e-crow

Do you maintain any royalty trusts in your portfolio?

These entities are primarily inside the Exploration & Manufacturing, E&P, Vitality business – their earnings is derived from preparations with E&P firms that deal with the operations on the Belief’s property and pay the Belief a share of the earnings. MV Oil Belief (NYSE:MVO) is just about a pure play on crude oil, with ~99% of its earnings coming from crude. The revenues from oil manufacturing are usually obtained by MV Companions one month after manufacturing.

Firm Profile:

MVO’s earnings come from a earnings curiosity of 80% of the web proceeds attributable to the sale of manufacturing from the underlying properties through the time period of the Belief. These internet earnings curiosity will terminate on the later to happen of (1) June 30, 2026 or (2) the time when 14.4 million barrels of oil equal (“MMBoe”) have been produced from the underlying properties and bought (which quantity is the equal of 11.5 MMBoe with respect to the Belief’s internet earnings curiosity), and the Belief will quickly thereafter wind up its affairs and terminate.

“As of September 30, 2023, cumulatively, since inception, the Belief has obtained fee for 80% of the web proceeds attributable to MV Companions’ curiosity from the sale of 13.9 MMBoe of manufacturing from the underlying properties (which quantity is the equal of 11.2 MMBoe with respect to the Belief’s internet earnings curiosity).” (MVO Q3 ’23 10Q)

Earnings:

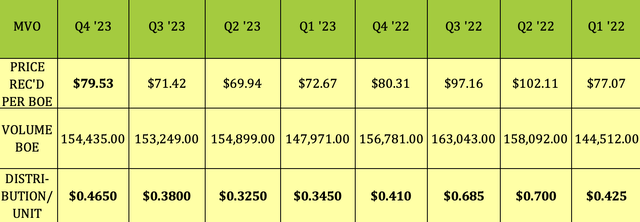

This fall ’23: Whereas Internet Revenue Pursuits, NPI, have been a lot decrease in 2023 than in 2022, they’ve been on the rise previously two quarters, leaping from $3.9M in Q2, to $4.55M in Q3, after which to $5.55 in This fall ’23.

This fall ’23 was the best NPI since This fall ’22.

With the unit rely fastened, and bills and reserves minimal, MVO’s distributable earnings/unit rose from $.38 to $.46 in This fall ’23:

Hidden Dividend Shares Plus

Each quantity and worth per barrel improved in This fall ’23, with worth/barrel hitting $79.53, leading to a better distribution/unit of $.465.

Hidden Dividend Shares Plus

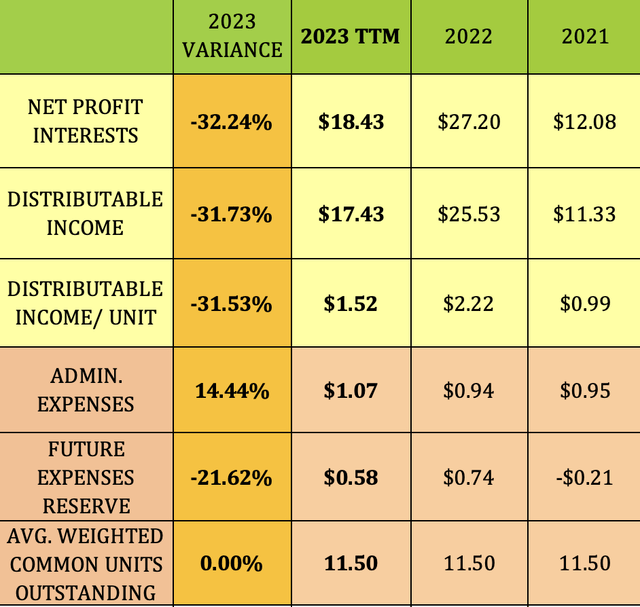

Full 12 months 2023:

Popping out of COVID-impaired 2021, 2022 was an enormous 12 months for MVO, with NPI and distributable earnings greater than doubling. Whereas 2023 was down ~32% for these metrics, it was nonetheless up by ~50% vs. 2021:

Hidden Dividend Shares Plus

Dividends:

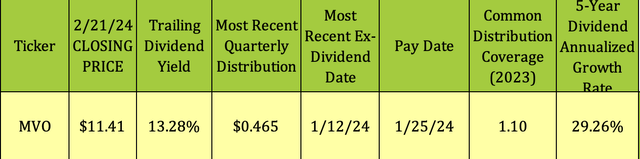

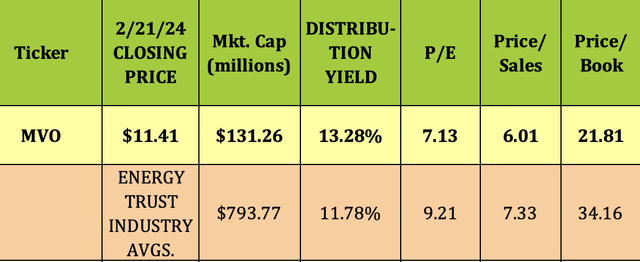

At its 2/21/24 closing worth of $11.41, MVO had a really engaging trailing dividend yield of 13.28%. Its most up-to-date distribution was $.465, which was paid on 1/25/24. MVO goes ex-dividend and pays in a Jan./April/July/Oct. schedule.

