alengo

It’s been a short time since I’ve printed a portfolio overview, however in latest months, I’ve continued to take strides reshaping my portfolio into my desired long-term kind, so I wished to take a while this week to supply an replace for everybody.

In brief, I’ve been intensely targeted on accumulating shares of blue chip compounders with the potential to provide market-beating returns whereas offering a reliably rising passive revenue stream over the previous 12 months or so… and that pattern continues.

Coming into the 12 months I wrote about my need to simplify issues a bit, lowering my place depend, and getting extra concentrated into my highest conviction concepts. In doing so, I mentioned I’d be chopping ties with low-growth deep worth trades and focus extra of my consideration on the very best high quality compounders (even when that meant paying a relative premium for shares).

That course of has been taking part in out all through 2024, and I’ve decreased my holding depend from 85 shares/funds to 70.

I’ve gotten way more concentrated on the high of my portfolio, and I anticipate to see that pattern play out over the approaching months/years as effectively.

Up to now, I’d get your hands on enticing margins of security on all kinds of dividend progress shares, leading to numerous redundancy throughout my portfolio. That technique labored out effectively as a result of the straightforward recipe of shopping for collections of shares with greater dividend yields than the S&P 500, greater dividend progress charges than the S&P 500, and progress prospects that had been above the S&P 500’s resulted in complete returns that beat the market.

However, work is getting busier. Life is getting busier as the children become older and have extra actions. And I’m getting older (as a lot as I’d hate to confess it, I’ve much less power than I did earlier than…and dealing 50-60 hour weeks persistently is unsustainable).

It was comparatively simple to establish stable firms buying and selling at reductions to truthful worth, however as soon as I purchased them, I needed to sustain with my due diligence transferring ahead. That meant that each new inventory added duties to my each day to-do record.

So, I’ve reformulated my technique a bit…and now I’m targeted on high quality, at the start, and nowadays, as an alternative of asking myself, “Is corporate X undervalued?” earlier than buying it, I ask myself “would shopping for shares of firm X enhance the general high quality of my portfolio?”

If the reply to the latter query isn’t any, then I go (even when enticing worth is clear).

I’ve come to the conclusion that high quality will outperform worth over the long run.

Attributable to adjustments in my monetary scenario, I’m completely satisfied to sacrifice some yield (which is often related to worth shares) within the quick time period whereas enhancing my long-term progress potential.

Fortunately, this hasn’t come again to chew me but.

