We don’t simply uncover all of the teased shares from these hyped-up e-newsletter adverts all of us see every day… we additionally hold observe of these teased shares, search for tendencies, and monitor efficiency, and the largest story and the largest driver of inventory costs over the previous 12 months has been our newfound fascination with synthetic intelligence. As of now, many of the top-performing teaser picks over the previous 12 months are shares which have some kind of AI connection, whereas past-favored sectors like biotech or oil or mining or different power are filling out many of the backside of our monitoring spreadsheets. You possibly can at all times test on our Teaser Monitoring web page to see which of the teased shares are doing greatest and worst at any second, however I assumed I’d run down the listing of AI-specific teasers for you… we final did this again in October, and the listing has since doubled in dimension.

Immediately we’re nearly a 12 months into the “AI Mania” section of this market, which arguably began when the primary public model of ChatGPT was launched by OpenAI and actually sparked all of it in late 2022, however actually caught hearth when NVIDIA received folks excited with with their February 2023 quarterly replace after which blew up the market with their stunning leads to Could of 2023.

It is a fast rundown of which AI shares have been teased and pitched by the varied newsletters over the previous 12 months, to attempt to reply among the ongoing questions from of us… a number of of those shares are model new, many are very acquainted, and a few of them definitely wouldn’t qualify as “AI shares” if I had been the choose, however now we are able to not less than see them multi function place… and if you happen to’ve been questioning about an AI teaser pitch you’ve seen, hopefully it’s one I coated under. I first put this listing collectively again in October, and all of these shares are nonetheless listed right here, however we’ve additionally now up to date it with each AI-related tease since then.

I’ll undergo them in alphabetical order, and can attempt to listing all of the newsletters who teased the inventory, with hyperlinks to these unique articles… and anything I occur to find out about them. I snuck in a single or two picks that had been teased late in 2022, after ChatGPT was launched, however virtually all of those have been actively teased and promoted by newsletters over the previous 12 months — some virtually incessantly for all of that point, and some only in the near past.

I’ll embody a one-year chart for every, simply to place the inventory in some context (that’s NOT the chart “because it was picked” for any of those, simply the full-year chart — many of those names had been picked by totally different of us at totally different instances).

In case you’ve received different AI “story shares” that you already know are beneficial by varied newsletters or pundits, be at liberty so as to add these within the feedback under so we are able to hold observe of ’em multi function place — and it’s very seemingly, in fact, that some shares that we didn’t see particularly teased by an enormous e-newsletter this 12 months may also be important AI gamers because the sector matures.

And sure, I additionally personal a bunch of those shares personally, full disclosures on the backside in case I neglect to say that in a particular abstract.

Because of the vagaries of the alphabet, we begin with one of many stranger pitches…

1-800-Flowers.com (FLWS) was teased by Motley Idiot Canada in adverts for his or her Market Go service in mid-December (that advert additionally teased Docebo (DCBO) and Mitek (MITK), extra on these additional down), and it appears it was pitched largely as a result of FLWS was a expertise chief in previous cycles (an early e-commerce adopter, for instance, promoting on AOL earlier than most individuals even had web service), and the founder has come again to run the corporate. Right here’s what I stated about that advice on the time:

They’ve innovated and grown, with new manufacturers and acquisitions through the years… however FLWS has by no means generated a ton of free money move or earnings, and when income development collapsed in 2022 after the 2020-2021 e-commerce increase the outlook received so much murkier, although maybe the return of the founder to the CEO position this previous summer time will assist ignite earnings development once more, we’ll see — that choose appears fairly contrarian to me given their historical past, however the income is so excessive, and the worth/gross sales valuation is about as little as it has ever been, so maybe there’s some potential revenue magic hiding of their future.

ABB (ABB.ST, ABBNY) was teased by Eric Wade for his autonomous driving adverts for Stansberry Improvements Report simply final month — self-driving vehicles had been lengthy the first focus of “AI” speak, although that’s not true, in order that’s the sort-of connection, although ABB is an industrial automation and electrical infrastructure play on a much wider scale and has solely restricted publicity to the automotive market (and has extra to do with electrical motors and EV charging than with AI particularly).

