Knowledge up to date dailyConstituents up to date yearly

So as to create a dividend earnings stream that varies little from month-to-month, retirees (and different income-oriented buyers) should be capable of decide which shares pay dividends in every month of the calendar 12 months.

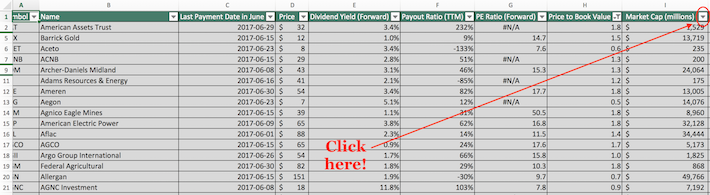

That’s the place Certain Dividend is available in. We preserve a free database of shares that pay dividends in June (together with vital metrics similar to price-to-earnings ratios and dividend yields), which you’ll be able to obtain by clicking beneath:

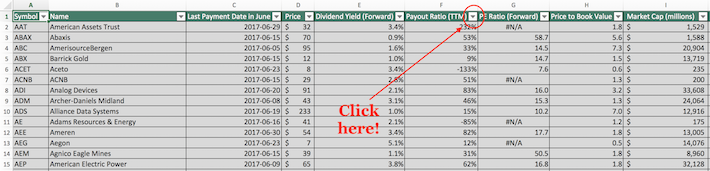

The checklist of shares that pay dividends in June accessible for obtain above incorporates the next data for each inventory within the database:

Final dividend cost date within the month of June

Dividend yield

Payout ratio

Worth-to-earnings ratio

Worth-to-book ratio

Market capitalization

Return on fairness

3-year beta

Preserve studying this text to be taught extra about maximize the usefulness of our database of shares that pay dividends in June.

Notice: Constituents for the spreadsheet and desk above are from the Wilshire 5000 index, with knowledge offered by Ycharts and up to date yearly. Securities outdoors the Wilshire 5000 index should not included within the spreadsheet and desk.

How To Use Our Record of Shares That Pay Dividends in June to Discover Funding Concepts

Having an Excel doc that incorporates the identify, ticker, and monetary data of each inventory that pays dividends in June might be very helpful.

This doc turns into much more highly effective when mixed with a working data of Microsoft Excel.

With that in thoughts, this tutorial will reveal how one can implement two extra investing screens to our checklist of shares that pay dividends in June.

The primary display screen that we’ll implement is for shares that distribute nearly all of their earnings to shareholders and in addition commerce at cheap value multiples of those earnings. Extra particularly, we’ll filter for shares with payout ratios between 50% and 100% and price-to-earnings ratios beneath 15.

Display screen 1: Shares With Payout Ratios Between 50% and 100% and Worth-to-Earnings Ratios Beneath 15

Step 1: Obtain your checklist of shares that pay dividends in June by clicking right here.

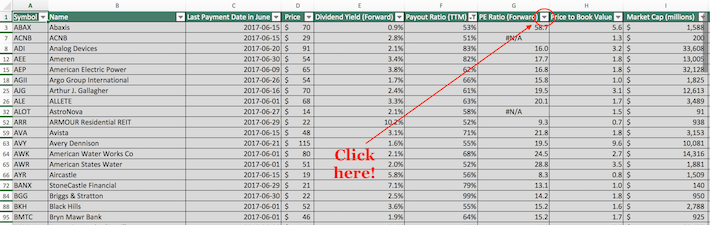

Step 2: Click on on the filter icon on the prime of the payout ratio column, as proven beneath.

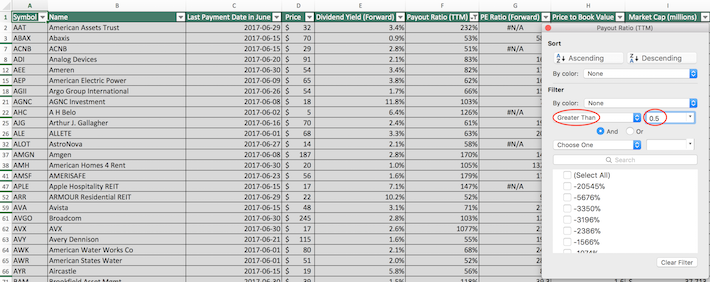

Step 3: Change the filter setting to “Larger Than” and enter 0.5 into the sphere beside it, as proven beneath. Since payout ratio is measured in share factors, it will filter for shares that pay dividends in June with payout ratios above 50%.

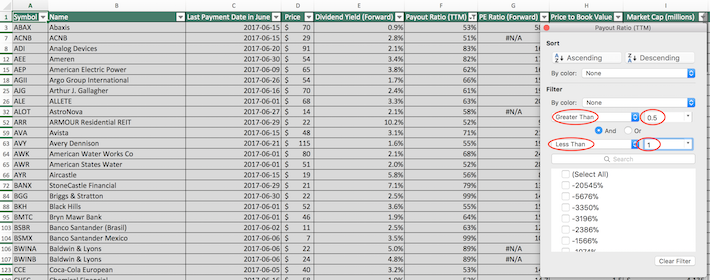

Step 4: Change the secondary filter setting to “Much less Than” and enter 1 into the sphere beside it, as proven beneath. Since payout ratio is measured in share factors, it will filter for shares that pay dividends in June which have payout ratios beneath 100%.

Step 5: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on the filter icon on the prime of the price-to-earnings ratio column, as proven beneath.

