Andersen Ross/DigitalVision by way of Getty Pictures

In February, I wrote a cautious replace on Nationwide CineMedia, Inc. (NASDAQ:NCMI). Though the corporate was working with a clear stability sheet after rising from Chapter 11 chapter in late 2023, Nationwide CineMedia’s enterprise fundamentals weren’t strong, and I had doubts about whether or not the corporate can return to profitability within the close to future.

With the corporate just lately reporting fiscal Q1/2024 outcomes, I believed it could be well timed to examine in on the corporate, to see how its cinema promoting enterprise is progressing in 2024.

NCMI carried out higher than anticipated within the first quarter, with revenues and working earnings each higher than administration’s prior steerage. Nonetheless, the outlook for the remainder of 2024 is for big double-digit declines, because the movie slate seems particularly weak.

With 2024 being a write-off, buyers contemplating NCMI could have to look ahead to 2025’s movie slate, when just a few extremely anticipated blockbusters are attributable to be launched. Nonetheless, if buyers are betting on 2025’s movie slate, they might discover higher worth within the movie show chains. I’m sustaining my maintain advice on NCMI for now.

Temporary Firm Overview

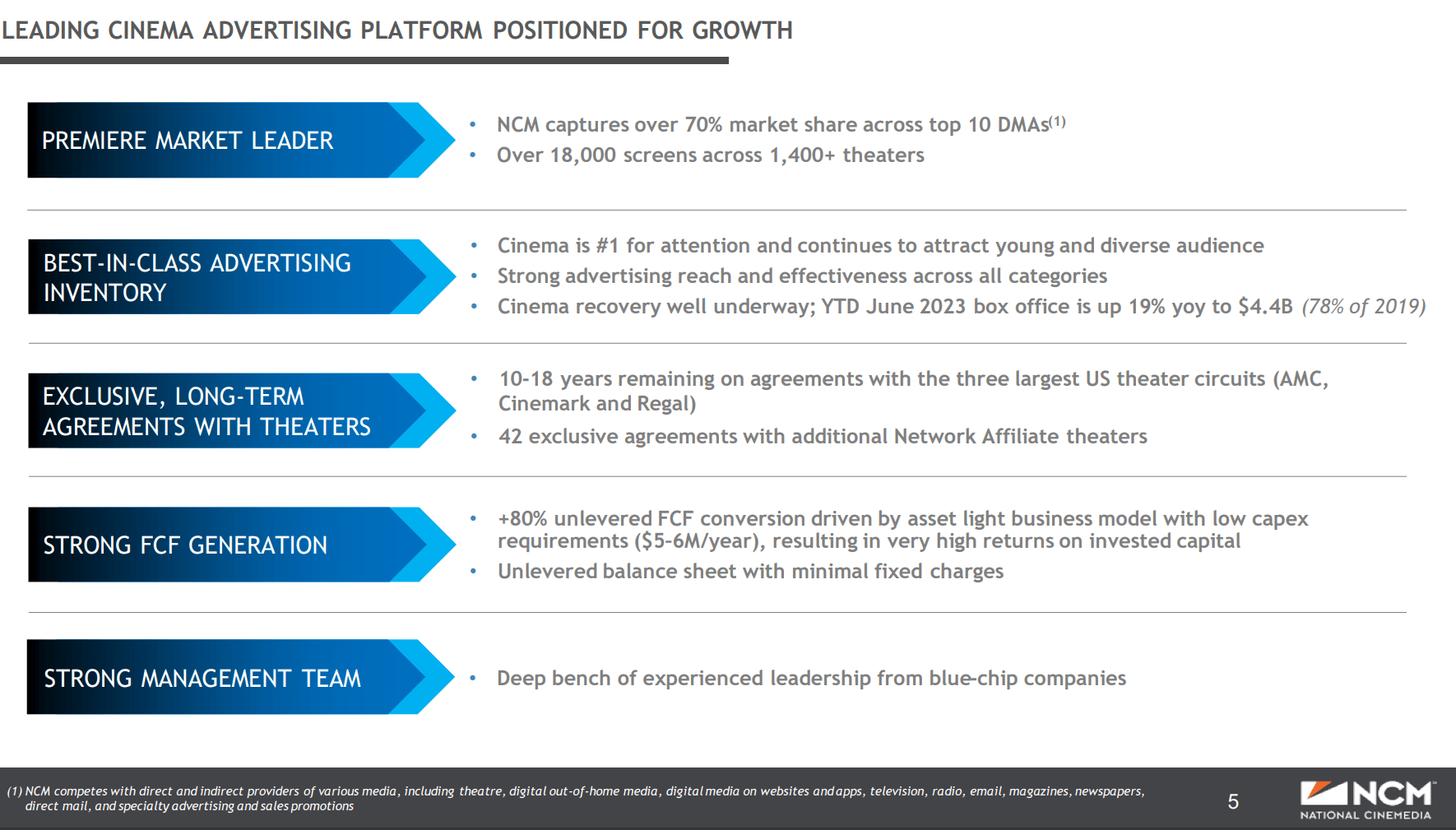

A fast refresher for these not aware of the corporate, Nationwide CineMedia is the most important U.S. theater advert community. NCMI reveals pre-show promoting (i.e., film trailers) on over 18,000 screens and 1,400 theatres. Its promoting community contains main nationwide chains reminiscent of AMC, Cinemark, and Regal (Determine 1).

Determine 1 – NCMI overview (NCMI investor presentation)

The corporate bumped into monetary bother in the previous couple of years, primarily due to the COVID-19 pandemic, which brought about moviegoers to remain house. This negatively affected NCMI’s potential to service its money owed and in the end compelled the corporate into Chapter 11 chapter.

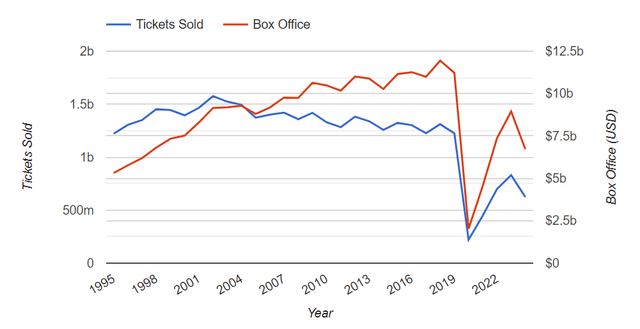

Though film box-office gross sales have since recovered to ~80% of pre-pandemic ranges in 2023, the precise variety of tickets offered, which is the important thing driver of NCMI’s revenues, solely recovered to 68% of pre-pandemic ranges (Determine 2).

Determine 2 – Home box-office and tickets offered (the-numbers.com)

