Up to date on Might thirty first, 2024 by Bob Ciura

Excessive-yield shares pay out dividends which might be considerably greater than market common dividends. For instance, the S&P 500’s present yield is simply ~1.4%.

Excessive-yield shares will be very useful to shore up revenue after retirement. A $120,000 funding in shares with a median dividend yield of 5% creates a median of $500 a month in dividends.

Altria is a part of our ‘Excessive Dividend 50’ sequence, the place we cowl the 50 highest yielding shares within the Certain Evaluation Analysis Database.

We’ve created a spreadsheet of shares (and intently associated REITs and MLPs, and so on.) with dividend yields of 5% or extra…

You possibly can obtain your free full listing of all securities with 5%+ yields (together with vital monetary metrics akin to dividend yield and payout ratio) by clicking on the hyperlink beneath:

Subsequent on our listing of excessive dividend shares to evaluation is Altria Group (MO).

Altria has a 54-year dividend improve streak, which qualifies it as a Dividend King. A big a part of why Altria has been capable of elevate the dividend for thus lengthy is due to its a number of aggressive benefits.

Enterprise Overview

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra below quite a lot of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the hashish firm Cronos Group (CRON).

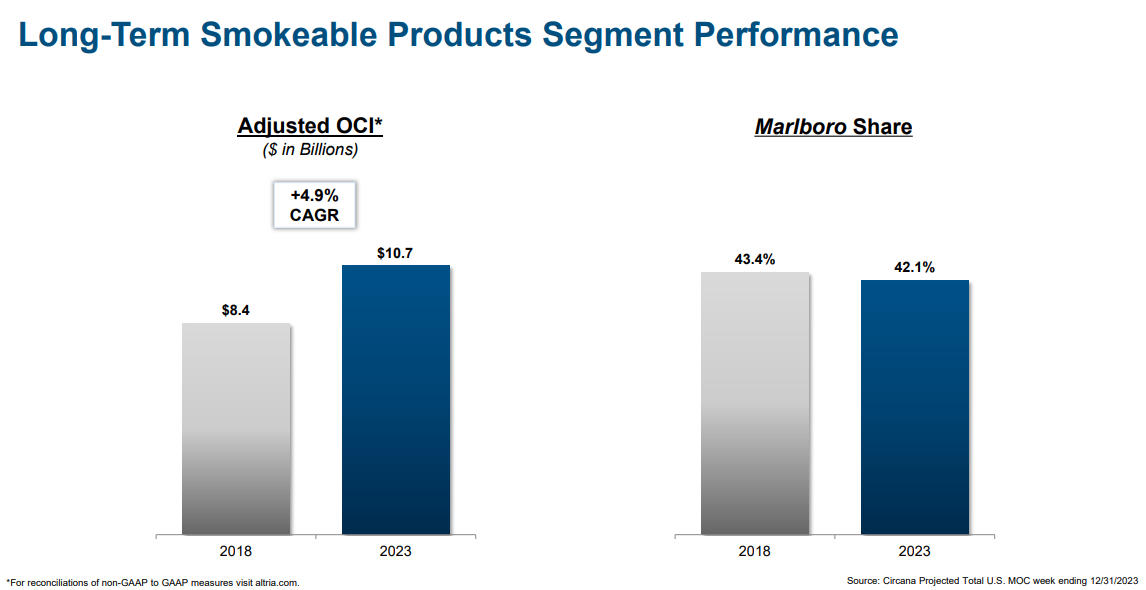

The vast majority of Altria’s income and revenue remains to be made up of smokeable tobacco merchandise. The Marlboro model nonetheless enjoys the main market share within the U.S. market.

Supply: Investor Presentation

Over many a long time, this has served the corporate (and its shareholders) very effectively. Whereas excessive dividend yields are frequent with tobacco shares, no different firm within the {industry} has a dividend improve streak so long as Altria’s.

Within the 2024 first quarter, Altria’s web income of $5.576 billion declined 2.5% from the primary quarter of 2023, with income web of excise taxes at $4.717 billion, down 1.0%.

Adjusted diluted EPS stood at $1.15, a lower of two.5% in comparison with the identical interval final yr.

Progress Prospects

Altria’s future development faces an unsure future resulting from altering shopper habits.

As a serious tobacco firm, Altria has to face the truth of declining smoking charges in the USA. Annually, there are fewer cigarette people who smoke within the U.S. Consequently, there are fewer clients for tobacco corporations like Altria.

The full {industry} decline was estimated at 8% in 2023. Altria’s declines mirror the industry-wide challenges.

Historically, tobacco producers have compensated for falling smoking volumes with worth will increase. To this point, this has labored to offset misplaced income. Altria will proceed to boost costs within the years to return.