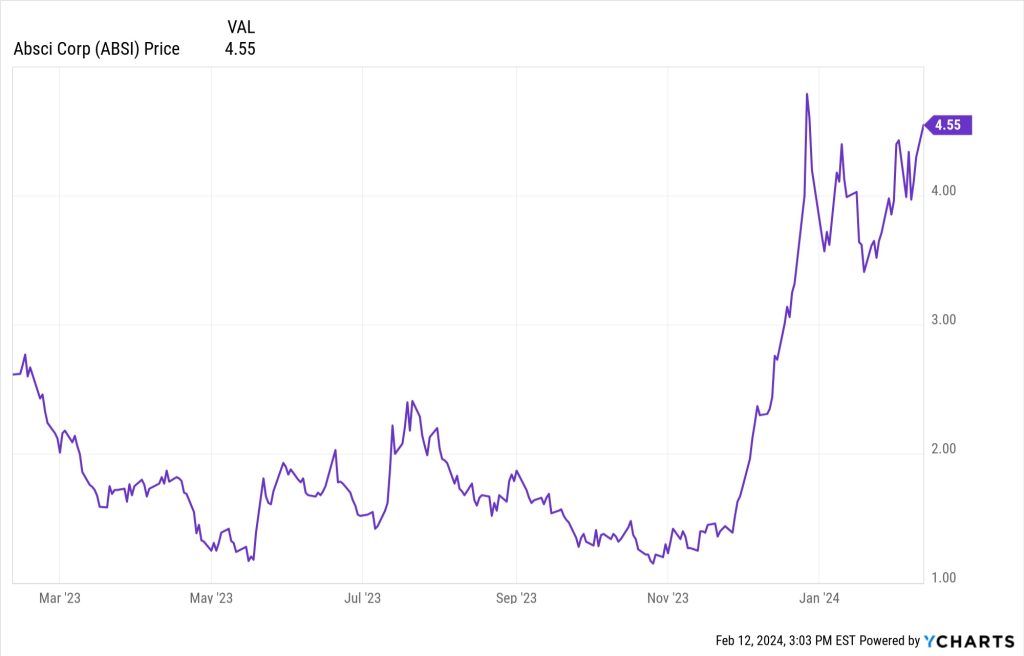

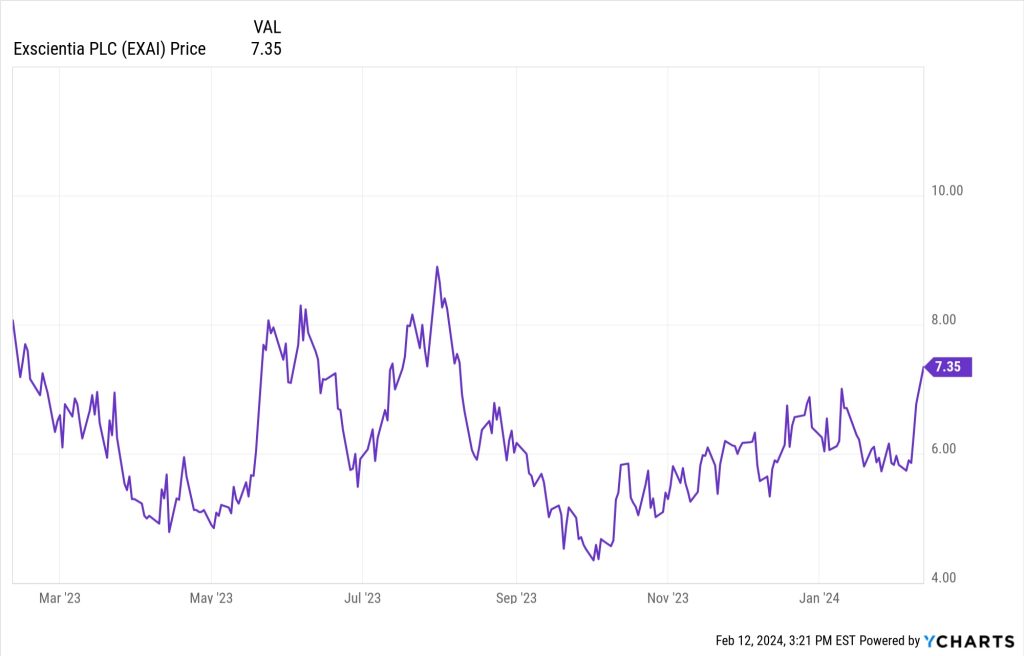

Absci (ABSI) was teased by Alexander Inexperienced at Oxford Microcap Dealer as his “#1 Inventory for 2023” and, extra lately, as his “#1 Funding for 2024” as a “synthetic intelligence inventory that trades for simply $3” largely on the power of ABSI’s AI-powered drug improvement platform and their drug improvement cope with Merck (MRK) (and their “secret partnership” with NVIDIA). (Inexperienced additionally teases Exscientia (EXAI) as an “AI drug discovery” inventory that he thinks “will turn into a very powerful AI firm on this planet” in more moderen adverts for his entry-level Communique e-newsletter, although the ABSI adverts proceed to flow into as properly.)

Superior Micro Units (AMD) is usually talked up as a “subsequent NVIDIA” play, since they’re the second-place designer of GPUs and are attempting to meet up with NVIDIA in information heart GPU chips for AI processing — essentially the most particular pitch of AMD we noticed final 12 months was from Colin Tedards, who took over Close to Future Report when Jeff Brown left Brownstone Analysis and teased it because the Subsequent NVIDIA that may “unlock the following wave of AI earnings” in October.

AMD was teased by Ian King in adverts for his Strategic Fortunes in December of 2023, this was his “A.I. Vitality” play due to AMD’s work at serving to to construct the supercomputers that are getting used to regulate the primary experimental nuclear fusion reactors. They do certainly companion with Lawrence Livermore on that R&D Mission, and AMD is a formidable firm, however nuclear fusion is not going to be shifting the needle for them anytime quickly — their story will likely be written by how properly their Radeon and M100 chips compete with NVIDIA as AMD’s “AI” chips actually start to promote in quantity this 12 months, and, to a lesser extent, by how properly their Ryzen CPU chips compete with Intel. Rollout has been a bit gradual as of the final AMD report, which disenchanted traders, however the subsequent couple quarters will presumably be dominated by dialogue of their gross sales of AI GPUs for information facilities.

Alphabet (GOOGL, GOOG) has been one of many major A.I. shares for a decade, working largely behind the scenes (together with with their acquisition of DeepMind a couple of decade in the past), and it was usually talked about early on as a sufferer, since of us had been initially smitten by Microsoft’s ChatGPT-fueled Bing search as a competitor, although after that preliminary overreaction it bounced again strongly and is now seen as a reasonably core a part of the AI story, together with fellow mega-cap tech firms Microsoft, Meta, Amazon and, extra instantly, NVIDIA. Whitney Tilson pitched this as certainly one of his AI picks in April at about $106, although, like many of the huge tech shares, it’s an funding he has fairly persistently touted for a number of years… Tilson doesn’t have his personal e-newsletter any extra, Empire Monetary was successfully shut down by Stansberry/Marketwise after Porter Stansberry got here again to steer the corporate he based, and Tilson is now the lead editor of Stansberry’s Funding Advisory. The Motley Idiot has additionally lengthy pitched GOOG for his or her “AI Disruption Playbook,” going again to not less than 2018 or so, and there was an enormous push for that tease beginning once more final Fall (coated right here, GOOG is their “Sleeping Large”), and plenty of people have beneficial the inventory for years — most up-to-date was Stansberry Improvements Report, for which GOOG was the “freebie” inventory giveaway in displays due to the power of the Waymo self-driving automobile enterprise.

