koto_feja

The AI pattern has lifted virtually each inventory that has a whiff of synthetic intelligence capabilities out there this 12 months. However what generalist buyers need to be cautious of is that AI is a really broad class, and positively not all firms are of comparable high quality.

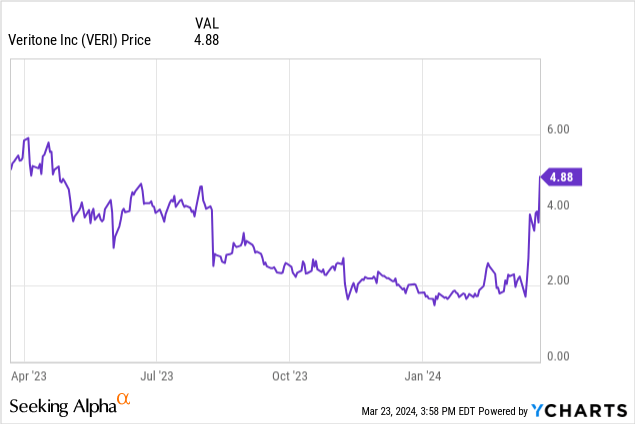

This 12 months’s rally appears to have lifted all boats, together with Veritone (NASDAQ:VERI), an organization based about ten years in the past that has made little or no incremental progress. Yr thus far, the inventory has almost tripled, recouping a lot of final 12 months’s losses as financials deteriorated. Do not belief this phantom rally: it is prone to be short-lived.

I final wrote a bearish article on Veritone final Could, when the corporate was buying and selling simply shy of $4 per share. The inventory had been sleepily buying and selling downward till only recently when the corporate introduced This fall outcomes as nicely as a restructuring plan that goals to chop out a minimum of 15% of annual working bills.

That, in and of itself, needs to be the primary pink flag. AI is having a watershed second this 12 months, and most AI firms are investing in progress whereas the time is ripe: however Veritone is contracting. There is no doubt, in fact, that this transfer is kind of vital for Veritone (we’ll get into the corporate’s shrinking stability sheet later on this article). However the level nonetheless stands: Veritone is definitely not thriving, even when its inventory worth rally this 12 months means that it’s.

Crimson flags abound right here, really. The corporate continues to see precipitous y/y drops in income, and new software program bookings are coming in decrease than final 12 months’s ranges. We word as nicely that not all of Veritone’s income is software-driven; it nonetheless generates roughly half of its income from “managed providers,” or primarily its legacy ad-tech/media administration providers enterprise.

The query right here is survivability: in my opinion, Veritone will discover it tough to ship on its promise of returning to progress and profitability this 12 months. I stay solidly bearish on this title and advise buyers to take a position elsewhere.

Sharp contraction within the high line: the place’s the AI benefit?

The same narrative has performed out throughout most software program firms that ship AI merchandise this 12 months: enterprise adoption is surging as mainstream curiosity has picked up in ChatGPT, serving to these software program firms buck the broader macro challenges and obtain excessive ranges of recent bookings.