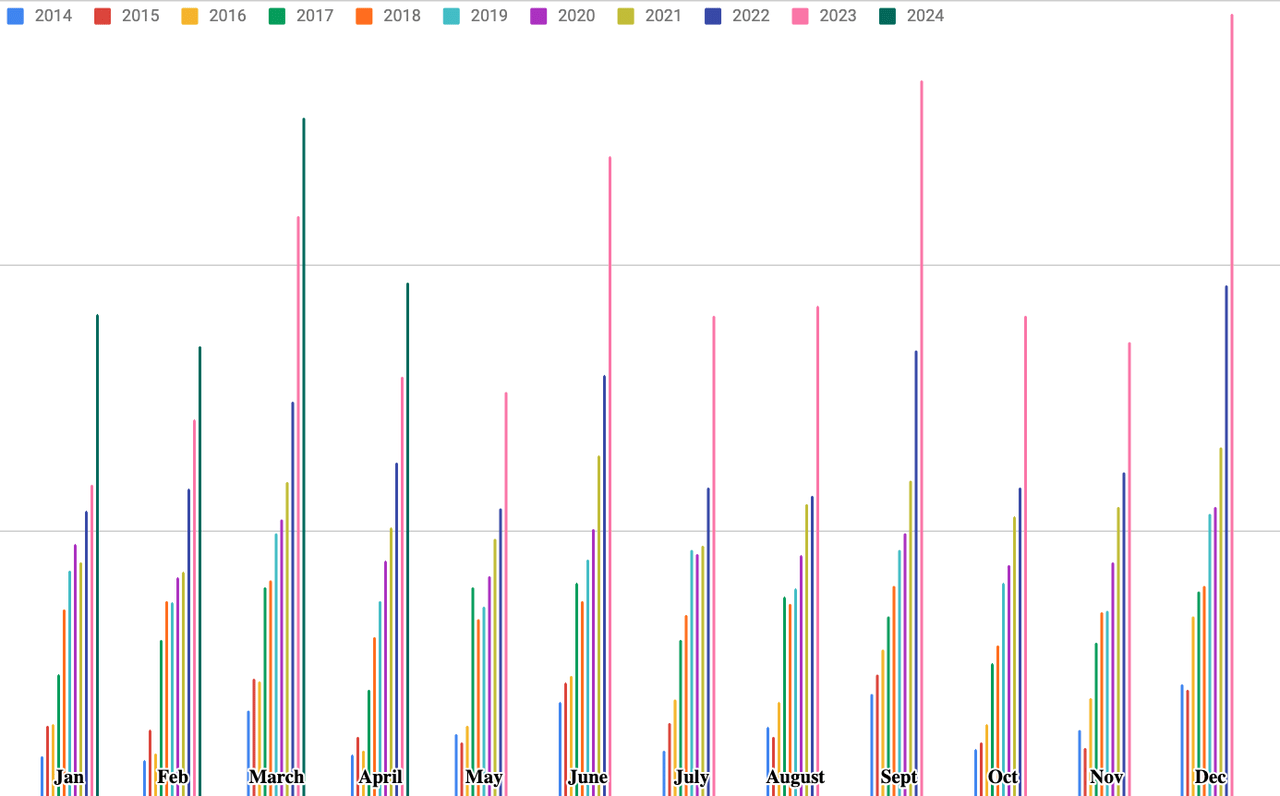

Via the primary 4 months of the 12 months, my passive revenue is up by 25.85% in comparison with the primary 4 months of 2023.

Nick’s Month-to-month Dividend Development Outcomes

However, I’m a realist. Due to latest trades, comparable to exiting the tobacco trade and reducing my REIT publicity (attributable to investments in bodily actual property exterior of my inventory portfolio) I anticipate to see some detrimental y/y dividend progress months later in 2024.

However, that’s okay as a result of the anticipated dividend progress price of my portfolio has by no means been greater. In 2025, I anticipate to see double-digit natural dividend progress once more. I’m trying ahead to seeing the adjustments that I’ve made in 2023/2024 reignite fast dividend progress within the years to return.

Latest Buying and selling Exercise

This transition from a extra worth oriented portfolio right into a extra compounder-centric portfolio – whereas nonetheless specializing in reliably rising passive revenue – has been surprisingly simple all through 2024 with a number of extremely regarded big-tech shares discovering faith on the subject of capital self-discipline and shareholder returns.

As an illustration, I’ve had my eye on Reserving (BKNG) for years, however I might by no means justify proudly owning shares.

This was regardless of its extremely high-quality metrics. Merely put, BKNG simply didn’t verify sufficient of the packing containers that I used to be in search of when screening potential investments.

Nicely, now that the corporate has established a dividend (that has the potential to develop at a fast tempo for years to return) issues have modified. In a matter of months, Reserving went from a 0.00% weighting in my portfolio to my tenth largest place.

For these , I coated my bullish outlook on BKNG shares right here and right here earlier within the 12 months.

When it comes to invested capital, my Reserving Holdings place is my 4th largest…and but, the fast nature of that share depend accumulation doesn’t scare me as a result of I imagine that it is a uncommon alternative to purchase an exquisite firm at a good value.

Coming into 2024, I used to be already very bullish on big-tech. In February, I printed an article titled, “Profitable With Massive Tech: The 2023 Playbook Is The 2024 Playbook”.

The “Magnificent Seven” dominated the market all through 2023, serving to me to outperform.

I don’t personal all 7 of these fabulous shares. I proceed to be completely satisfied to keep away from Tesla (TSLA). However, basically, I imagine that the dependable money flows and best-in-class steadiness sheets that a majority of these firms possess make them all-weather investments and the best shares available in the market for me to purchase and maintain over the long run.

Once I have a look at the market via a broad lens, blue chip big-tech shares stand out to me as among the greatest values available in the market immediately, when factoring in PEG ratios.