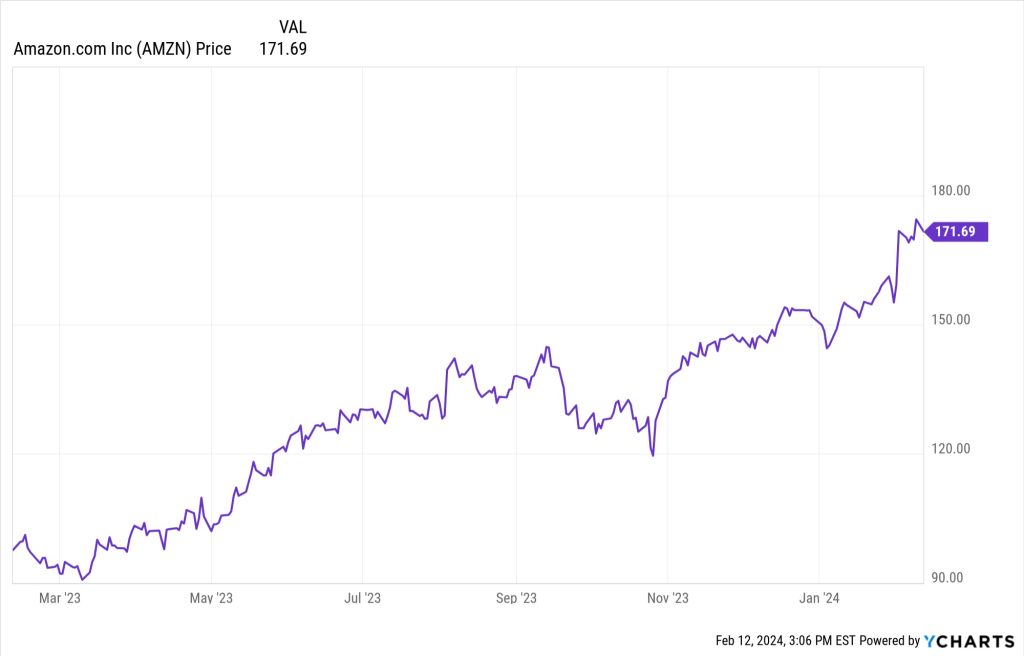

Amazon (AMZN) is, no shock, one of many core AI shares that just about everybody talks about — they use AI on Amazon.com for varied issues, together with pricing and promoting and their advice engine, and AI providers are additionally a key providing for different firms by Amazon Net Companies (AWS). Whitney Tilson additionally teased this as certainly one of his AI picks in April, and, like Alphabet and Meta, he has beneficial it many instances through the years — he touted it in January, too, at round $99, although not likely as an “AI-specific” play, but it surely received the complete AI therapy in mid-April at round $107. I’ve additionally been step by step shopping for Amazon for about six years, although I can’t declare that “AI” was an enormous a part of my reasoning. The Foolies had been on board with this one, too — they added Amazon to the latest iteration of their A.I. Disruption Playbook (they name it their “Whispers from the E-Commerce Shadows” play), and naturally David Gardner on the Idiot is sort of well-known for choosing Amazon again earlier than the dot-com peak within the late ’90s and holding on for 25+ years, giving him a price foundation in AMZN of I take into consideration 15 cents per share at this level.

Ambarella (AMBA) was pitched as a “subsequent wave” A.I. inventory due to their video chips that assist with processing of pictures — the pitchman was Shah Gilani this 12 months, touting it as the following nice chip story within the US in adverts for his L.A.U.N.C.H. Investor, although the inventory has been teased earlier than as a play on drones, or on self-driving vehicles, and the corporate now calls itself an “edge AI semiconductor firm.”

My ideas on the time?

“The final time they reported an actual revenue was again in 2018, and rising bills and slack demand for digital gadgets this 12 months have made issues even worse lately. They definitely might bounce again, as extra “web of issues” gadgets are put in to gather extra information and as extra autonomous gadgets depend on image-capture chips to know the world round them, however the windfalls that Ambarella traders appear to have anticipated for a decade now haven’t come but. Whether or not that’s due to competitors from extra commoditized imaging chips which can be “ok,” or as a result of there are extra superior suppliers on the market that I don’t find out about, they’ve by no means been capable of put collectively actual income development and margin enchancment that may inform traders that the story in regards to the high quality of and demand for his or her chips and designs is actual sufficient to show into precise cash. I actually don’t know why, however, since we’re speaking in regards to the semiconductor enterprise, I believe it’s competitors and pricing stress from their prospects that’s preserving them down.”

Appian (APPN) was, I guessed on the time, a choose by Luke Lango in his AI “SUPRMAN” promo. The attention-grabbing a part of Appian, which is among the unprofitable crop of SaaS shares from the COVID increase that everybody briefly liked, and drove as much as wild valuations of properly over 20X gross sales, is the stickiness of their subscribers. They’re integrating AI into their enterprise on the “low code software program” aspect, however they’ve additionally been speaking about their alternatives in personal AI, AI techniques that could be skilled on public information however are additionally accessing an organization’s personal information and getting used solely internally. I stated on the time that “they’ve been a bit bit left-for-dead after being an enormous winner of the SaaS mania of 2020, they supply a low-code platform for customizing enterprise software program, and so they’ve continued to develop fairly properly… and they’re integrating AI into the enterprise, although it’s not a key a part of their quarterly earnings press releases but.”

Earnings haven’t notably impressed in current quarters for APPN, and there’s been a very good chunk of insider promoting, which traders by no means like to see, although they did launch an “AI Copilot” for builders. They’re nonetheless in all probability not less than 3 years from changing into worthwhile.

