Nikada

Preamble

Of late, I’ve written a few sell-while-you-can articles. For individuals who observe Deere & Firm (DE), chances are you’ll recall the article I penned forecasting an imminent drop within the inventory value. Though, I’ve coated NVIDIA (NASDAQ:NVDA) (NEOE:NVDA:CA) funding in AI minnows, which evokes optimistic optimism in Nvidia’s future dominance in AI, this text is extra of a harbinger of robust instances forward in markets outdoors of the collective West and the Chinese language market.

Those that hold abreast of chip associated tales will probably be conversant in the US authorities’s sanctioning of China with the passion of a Wall Avenue banker promoting Mortgage-Backed Securities to the Greeks. As an illustration, in October final 12 months, it was reported that the US authorities tightened export restrictions on Nvidia’s most superior AI chips. These chips, which had been designed for the Chinese language market below earlier laws, then had been banned for export. This transfer escalated the tech warfare and China condemned the restrictions. The US carried out comparable restrictions the earlier 12 months in an effort to stop China from buying highly effective AI know-how.

Quick-forward 1 12 months, and it’s evident that the restrictions haven’t labored. Apparently, regardless of the US ban on promoting superior AI chips to China, varied establishments have managed to accumulate them via resellers, who stay unknown. Consultants who’ve delved into the matter declare that the chips might nicely have been diverted with out the producer’s information. The US is now investigating potential violations, and Nvidia says they’re going to take motion if vital. Server makers declare they complied with laws and the merchandise offered weren’t essentially the most superior.

As chances are you’ll think about, not solely did the restrictions have a restricted impact, however they spurred China to develop alternate options to Nvidia from home-grown corporations resembling Huawei.

As an investor in Nvidia, I’m hopeful that the corporate can efficiently navigate the problems related to promoting into China, nonetheless, different large names, resembling Tesla (Nasdaq:TSLA), have failed to keep up revenues and margin.

Tesla is embroiled in a brutal value warfare in China, and to keep up gross sales towards a rising tide of competitors from established automakers and new EV gamers like BYD and Xiaomi, Tesla has been pressured to slash costs throughout a number of fashions.

These aggressive value cuts have come at a price to Tesla’s income, that are shrinking at an alarming charge in China. Home producers, resembling BYD, supply considerably cheaper automobiles, which might be round a 3rd of Tesla’s most cost-effective possibility.

I’ve beforehand coated the travails of Intel and AMD within the Chinese language market

Nvidia’s Financials

Total, the final quarterly report painted an image of a flourishing firm with a dominant place in AI know-how and laudable long-term development prospects.

Income surged by 262% year-over-year, pushed by the info middle section, and the corporate’s AI-related enterprise is anticipated to proceed its spectacular development.

Certainly, it was onerous to seek out any negatives in any respect. The report went on to focus on the corporate’s rising profitability, ensuing from excessive ranges of operational leverage and a transfer in the direction of higher-margin merchandise such because the Blackwell vary. And given the expansion in all issues AI, buyers are likely anticipating additional above anticipated returns going ahead.

Allow us to not neglect the introduced 10 for 1 inventory break up, which usually propels a inventory value in an investor-pleasing course.

Now, to deal with potential impediments for fulfillment in China. The challenges concerned within the Chinese language markets as a result of export restrictions had been addressed, and the corporate has a method to beat the hurdles set by the US authorities. The truth is, the corporate recommended that extra competitors from Chinese language corporations would galvanise Nvidia to innovate much more.

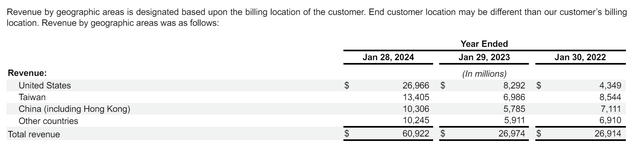

In line with Nvidia’s most up-to-date Type 10-Okay submitting, China accounts for round 17% of Nvidia’s whole revenues. Whereas “different nations” additionally accounts for circa 17%. These “different nations” embrace Western nations and nations outdoors of the affect of the collective West; Indonesia and Russia, for instance.

Nvidia’s regional gross sales (Nvidia Type 10 Okay)

Lately, US export restrictions have restricted the kinds of chips Nvidia can promote in China. As everyone knows, essentially the most superior AI chips have been banned. However now, even these designed particularly for the Chinese language market on account of restrictions have been placed on the banned-for-sale listing.

To deal with this, Nvidia have needed to develop modified, much less highly effective variations of its chips to adjust to US export controls. In a nutshell, Nvidia is caught with promoting merchandise with specs approach beneath their most superior know-how.

To say that the state of affairs is fluid could be an understatement. There are ongoing adjustments in US laws and enforcement actions, which might all affect what chips Nvidia is ready to promote in China.

Huawei

Again in 2023, it was reported that US restrictions on exporting superior AI chips to China might create an surprising alternative for Huawei and their Ascend chips.

