By Stefano Rebaudo and Rae Wee

(Reuters) -The greenback struggled for course on Tuesday as buyers caught to their views of the anticipated timing of Federal Reserve financial easing this yr.

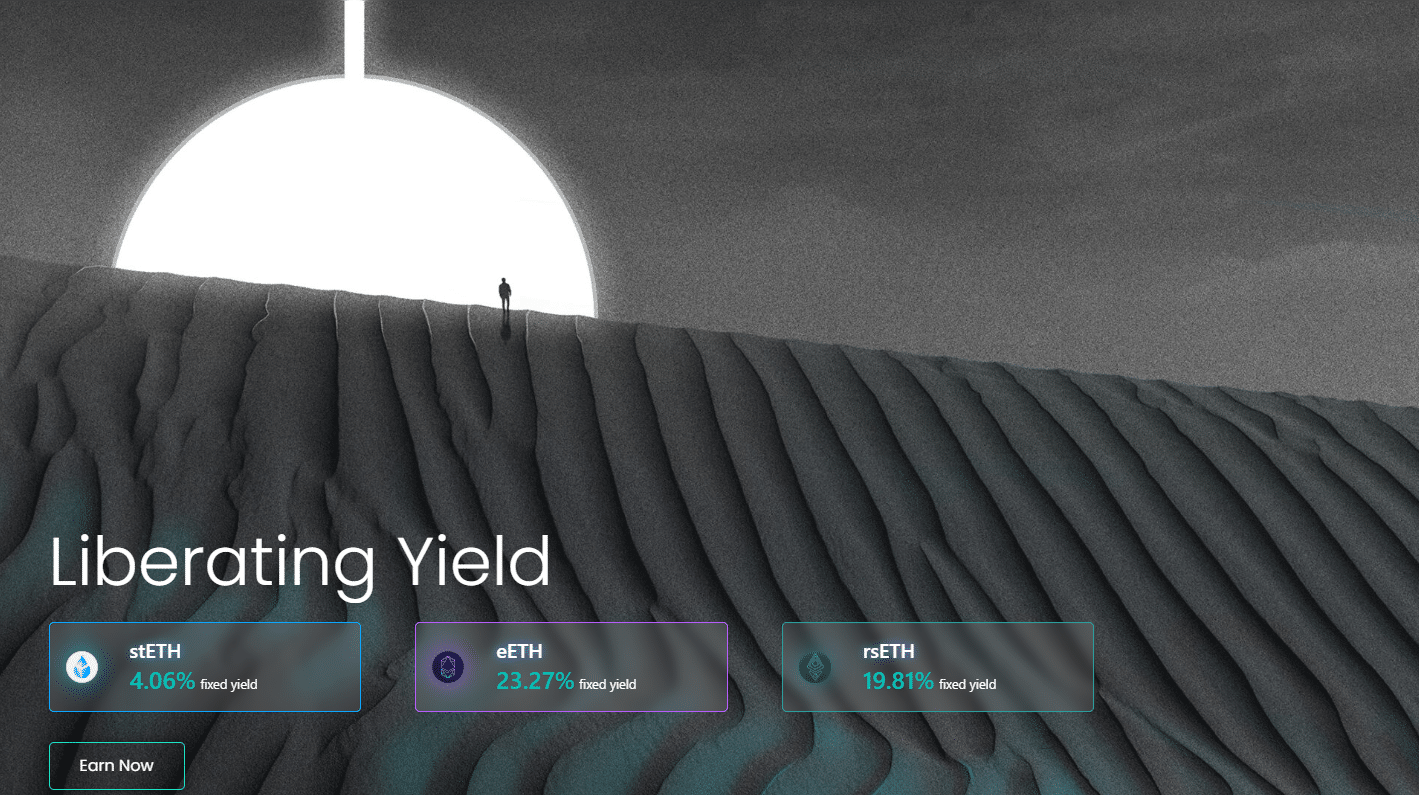

Cryptocurrencies rallied, led by a surge in ether on good threat urge for food and rising anticipation of an impending approval of spot ether exchange-traded funds (ETFs) by the U.S. Securities and Trade Fee (SEC).

The euro edged 0.06% larger to $1.0860.

Traders anticipate Thursday’s information from the European Central Financial institution negotiated wage tracker and euro zone Buying Managers’ Index (PMI) to supply additional clues in regards to the financial cycle within the euro space.

In the meantime, with little on the U.S. financial information calendar this week to information the course of the greenback, buyers’ focus is popping to a slew of Fed audio system.

A number of officers on Monday known as for continued coverage warning, even after information final week confirmed an easing in shopper worth pressures in April.

Cash markets priced in 42 bps of Fed charge cuts in 2024 — implying one 25 bps discount and a 68% probability of a second transfer by December — from absolutely pricing two cuts earlier than latest hawkish feedback from central financial institution officers.

Some analysts highlighted that Atlanta Fed President Raphael Bostic made dollar-positive remarks when he cautioned that the Fed’s benchmark charge would possible find yourself at a better regular charge than previously decade.

With few information releases of observe, “the greenback’s rebound must watch for a extra intensive washout of lengthy positioning,” mentioned Themistoklis Fiotakis, head of foreign exchange technique at Barclays.

“Within the absence of a compelling case for an abrupt U.S. slowdown or a world progress rebound, we nonetheless suppose extra coverage divergence must be priced in between the U.S. and different main central banks, finally favouring recent longs,” he added.

In opposition to a basket of currencies, the greenback dropped 0.08% at 104.52.

On the info entrance, the main focus will now be on the Private Consumption Expenditures (PCE) worth index report – the Fed’s most popular gauge of inflation – due on Could 31.

Within the cryptoverse, ether jumped 4.5% to $3.663.40 after hitting a greater than one-month excessive of $3,720.80. It surged almost 14% within the earlier session – its largest every day share achieve since November 2022.

broke above the $70,000 stage and was final buying and selling 2% larger at $71,128.

“It is completely flown,” mentioned Tony Sycamore, a market analyst at IG. “I feel it is partly to do with that hypothesis, but in addition to do with that core (U.S.) inflation information final week that is boosted threat sentiment and clearly introduced charge cuts again into play.”

In opposition to the yen, the greenback dropped 0.13% to 156.41, not removed from its lowest in over 30 years at round 160, whereas Japan’s yield hit a recent 11-year excessive at 0.983%.

Fears of additional intervention from Japanese authorities deterred merchants from pushing the yen to new lows. Nonetheless, the still-stark rate of interest differentials between the U.S. and Japan maintained the enchantment of the yen as a funding foreign money.

“The large query in the intervening time is whether or not the big Japanese authorities debt, roughly 240% of Japanese GDP, will stay refinanceable even when the Financial institution of Japan (BoJ) is not obtainable as the final word purchaser,” mentioned Ulrich Leuchtmann, head of foreign exchange and commodity analysis at Commerzbank (ETR:).

Leuchtmann identified that the BoJ has communicated for a while that 1% isn’t a set higher restrict for 10-year yields.

The New Zealand greenback fell 0.02% to $0.6103, whereas the slipped 0.03% to $0.6656.

Minutes of the Reserve Financial institution of Australia’s Could assembly out on Tuesday confirmed the central financial institution determined to face pat on rates of interest partly to keep away from “excessively fine-tuning” coverage, however judged a hike is perhaps wanted if forecasts on inflation proved too optimistic.