Jean-Luc Ichard

Funding Thesis

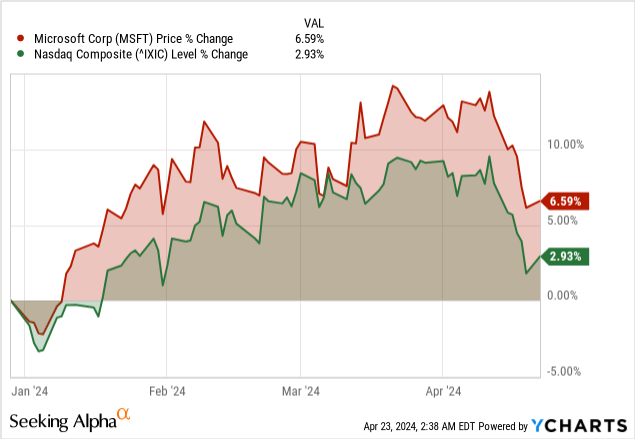

Microsoft Company (NASDAQ:MSFT) accomplished a powerful 2023, attaining a 57% enhance in market worth, which exceeded Apple (AAPL) as probably the most useful firm by market cap. This vital milestone aligns nicely with Microsoft’s long-standing affect within the computing sector. Its Home windows working system has been a cornerstone expertise for many years and is now put in on almost two-thirds of computer systems worldwide.

The software program large has made a mark in virtually all vital transitions from the dot-com period within the data expertise sphere. Its dominance in laptop working programs has been the first catalyst for increasing its affect into virtually all aspects of the software program world across the globe. Likewise, having made a mark with Home windows and different Workplace software program, the corporate can be making a reputation for itself within the multi-billion cloud computing area.

Moreover being the second most vital cloud computing participant out there, it’s flexing its muscle mass within the multibillion-dollar gaming trade with the Xbox online game system. Progress pursued on Home windows, cloud infrastructure, and gaming is why the corporate is immensely worthwhile and one of the coveted shares within the tech house.

Lastly, Microsoft is coming into the AI race, having pledged over $13 billion in an funding within the father or mother firm of ChatGPT, OpenAI. With that funding, the corporate has a front-row seat on among the greatest improvements round AI which might be prone to extremely form its core enterprise, which has been lagging Alphabet’s Google for years.

Furthermore, its aggressive acquisition technique has allowed Microsoft to unfold and strengthen its footprint into among the fastest-growing markets and segments. Because of this, in 2023, the inventory was up greater than 60%, outperforming the 25% achieve of the S&P 500 (SP500).

Microsoft Strong Income Progress

Regular monetary outcomes, fuelled by the AI frenzy, have been one of many major catalysts behind Microsoft inventory’s spectacular run over the previous yr. The software program large has delivered better-than-expected outcomes, signaling progress in its key enterprise segments.

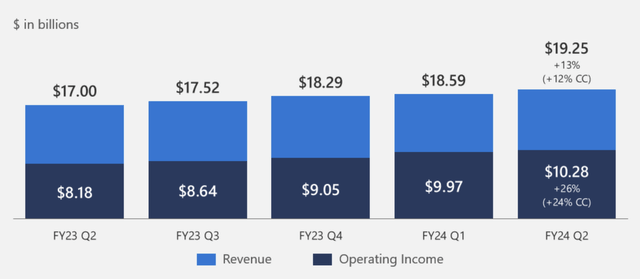

For its fiscal second quarter, which ended December 31, 2023, Microsoft delivered a 17.6% year-over-year (YoY) income enhance of $2 billion. The rise got here as the corporate posted a 13% enhance in Productiveness and Enterprise Processes revenues at $19.2 billion, pushed by Workplace 365 Business income progress of 17%. The section’s workplace shopper merchandise and cloud service income additionally elevated by 5%, whereas LinkedIn income elevated by 9%.

Moreover, income in Microsoft’s Clever Cloud unit was up 20% YoY to $25.9 billion, attributed to a 22% enhance in server merchandise and cloud companies income. Equally, Azure and different cloud companies income have been up 30%.

Chart displaying Clever cloud section income progress (Microsoft)

Furthermore, the gross margin within the Clever Cloud unit was up by 20% within the quarter, pushed by enhancements in Azure as working bills decreased by 8% and working earnings grew by 40%.