With the market making new all-time highs, it’s been onerous to aggressively allocate money to equities as a result of though I’m prepared to just accept extra slim margins of safeties when shopping for compounders, I don’t wish to knowingly over pay for shares.

Irrespective of how excessive an organization’s high quality metrics are, I nonetheless imagine that’s a recipe for long-term underperformance.

The worth investor in me is not gone, that’s for positive. I’m simply targeted extra on high quality than ever earlier than. And massive-tech shares proceed to supply enticing bargains, in that regard.

With that in thoughts, I’ve felt snug build up a big stake in META (after that firm established its dividend in Q1) all year long as effectively.

On the finish of 2023 I didn’t personal a single META share. At this time, META is my eighth largest place, representing roughly 2.5% of my complete portfolio worth.

META is now my second largest funding, so far as value foundation goes, trailing solely Amazon (AMZN), which I’ve been including to all through 2024 as effectively.

One other inventory that I’ve been shopping for in latest months is Salesforce (CRM).

Coming into the 12 months, this was one of many uncommon, non-dividend paying speculative progress shares that I used to be holding in a ROTH, in search of vital long-term beneficial properties. Nicely, after CRM’s administration adopted META’s lead and established a dividend fee, I considerably elevated that place dimension as effectively.

On the finish of December, my CRM weighting was simply 0.2%. At this time, Salesforce is a top-20 place for me, making up roughly 1.35% of my complete holdings.

However, this 2024 transition from worth to high quality isn’t nearly know-how shares.

I’ve been capable of make the most of latest dips in fantastic firms like Zoetis (ZTS) and MSCI (MSCI) as effectively.

I wrote about my bullish outlook on ZTS shares right here, calling it my favourite healthcare inventory.

I not too long ago highlighted my bullish outlook for MSCI on this article, the place I defined my rationale for purchasing shares in the course of the inventory’s latest sell-off.

Cash doesn’t develop on timber the place I reside, although. So, to make all of those buys, I’ve needed to half methods with some long-term portfolio positions to fund this transition.

In latest months, I’ve taken benefit of energy within the healthcare house to lock in earnings with decrease conviction bio-tech/bio-pharma names that I’ve owned for years.

In latest months, I’ve bought out of AbbVie (ABBV) in two separate trades in late April, locking in beneficial properties of 117% at $159.84 after which 89% beneficial properties on a separate lot of shares at $162.02.

With these ABBV proceeds, I purchased shares of META and AMZN at $430.16 and $179.05, respectively.

On 4/16/2024, I trimmed my Johnson & Johnson (JNJ) stake, locking in 15.6% beneficial properties on some shares I held in a retirement account at $145.02.

Alongside JNJ, I took some earnings on my Qualcomm (QCOM) place (which had change into chubby attributable to its latest rally). I bought roughly 41% of my QCOM stake at $168.51 on 4/16, locking in earnings of 121.8% (as soon as once more, in an IRA, so no detrimental tax penalties).

I used the proceeds of those two trades so as to add to my present positions in UNH at $468.86, MSCI at $511.39, ARCC at $20.26, SBUX at $85.93, and BKNG at $3479.33. I additionally initiated a brand new place, shopping for into AWK at $114.13.

These gross sales got here on the heels of my Merck (MRK) liquidation in late February. On 2/22/2024 I bought my whole MRK stake at $129.33, locking in earnings of 75.5%.

With these MRK proceeds I purchased shares of AMZN, BKNG, META, AvalonBay Communities (AVB), and Blue Owl Capital (OBDC) utilizing a barbell strategy from a yield standpoint to take care of my passive revenue.

I’ve had success with bio-pharma investments all through my investing profession, however the increasingly more I take into consideration a majority of these shares transferring ahead, the increasingly more I query whether or not or not they’ve large aggressive moats in immediately’s day and age.

Technological developments are pushing the science of those firms far past my scope of understanding. I anticipate to see innovation on this house proceed to extend at a fast tempo as synthetic intelligence is applied into the invention part of recent medication. And finally, this elevated volatility (from a science standpoint), mixed with the ever current risk of patent cliffs, makes earnings/money flows from these firms extremely tough to foretell over the long run.

