By Peter St. Onge, Mises Institute

Argentina’s Javier Milei is racking up some strong wins, with the fiscal basket case seeing its first month-to-month funds surplus in 12 years.

Apparently, it took Milei simply 9 and a half weeks to steadiness a funds that was projected at 5% of GDP beneath the earlier authorities. In US phrases, he turned a 1.2 trillion-dollar annual deficit right into a 400 billion surplus. In 9 and a half weeks.

How did he do it? Simple: he minimize a number of central authorities company budgets by 50% whereas slashing crony contracts and activist handouts.

For perspective, if you happen to minimize everything of Washington’s funds by 50%, you’d save a quick 3 trillion {dollars} and begin paying off the nationwide debt.

It seems it may be achieved, and the world does not collapse into chaos.

Milei Making Quick Progress

Deficits aren’t the one win Milei’s logged. He’s slashed crony regulation, removed foreign money controls, and lately slashed lease costs by eradicating controls — that really led to a doubling of residences for lease in Buenos Aires, slashing lease prices.

Sadly, it is not all easy crusing: a invoice to denationalise corrupt state-owned corporations — to successfully de-Soviet the Argentine financial system — was blocked by the socialist opposition who serve the federal government unions who would lose their jobs.

In the meantime, a significant Milei reform to make it rather a lot simpler to rent folks however would damage unions was struck down by the excessive court docket, which mentioned it should undergo Congress.

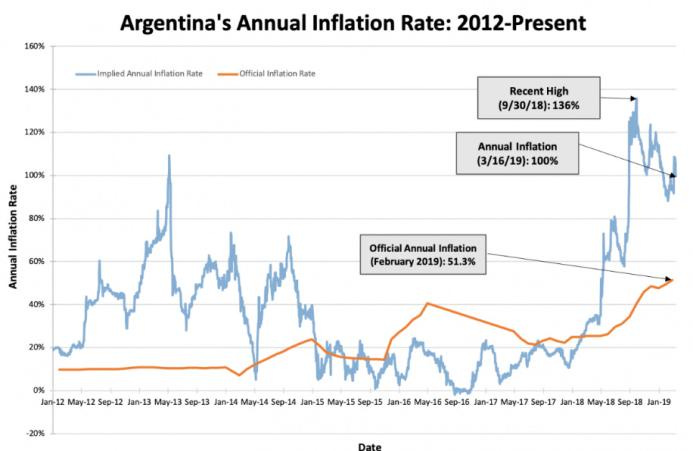

Having mentioned that, for the typical Argentinian, these are deckchairs on the Titanic in comparison with the elephant within the financial system: Argentina’s hyperinflation.

Simply final week, the month-to-month inflation determine got here in at 20.6% — on the month. That was rather a lot higher than the outgoing authorities, but it surely nonetheless left year-on-year inflation at 254%.

Why so excessive? Partly as a result of Milei needed to unencumber the alternate price to easy the trail to dollarization — for Argentina adopting the US greenback as an alternative of the native confetti.

However largely as a result of the rivers of cash printed by the earlier socialists proceed to run by the battered ruins they left of Argentina’s financial system. In any case, Milei’s solely been in workplace for 2 months.

Argentina’s Dollarization

Milei’s reforms will proceed to be trench warfare. However his inflation progress goes to be key to retaining assist.

He simply notched an enormous win with the deficit, but it surely solely stops the bleeding — the affected person continues to be on life assist.

To totally kill Argentina’s hyperinflation, Milei would want to make actual progress on the dollarization — or, dare we dream, a gold commonplace. On dollarization, that might contain saying a months-long window for peso property to be revalued in {dollars}.

He is been making ready the groundwork up to now…(READ THIS FULL ARTICLE HERE).

Contributor posts printed on Zero Hedge don’t essentially signify the views and opinions of Zero Hedge, and usually are not chosen, edited or screened by Zero Hedge editors.

Loading…