However, income within the Private Computing section, which incorporates Home windows units, Xbox content material, and companies, was up by 19% to $16.9 billion. The rise was pushed primarily by a 615 rise in Xbox content material and companies income, as Home windows industrial and cloud companies income elevated by 9%.

Lastly, gross margin within the Private Computing section grew by 34%, attributed to the web affect of the Activision Blizzard acquisition, as working earnings additionally elevated by 29%. Amid the sturdy income enhance within the three enterprise segments, Microsoft delivered a 33% enhance in working earnings, totaling $27 billion. Thus, web earnings elevated 33% to $21.9 billion, translating to diluted earnings per share of $2.93.

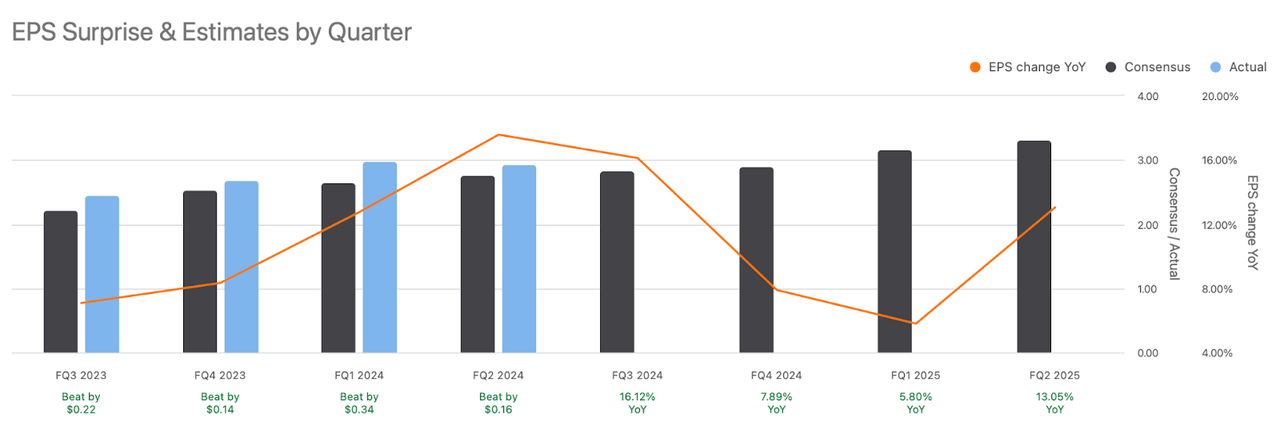

What To Anticipate in Q3

Microsoft is about to report fiscal Q3 FY 2024 monetary earnings post-close this Thursday, April twenty fifth. Analysts are in search of a small step again in gross sales to $60.87 billion after final quarter’s $62.02 billion. This, in fact, would nonetheless symbolize a 19% YoY achieve. EPS is about to rise to $2.84 from the prior quarter’s $2.93, a big 27% YoY soar.

seekingalpha.com

Key Areas of Focus:

Cloud Section: The corporate’s Clever Cloud enterprise has been a strong progress driver. In line with firm tips, revenues from this section are anticipated to rise by $26- $26.3 billion for the third quarter. Azure, Microsoft’s cloud platform, would lead this surge, with CFRA analysts anticipating a 29% uptick, of which six to eight share factors will likely be tied to the AI channel. AI Developments: The AI part will in all probability be underneath the highlight within the subsequent report. Much more noteworthy will likely be Microsoft’s strategic partnership with OpenAI and the deployment of AI applied sciences akin to ChatGPT throughout its ecosystem. The analysts additionally count on a big contribution to the income profile from AI, which, based on them, might be significant for the market standing and progress within the subsequent 5 years. Challenges: Tender segments stay units and Workplace industrial merchandise, which have declined as a result of decreased PC market demand. These are anticipated to proceed underperforming, with the estimates pointing at a low double-digit income discount for Q3.

Microsoft AI Enhance on Search and Cloud

The corporate’s better-than-expected earnings ends in current quarters mirror it is rising as a winner within the AI race. Following its multi-billion funding in ChatGPT developer OpenAI, the corporate expects the revolutionary expertise to be a key driver of its future progress.

The mixing of pure language capabilities from OpenAI early final yr was probably the most unambiguous indication that Microsoft was able to tackle Google search by way of generative AI. With the mixing, the corporate can now provide higher search, extra full solutions, and a brand new chat expertise because it appears to tackle Google search on person expertise.