Traders on this house who don’t personal superior levels in varied scientific fields are basically trusting administration’s steerage and skill to execute. That’s fantastic, I suppose. To a sure extent, that’s how all fairness investments go. However, to me, I’d choose to have a deeper understanding of my holdings, theoretically main to raised success in terms of predicting basic outcomes.

Due to this fact, I plan to proceed to shift my time, power, and focus away from monitoring bio-pharma firms transferring ahead.

At this level, I’ve principally taken the entire tax-free earnings that I can from bio-pharma firms in my IRA accounts. I’m extra hesitant to promote my massive winners in my taxable accounts as a result of I don’t wish to pay giant payments to Uncle Sam. So, in the intervening time, I’ll probably let my remaining bio-pharma positions experience. However, basically, readers ought to anticipate to see my allocation in direction of bio-pharma holdings fall as a result of I don’t plan on allocating new cash in direction of bio-pharma shares.

It’s been good (largely attributable to time financial savings) to cut back publicity to this space of the market all year long and use the proceeds from these gross sales to bolster greater conviction picks.

In doing so, I’ve misplaced out on some passive revenue (firms like ABBV, MRK, and JNJ yield fairly a bit greater than the compounders that I’ve rotated into). However, I’m assured that the blue-chip tech shares that I’ve rotated the vast majority of these proceeds into will outperform, from a complete return perspective, over the long run.

Rapidly, I ought to be aware that I additionally not too long ago took earnings on Danaher (DHR) at $253.09, trimming roughly 18% of my stake and locking in earnings of 17.1%, to lift funds so as to add to MSCI on its latest dip.

I additionally bought off my whole Essex Property Belief (ESS) place as part of my most up-to-date MSCI addition. I liquidated ESS on 4/23/2024 at $243.02/share, locking in 13% beneficial properties.

Asset Allocation

I believe that almost covers the entire main trades that I’ve made in latest months…so now, let’s focus on asset allocation.

You’ll discover a pattern right here…taking earnings and reallocating the funds to extraordinarily top quality firms.

Now, let’s check out how these trades have reshaped my portfolio from an asset allocation standpoint.

S&P 500 Index

Nick’s Portfolio

Inventory

Weighting

Inventory

Weighting

Microsoft

6.99%

Apple

7.90%

Apple

6.10%

NVIDIA Corp

5.53%

Nvidia

5.00%

Broadcom Inc

5.19%

Alphabet (class A and C mixed)

4.28%

Microsoft Corp

4.84%

Amazon

3.93%

Amazon.com Inc

4.22%

Meta Platforms

2.38%

Alphabet Inc Class A

4.15%

Berkshire Hathaway

1.69%

Visa Inc

3.00%

Eli Lilly

1.40%

Meta Platforms Inc

2.50%

Broadcom

1.31%

Realty Earnings Corp

2.17%

JPMorgan

1.30%

Reserving Holdings Inc

2.07%

Complete

34.38%

41.57%

Click on to enlarge

The S&P 500’s high 10 positions signify 34.38% of the general index.

My efforts to change into extra concentrated into my high concepts have pushed my top-10 place weighting to 41.57%.

Trying on the high 20 positions of the S&P 500, you’ll see a 43.66% weighting.

As soon as once more, my portfolio, you’ll see that I’m way more high heavy, with a 56.62% weighting on my high 20 positions.

Lastly, I’ll be aware that this story is identical in terms of know-how holdings.

For years, I’ve felt snug with an chubby know-how allocation. I view the secular tailwinds that tech advantages from as a defensive mechanism available in the market. Due to this fact, I sleep effectively at evening with an chubby tech allocation.

The S&P 500’s present tech sector weighting is 29.6%.

That’s a hefty chunk of the index, however I’m much more chubby tech, with a 40.7% weighting.

To me, this tech-centric allocation goes to not solely result in long-term outperformance…but additionally, fast dividend progress because of the new shareholder return insurance policies put into place by among the largest, most worthwhile firms on the planet that simply so occur to hail from this sector.

Nicholas Ward’s Dividend Development Portfolio

Ticker

Title

Share Value

Value Foundation/Share

Total Acquire/Loss %

Value Foundation Proportion

Portfolio Weighting

(AAPL)

Apple

$183.05

$22.79

703.20%

1.81%

7.90%

(NVDA)

NVIDIA Corp.

