With regards to dividend investing, one might do worse than beverage giants The Coca-Cola Firm (NYSE: KO) and PepsiCo (NASDAQ: PEP). Each corporations have two key traits that dividend traders crave: Predictability and excessive yields.

Coca-Cola and Pepsi are two of probably the most predictable dividend payers in the marketplace. Each corporations have paid and elevated their dividends for greater than 50 years (61 years and 51 years, respectively), incomes them the distinguished title Dividend King.

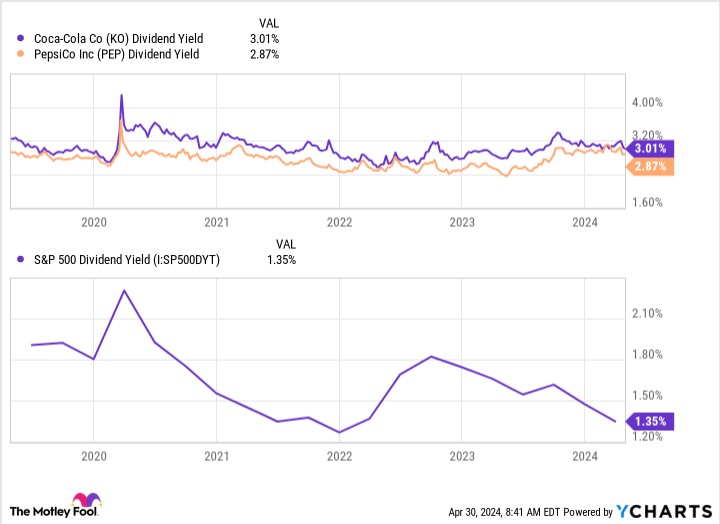

Coca-Cola and Pepsi are additionally each thought-about to have high-yield dividends — a yield is how a lot traders get again in comparison with the worth of the funding. The yield for Coca-Cola is over 3%, whereas the yield for Pepsi is slightly below that. However because the chart under exhibits, the yield for each corporations is greater than double the common for the S&P 500.

Nevertheless, if there is a knock in opposition to Coca-Cola and Pepsi as dividend investments, it is of their potential to develop their dividends.

In February, Coca-Cola introduced that it was elevating its dividend by about 5%. For its half, Pepsi’s newest increase (additionally introduced in February) was higher at 10%. Due to this fact, they’re rising dividends, nevertheless it’s honest to marvel if raises in future years can be as massive as these.

Many traders have a look at an organization’s money stream and examine it to dividend funds to get a way of how a lot a dividend can develop over time. In Coca-Cola’s case, this yr it expects full-year free money stream of $9.2 billion, down barely from 2023. But it surely paid $8 billion in dividends in 2023 and simply raised its dividend by 5%. Due to this fact, future raises may very well be small as a result of its dividend is consuming up numerous its present money stream.

Pepsi is in an analogous scenario. It would not discuss free money stream in its earnings experiences. However taking a look at conventional profitability metrics exhibits a comparable scenario. In 2024, the corporate expects to pay dividends of $5.06 per share. As compared, it expects $8.15 in earnings per share (EPS) this yr. Due to this fact, it expects to pay out 62% of its earnings as dividends this yr, which leaves some room for future raises. However dividend will increase doubtless will not outpace EPS development.

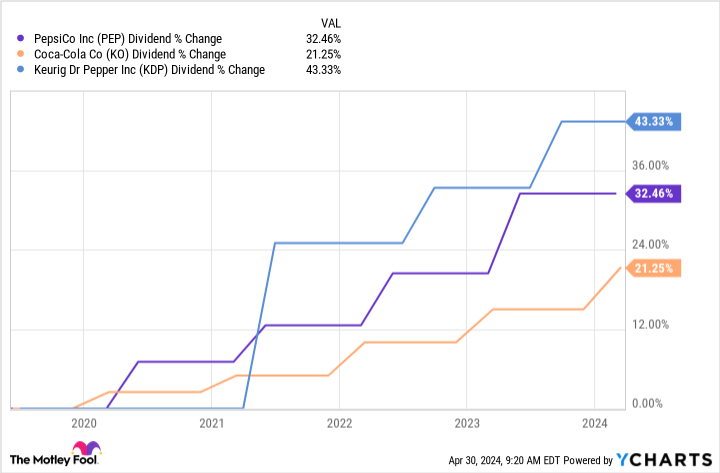

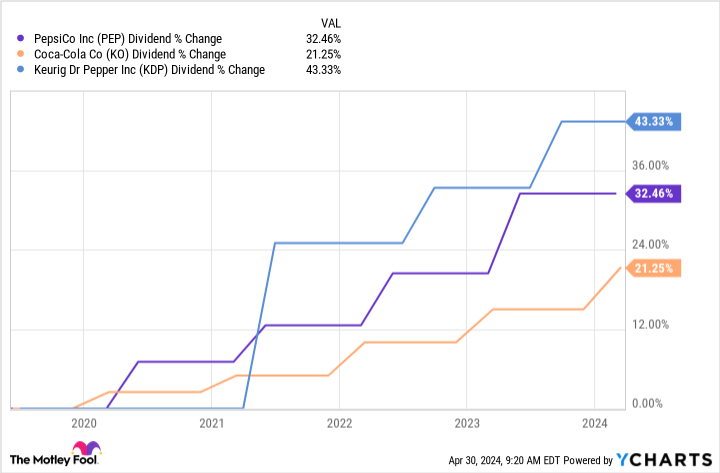

Dividend development is necessary for traders with longer time horizons. That is why dividend traders would possibly wish to give the third greatest beverage firm, Keurig Dr Pepper (NASDAQ: KDP), a glance at the moment.

