Thomas Barwick

Co-authored by Treading Softly.

When wanting over a big discipline, a farmer has some key issues to mull over. What crop will they develop? Ought to they rotate crops? Or is the land higher suited to grazing livestock? Can they do all of the work themselves, or ought to they rent assist? Many who personal farmland do not truly farm in any respect, they strike a take care of another person to do the work whereas they share the income.

Relating to the market, I am not within the enterprise of slaughtering my investments to unlock their worth. I am all about planting huge fields of revenue crops, harvesting my revenue, and repeating it over the lengthy haul. At instances, I will promote out of an funding, particularly if I can transfer into a brand new place that may enhance the output of my revenue farm.

Typically, I get pleasure from doing the “labor” myself. I like to decide on my shares, manually reinvest my dividends, and actively handle my portfolio. Nonetheless, I can not observe each sector and handle each phase myself. When in search of investments, I typically get pleasure from leveraging employed fingers. Typically, I will use a CEF (Closed-Finish Fund) overseen by expert portfolio managers to spice up my revenue farm’s output.

At the moment, I need to dive in and study one such fund that has seen a bumper crop lately.

Let’s dive in!

Bumper Crop = Large Earnings

XAI Octagon Floating Charge & Various Earnings Belief (NYSE:XFLT), yielding 14.3%, is a CEF specializing in financial institution loans. These are loans which can be issued to below-investment-grade companies, often with credit score scores within the B/B+ vary. They’re “senior secured,” which means that they’re often essentially the most senior debt on the borrower’s stability sheet. The rate of interest is often floating. In case you are wanting on the 10-Q/Ok of a public borrower, and lots of of those debtors are public, you’ll find the mortgage recognized as a “time period mortgage.”

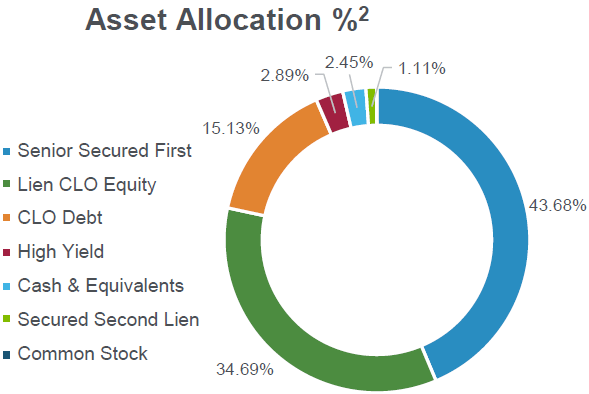

XFLT invests in these loans utilizing three methods: Direct possession, collateralized mortgage obligation, or CLO, fairness, and CLO debt. Supply.

XFLT Might 2024 Presentation

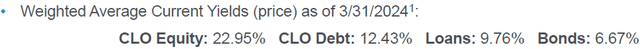

Whereas all three of those investments are based mostly on the identical forms of loans, the completely different methods have completely different dangers and rewards. XFLT offers the common present yields it’s experiencing on its belongings:

XFLT Might 2024 Presentation

Direct loans are their largest place at just below 44% of the portfolio and are yielding 9.76%. These investments are easy. XFLT buys the mortgage after which collects its portion of the curiosity.

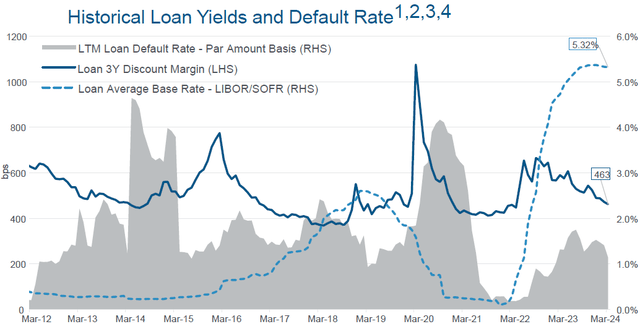

If you get to CLOs, it will get extra advanced. CLOs are made up of assorted tranches, and every tranche is in line to receives a commission. When cash is available in, the senior debt tranches are paid first, then the subordinated junior debt tranches, and eventually, the fairness tranche will get no matter is left. For the privilege of being first in line, the senior debt holders take a haircut. Word that XFLT is getting a mean of 9.76% yield on its instantly held loans. The loans inside CLOs are going to have a really comparable yield. Janus Henderson AAA CLO ETF (JAAA), an ETF that holds the senior debt tranches of CLOs, is yielding about 6.4%. Janus Henderson B-BBB CLO ETF (JBBB), an ETF that owns CLO debt tranches within the B-BBB vary, is yielding about 7.75%. Each numbers are considerably lower than the 9.76% that the debtors are paying. The place does the surplus curiosity go?

It goes to the junior debt tranches that XFLT invests in, the place it will get a 12.43% yield. After that’s paid in full, it goes to the fairness tranches, which yield 22.95%. Institutional traders and ETFs like JAAA and JBBB pay premiums to be first in line and have much less credit score danger. XFLT and CEFs that spend money on the junior debt and fairness tranches get a lot greater funds for taking up that credit score danger.

This positioning has been very worthwhile over the previous yr, because the lowest-rated tranches expertise materially greater complete returns.