$898.78

$61.61

1358.82%

0.70%

5.53%

(AVGO)

Broadcom Inc.

$1,332.80

$234.30

468.84%

1.68%

5.19%

(MSFT)

Microsoft Corp.

$414.74

$85.56

384.74%

1.84%

4.84%

(AMZN)

Amazon

$187.48

$120.62

55.43%

5.00%

4.22%

(GOOGL)

Alphabet Inc. Class A

$168.65

$45.45

271.07%

2.06%

4.15%

(V)

Visa

$280.74

$124.24

125.97%

2.44%

3.00%

(META)

Meta Platforms

$476.20

$468.39

1.67%

4.52%

2.50%

(O)

Realty Earnings Corp.

$55.01

$59.43

-7.44%

4.31%

2.17%

(BKNG)

Reserving Holdings

$3,805.75

$3,499.68

8.75%

3.50%

2.07%

(BLK)

BlackRock

$796.67

$462.83

72.13%

2.16%

2.02%

(RTX)

RTX Corp.

$106.32

$84.65

25.60%

2.82%

1.92%

(APD)

Air Merchandise and Chemical substances

$250.55

$260.12

-3.68%

3.07%

1.61%

(CNI)

Canadian Nationwide Railway

$127.42

$112.44

13.32%

2.34%

1.44%

(UNH)

UnitedHealth Group

$512.81

$483.07

6.16%

2.41%

1.39%

(PEP)

PepsiCo

$179.79

$115.51

55.65%

1.62%

1.37%

(QCOM)

Qualcomm

$182.08

$42.93

324.13%

0.58%

1.33%

(SPGI)

S&P International

$431.57

$358.53

20.37%

2.03%

1.33%

(CRM)

Salesforce Inc.

$276.67

$294.44

-6.04%

2.60%

1.33%

(MSCI)

MSCI Inc.

$485.16

$470.38

3.14%

2.35%

1.32%

(SBUX)

Starbucks Corp.

$76.11

$54.30

40.17%

1.73%

1.32%

(USFR)

WisdomTree Floating Charge Treasury Fund

$50.43

$50.40

0.06%

2.33%

1.27%

(PH)

Parker-Hannifin Corp.

$561.13

$255.96

119.23%

1.02%

1.22%

(MAIN)

Fundamental Avenue Capital

$49.40

$41.19

19.93%

1.83%

1.19%

(OBDC)

Blue Owl Capital

$16.55

$13.95

18.64%

1.69%

1.09%

(HON)

Honeywell Worldwide

$202.92

$142.19

42.71%

1.40%

1.08%

(MA)

Mastercard

$456.98

$119.79

281.48%

0.50%

1.03%

(TMO)

Thermo Fisher Scientific

$593.03

$529.96

11.90%

1.68%

1.02%

(LMT)

Lockheed Martin

$468.88

$354.14

32.40%

1.41%

1.02%

(AVB)

AvalonBay Communities Inc.

$196.89

$170.35

15.58%

1.56%

0.98%

(BR)

Broadridge Monetary Options

$195.69

$148.90

31.42%

1.34%

0.96%

(KO)

Coca-Cola Co.

$63.26

$42.38

49.27%

1.14%

0.92%

(TXN)

Texas Devices Inc.

$187.05

$110.11

69.88%

0.97%

0.90%

(AMGN)

Amgen Inc.

$310.15

$136.07

127.93%

0.70%

0.87%

(REXR)

Rexford Industrial Realty

$45.11

$52.38

-13.88%

1.82%

0.85%

(DE)

Deere & Co.

$407.89

$347.85

17.26%

1.33%

0.85%

(ECL)

Ecolab

$233.52

$153.95

51.69%

1.03%

0.85%

(ZTS)

Zoetis

$169.04

$168.80

0.14%

1.55%

0.84%

(ARCC)

Ares Capital Company

$21.10

$19.22

9.78%

1.41%

0.84%

(ENB)

Enbridge Inc.