By leveraging generative AI capabilities, Microsoft hopes to reply extra complicated questions and remedy duties within the web search enterprise. Moreover, Bing search permits individuals to write down emails, create journey itineraries, and simply create quizzes by way of the search engine interface.

Microsoft has additionally made it straightforward for individuals to search for data like sports activities scores and inventory course of recipes on the search engine homepage. Feeling threatened, Google responded by launching its chatbot, Bard, and integrating it into the race to reinforce its Google search device additional.

With AI poised to vary how individuals seek for data on-line, Microsoft has an opportunity to tackle Google, which has dominated the search enterprise for years with a market share of greater than 90%. Along with strengthening Microsoft’s edge within the search enterprise, AI can be strengthening the corporate’s cloud computing options. Because of this expertise, Azure can now deal with all kinds of cloud computing duties with one model of the software program constructed for AI purposes.

The corporate has been including graphics processing items to its information facilities, permitting shoppers to run all AI fashions on Azure. Because of the integrations, Microsoft now has 53,000 Azure AI shoppers. One cause cloud infrastructure accounts for 29% of the corporate’s whole income is the rising variety of AI shoppers.

Microsoft registered a 33% enhance in cloud companies income in its fiscal second quarter, primarily as a result of AI-enhanced Azure, enabling companies to harness huge information’s energy. Instruments like Azure Machine Studying and Azure Cognitive Companies permit organizations to investigate huge quantities of knowledge shortly.

Equally, AI Azure capabilities allow organizations to automate repetitive duties, streamline workflows, and optimize useful resource utilization. The instruments are additionally getting used to create enterprise-specific AI chat purposes, attracting curiosity from huge shoppers akin to Heineken, printer maker Lexmark, and AT&T.