May Keurig Dr Pepper be a dividend development inventory?

With its dividend yield of two.6%, many dividend traders will look previous Keurig Dr Pepper inventory and purchase shares of Coca-Cola or Pepsi as an alternative, given the upper yields. Nevertheless, Keurig Dr Pepper has elevated its dividend at a sooner price over the past 5 years, and I imagine it might probably do it once more.

Story continues

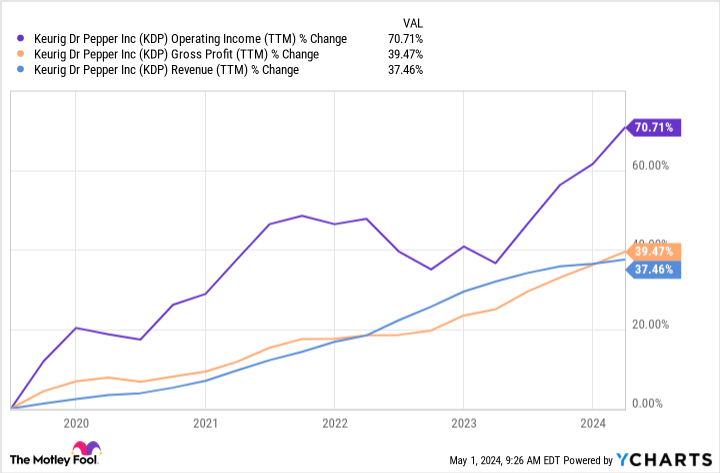

Keurig Dr Pepper simply reported monetary outcomes, and its income are lastly surging after years of disappointing progress.

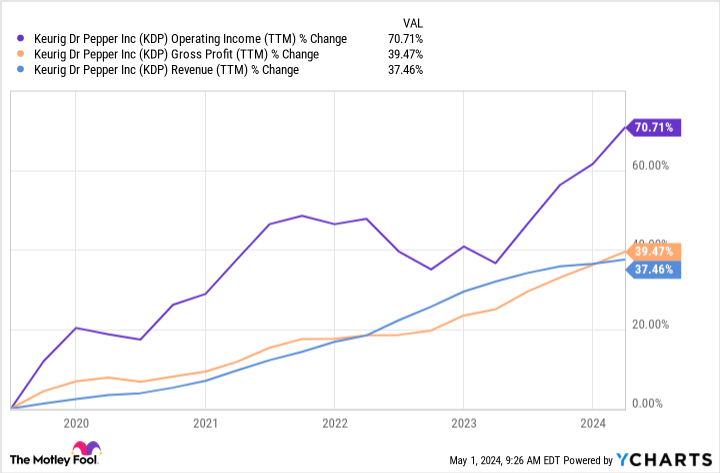

During the last 5 years, Keurig Dr Pepper’s gross revenue development has outpaced income development, which is an efficient factor to see. The corporate’s working revenue development is outpacing progress with its gross revenue, which is even higher. Whereas it is a five-year development, the development because the starting of 2023 is extra pronounced.

Keurig Dr Pepper’s administration credit its enhancements to simply good old school operational self-discipline. What I like about this sort of enchancment is that it isn’t pushed by exterior components, that are unpredictable and maybe not repeatable. The corporate can maintain its success and even additional construct on it.

As it’s, Keurig Dr Pepper has a dividend payout ratio of simply 54%, in response to YCharts. That is far decrease than the payout ratios for Coca-Cola and Pepsi, that are each at 74%. This metric alone means that Keurig Dr Pepper has extra room to develop its dividend at a sooner tempo than the opposite two. And if the corporate retains rising its earnings at a sooner tempo, then it’ll have much more room.

Keurig Dr Pepper will not essentially be the top-performing inventory in the marketplace yr in and yr out — it is a mature enterprise and development is modest. However from a dividend perspective, I imagine Keurig Dr Pepper can provide traders with consistency, a beneficiant yield, and above-average dividend development for the following a number of years and past.

Do you have to make investments $1,000 in Keurig Dr Pepper proper now?

Before you purchase inventory in Keurig Dr Pepper, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Keurig Dr Pepper wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $544,015!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 30, 2024

Jon Quast has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Dividend Buyers Love Coca-Cola Inventory and Pepsi Inventory. However This Different Beverage Inventory Would possibly Be Poised for Higher Dividend Development. was initially printed by The Motley Idiot