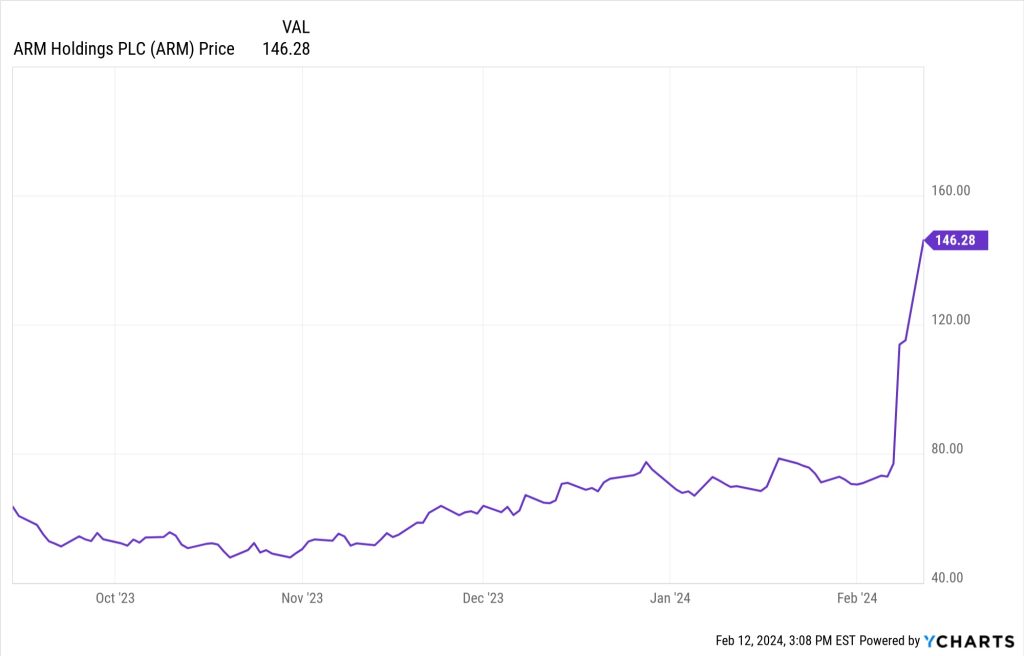

ARM Holdings (ARM) is the latest IPO to be aggressively teased as an A.I. play, in adverts for the Disruptoers & Dominators e-newsletter by Jon Markman at Weiss Analysis. I famous on the time that it’s “maybe a less-direct play on AI chips, since they personal the IP on the essential structure of numerous semiconductors getting used in the present day for every part from cell phones to servers, and revenue from development in demand for brand new chip designs… however they’re additionally way more richly valued, at greater than 70X earnings” — and since then the inventory has roughly doubled in a month on A.I. enthusiasm following its blowout earnings report (so now it’s at 120X forecasted adjusted 2024 earnings).

ASML (ASML) is the monopoly provider of key lithography gear for producers of high-end semiconductors, which implies that as smaller and extra advanced chips are made for AI there could also be extra want for extra of ASML’s big machines. They had been teased for that motive by James Altucher again in October, he known as them the “provider’s provider” as a result of they supply gear that’s wanted by Taiwan Semiconductor, which he known as the “A.I. Crown Jewel.” They’ve additionally been teased on and off by the Motley Idiot because the “most vital firm on this planet,” although that recurring advert doesn’t particularly deal with A.I. as the rationale to purchase ASML.

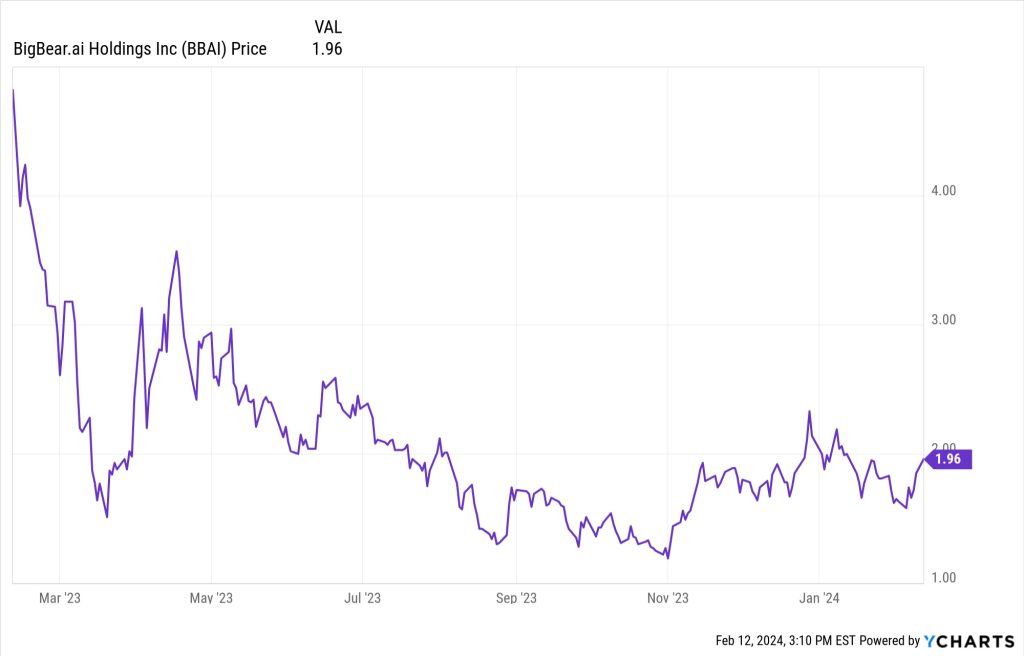

BigBear.ai (BBAI) was touted by Nomi Prins at Rogue Strategic Dealer — truly, she actually beneficial the warrants on BigBear.ai (BBAI.WT), which largely strikes me as dumb, given how low the worth of the inventory already was (the warrants didn’t present all that a lot leverage, given the extraordinarily excessive chance that they’ll expire nugatory). That was one of many first AI picks that the primary wave of next-big-thing speculators jumped on again in January — largely, I believe, simply because it had the “.ai” in its title. BigBear was round $1.75 once we coated that Prins tease on August 30, and the warrants had been round 25 cents… although her consideration instantly spiked these warrants to 60 cents (they’re again down round 35-40 cents now, nonetheless awfully excessive for $11.50 warrants on what’s now a $1.40 inventory.

Right here’s a part of what I stated after I coated this one:

“I’m not so impressed by the corporate — they’re rising their income slowly, and so they’re operating brief on money, but it surely’s potential it’s going to work out if they’ll win some meaningfully bigger contracts (although they’d in all probability must spend closely to meet these contracts, too)… I definitely wouldn’t take the a lot bigger danger of speculating on BigBear utilizing warrants even at 26 cents, and that goes doubly true at 50 cents, that may imply you’re growing the chances of a 100% loss dramatically, on a inventory that’s already a dangerous guess (if BBAI goes up lower than 500% within the subsequent three years, the warrants would expire nugatory… and given the present fundamentals, a return of lower than 500% for the inventory appears awfully prone to me).”

Shah Gilani pitched BigBear.ai (BBAI) shares in August, too, as a part of his “Three AI Breakthrough” shares advert for L.A.U.N.C.H. Investor, choosing smaller firms that he thought would crush NVIDIA, Microsoft and Alphabet. That was at a considerably cheaper price, round $1.30, after the AI mania had began to burn off a bit.

BrainChip (BRN.AX, BRCHF) is a tiny Australian chip designer, it’s been teased since August because the “Subsequent NVIDIA” by Tim Bohen at StocksToTrade, he additionally calls it his “Inception” inventory. The fundamental thought is that this firm would be the savior of autonomous driving, utilizing their partnership with Mercedes and different high-profile firms to get their Akida AI chips into automobiles (and different Edge purposes) to enhance real-world processing, as an alternative of getting to have all that processing accomplished in centralized information facilities. Nonetheless largely pre-commercial and looks as if a enterprise capital-type hypothesis, although it has been publicly traded (and burning money) for a few years.