NCMI Q1/2024 Beating Steering

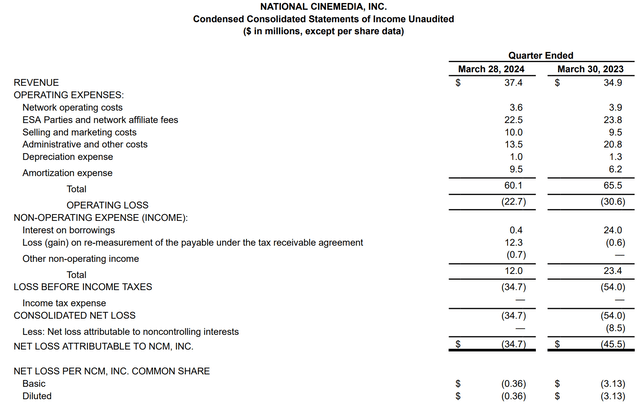

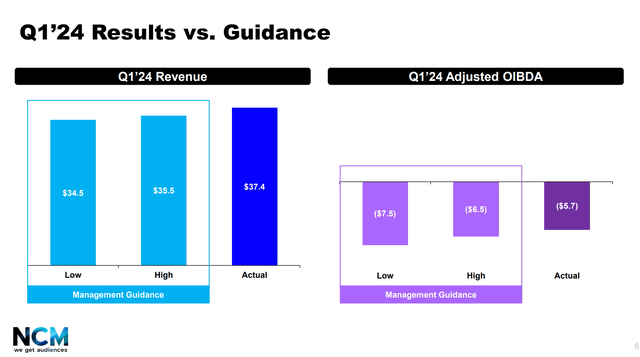

Within the just lately reported Q1/F24, NCMI recorded $37.4 million in revenues, a 7.2% YoY improve, however nonetheless suffered an working lack of $22.7 million (Determine 3).

Determine 3 – NCMI Q1/24 monetary efficiency (firm studies)

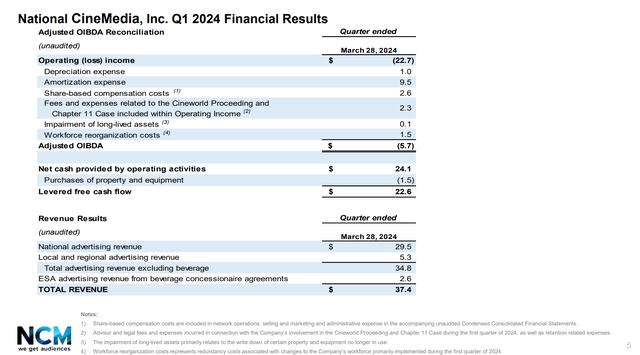

Adjusted Working Earnings Earlier than Depreciation and Amortization (“Adj. OIBDA”), a key working metric that NCMI makes use of to measure its monetary efficiency, was -$5.7 million within the quarter (Determine 4).

Determine 4 – NCMI Q1/24 Adj. OIBDA (NCMI investor presentation)

Nonetheless, on the brilliant facet, NCMI did handle to beat its prior steerage of $35 million in revenues and -$7.0 million in OIBDA (Determine 5).

Determine 5 – NCMI beat steerage (NCMI investor presentation)

However Future Steering Is The Difficulty

Whereas NCMI’s Q1/24 outcomes have been barely higher than the identical interval in 2023 and a beat to steerage, the corporate’s outlook for Q2 seems materially weaker than final 12 months. For the upcoming quarter, NCMI is guiding to revenues of $49.5 – $51.5 million in comparison with $64.4 million in Q2/2023, or a decline of 21.6% YoY on the midpoint.

Adjusted OIBDA is predicted to return in at $3.5 – $4.5 million, vs. $12.5 million in Q2/23.

Weak Movie Slate To Blame For Poor Steering

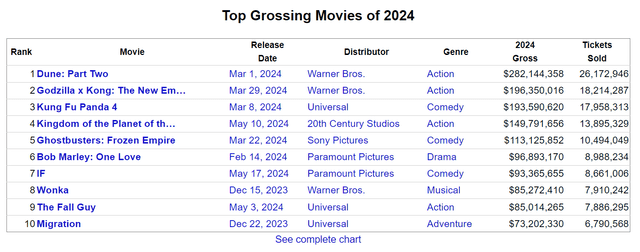

The issue for Nationwide CineMedia and the movie show chains, on the whole, is that film attendance has fallen off a cliff. As we are able to see from Determine 2 above, 2024 box-office gross sales are at present monitoring at 75% of 2023 ranges and simply 60% of pre-pandemic ranges!

A part of the rationale for a weak 2024 box-office is that the 2023 Hollywood labour strikes delayed the manufacturing and launch of many motion pictures. Moreover, as I famous in a current article on The Marcus Company (MCS), the 2024 movie slate has been missing box-office hits like 2023’s Oppenheimer and The Barbie Film.

To this point, the top-grossing home film of 2024 is Dune: Half 2 at $282 million (Determine 6), far lower than 2023’s top-grossing film The Barbie Film, which grossed $636 million (Determine 7).