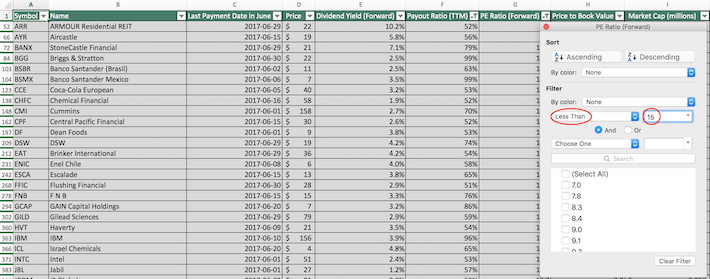

Step 6: Change the filter setting to “Much less Than” and enter 15 into the sphere beside it, as proven beneath. This may filter for shares that pay dividends in June with price-to-earnings ratios beneath 15.

The remaining shares within the spreadsheet are shares that pay dividends in June with payout ratios between 50% and 100% that even have price-to-earnings ratios beneath 15.

The following display screen we’ll implement is for shares with price-to-book ratios beneath 2 and large-cap shares with market capitalizations above $10 billion.

Display screen 2: Worth-to-Guide Ratios Beneath 2, Market Capitalizations Above $10 Billion

Step 1: Obtain your checklist of shares that pay dividends in June by clicking right here.

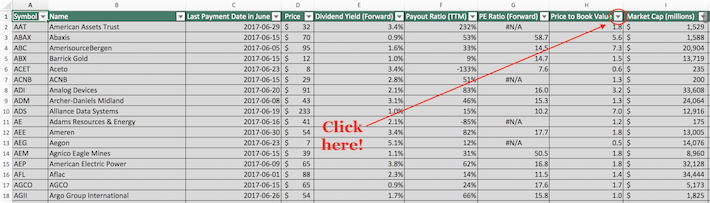

Step 2: Click on the filter icon on the prime of the price-to-book ratio column, as proven beneath.

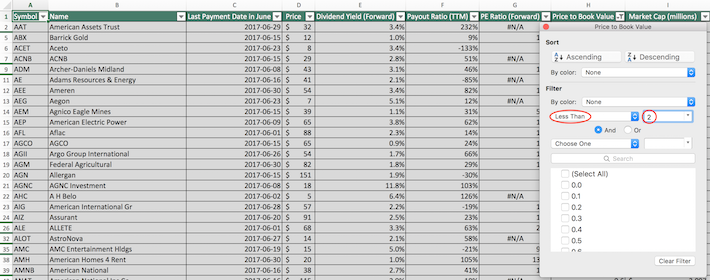

Step 3: Change the filter setting to “Much less Than” and enter 2 into the sphere beside it. This may filter for shares that pay dividends in June with price-to-book ratios beneath 2.

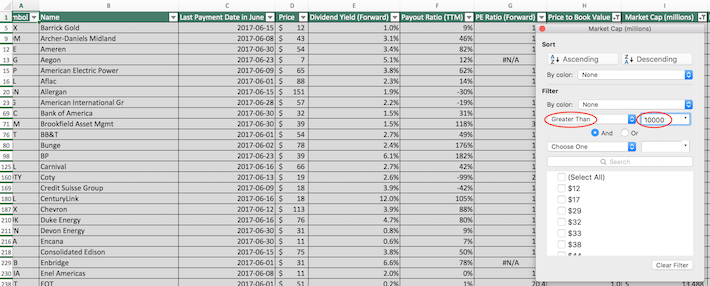

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Then, click on the filter button on the prime of the market capitalization column, as proven beneath.

Step 5: Change the filter setting to “Larger Than” and enter 10000 into the sphere beside it. Notice that since market capitalization is measured in tens of millions of {dollars}, filtering for shares with market capitalizations above “10000 million” is equal to screening for securities with capitalizations above $10 billion.

The remaining shares on this spreadsheet database are shares that pay dividends in June which have price-to-book ratios beneath 2 and market capitalizations above $10 billion.

You now have a working understanding of use Microsoft Excel to implement extra monetary screens to our checklist of shares that pay dividends in June.

The rest of this text will introduce different investing assets that may show you how to make higher selections alongside your investing journey.

Remaining Ideas: Different Helpful Investing Sources

Having an Excel doc that incorporates the identify and monetary knowledge of shares that pay dividends in June could be very highly effective, however is proscribed in its usefulness until it may be paired with comparable monetary data for the opposite 11 calendar months.

Happily, Certain Dividend develops and maintains databases for each calendar month. You may entry the opposite databases beneath:

These touchdown pages ought to assist retirees diversify their dividend earnings by calendar month.

One other vital element of diversification is investing applicable quantities into every sector of the inventory market. With that in thoughts, Certain Dividend maintains databases (up to date month-to-month) for the next inventory market sectors:

Diversification apart, our analysis means that a number of the greatest returns within the inventory market might be discovered with firms which have a behavior of persistently rising their dividend funds over time.

With this in thoughts, the next Certain Dividend databases are nice locations to search for funding alternatives:

The Dividend Aristocrats: S&P 500 shares with 25+ years of consecutive dividend will increase

The Dividend Achievers: dividend shares with 10+ years of consecutive dividend will increase

The Dividend Kings: thought of to be the best-of-the-best in the case of dividend progress shares, the Dividend Kings are an unique group of dividend shares with 50+ years of consecutive dividend will increase

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].