niphon

By Seema Shah, Chief World Strategist

To no-one’s shock, the Federal Open Market Committee (FOMC) selected to maintain the benchmark coverage fee at 5.25%-5.50% on March twentieth.

Extra considerably, the most recent dot plot revealed the committee continues to count on 75 foundation factors of cuts this yr.

That’s regardless of current upside inflation surprises in addition to upward revisions to each its GDP progress and inflation forecasts. This can be a Fed that wishes to scale back rates of interest.

The Fed didn’t make any bulletins with regards the stability sheet, however famous that they may doubtless start to sluggish quantitative tightening pretty quickly.

Current upside surprises

The previous few months have been a very unstable interval for Fed forecasts. As just lately as early February, monetary markets have been satisfied that the Fed would minimize coverage charges at the least six occasions this yr.

But the recent January and February inflation and jobs stories prompted markets to considerably revise their expectations, bringing them in keeping with our personal forecast for 3 cuts this yr, beginning in June.

Within the final week, there was rising hypothesis that the most recent inflation prints represented a setback to the Fed’s efforts to succeed in the two% inflation goal and, as such, the Fed’s dot plot might even see one minimize eliminated this yr.

The truth is, the Fed maintained its median forecast for 3 cuts this yr, suggesting that the Fed believes the current inflation prints might have probably been distorted by seasonal results and, consequently, the broader image of disinflation has not modified.

Updates to the Abstract of Financial Projections

The brand new dot plot and Abstract of Financial Projections (SEP) indicated that inflation has confirmed to be barely stronger than the Fed had anticipated, however financial progress and the labor market are stronger—basically, a comfortable touchdown.

The 2024 GDP progress forecast was revised considerably increased, from 1.4% to 2.1%. Development for 2025 and 2026 have been additionally each revised increased to 2%. This means they count on progress to stay above potential (estimated at 1.8%) for your entire forecast interval. The core PCE inflation forecast for 2024 was revised up from 2.4% to 2.6%, transferring additional away from the two% goal. Whereas this was at the least partially a mirrored image of the higher-than-expected inflation prints for January and February, the implication is that they don’t have to see inflation dropping to 2.5% earlier than they minimize charges. Forecasts for 2025 and 2026 have been left unchanged at 2.2% and a couple of.0%, respectively. The SEP sees unemployment rising to simply 4.0% this yr, and 4.1% subsequent yr.

Regardless of the image of stronger progress and better inflation, the brand new dot plot was solely barely adjusted:

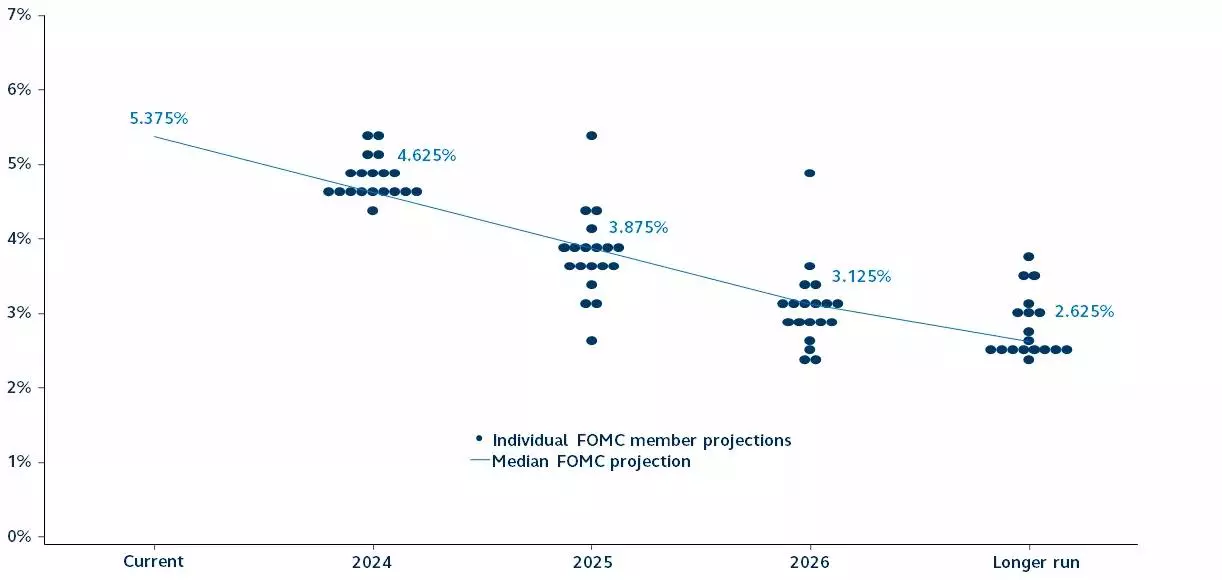

The median projection nonetheless sees charges falling to 4.6% by the top of this yr. This equates to 75 foundation factors of cuts in 2024, unchanged from December. Of the 19 contributors, 18 see three or fewer cuts this yr. Just one sees 4 cuts. Two contributors count on no cuts. The median dot falls additional to three.9% by finish 2025, equal to a different 75 foundation factors of cuts. Against this, the December 2023 dot plot projected 100 foundation factors of cuts in 2025. The median dot then falls to three.2% in 2026, equal to one more 75 foundation factors of cuts. This means that between 2024-2026, the committee anticipants 225 foundation factors of easing. As was a lot anticipated, the median longer run dot was elevated barely, from 2.5% to 2.6% – a (barely) higher-for-longer consequence.

FOMC dot projections

March 2024

Supply: Federal Reserve, Clearnomics, Principal Asset Administration. Information as of March 20, 2024.

Trying forward

Powell downplayed the significance of the current inflation prints, as a substitute referring to the anticipated inflation path as “bumpy.”

He did, nevertheless, acknowledge that the prints haven’t helped their disinflation confidence and famous that they might want to achieve extra proof and confidence that inflation is trending again towards goal.

Even so, the FOMC’s expectation that inflation will solely fall to 2.6% this yr, and that being a ample situation to start out easing financial coverage, will elevate questions on their dedication to the two% inflation goal.

Moreover, chopping charges at a time when the financial system is working above development and whereas unemployment remains to be close to document lows absolutely raises the chance of one other inflation wave.

The general image, nevertheless, was of a Fed that actually needs to chop charges, would wish an excellent motive to not minimize charges, and is sort of assured in its expectations for a comfortable touchdown. Markets couldn’t actually have hoped for a extra market-friendly Fed determination.

Authentic Put up

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.