Determine 6 – High grossing motion pictures of 2024 (the-numbers.com) Determine 7 – High grossing motion pictures of 2023 (the-numbers.com)

Extra importantly, 2024 has had many notable duds, together with the a lot anticipated Furiosa: A Mad Max Saga, which grossed simply $26 million in its opening weekend, a far cry from its predecessor, Mad Max: Fury Street, which debuted at $45 million in 2015, or roughly $61 million in 2024 {dollars}, adjusted for inflation.

So as to add to the trade’s distress, the perennial blockbuster manufacturing unit Disney/Marvel Studios is just releasing one film in 2024, the extremely anticipated Deadpool And Wolverine. In the meantime, its competitor, Warner Brothers/DC, will probably be taking a hiatus in 2024 after rebooting their DC cinematic universe. So there may very well be a severe dearth of blockbuster motion pictures within the 2024 slate.

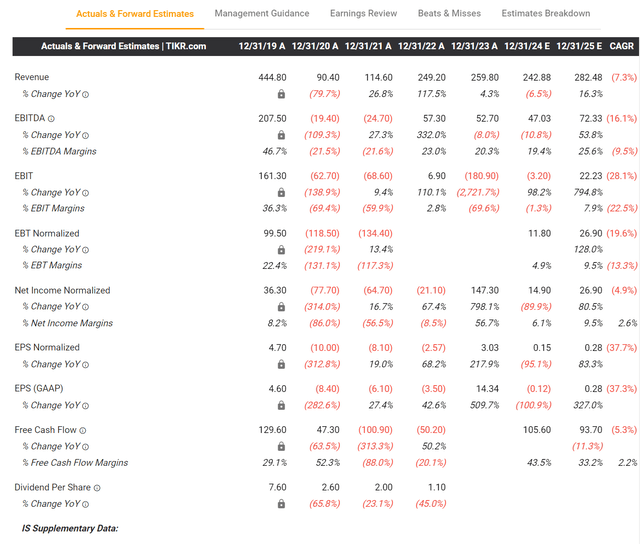

Consensus Estimates Now Count on A Loss

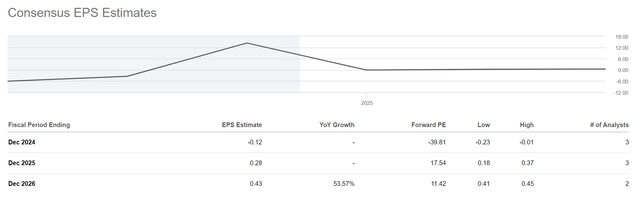

In my February article, I famous that consensus estimates have been fairly hopeful about Nationwide CineMedia’s outcomes and have been in search of roughly breakeven efficiency for the corporate in 2024. Nonetheless, after the poor box-office efficiency in current months, analysts have now largely written off 2024, with consensus anticipating NCMI to report a $0.12/share loss (Determine 8).

Determine 8 – Consensus expects 2024 to be a write-off (tikr.com)

Valuation Seems to be Costly

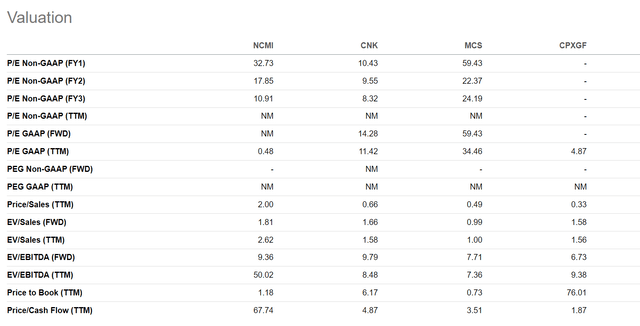

With 2024 a write-off, buyers in search of valuation assist could must roll their expectations to 2025. Based mostly on consensus estimates of $0.28/share in EPS for 2025, NCMI is at present buying and selling at 17.5x 2025E Fwd P/E (Determine 9).

