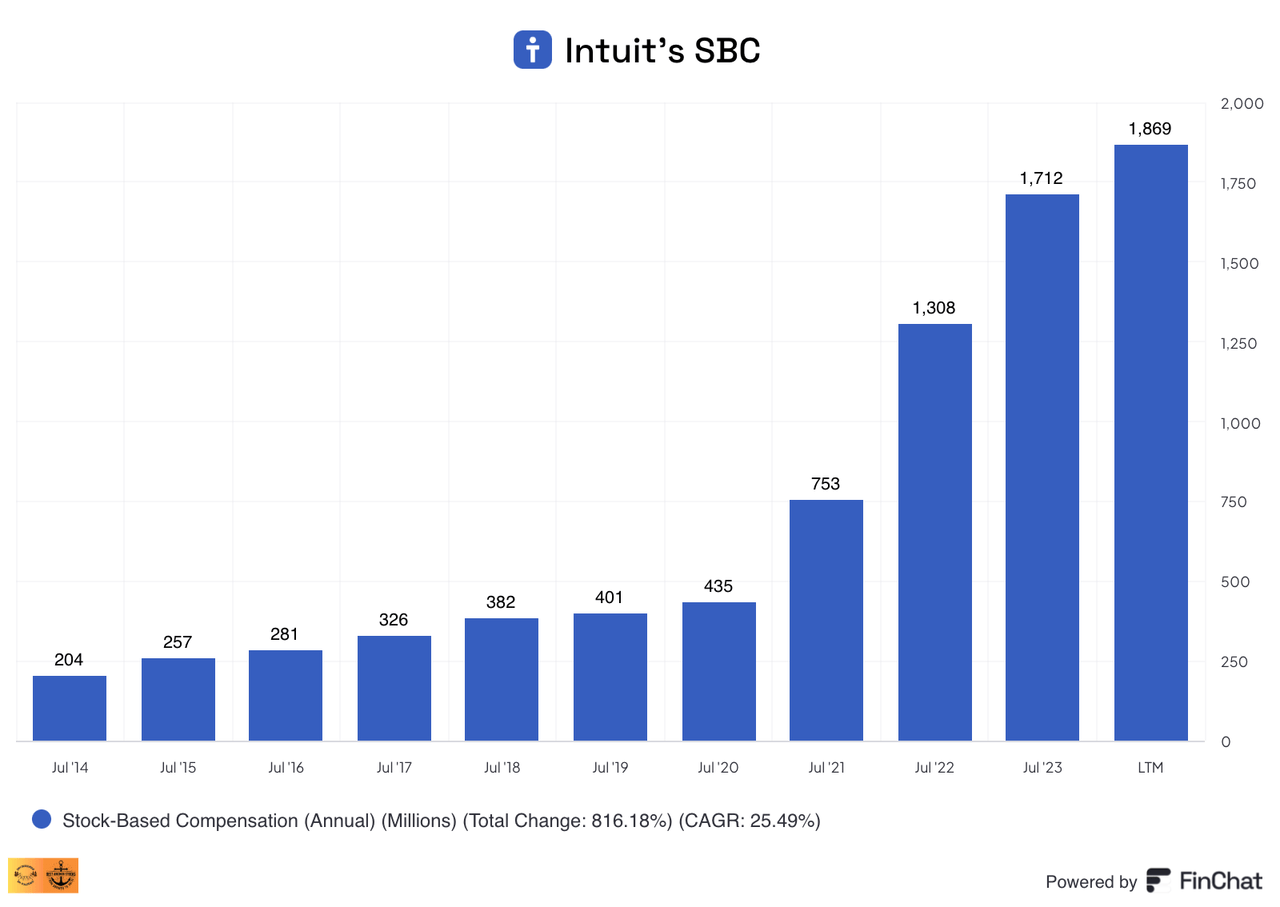

Intuit has generated $5.1 billion in Free Money Stream over the past twelve months. That is important, however an vital portion comes from stock-based compensation, or SBC, or higher stated, from the corporate not having to pay money salaries because of SBC. I alter FCF for SBC as a result of the corporate later spends important parts of its Free Money Stream to make repurchases. After all, repurchases will be thought-about a return of capital to shareholders, however not when they’re being made to offset (to an amazing extent) the dilution created by SBC.

Intuit had an SBC of $1.87 billion over the past twelve months, or round 12% of gross sales. That is important, however I do not assume the latest will increase are consultant of SBC going ahead. The corporate incurred important SBC with the acquisitions of Mailchimp and Credit score Karma, and SBC jumped fairly significantly in 2021:

Finchat

SBC has stored on rising since, however the tempo of the rise has moderated, and administration claimed that round 25% of the present SBC might be attributable to these acquisitions and that it ought to flatten thereafter. After all, no matter this, I nonetheless consider it is fairly excessive, and I’ll deduct all the quantity from Free Money Stream as a result of I really feel I’m being extra conservative on this method.

Because of this the Free Money Stream adjusted for SBC is round $3.23 billion. The corporate’s EV is at the moment $162 billion, which means the corporate is at the moment buying and selling at an EV/FCF yield adjusted for SBC of round 2%. It isn’t low-cost, to be sincere. May the inventory obtain a double-digit return in the long run? Positively; I consider the corporate will proceed rising by double digits for a very long time. Nevertheless, I do not assume the corporate is in low-cost territory but, and I’ll wait so as to add to my place if we get further drops.

Conclusion

I hope this text helped you perceive why I do not assume Intuit is uncovered to the dangers of AI and the IRS. They’re certainly truthful issues, nevertheless it’s not like AI will break all software program corporations, and there are important conflicts of curiosity with the IRS managing tax filings. Notice that individuals already utilizing free tax filings are unlikely to carry Intuit a lot income anyway.

Within the meantime, continue to grow!