choi dongsu/iStock through Getty Photographs

As I sit down to write down this night, traders might have burning questions regarding Pagaya Applied sciences Ltd.’s (NASDAQ:PGY) long-term path to profitability. Is the funding nonetheless viable?

There’s a lot to think about amidst latest gargantuan losses and sky-high volatility. Within the earlier week (March 8-15, 2024), Pagaya’s shares suffered a -40% loss in 5 days, precipitated by a reverse 12/1 cut up. Three days following the cut up, there was an surprising secondary providing that went badly (and obtained worse) by the hour, bringing the shares right down to $10.78.

This mini-crash has left the query of why such a debacle came about, and the rationale for the shock secondary providing within the first place.

This text is an try and reply these two questions.

To start with, 2023 featured a big quantity of BUY and STRONG BUY articles touting the progress and success of Pagaya as an ABS (Asset-backed Safety) securitizer. Right this moment Pagaya is the primary issuer of private mortgage ABS transactions within the U.S. The corporate has by no means misplaced a big consumer. As soon as onboarded, they’ve stayed.

As reported within the firm’s latest Fourth Quarter and Full 12 months 2023 Outcomes, there have been regular will increase in community quantity, prospects, securitizations “ABS” (15 in 2023), file income from charges much less manufacturing prices (“FRLPC”), and quarterly-losses are diminishing.

In Pagaya’s 4Q’23 Shareholder Letter (2/21/24), the corporate states,

We’re reaching a degree of sustainable profitability, setting us on a path to ship anticipated adjusted EBITDA within the vary of $150 million to $190 million in 2024, and constructive web money stream by early 2025.” (Web page 5)

Consensus from analysts is that “Pagaya Applied sciences is on the verge of breakeven. They anticipate the corporate to publish a ultimate loss in 2023, earlier than turning a revenue of US$28m in 2024. The corporate is subsequently projected to breakeven round 12 months from now or much less.”

On March 12, 2024, Zach’s upgraded Pagaya to Robust Purchase, citing the latest earnings revisions “as a mirrored image of an upward pattern in earnings estimates — one of the highly effective forces impacting inventory costs.”

So there may be A LOT to love.

But when Issues Look So Good, How Did They Out of the blue Get So Unhealthy?

I feel the crux of Pagaya’s present downside is its fast progress in ABS securitization, juxtaposed with its required compliance with the Dodd-Frank Danger Retention Guidelines for these Securitizations.

Part 15G of the Alternate Act imposes danger retention necessities on any “securitizer” of ABS, roughly 5% (some say it is really nearer to 2-3% in apply) of the ABS that’s securitized.

In 2024, Pagaya estimates it’s going to securitize $9 billion to $10 billion in ABS, which might require a risk-retention funding of $450 million to $500 million in these ABS.

The query on traders’ minds is, “Have they got the cash for this risk-retention funding?” Therefore the doubtless cause for the latest $280 million credit score facility, and the secondary providing and capital increase (Roughly $90 million).

At the moment, the corporate has:

$190 million money. $90 million from the latest secondary providing. $280 million credit score facility. Whole of $560 million.

The sudden sell-off

Traders are unsure. Is Pagaya Applied sciences Ltd. (PGY) experiencing a short lived ceiling of capital constraint, simply earlier than the corporate predicts it’s going to flip totally worthwhile? In a way, it is a race in direction of a shifting goal, with the aim of profitability in a yr’s time.

Right here is how the corporate’s marketing strategy performs out:

There’s a 3-year ramp, starting when a brand new consumer begins the ABS securitization course of with Pagaya. The transactions solely change into worthwhile within the 2nd yr, so there may be roughly a 12-month delay. The danger retention is established when the brand new ABS is securitized.

Pagaya’s detailed clarification of the method

After we onboard a brand new companion, the primary yr – the combination yr – is targeted on increasing throughout the lender’s community of branches, sellers, or retailers, making certain our product is stay and working efficiently at every level of sale.

In yr two – the ramp-up yr – we’re targeted on rising volumes with the lender as our fashions study from the brand new stream, enabling an growing conversion charge, all else being equal.

By yr 3 – the growth yr – most partnerships are totally ramped up and the main focus turns to additional growth and product innovation to drive constant progress in volumes.

To place it into context, the companions and channels we onboarded in 2022 delivered a further $800 million to our community quantity within the first 9 months of 2023, and we anticipate this determine to develop to roughly $1 billion in full-year 2023.

We anticipate that our lately introduced cohort of 2023 integrations (Westlake Monetary, high 5 financial institution (U.S. Financial institution), and high 4 auto (Exeter), that are a lot bigger in whole dimension and quantity potential in comparison with our 2022 cohort, has the potential to generate considerably extra incremental community quantity over the subsequent 12-18 months.

For our 2024 plan, we anticipate that every one of our community volumes will likely be sourced from companions which are already a part of our community as of at present.

As every new buyer is onboarded, a virtuous circle is created of their information, growing conversions.

Pagaya Conversion Charge

…As we obtain increased software stream, we will improve our credit score decisioning capabilities by way of elevated proprietary information, which may result in each an improved conversion charge of purposes and higher returns for traders.

Our fashions get smarter over time as we see extra information – we will detect behavioral patterns, higher predict the influence of macro traits on the flexibility of shoppers to repay or detect cases of fraud. With time, because the predictive energy of our AI fashions improves, we will improve our conversion charge by approving extra loans at related or increased anticipated returns. Larger conversion charges additionally result in a strengthened aggressive moat with our lenders.

After we first plug into a brand new lender, our conversion charge tends to be decrease than common as our fashions begin to practice on a brand new dataset. Over time, as proven within the illustration under, we anticipate the conversion charge for every lending companion, all else being equal, to steadily enhance over time as our fashions study in regards to the incoming information stream.

