Alexander Farnsworth

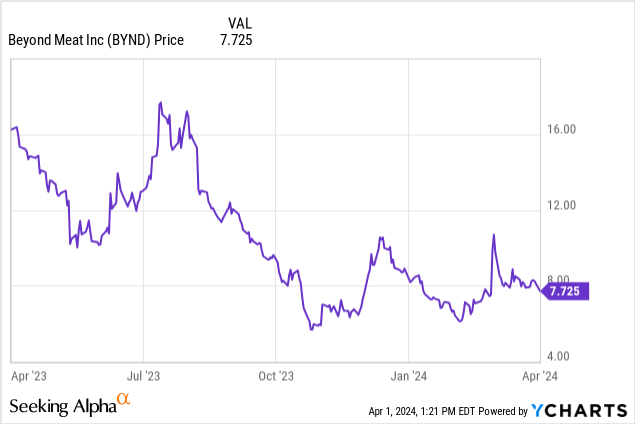

Amid all-time highs within the inventory market, now just isn’t a good time to be banking on speculative, struggling shares. Past Meat (NASDAQ:BYND) falls squarely into this class. The plant-based meat firm has now stagnated beneath years of falling demand, after a quick second within the solar pushed by dietary fads.

Yr to this point, shares of Past Meat have declined barely. The inventory tried a pointy rally after reporting This autumn outcomes and asserting new strategic strikes (reminiscent of its choice to eradicate its struggling Past Meat Jerky product), however that transient respite of optimistic sentiment has since light.

I final wrote a bearish be aware on Past Meat in December, when the corporate was buying and selling above $9 per share. Even now, having moved ~20% decrease, I nonetheless see extra dangers than alternatives on the horizon. I stay bearish on Past Meat.

Some issues that buyers ought to consider right here:

Past Meat is planning for continued contraction in FY24. Its outlook requires a single-digit decline in income. The corporate continues to shed distribution factors each domestically and internationally, reflecting the fading star energy of its model. The profitability story stays difficult. Although the corporate has vowed to simplify its product line and increase its manufacturing margins, it’s nonetheless producing huge losses and has very restricted liquidity left on its books.

We’ll dive into these two components in higher element within the subsequent sections, however the backside line right here: keep away from Past Meat; it is a firm that’s dying a really gradual loss of life with barely a touch of resolving its longer-term points.

An organization in perpetual decline

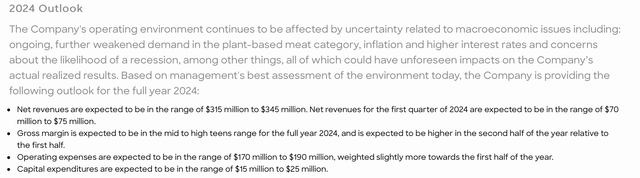

Let’s begin with Past Meat’s outlook for the present yr. The corporate is projecting $315-$345 million in income this yr, which represents as unhealthy as an -8% to a excessive case of flat y/y income.

Past Meat outlook (Past Meat This autumn earnings launch)

The issue: we see barely any hints that the corporate will be capable to do something near flat y/y in income. The corporate exited This autumn at a -8% y/y decline. And although the corporate made the good move to kill an underperforming product (Past Jerky), shrinking down its product line is not going to assist increase efficiency within the different classes.

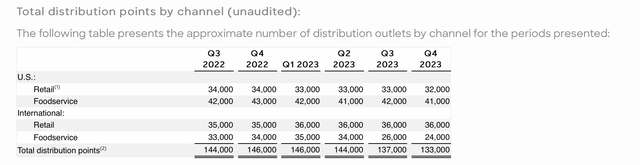

For a number of quarters now, the variety of shops and eating places carrying and promoting Past merchandise has been shrinking. This autumn was no completely different. Whole distribution level globally declined 4k quarter over quartet to 133k. The corporate misplaced 3k eating places globally (1k within the U.S. and 2k overseas), and 1k U.S. retail factors of sale.

Past Meat distribution factors (Past Meat This autumn earnings launch)

Word as properly that with the discontinuation of Past Jerky, the corporate additionally misplaced 44k factors of sale that had been distinctive to the Jerky product. All in all: this doesn’t seem like a setup that’s amenable to development this yr.