Determine 9 – NCMI is buying and selling at 17.5x 2025E EPS (Searching for Alpha)

In comparison with movie show friends like Cinemark (CNK), NCMI’s valuation seems costly, as CNK is just buying and selling at 9.6x 2025E Fwd P/E (Determine 10).

Determine 10 – NCMI vs. peer valuations (Searching for Alpha)

Put one other means, if analysts are appropriate and there’s a rebound in 2025 box-office gross sales, buyers can get a bigger ‘bang-for-their-buck’ by shopping for CNK shares at 9.6x P/E vs. NCMI at 17.5x.

Dangers To Nationwide CineMedia

For my part, the largest short-term threat to Nationwide CineMedia is the movie slate, which is one thing outdoors of the corporate’s management. If there are not any ‘must-see’ movies taking part in in theaters, then theater chains and advert networks like NCMI will undergo.

An extended-term situation is whether or not there’s a secular pattern away from attending motion pictures in theaters. As I’ve written beforehand, many households took benefit of the COVID-19 pandemic (and authorities stimulus cheques!) to improve their house theatre programs. With an upgraded house theatre system, non-blockbuster movies can now be loved within the consolation of 1’s house with none main distinction in image or sound high quality.

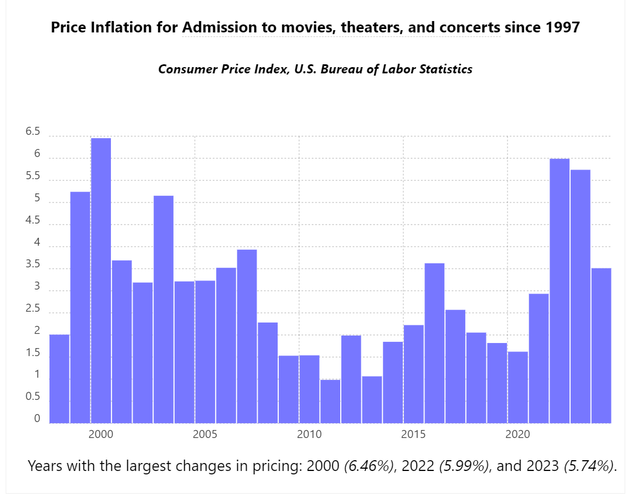

Moreover, the prices of going to the films have risen dramatically. Based on the U.S. Bureau of Labor Statistics, the worth of admission to film theaters has greater than doubled since 1997, with inflation particularly pronounced in the previous couple of years (Determine 11).

Determine 11 – Film admission inflation (BLS from in2013dollars.com)

Coupled with the exorbitant costs of concession gadgets like popcorn and sodas, an outing to the films can simply run over $100 for a household of 4 (from private expertise).

Lastly, many adolescents at present have more and more shorter consideration spans, pushed by the proliferation of short-form movies like TikTok movies and Instagram reels. 2-hour motion pictures could look like an eternity in comparison with the same old 30-seconds to 1-minute movies that these youngsters devour.

Subsequently, it’s not arduous to see why theater admission may very well be in a secular decline and won’t surpass pre-pandemic ranges for a few years to return.

Conclusion

Nationwide CineMedia began 2024 with a better-than-guided first quarter, delivering $37 million in income and -$5.7 million in OIBDA. Nonetheless, the corporate’s steerage suggests the remainder of 2024 will probably be a down 12 months in comparison with 2023.

It is because the movie slate for 2024 seems particularly weak, with many blockbuster franchises like Marvel and DC deciding to cut back their output after current missteps.

For NCMI, 2024 seems like a write-off, as analysts broadly anticipate the corporate to report a loss for the total 12 months. Wanting ahead to 2025, if there’s a box-office rebound, buyers could possibly discover higher worth in sure movie show chains like Cinemark.

Within the long-run, I additionally fear a couple of secular decline in movie show attendance.

I’m sustaining my maintain score for now as we await the arrival of 2025’s movie slate.