$37.80

$39.33

-3.89%

1.58%

0.83%

(ACN)

Accenture plc

$306.33

$270.99

13.04%

1.31%

0.80%

(ELV)

Elevance Well being

$539.18

$484.59

11.27%

1.29%

0.78%

(CME)

CME Group

$208.46

$196.49

6.09%

1.31%

0.75%

(ASML)

ASML Holding NV

$930.29

$649.43

43.25%

0.86%

0.67%

(CP)

Canadian Pacific Kansas Metropolis Ltd.

$82.93

$71.70

15.66%

1.04%

0.65%

(HSY)

Hershey Co

$204.78

$217.10

-5.67%

1.26%

0.65%

(NOC)

Northrop Grumman Corp.

$474.80

$385.78

23.08%

0.96%

0.64%

(BIL)

SPDR Bloomberg 1-3 Month T-Invoice ETF

$91.56

$91.63

-0.08%

1.16%

0.63%

(DHR)

Danaher Corp.

$253.38

$210.55

20.34%

0.95%

0.62%

(ICE)

Intercontinental Trade

$133.99

$97.23

37.81%

0.81%

0.61%

(JNJ)

Johnson & Johnson

$149.91

$102.62

46.08%

0.75%

0.60%

(LIN)

Linde plc

$434.39

$355.48

22.20%

0.89%

0.59%

(NNN)

NNN REIT

$42.26

$38.38

10.11%

0.92%

0.55%

(AWK)

American Water Works Firm

$135.50

$114.13

18.72%

0.84%

0.54%

(ADP)

Automated Knowledge Processing

$246.86

$238.79

3.38%

0.91%

0.51%

(WM)

Waste Administration, Inc.

$211.49

$159.54

32.56%

0.69%

0.50%

(TD)

Toronto-Dominion Financial institution

$56.62

$65.06

-12.97%

1.01%

0.48%

(MCD)

McDonald’s Corp.

$275.00

$259.46

5.99%

0.82%

0.47%

(BAH)

Booz Allen Hamilton Holding Company

$156.06

$75.49

106.73%

0.41%

0.47%

(SHW)

Sherwin-Williams Co.

$320.86

$219.30

46.31%

0.51%

0.41%

(MCO)

Moody’s Corp.

$400.35

$326.70

22.54%

0.54%

0.36%

(RSG)

Republic Companies

$189.24

$123.71

52.97%

0.39%

0.33%

(PLD)

Prologis

$107.49

$118.30

-9.14%

0.63%

0.31%

(CSL)

Carlisle Corporations, Inc.

$416.63

$228.31

82.48%

0.30%

0.30%

(CPT)

Camden Property Belief

$106.64

$114.08

-6.52%

0.57%

0.29%

(A)

Agilent Applied sciences

$149.76

$116.28

28.79%

0.41%

0.28%

(ARE)

Alexandria Actual Property Equities

$121.59

$130.96

-7.15%

0.50%

0.25%

(PLTR)

Palantir Applied sciences

$20.60

$10.79

90.92%

0.10%

0.11%

Click on to enlarge

Conclusion

So, there you’ve gotten it.

I’ve been busy this 12 months…however all of this work was executed so as to simplify my life a bit transferring ahead, finally saving me time, power, and focus (which I’d moderately be dedicating in direction of my household and new tasks at Vast Moat Analysis).

Solely time will inform if I’m proper concerning the tech sector outperforming over the long run…however an chubby allocation to this space of the market is what has allowed me to beat the market persistently during the last decade+ and transferring ahead, I see no motive to imagine that this pattern goes to finish.

Secular progress prospects, huge money flows, and beneficiant administration groups make these blue chips from the tech sector a sleep effectively at evening investments for me.

Possibly there shall be a market atmosphere the place the Coca-Cola’s of the world (which, I’m nonetheless very completely satisfied to personal, by the way in which) will shine once more. However, to me, most of my favourite shopper steady, discretionary, and industrial shares look like overvalued nowadays, and I’m discovering the perfect worth (on a PEG foundation) within the info know-how/fintech/monetary providers areas.

So, I’ll fortunately take what the market offers me in that regard. You’re definitely not going to listen to me complain about having the chance to purchase top quality compounders with double-digit gross sales, EPS, and dividend progress prospects at truthful (or higher) valuations.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.