Braze (BRZE) was pitched by Cabot as their #1 AI inventory again in August at round $42. No huge information since, that is what I stated about it on the time:

“It is a pitch for an AI supplier that’s relied upon by plenty of giant companies, and the Thinkolator’s greatest match (not 100% sure this time) is Braze, which is gives a software program platform for cross-channel buyer engagement/advertising and marketing, together with some advertising and marketing methods that use machine studying to focus on prospects and enhance outcomes. It could be a stretch to name it an enormous AI story, however I assume that’s a potential evolution of what they’re providing. They’re equally valued to numerous smallish SaaS firms (unprofitable, 20%+ income development, buying and selling at ~10X gross sales) — they’ve good metrics, with most of their income being from subscriptions and with 30%+ income development lately, and 122% dollar-based internet retention (which suggests their prospects are sticking round and spending extra annually), however they’re not fairly but at profitability — they could be worthwhile on an adjusted foundation subsequent 12 months. They did have the benefit of going public close to the market peak in late 2021, in order that they have a stable money steadiness that may help their continued development. Looks like an affordable small-cap SaaS story, I don’t know if there’s going to be an enormous AI enhance or in the event that they’re going to have the ability to push by to profitability and start producing earnings development within the subsequent few years, however that’s the trajectory that analysts see proper now.”

BWX Applied sciences (BWXT) has been teased by Porter Stansberry since Could of 2023, although the preliminary adverts simply targeted on a tangential connection to Elon Musk and the proprietor of the “secret power grid” that may save us all, due to their position in constructing small nuclear reactors… however in January, presumably to experience the AI enthusiasm, Porter began pitching BWXT because the “A.I. Keystone” in January of this 12 months as a result of, he says, the one solution to meet the massive energy wants of the unreal intelligence revolution will likely be by massively build up a community of small modular reactors, with BWXT a probable beneficiary (essentially the most talked-up title within the SMR area beforehand had been NuScale (SMR), which was briefly a darling of the SPAC mania a pair years in the past, and does have an authorized reactor design within the US, however which has been clobbered as a result of its first undertaking was canceled — SMR was by no means teased as an “AI” inventory, however Whitney Tilson did lately pitch it as a “E-92” inventory for the nuclear energy renaissance).

Cadence Design Methods (CDNS) was teased as certainly one of three “AI Blueprint” shares by Louis Navellier in December (its solely actual peer in offering the software program utilized by semiconductor builders is Synopsys, which has additionally been teased as an AI play as demand for AI chips grows the semi market typically).

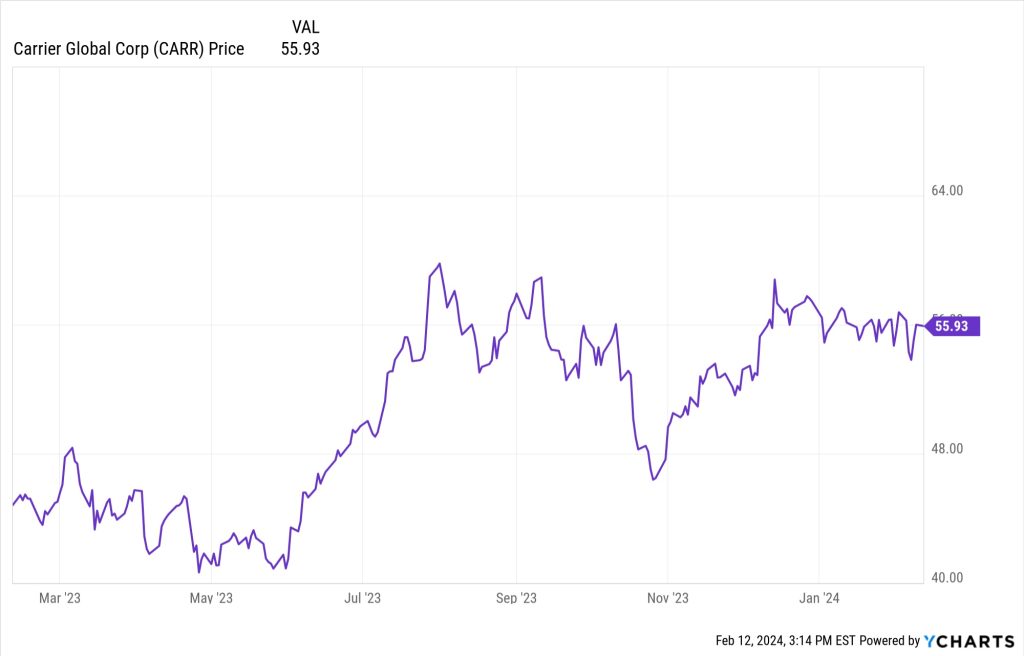

Service International (CARR) is, in fact, not likely an AI inventory in any direct approach… however Karim Rahemtulla teased it as an AI play in adverts for his Commerce of the Day service due to the massive calls for that AI is putting on information facilities, which implies that information facilities have to show to liquid cooling to deal with the surplus warmth from all these NVIDIA (and different) chips banging away at processing AI work. He pitched a number of “liquid cooling” shares, however Service International was essentially the most distinguished and is among the largest HVAC gear firms on this planet, with a robust and sustainable service and substitute enterprise in addition to some publicity to information facilities (although that’s nonetheless a comparatively small a part of their enterprise, smaller than the business or residential constructing markets). Rahemtulla additionally teased Daikin Industries, one other cooling big, in the identical advert, and possibly (clues weren’t sure) pitched DuPont (DD) and Air Liquide (AI.PA, AIQUY, AIQUF) for his or her publicity to liquid cooling for information facilities as properly — neither is at the same time as shut as CARR to being a “pure play” information heart firm, however there may be not less than a bit publicity to that enterprise.