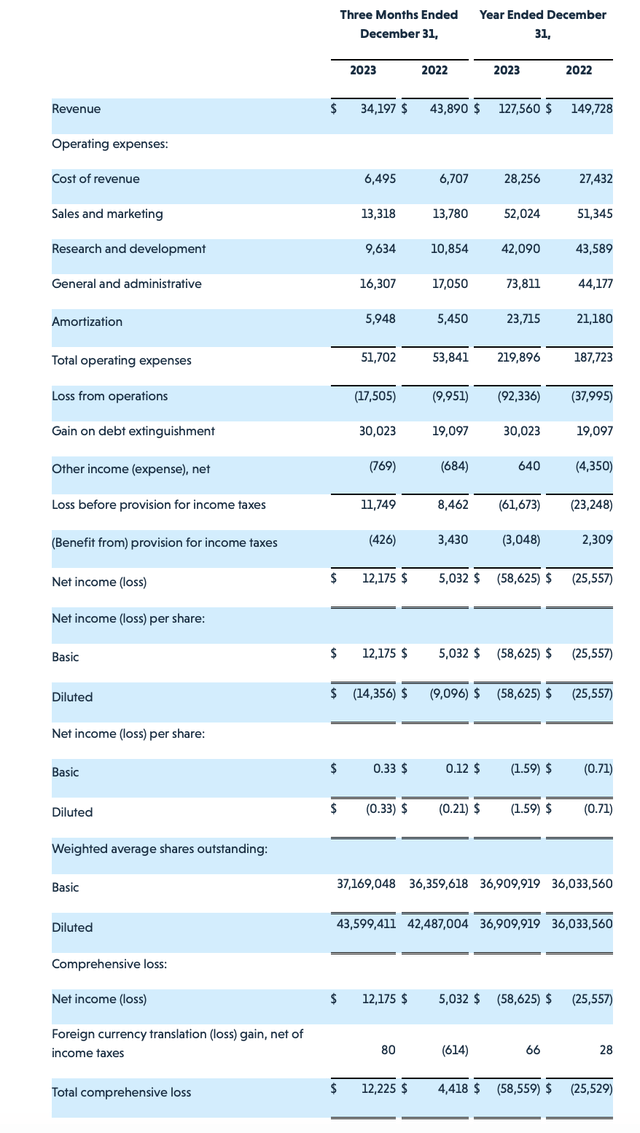

This isn’t the case for Veritone. Check out its This fall outcomes under:

Veritone This fall outcomes (Veritone This fall earnings launch)

Income declined -22% y/y to only $34.2 million (word right here: Veritone is at an extremely small scale vis-a-vis different publicly traded software program firms). Notice as nicely right here that software program income (which is what buyers who’re banking on the AI pattern ought to care about) fell -28% y/y to $19.8 million, whereas managed providers noticed a milder -11% y/y decline.

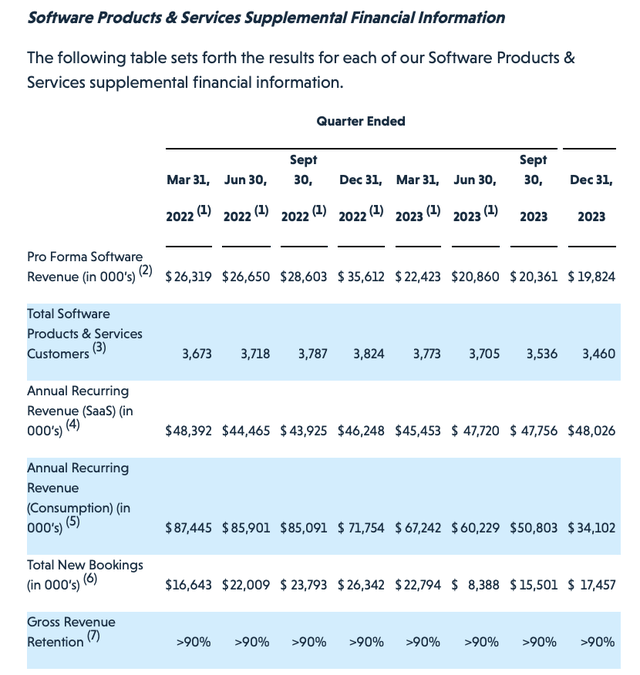

Here is the opposite warning signal to be cognizant about: new software program bookings additionally declined -34% y/y to only $17.5 million within the fourth quarter:

Veritone key metrics (Veritone This fall earnings launch)

The corporate attributed the y/y bookings decline to diminished engagement from Amazon (AMZN), beforehand certainly one of its largest clients. Going ahead, it expects Amazon to contribute to lower than 5% of general income. However that does not imply the danger is concentrated to Amazon solely. In the meantime, the corporate’s rely of software program clients declined by 76 clients quarter-over-quarter to three,460. That is the fourth straight quarter of buyer declines since peaking within the December quarter of 2022.

As a reminder, Veritone’s core AI product is named aiWare. That is primarily a PaaS (platform-as-a-service) providing that provides firms the flexibility to embed AI options akin to transcription and course of automation into internally constructed purposes. A great chunk of Veritone’s software program shoppers sits within the public sector, working with clients akin to native police forces.

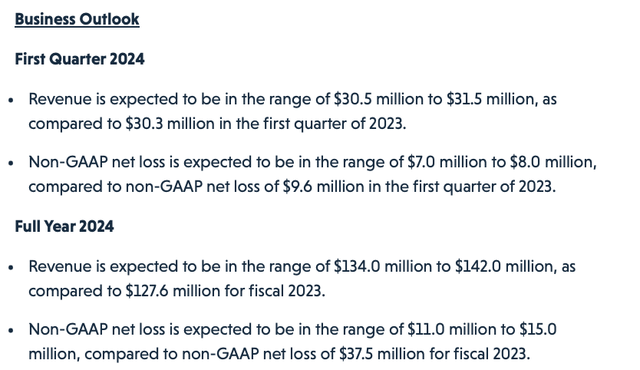

Veritone is projecting to return to complete income progress by the primary quarter of FY24, and for the complete 12 months FY24 to develop at a 5-11% y/y clip, as proven within the chart under:

Veritone outlook (Veritone This fall earnings launch)

To me, we have seen no proof of a path again to progress, particularly with new software program bookings declining in This fall: so we should always deal with this outlook with a heaping grain of salt.