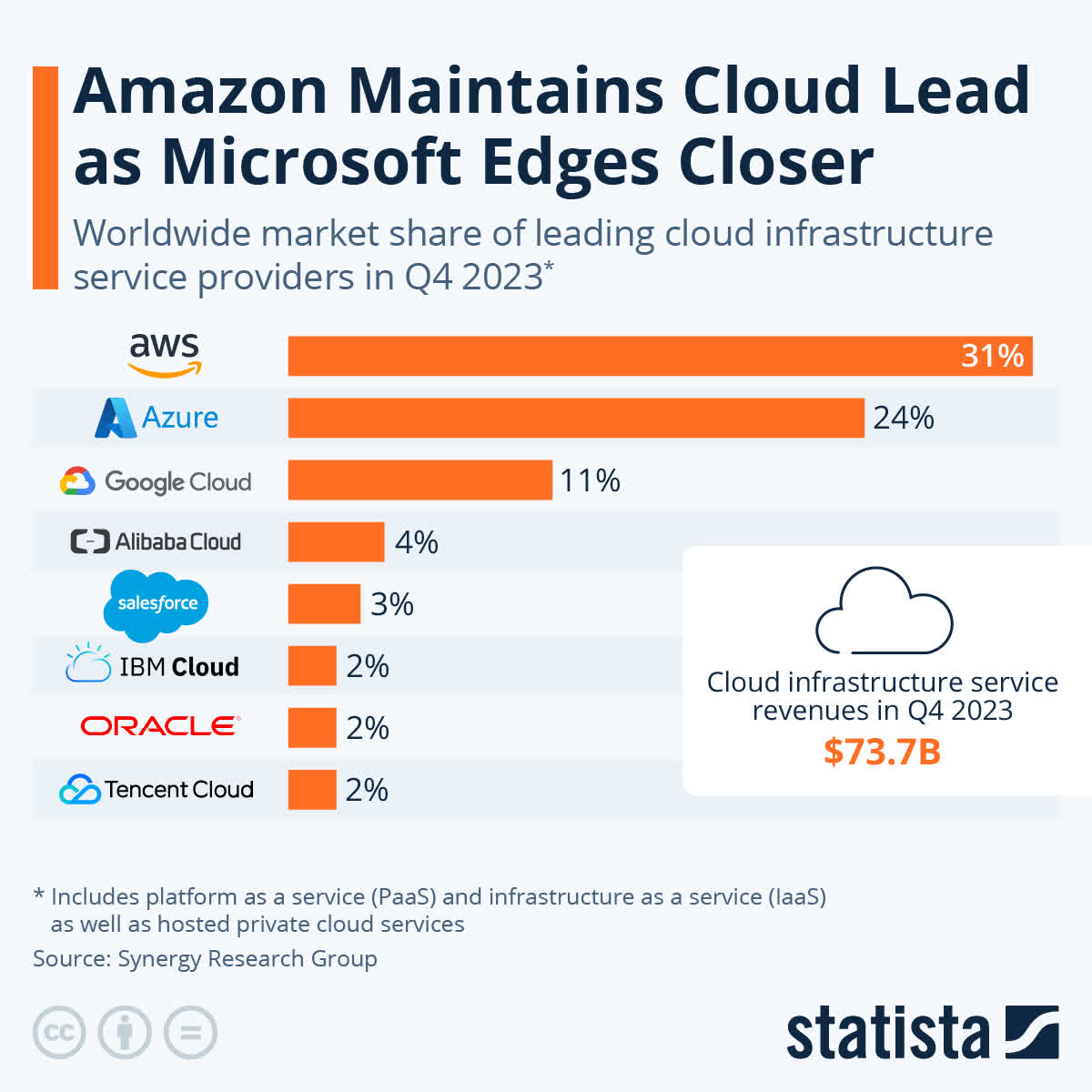

Whereas Amazon’s (AMZN) AWS stays probably the most dominant cloud supplier, Microsoft is slowly closing the hole due to its synthetic intelligence capabilities. Whereas the corporate doesn’t disclose income figures for its cloud infrastructure, analysts consider they’re about three-quarters the scale of Amazon from half 5 years in the past.

Lastly, in the newest earnings name, CFO Amy Hood reiterated that 6% of income progress within the Azure and cloud companies division got here from AI. Which means income in Azure elevated by 30% within the quarter, in comparison with 13% for AWS. Microsoft stays the second-largest participant within the multi-billion cloud computing market, with a 24% market share, behind AWS, which has a 31% market share.

Chart displaying cloud infrastructure market share (Statista)

Microsoft Burgeoning Gaming Alternative

Whereas the main target has been on AI and its affect on Microsoft’s core enterprise, gaming can be rising as a vital side of the enterprise, poised to generate vital long-term worth. Following the acquisition of online game writer Activision Blizzard for $69 billion, Microsoft has beefed up its gaming operations by getting access to recognized titles like Name of Responsibility.

With Activision Blizzard in play, Microsoft can now add new titles to Xbox, subsequently pursuing extra share within the cell gaming house and driving extra subscribers into buying Xbox subscriptions and Recreation Move. Subsequently, Activision Blizzard is already considerably impacting Xbox enterprise income, having jumped by 61% within the second quarter, with 55% of the expansion from the sport writer.

AI-Pushed Progress Poised to Unlock 31% Upside

After rallying by greater than 42% over the previous 12 months, Microsoft inventory is buying and selling 34 instances ahead earnings. Given how AI accelerates progress within the core enterprise, the corporate has what it takes to command a premium earnings a number of. If Microsoft have been to commerce at 35 instances ahead earnings over the subsequent three years and generate near $15 a share, its inventory might commerce at about ~$525 a share.

Moreover, Microsoft has confirmed its skill to return worth to shareholders, which explains why it would command a excessive valuation sooner or later. As an example, within the second quarter ended December 31, 2023, the corporate returned $8.4 billion to shareholders, with $2.8 billion on share buybacks and $5.6 billion by way of dividends.

Backside Line

Microsoft has been among the many most useful corporations for years owing to its large empire round software program, gaming, and units. The corporate has additionally been enormously worthwhile in providing among the most sought-after merchandise and options leveraged by enterprises and common prospects. Having made a reputation as a software program large with Home windows OS, the corporate is already strengthening its edge in cloud infrastructure and gaming.

Likewise, it is without doubt one of the corporations spearheading the unreal intelligence race because it continues integrating varied instruments to reinforce its search device and cloud options. The sturdy income progress that has come into play regardless of the stiff competitors in a number of sectors underlines the corporate’s edge and skill to generate worth. Whereas the inventory trades at 34 instances ahead earnings, it appears undervalued owing to its strong underlying fundamentals and large AI alternative. Microsoft is a strong long-term play for any investor eyeing publicity to the burgeoning AI panorama of cloud computing and gaming.