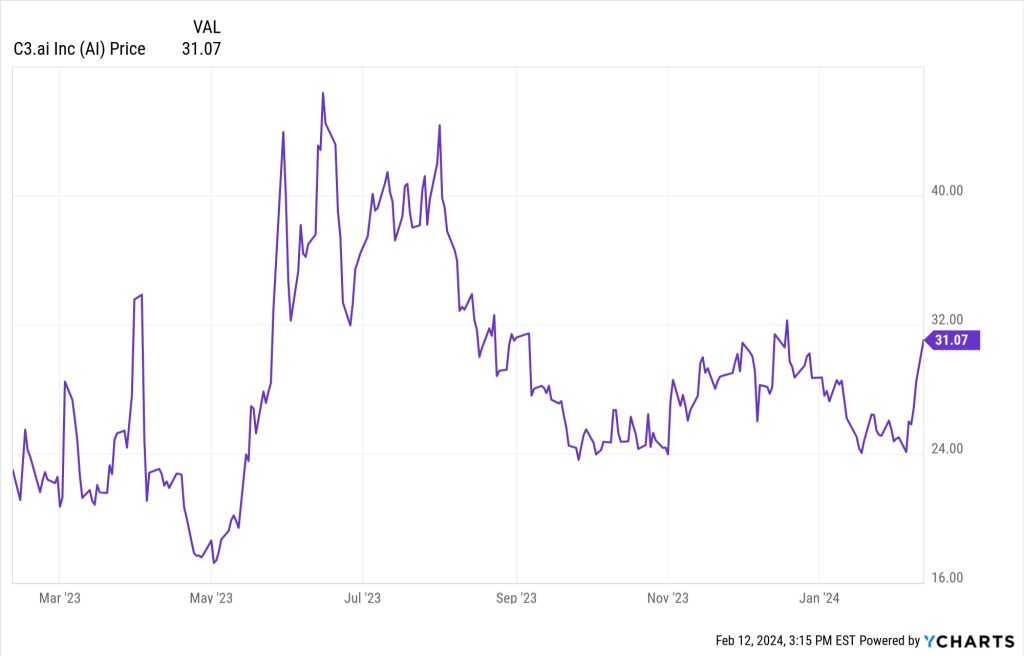

C3.ai (AI) was one of many preliminary shares to react strongly to ChatGPT and the instant fascination with generative AI late within the Winter — partly as a result of it’s received the very best ticker image of all, I think about (all the shares that add “.ai” to their title caught not less than a bit consideration, together with BigBear.ai). The large push for C3.ai in teaser world got here forst from Enrique Abeyta at Empire Monetary, he teased it closely beginning in mid-March round $21, in a pitch that was repeated not less than by April. Abeyta was keyed in to the truth that C3.ai launched a chat bot-style product this Spring, comparable in some methods to ChatGPT, and he thought that may drive curiosity… maybe it has. (Abeyta went off on his personal after Empire Monetary shut down, he has lately began a brand new publishing firm known as HX Analysis).

And Dylan Jovine, although he was primarily pitching Palantir, additionally teased and beneficial C3.ai in his “dwelling software program” pitch beginning in late March, round $26, and persevering with not less than by August, when it was round $40, near the height of the mania for that specific title (not less than thus far — I’ve seen this advert extra lately, as properly). His pitch was defense-focused, so he talked up the AI-driven predictive plane upkeep product they promote to the navy.

Right here’s how I summed up my opinion of that one:

“… it’s a lot smaller than Palantir, extra “pure play” AI, however has struggled to develop its buyer base so it’s not practically as near changing into persistently worthwhile and never rising very quick this 12 months. I don’t belief C3.ai to construct or hold these buyer relationships, given the dramatic discount in income development, so I’d must see them construct on that income development earlier than I’d take into account the inventory. “

Daikin Industries (6367.T, DKILF, DKILY) was teased by Karim Rahemtulla in his Commerce of the Day service adverts about liquid cooling for information facilities — fairly much like his pitch for Service International (CARR) in that very same advert, and the 2 firms are very comparable (they’re the 2 international HVAC gear leaders, commerce at comparable valuations, and each have some publicity to information facilities as huge cooling prospects).

Deere & Co. (DE) was pitched by Porter Stansberry a couple of month in the past as a “fail-safe solution to play AI” due to their use of synthetic intelligence for (largely) autonomous and automatic tractors and farm gear. It was at about $400 on the time, and fairly cheap for a expertise chief, although additionally way more costly than all of its near-peer farm gear opponents around the globe. Right here’s a bit little bit of what I stated on the time:

“They’ve constructed up a robust stream of recurring income as they promote software program and repair on prime of the gear, and loved nice pricing (not in contrast to the auto makers) in recent times, although there appears to be a widely-held perception that the gravy practice is slowing, not less than for a bit bit, in all probability largely due to the impression of upper rates of interest on the farm economic system and on capital gear gross sales.”

He continued to pitch Deere because the 12 months went alongside, his particular report promo in late November known as it the “Apple of Agriculture” when he was promoting the thought of shopping for “AI Railroad” firms that profit from AI as an alternative of being direct performs on synthetic intelligence software program or {hardware}.

Digital Realty (DLR) received the “earnings” model of the A.I. spiel from Jim Pearce at Private Finance again in early July, at round $114… that is what I stated about that on the time:

“It is a pitch that the surge in demand for AI will result in extra want for information, which ought to profit the businesses who personal and handle information facilities and lease out that area. The “AI Enabler” he teases is Digital Realty, which is the oldest information heart REIT, and is at the moment in a bit little bit of strategic reset to cope with rising rates of interest — they’ve elevated their dividend yearly since going public in 2004, however they thus far have saved the dividend flat over the previous six quarters, and bought a bunch of inventory and a few belongings, as they fight to ensure they’ll cope with their capex wants and the debt maturities that may come up over the following few years. They face the identical challenges as numerous the opposite very giant REITs, as their price of borrowing will get dearer and so they must concern extra shares at increased dividend yields (and subsequently decrease costs), which dilutes present shareholders a bit… possibly they’ll be capable of turn into extra environment friendly or increase their costs greater than they’ve lately, to enhance per-share money move and allow them to get again to elevating the dividend, however for the previous few years it has been a gradual grower, and the present rate of interest atmosphere makes me fairly cautious about DLR and its near-peers within the “expertise infrastructure” REITs — they’ve nice belongings, but it surely’s exhausting for them to lift costs quick sufficient to maintain up with their working prices and their curiosity payments. Investor sentiment about DLR over the following 12 months or so in all probability relies upon totally on whether or not they can increase their dividend within the subsequent quarter or two (subsequent announcement ought to be mid-August), and on what occurs to prevailing rates of interest — excellent news is definitely potential on both entrance, however I don’t know the way seemingly it’s — proper now, they appear like a really common REIT, with a yield of 4.25% and a dividend that has gone up about 4-5% per 12 months over the previous 5 years.”