Even with layoffs, can Veritone stay solvent?

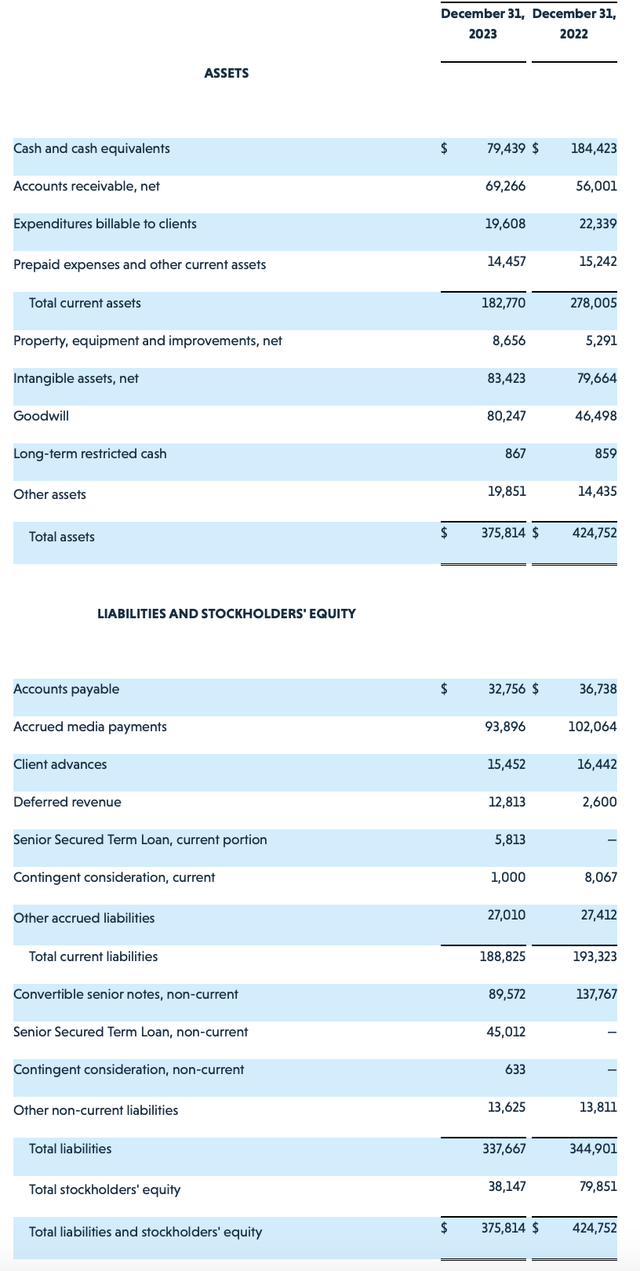

As of the tip of the fourth quarter, Veritone solely had $79.4 million of money left on its stability sheet, and it is really in a slight internet debt place after contemplating its $50.8 million time period mortgage and $89.6 million of convertible debt.

Veritone stability sheet (Veritone This fall earnings launch)

In the meantime, working money stream in FY23 was -$76.4 million. If Veritone does nothing else, the corporate would run out of money by the tip of the 12 months.

In fact, administration is projecting that it’s going to return to profitability and constructive money stream by the second half of FY24 on the again of its layoff plan. Per CFO Mike Zemetra’s remarks on the This fall earnings name:

I am comfortable to report that because of our Q1 2024 restructuring efforts, we executed on over $10 million of further annualized value reductions via at this time, which is included in our full 12 months in Q1 2024 monetary steerage, and we’re not achieved. On account of this section of reorganization, we count on future synergies, each value and income associated to materialize within the latter a part of fiscal 2024, notably throughout our software program services strains.

The Q1 restructuring, together with organizational realignments inside gross sales engineering and company, the results of which was a discount of roughly 14% of our international workforce.”

All in all, the corporate expects a 15% financial savings on working bills. FY23 opex was roughly $220 million on a GAAP foundation; so 15% would translate to $33 million of annualized financial savings. All else equal, this is not sufficient to push Veritone’s money stream again to constructive. And that is to not point out the danger of additional software program deterioration, as has been the pattern over the previous few quarters.

Key takeaways

With a really restricted stability sheet, declining software program income, and what to me looks like unrealistic steerage for FY24, Veritone has a variety of pitfalls forward of it this 12 months. Proceed to keep away from this inventory.