Tara Moore/DigitalVision by way of Getty Photos

Again in January, I mentioned how Canadian hashish and beverage agency Tilray (NASDAQ:TLRY) was principally caught within the mud. The corporate had simply missed avenue income estimates for its newest quarter, with massive losses and money burn placing a pressure on the agency’s stability sheet. As we now method the tip of the corporate’s fiscal 12 months, administration has introduced just a few steps to enhance the financials right here, however extra work nonetheless must be executed.

Trying again at earlier struggles:

Tilray shares soared as excessive as $300 again in 2018 when there was a significant growth for hashish shares, however the bubble burst shortly as progress tales did not materialize. Between a major quantity of competitors in addition to the failure of the US authorities to completely legalize hashish, Tilray has not delivered the most important income progress figures that have been as soon as talked about.

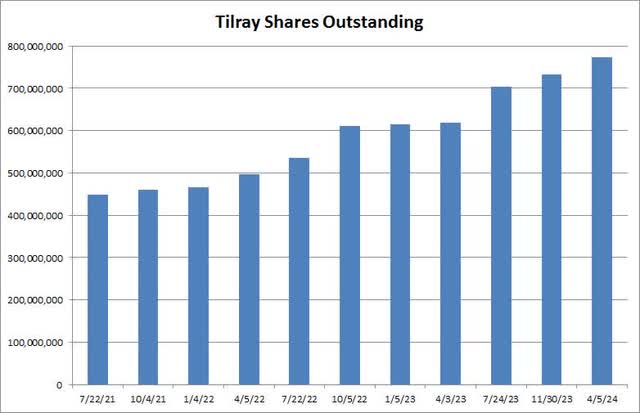

One of many gadgets that has frightened me essentially the most over time is dilution. Tilray administration has handed out shares of inventory like prizes on a sport present, sending the share rely hovering, because the chart under reveals. Even with all of this dilution in recent times, I discussed in my earlier article that the corporate remained in a large web debt place. I said that I could not be really bullish on Tilray shares till this monetary state of affairs was improved in a significant approach.

Tilray Shares Excellent (Firm Filings)

Enhancing stability sheet, however at a significant price:

Because the date on the chart above from the corporate’s 10-Q submitting, the corporate has introduced a number of strikes to deal with its massive debt pile. These embody the next three gadgets:

From the 10-Q submitting on April ninth: entered into an settlement to trade $41.9 million principal quantity of its APHA 24 Notes for cancellation by issuing as much as 25 million shares. Between April 24, 2024, and Could 6, 2024, Tilray entered into sure non-public debt-for-equity trade transactions with unrelated events. The Firm expects to subject an mixture of as much as 15.2 million shares of widespread inventory in trade for $24 million mixture principal quantity of the 5.25% Convertible Senior Notes due June 1, 2024. On Could 13, 2024, the Firm entered into an trade transaction. The Firm expects to subject an mixture of as much as 13.1 million shares of widespread inventory, in trade for $19.8 million mixture principal quantity of the 2024 Convertible Notes.

On the finish of the February fiscal interval, Tilray had over $83 million of these, 2024 convertible notes excellent. After final week’s transaction, it had only a few hundred thousand {dollars} left. This could put whole debt at simply over $300 million, excluding another strikes, through the Could ending fiscal quarter. The corporate began this quarter with about $226 million in money and short-term investments on the stability sheet.

Maybe the most important information on this entrance got here late final week, nevertheless. I have been arguing for some time now that Tilray doubtless wanted to lift capital by way of fairness to shore up its stability sheet. That’s precisely what occurred, with a $250 million fairness distribution settlement being introduced. This transfer will definitely assist to enhance the general monetary state of affairs, however with the inventory buying and selling under $2 a share at the moment, would imply properly over 100 million extra shares being added to the rely if this system is totally executed.

Because of this within the subsequent couple of quarters, we might see greater than a billion shares excellent. All of this dilution might weigh on the inventory within the close to time period, which is why I can not totally purchase in simply but. Nonetheless, the primary subject right here is that the corporate must maintain driving prices down and discover a strategy to ship optimistic money circulate in some unspecified time in the future. In any other case, we’ll be one other fairness providing sooner or later to maintain issues going, in addition to repay all of these different excellent money owed.

Valuation argument improves so much:

On a valuation entrance, Tilray at the moment trades for about 1.9 instances its anticipated gross sales for the Could 2025 fiscal 12 months. That is now a large low cost to the valuation that peer Cover Progress (CGC) goes for at practically 4.0 instances, which is because of Cover’s surge in the previous couple of months on the hopes of US hashish legalization. After I beforehand coated Tilray, it traded at a premium of some tenths on a value to gross sales foundation over Cover.

Road analysts are nonetheless pretty optimistic on Tilray. The typical value goal is at the moment $2.37, implying greater than 20% upside from the $1.90 value shares are at in late morning Monday buying and selling. I ought to notice, nevertheless, that the road common was $2.65 once I final coated the identify, and over $3.50 a 12 months in the past, so analysts are chopping their targets a bit, doubtless on this large ongoing dilution.

Ultimate ideas/advice:

In the case of Tilray, the identify has taken a step ahead in current months by working to enhance its stability sheet. The corporate has diminished its debt pile fairly properly and is now trying to enhance its money pile fairly a bit by promoting fairness. Sadly, these efforts are leading to vital dilution that continues to pile up over time, which is seemingly offering a headwind to shares within the close to time period.

For now, I’m persevering with to fee Tilray shares as a maintain. The potential for US hashish legalization is definitely a optimistic, however it’s arduous to advocate a reputation like this when the excellent share rely is surging this a lot over time. Administration nonetheless has quite a lot of work left to do right here because it appears to be like to chop prices and cut back money burn, so hopefully a few of these debt discount efforts will assist there. Ought to the fairness gross sales program be accomplished within the subsequent few months, and we get some respectable steering on the Could 2025 fiscal 12 months that is about to begin, we are able to have a look at the ranking once more in just a few months.