Docebo (DCBO) was the inventory that the Canadian outpost of the Motley Idiot stated “could possibly be the following NVIDIA” in a barrage of late-August adverts, when the inventory was round $42 — the AI connection is thus far fairly restricted, although that would change. Right here’s what I stated on the time:

“Docebo is concerned with AI however in a reasonably restricted approach up to now, growing AI techniques to assist them create higher studying and coaching packages for his or her company prospects (Docebo sells a cloud-based studying administration system for training and improvement of staff). I don’t know in the event that they’ll be an A.I. barnburner, however they do have stable longer-term contracts for his or her SaaS platform, with rising income and good buyer retention, so it’s fairly potential that they’ll be capable of develop into their pretty wealthy valuation, particularly as a small firm.”

DCBO additionally made it into Motley Idiot Inventory Advisor Canada’s listing of smaller A.I. shares that was pitched a number of instances final Fall — the Canadian fools used Docebo because the headliner of their very own “A.I. Disruption Playbook” in November, which is all small-cap shares (the US Idiot’s comparable Playbook is all mega-cap shares). The advert continues to make the rounds now.

Evolv Applied sciences (EVLV) was pitched by Shah Gilani in August at round $6.25, as a part of his “Three AI Breakthrough” shares advert — this one was known as a “Public Security AI” story, and we’ve been teased with so many of those safety screening shares through the years, all of which turned out to be junk, that I’m at all times a bit cautious with such concepts. Right here’s how I described them on the time:

“Evolv makes safety screening {hardware}, largely for stadiums and faculties at this level, and so they have had preliminary success in constructing a reasonably good buyer base, and it ought to have a very good money move profile due to the longer-term contracts of those techniques and the continued subscription price and improve potential, although it’s not but sufficiently big to point out any actual scalability within the enterprise.”

Excscientia (EXAI) was pitched as a “main AI drug discovery” inventory by Keith Kohl — he known as them the “Algo Meds” chief in an advert we coated only a few weeks in the past. The second-best match for that tease was Recursion Prescribed drugs (RXRX), which we’ve additionally briefly touched on earlier than (scroll down for that one).

Right here’s how I summed up that one…

“AI drug discovery shares will virtually definitely require endurance — even with a bit assist from synthetic intelligence, the drug improvement and approval course of requires discovering and treating sick sufferers and monitoring the outcomes over time, so it strikes fairly slowly and prices a ton of cash. As is at all times the case with biotech, I do just like the long-term royalty potential (most drug discovery corporations negotiate a royalty on any drug they uncover which a companion develops), and I agree that Exscientia sounds fairly compelling as a long-term hypothesis, however I attempt to reasonable my curiosity in that far-future income with the truth that I’m approach out of my league on the science aspect, so if I purchase these shares that in all probability means I’ll be shopping for them from somebody who is aware of much more than I do… which doesn’t really feel like a fantastic thought. “

Extra lately, I wrote a couple of comparable teaser pitch from Alex Inexperienced on the Oxford Membership, who stated that he thinks Exscientia (EXAI) “will turn into a very powerful AI firm on this planet”.

Fortinet (FTNT) was the cybersecurity firm teased as a part of Louis Navellier’s “AI Blueprint” late final 12 months, and it’s a inventory he has teased within the pre-AI days in addition to a a cybersecurity chief. Just about all of the main firms on this area use some AI to attempt to sustain with the black hats, although CrowdStrike (CRWD) has additionally been talked up as an AI beneficiary and has had a significantly better 12 months than FTNT — CRWD was teased in 2023 by the Motley Idiot, although not particularly as a synthetic intelligence play.

FuboTV (FUBO) was teased as “the Nice $2 AI Moonshot” by LikeFolio Investor in adverts that we coated again in July, when it was round $2.80. Additionally they known as this one an “AI TV” inventory, and so they pitched it largely as a result of they noticed it getting a groundswell of social media consideration.

FUBO has fallen HARD in recent times, after an preliminary surge of enthusiasm once they went public… right here’s what I stated about this pitch again in July:

“FUBU has a bit little bit of an AI connection, not less than tangentially, of their means to personalize streaming TV and do issues like acknowledge gamers on the sphere in a sport. At coronary heart, FUBO is a ‘cable TV substitute’ whose sports activities focus is a solution to stand out in advertising and marketing (although all reside streaming choices deal with sports activities, as a result of advertisers love reside collective occasions), and I’ve a tough time believing that they’ll compete with Alphabet and Disney in reside streaming, given the price of content material rights, but it surely’s not unimaginable — they only reported their first two quarters with a constructive gross margin, to allow them to not less than cost their prospects as a lot because it prices them to ship the content material now, for the primary time, which is a hopeful signal. Not satisfied, personally, even with fairly good development I’m unsure they’ll enhance their margins quick sufficient to turn into sustainably worthwhile sooner or later, and their restricted AI work isn’t sufficient to make an apparent distinction, however FUBO not less than seems to be so much higher in the present day than it did after I first seemed into the inventory two years in the past.”

FUBO has currently gotten clobbered by the rumored launch of a mega-sports streaming service by a number of of the bigger gamers, which could additional dent FUBO’s so-far-failed try to differentiate its streaming platform as essentially the most sports-focused possibility. They’re shedding out to YouTube TV in the mean time, thanks partially to YouTube’s NFL deal (Sunday Ticket), however they’re actually shedding out to just about all of the competitors, they only don’t appear to have the dimensions or the cash to compete with Hulu, Amazon Prime, YouTube, and even Paramount/CBS.