Hidden Dividend Shares Plus

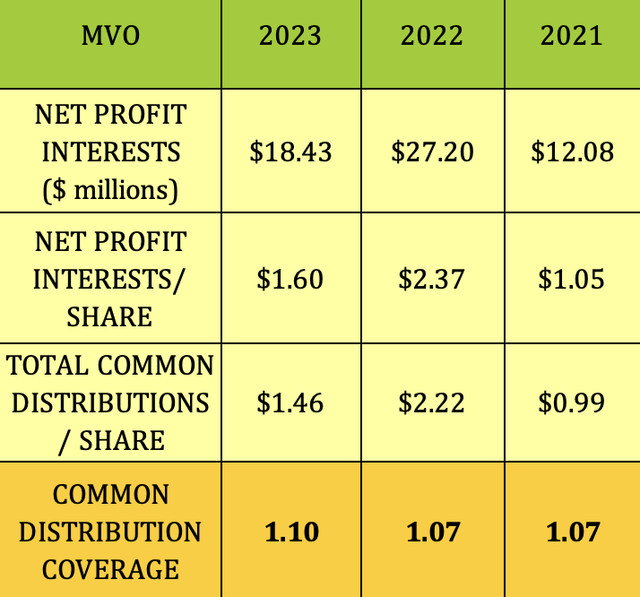

NPI/distribution protection ran at 1.07X in 2021 and 2022, and has elevated to 1.10X in 2023:

Hidden Dividend Shares Plus

Debt and Liquidity:

MVO has no debt. Nevertheless, “The Trustee might trigger the Belief to borrow funds required to pay bills if the Trustee determines that the money readily available and the money to be obtained are inadequate to cowl the Belief’s bills. If the Belief borrows funds, the Belief unitholders won’t obtain distributions till the borrowed funds are repaid. In the course of the three and 9 months ended September 30, 2023 and 2022, there have been no such borrowings. MV Companions has supplied a letter of credit score within the quantity of $1.8 million to the Trustee to guard the Belief in opposition to the chance that it doesn’t have enough money to pay future bills.” (MVO Q3 ’23 10Q)

Efficiency:

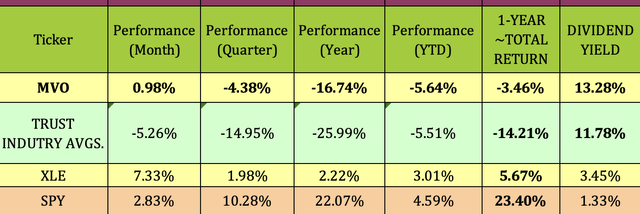

In contrast to 2022, when it surged 84%, the previous 12 months hasn’t been so sizzling for worth efficiency for MVO and different trusts, which fell 16.7% and 26% respectively. MVO’s one-year whole return of -3.46% outperformed the belief business, however severely lagged the S&P and the broad power sector. That lag has continued to date in 2024, with MVO down 5.6% and the Belief business down 5.5%.

Hidden Dividend Shares Plus

Valuations:

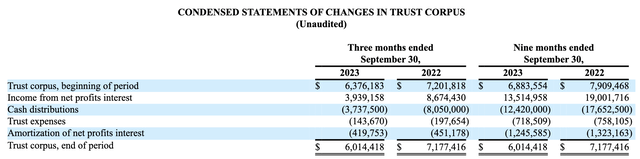

MVO’s corpus, i.e. capital or principal quantity, declined from $7.18M to $6.01M within the 9 months ending 9/30/24.

Hidden Dividend Shares Plus

At its 2/21/24 closing worth of $11.41, MVO’s trailing P/E of seven.13X is less expensive than the belief business’s 9.21X mark. Its Worth/E-book and P/Gross sales are additionally decrease than common.

Hidden Dividend Shares Plus

Parting Ideas:

As of 9/30/23, MVO had obtained the equal of 11.2 MMBoe with respect to the belief’s internet earnings curiosity, up .2 MMBoe vs. 6/30/23. That is not that removed from the 11.5 MMBoe acknowledged as a set off for termination in its SEC filings.

For that motive, we fee MVO a Maintain. There isn’t any This fall 10K filed but, which might replace the whole MMBoe for NPI obtained as of 12/31/23.

All tables furnished by Hidden Dividend Shares Plus, except in any other case famous.