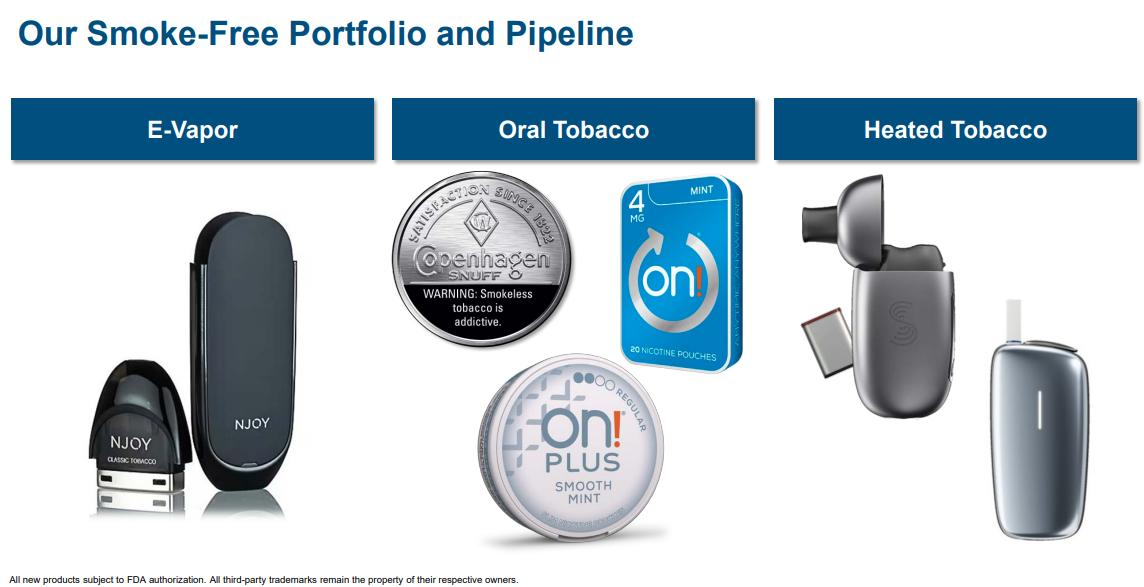

However nonetheless, tobacco corporations should adapt to the brand new setting, and Altria is getting ready for a post-cigarette world by investing within the improvement of smoke-free merchandise.

Supply: Investor Presentation

Altria has invested closely in non-combustible merchandise, akin to its $13 billion funding in e-cigarette chief JUUL and its $1.8 billion funding in Cronos. E-vapor and hashish could possibly be two main long-term development catalysts going ahead.

Altria has additionally acquired Swiss firm Burger Söhne Group, to commercialize it’s on! oral nicotine pouches. Oral tobacco is a development space for Altria, as shoppers who’ve stop smoking more and more shift to oral tobacco merchandise.

The corporate can even be capable to generate earnings-per-share development by means of price reductions and share repurchases. Altria utilized $1 billion for share repurchases in 2023, and $1.8 billion in 2022.

In all, we count on ~2.4% compound annual development for Altria’s earnings-per-share over the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

Altria advantages from a large number of aggressive benefits, which have allowed the corporate to generate regular development over a long time. First off, Altria has great model loyalty.

Retail market share for the flagship Marlboro cigarette model has remained at over 40% for a few years. This enables the corporate to boost costs yearly and nonetheless maintain its buyer base intact.

Additionally, tobacco producers function an advantageous enterprise mannequin which doesn’t require intensive capital expenditures. Tobacco isn’t a capital-intensive enterprise, because of economies of scale in manufacturing and distribution. Because of this Altria generates sturdy free money movement every year, at the same time as income has stagnated from falling smoking charges.

Such sturdy free money movement leaves an excessive amount of money accessible for shareholder returns, debt reimbursement, and funding in future development initiatives.

One other advantage of Altria’s enterprise mannequin is that it’s extremely immune to recessions. Cigarettes and alcohol gross sales maintain up very effectively throughout recessions, which retains Altria’s profitability and dividend development intact.

The corporate carried out strongly through the earlier main financial downturn, the Nice Recession of 2008-2009:

2008 earnings-per-share: $1.66

2009 earnings-per-share: $1.76

2010 earnings-per-share: $1.87

Altria grew its adjusted earnings-per-share in every year of the Nice Recession. This demonstrates the corporate’s skill to provide regular earnings development, even when the broader financial setting turns into more difficult.

Earnings-per-share additionally grew through the pandemic, which is simply one other instance showcasing the resilience of Altria’s enterprise below numerous robust financial environments and unsure buying and selling situations.

Given Altria’s publicity to recession-resistant merchandise, it ought to maintain up very effectively through the subsequent downturn.

Dividend Evaluation

Altria’s present annual dividend is $3.92 per share. With the corporate shares at present priced at $46, Altria has a excessive yield of 8.5%.

Given Altria’s outlook for 2024, diluted EPS is predicted to be $5.06. Consequently, the corporate is predicted to pay out roughly 78% of its EPS to shareholders within the type of dividends.

Because the firm has sturdy adjusted working corporations revenue (OCI) margins, low CAPEX, little competitors, and a really huge moat, it may possibly afford to pay out a big portion of earnings safely. For its half, Altria has a goal payout ratio of about 80%.

Altria is a Dividend King, which is an elite group of shares which have every raised their dividend for 50 consecutive years or extra. This reveals Altria’s dependability as a dividend development inventory.

The dividend seems to be sustainable, and we estimate the corporate will proceed to develop the dividend at an annual development charge of about 2% over the medium time period.

The 8.5% dividend yield could be very enticing for buyers who focus totally on revenue.

Last Ideas

Altria has elevated its dividend every year for over 5 a long time, a extremely spectacular monitor report. It now faces uncertainty because of the continued decline in smoking charges, but it surely has made investments to cope with the altering shopper panorama by increasing into new merchandise akin to heated tobacco, e-vapor, and hashish.

The corporate can be counting on these segments to gasoline continued development within the years to return. Subsequently, the inventory appears very enticing for revenue buyers.

If you’re enthusiastic about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources can be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].