Talking to the corporate’s priorities and strategic shifts on the This autumn earnings name, CEO Ethan Brown commented as follows:

One, we’re starting 2024 by executing inside a leaner operation, in step with considerably decreased 2024 deliberate OpEx and money use. Half and parcel with this leaner operation is our ongoing tightening of focus regarding portfolio, markets, and shopper. We’re, as only one instance, discontinuing our Past Meat Jerky product line, regardless of its primary place within the plant-based jerky class. These refinements permit focus and assets to be put in opposition to our newest product platform renovation, Past IV, and different SKUs which you consider have increased worthwhile development potential right here within the U.S. and are in step with my intention to focus extra assets in opposition to key markets and clients in Europe.

Two, we might be rolling out Past IV in U.S. retail and think about this renovation as an vital and probably transformative second for our model and class. Iron sharpens iron and we actually skilled this historic metaphor firsthand. Particularly, the present local weather of misinformation and efforts by incumbents, together with sadly, pharmaceutical pursuits, to poison the plant-based meat properly push us to speed up good points within the well being profile of our product platforms.”

The one vibrant spot is that if we have a look at Past Meat’s gross sales on a per-pound foundation. Comparatively talking, Past Meat has been doing higher abroad than within the U.S., the place demand is tanking.

Past Meat gross sales in kilos (Past Meat This autumn earnings launch)

As proven within the chart above, on a poundage foundation, Past Meat’s gross sales in worldwide foodservice (eating places) grew 53% y/y to five.4 million kilos. Total worldwide quantity, in the meantime, scaled 40% y/y.

The issue, nonetheless, is that Past Meat has resorted to decrease pricing to maneuver quantity. Precise income in worldwide markets grew solely 20% y/y within the fourth quarter, indicating a big lower in worth per pound. And regardless of 8% quantity development globally, income nonetheless declined -8% y/y: reflecting Past Meat’s massive drag from each quantity and ASP shrinkage within the U.S., which right now remains to be roughly two-thirds of total income.

The margin drawback

Worth reductions, in the meantime, deliver us to Past Meat’s ongoing margin issues. The corporate remains to be posting unfavourable gross margins. The corporate is hoping to show margins optimistic once more in FY24 after ending the Jerky line (and taking write-downs on stock in This autumn, which accelerated gross margin losses to over 100% of income)

In the meantime, losses have soared. Adjusted EBITDA for FY23 clocked in at -$269 million, or -78% of income:

Past Meat adjusted EBITDA (Past Meat This autumn earnings launch)

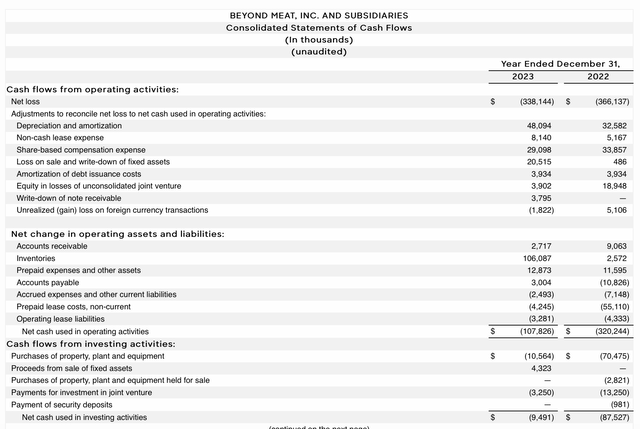

Free money circulation for the yr, in the meantime, was -$118 million, of which -$11 million was capex. Word that the corporate is anticipating increased capex of $15-25 million in FY24!

Past Meat money flows (Past Meat This autumn earnings launch)

In the meantime, Past Meat has solely $190.5 million of money left on its steadiness sheet, and that is not counting $1.14 billion in convertible debt. In different phrases, the corporate has very restricted liquidity left with out elevating extra capital. In mid-March, it filed a blended shelf assertion for a increase of as much as $250 million, however for a corporation in such dire straits any financing the corporate manages to lift might be at an exorbitant value that can solely exacerbate the corporate’s points.

Key takeaways

In my opinion, there continues to be little or no motive to remain invested in Past Meat. Margins are sinking, money is restricted, and factors of sale are dwindling: all of the hallmarks of an organization on its final remaining legs. Steer clear right here.