XFLT Might 2024 Presentation

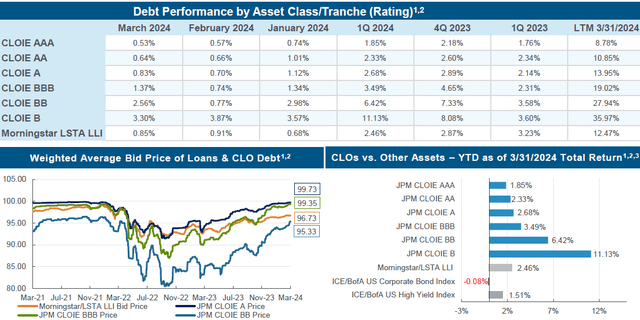

In the meantime, defaults proceed to be effectively under historic averages; regardless of drifting upward in 2023, they’ve been slowing down.

XFLT Might 2024 Presentation

For the previous few years, I’ve been discussing my expectation that default charges will stay low all through the present cycle. COVID had two important impacts on debtors: it precipitated defaults to be pulled ahead and compelled corporations that have been borderline to shore up their stability sheets. The weakest corporations have been weeded out in 2020/2021, and many of the relaxation had the warning shot throughout the bow that precipitated them to scrub up their stability sheets.

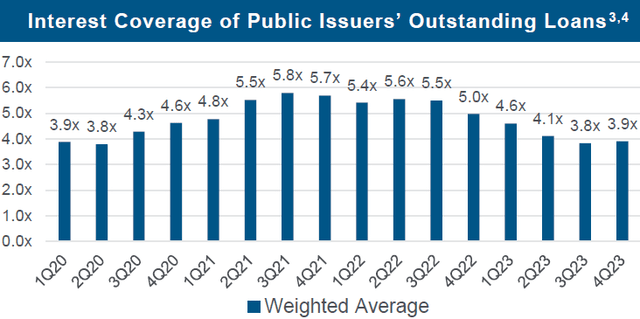

Excessive rates of interest put strain on debtors as a result of it will increase their curiosity expense. Nonetheless, due to debtors managing their stability sheet and refinancing unsecured bonds at very low rates of interest, curiosity protection was exceptionally excessive. So whereas curiosity protection has been deteriorating with excessive charges, it has come all the way down to pre-COVID ranges, which have been wholesome.

XFLT Might 2024 Presentation

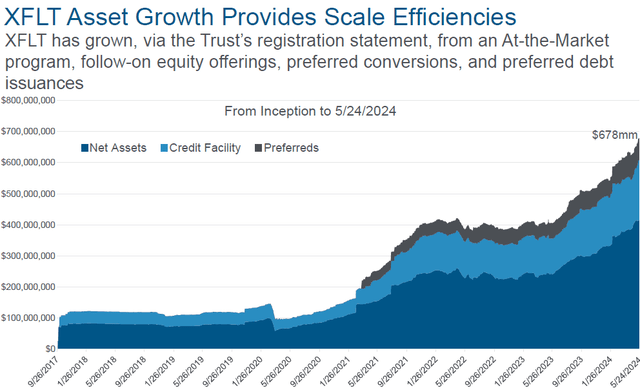

It’s a nice time to be shopping for loans, and XFLT has been shopping for hand over fist. XFLT has grown its belongings by almost 70% yr over yr.

XFLT Might 2024 Presentation

As XFLT continues to make the most of this shopping for alternative, one other hike in its distribution might be on the desk.

With publicity to direct loans and debt tranches of CLOs, XFLT is a lower-risk choice than different CEFs that focus totally on CLO fairness, like OXLC and ECC. This has led to much less volatility in share value, and following COVID, XFLT was the quickest to boost its distribution again up. This makes it the perfect decide for traders who need to get a style of the sector however need much less danger.

Conclusion

With XFLT, you possibly can leverage expert portfolio managers as employed fingers to assist enhance your revenue farm’s output. Relating to the market, many individuals can have a really particular focus for his or her portfolio. They might have a portfolio that is designed strictly to spend money on progress shares and attempt to slaughter these investments to unlock a revenue; others will make investments for dividends and solely spend money on corporations that pay them again.

For my portfolio and my retirement planning, I’ve taken the route of being an revenue farmer. I discover high-quality investments, plant them into my portfolio discipline, and proceed to reap and accumulate the revenue on a quarterly foundation, having fun with that revenue in order that I can afford extra high-quality investments to affix my farm’s assortment.

Relating to retirement, you are going to want revenue from someplace, whether or not that’s often promoting off investments that you simply purchased at a revenue or by sitting again and accumulating revenue. Each halves are a part of the whole return equation. Sadly, it looks like many retirees droop their understanding of how funds work and the idea of “dwelling inside your means” once they retire, pondering that this new paradigm requires a wholly new option to handle their funds.

I am happy to let you know that whereas retirement is a paradigm shift so far as the way you work together with the world and the way you are now not employed, it doesn’t require a paradigm redesign on the way you do your funds. As an alternative, you possibly can proceed to gather revenue from high-quality contributors of the monetary markets as a substitute of an employer and meet these bills head-on with out having to unload the portfolio pillars you will have labored so arduous to construct. That is the great thing about my Earnings Methodology. That is the great thing about revenue investing.