Analysts mentioned that Huawei’s Ascend chips had been roughly on par with Nvidia’s China chips by way of uncooked energy, however nonetheless fell brief in efficiency. Nonetheless, the report went on to say {that a} problem lay in growing the software program ecosystem constructed round Nvidia’s CUDA platform. This ecosystem permits for coaching complicated AI fashions, one thing Huawei’s CANN different struggled with on the time. Know-how gurus estimated that it might take Huawei 5-10 years to catch up, however Huawei produced aggressive merchandise far earlier than anticipated.

Newest Stories

Nvidia’s try and deal with the Chinese language AI chip market with their H20 chip is going through an uphill battle. Regardless of being their strongest chip designed particularly for China, the H20 has acquired off to a weak begin. It could seem that there is an oversupply available in the market, forcing Nvidia to slash costs and promote the H20 at a reduction in comparison with Huawei’s competing Ascend 910B chip.

Moreover, Huawei is anticipated to ramp up manufacturing of their Ascend 910B chip this 12 months, a chip that will even outperform the H20 in some key areas.

I’m positive it may be appreciated that the rise of Huawei as a severe competitor must be a serious concern for buyers.

In line with Reuters, analysts have gotten more and more anxious about Nvidia’s long-term prospects in China, a market that contributes considerably to their income. And this value warfare is only one symptom of the extraordinary competitors Nvidia faces in China. China’s push for home chip improvement and a authorities directive to prioritise Chinese language chips are extra complications for Nvidia.

Whereas some Chinese language tech giants have positioned orders for the H20, total demand appears low. Authorities procurement information suggests much less curiosity within the H20 in comparison with Huawei’s providing. To make issues worse, the necessity to undercut Huawei on value mixed with larger manufacturing prices for the H20 is squeezing Nvidia’s revenue margins.

With almost 1,000,000 H20 chips anticipated to be shipped to China within the coming months, it’s claimed that Nvidia’s success hinges on their potential to compete successfully on value and efficiency with Huawei. Nonetheless, in case you ask me, if Nvidia is struggling to promote the H20 cheaper than the Ascend 910B, it’s a really unhealthy omen.

Manufacturing

Huawei has partnered with quite a few corporations, together with China’s greatest chip foundry, SMIC (OTCQX:SIUIF), to supply new superior chips.

SMIC reportedly plans to fabricate Huawei designed chips with out essentially the most superior excessive ultraviolet (EUV) machines, relying as a substitute on older deep ultraviolet (DUV) know-how. The businesses are additionally growing applied sciences that contain self-aligned quadruple patterning, or SAQP, which is able to scale back their reliance on high-end lithography.

Whether or not Huawei and SMIC can use SAQP to realize mass manufacturing of superior chips stays to be seen. This analysis and improvement effort is taken into account an important step for China to probably obtain self-sufficiency in chip manufacturing.

As soon as quantity manufacturing of superior chips has been achieved, it appears to me that there are markets outdoors of China that could possibly be glad.

Potential Markets

It is just about frequent information that Huawei is the equal of persona non grata within the collective West. However they can promote their wares in nonaligned nations, such because the nations that make up BRICS plus or Indonesia. This being so, it’s conceivable that their Ascend vary might quickly be competing with Nvidia outdoors China; definitely, Russia.

Potential clients of Huawei might embrace Chinese language information middle large, GDS Holdings Restricted (GDS), which is making an enormous push into Southeast Asia. Stories are that, via a three way partnership with Indonesia’s sovereign wealth fund, the corporate goals to develop a complete information middle platform throughout Indonesia, with their preliminary give attention to constructing an enormous hyperscale information middle campus in Batam.

This facility will boast a internet ground space of 10,000 sqm and an IT energy capability of 28MW. GDS views this collaboration as a validation of their experience and a springboard for additional growth inside Indonesia.

One other prospect for Huawei’s chips must be Tencent Holdings Restricted (OTCPK:TCEHY), a widely known Chinese language cloud firm. As early as 2012, the corporate constructed a facility in Jakarta, which is now absolutely operational. Other than Indonesia, Tencent has information centres in; the US, Singapore, Russia, Germany, Canada, and India. And there have been a slew of articles describing Tencent’s push into MENA.

Dangers

As beforehand talked about, this text provides an alternative choice to the perpetually optimistic narrative that may be learn often within the media. And, I’m the primary to confess that there are dangers to this less-than-gung-ho-bullish thesis. To begin with, nations outdoors the collective West might insist on one of the best, and at this time limit, no firm comes near Nvidia’s providing.

Secondly, even when some enterprise is misplaced in China, and that appears extremely possible, growth in revenues outdoors of China are set to rise fairly impressively.

Abstract

It’s clear that US restrictions have knobbled Nvidia’s plans to promote their most superior AI chips in China, forcing them to aim to flog decrease specification variations. To complicate issues, Huawei has emerged as a severe competitor.

Huawei’s Ascend chips are gaining traction and will outperform Nvidia’s H20 within the Chinese language market. After all, a decrease demand for the H20 and a value squeeze might impression Nvidia’s income.

Then there may be at all times the likelihood that, at some stage, Huawei might carve out a foothold in different nations via Chinese language information middle targeted companies.