If Pagaya is pushing up towards a ceiling of accessible assets wanted for his or her 5% funding in new securitizations (2024), they need to resolve this quandary, and with some urgency.

The one means to do that is:

Elevate money by way of secondary choices. Tackle elevated debt, or a credit score line. Decelerate progress (variety of new ABS created) till the profitability of the ABS onboarded in 2023 ramps up later in 2024. Prepare a forward-funding settlement wherein a few of the eventual revenue from the brand new ABS is shared with a guarantor in alternate for a portion of Pagaya’s 5% accountability in every new securitization. The principles permit some extent of horizontal co-sharing. On this occasion, Pagaya loses some profitability within the close to time period, however is ready to develop their guide of enterprise with certainty all through 2024.

When the corporate reaches core profitability by early 2025 (a really doubtless final result), the forward-funding settlement (or parts thereof) would now not be vital, and future ABS may doubtless be self-funded.

In a way, it’s a race each towards time and with time, as a result of the corporate must get by way of 2024’s onboarding of recent purchasers – and the fuller integration of 2023’s purchasers ($) on Pagaya’s platform – earlier than reaching profitability.

Takeaway

There have been voluminous analysis, articles, and convention calls relating to Pagaya’s prospects. There isn’t any data (so far) to help a collapse within the firm or its prospects. The worst that the present state of affairs might be is a short lived ceiling of capital constraint that has now been resolved. The corporate has averred that it got here to the US to create nearer institutional partnerships with American monetary firms, most of whom are headquartered in NYC. If Pagaya was on the verge of imploding, it will not transfer its headquarters to New York to pursue larger transparency in its accounting and to play by extra stringent guidelines.

The corporate stays a Purchase, with a one-year highway to profitability, as beforehand said by the corporate and the analysts which cowl the corporate.

What May Go Proper With This Funding?

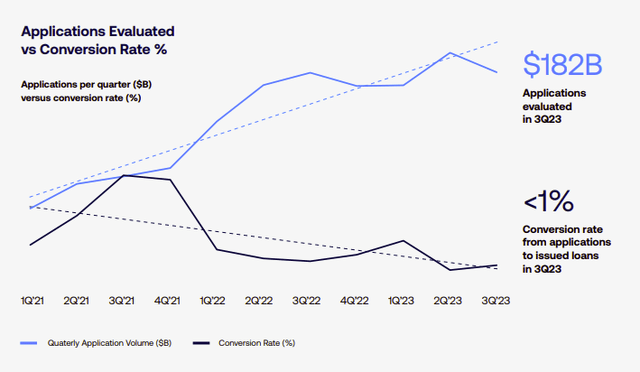

Pagaya estimates it’s going to obtain profitability inside a yr. We’re at present in probably the most restrictive credit score surroundings in 17 years, and but Pagaya is flourishing with solely a 0.8% conversion charge.

Pagaya conversion charge comparability

In a Fed-Easing cycle, that conversion charge may improve by 50% to 1.2%. When credit score circumstances ease, Pagaya’s charges and earnings may improve exponentially, due to 1) the conversion charge of recent loans permitted, and (2) the vastly-increased dimension of its future community.

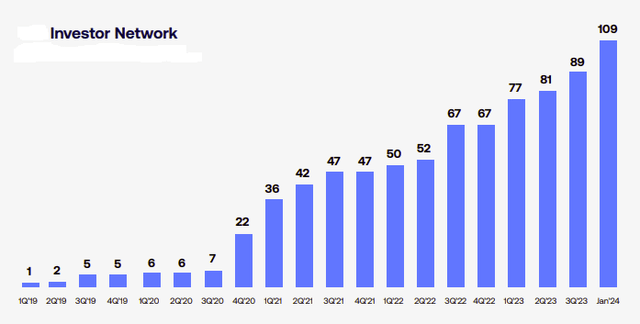

Progress in Pagaya Investor Community (Firm shareholder report (2.21.24))

Draw back Dangers

There are a number of draw back dangers:

Pagaya restates its earnings. 4 weeks in the past, on February 21, 2024, the corporate upwardly revised its earnings estimates for Q1’2024 and for the yr, estimating it will be totally worthwhile by 2025. Nonetheless, if the corporate revised them downward in a shock announcement going ahead, it will have a fabric impact on the share worth. After the latest sell-off on excessive quantity, Pagaya must be thought-about a high-risk funding. Extra analyst downgrades. On March 15, 2024, Wedbush Morgan analyst Dan Chiaverini lowered his worth goal from $18 ($1.50/share pre-split) to $11.50 ($0.96 pre-split), whereas sustaining his impartial score. He cited losses within the risk-retention property talked about on this article. On February 21, 2024, he had raised his estimates from $12 ($1.00/share pre-split) to $18 ($1.50/pre-split). Additional downgrades by extra analysts may have a fabric impact on the share worth. Extra fairness raises or secondary choices, diluting shareholders. Pagaya has a historical past of violent strikes on the information. The newest short-interest on the corporate now lists it at 9% (TD Ameritrade). Due to the small dimension of the float (31.67 million shares), any information can create massive strikes in worth. One other secondary providing later within the yr may drop the value of the inventory considerably. In the identical method, an announcement of a brand new giant consumer, or main financial institution onboarding to Pagaya’s platform, may have a really constructive impact. Uncertainty. Amidst the panic-selling of the final 2 days – and the information vacuum that has occurred within the midst of it – there was little to alter evaluations of the corporate going ahead, moreover what was said by the corporate simply 4 weeks in the past. An absence of a response by the corporate’s Investor Relations to violent strikes within the share worth can rapidly change traders’ confidence to doubt.

Editor’s Observe: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.