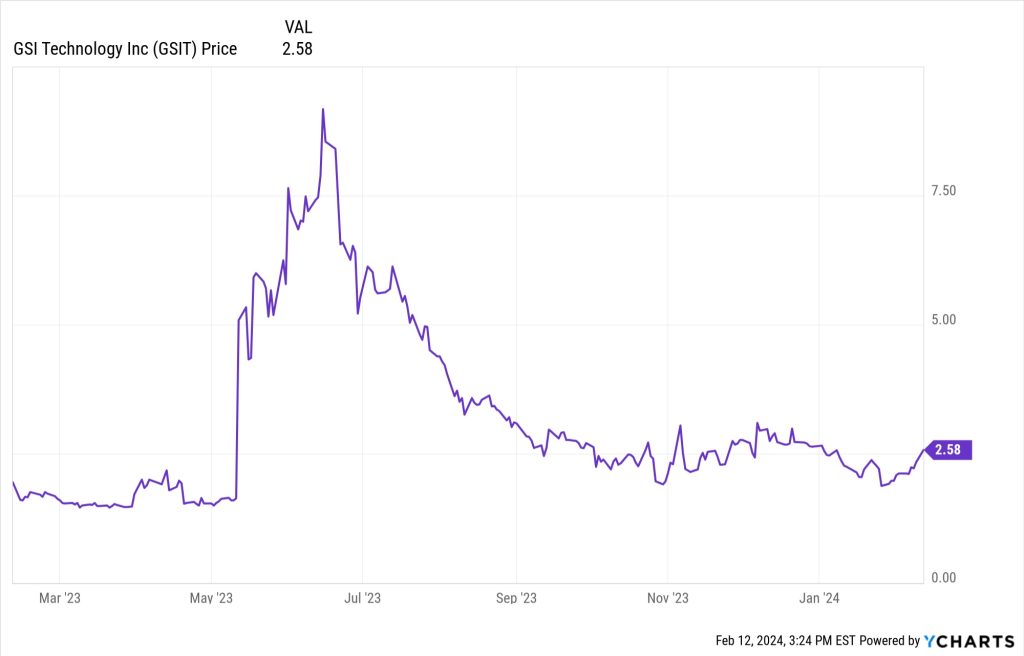

GSI Expertise (GSIT) was teased because the “NVIDIA Killer” final 12 months by Keith Kohl’s Expertise & Alternative e-newsletter. That is an previous vendor of military-grade reminiscence that started to transition to specializing in growing what they name APUs (Associative Processors) for AI 4 years in the past, designs that use reminiscence extra effectively, cut back CPU bottlenecks, and enhance speeds. Their preliminary product (Gemini I) apparently benchmarked properly however has had restricted orders in its first few years, and a way more highly effective new chip (Gemini II) is about to start out the preliminary testing course of (they anticipate to have the primary chips to check “early this 12 months” and have benchmarking information accessible in the summertime).

Hon Hai Precision Trade/Foxconn (HNHPF within the US) has been teased by Alexander Inexperienced on the Oxford Membership as his “single inventory retirement play” since mid-2018… however this 12 months, he began altering his adverts a bit to name it a “hidden AI inventory” as properly, largely as a result of, as a contract producer, in addition they assemble among the servers that firms are shopping for as much as gas their AI ambitions (true, however that is by definition a high-volume producer that’s been pushed by hit client merchandise, notably the iPhone, for many years, and that server demand is nowhere close to sufficient to make up for falling or decelerating gross sales of laptops and smartphones in recent times). The inventory is essentially unchanged since I final wrote about it — right here’s how I summed up my most up-to-date ideas on that inventory, which has been underwhelming for a really very long time:

“They’ve remained worthwhile, income per share has grown by virtually 50% in 5 years, and the following upcoming catalyst, with iPhone gross sales volumes down a little bit of late, is the hope that they’ll have a brand new surge by constructing the Apple Automobile finally (or different electrical automobiles), or that development in demand for servers will give them a bit income enhance (they construct servers, too, although it’s a small a part of their enterprise)… however internet revenue margins have fallen by 16%, so earnings per share have solely grown about 15-20% since 2018. 10-11X earnings might be nearly proper as the utmost valuation for this inventory except it good points extra leverage over the manufacturers who rent them for manufacturing. Since Inexperienced began pitching it because the “One Inventory Retirement Plan” in mid-2018, the inventory has supplied a complete return of about 32%, with all however 3% of that from dividends, lower than half of what you’ll have earned from holding a S&P 500 index fund (79%)”

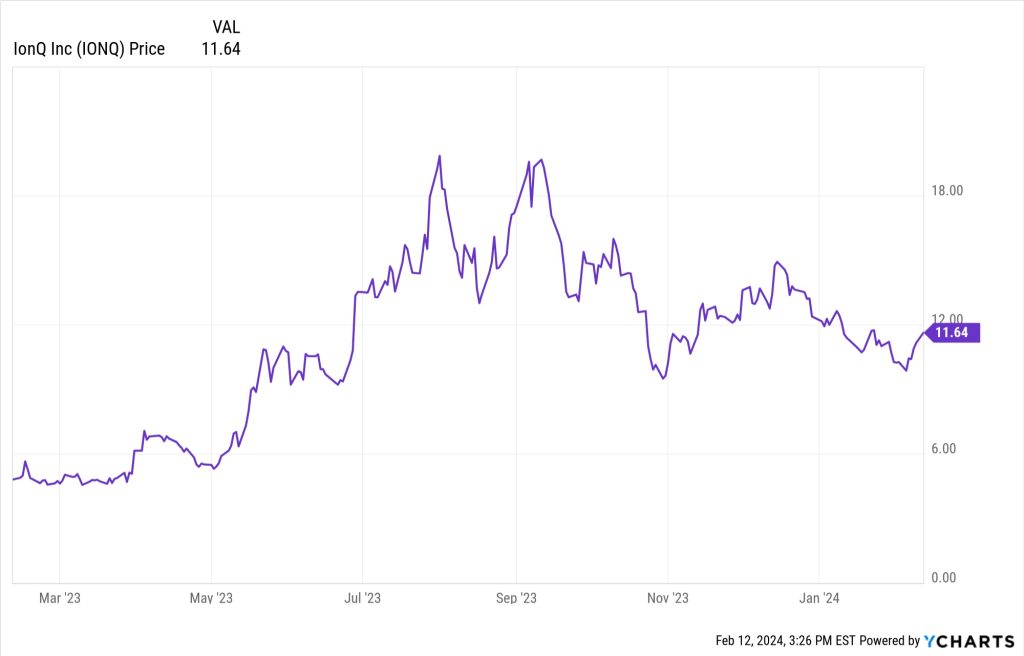

IonQ (IONQ) has been pitched by Luke Lango and his ilk within the “subsequent huge factor” enterprise for some time now, everybody desires to get in early on no matter business quantum computing finally ends up wanting like a number of years from now, and IONQ has been essentially the most mature “pure play” on that theme. He additionally prolonged the argument to say that in some way the elevated computing energy of quantum computing will result in these new machines dominating AI processing, although that strikes me as much more of a “approach off sooner or later” argument. The most recent pitch of his on that entrance was again in March, at round $5, so it has accomplished properly. The primary tease of his that we coated wasn’t technically an “AI” tease (this was the “Space 51” pitch he was making early within the 12 months, if that rings a bell), however IONQ was additionally teased in November as Lango’s “High AI Moonshot”

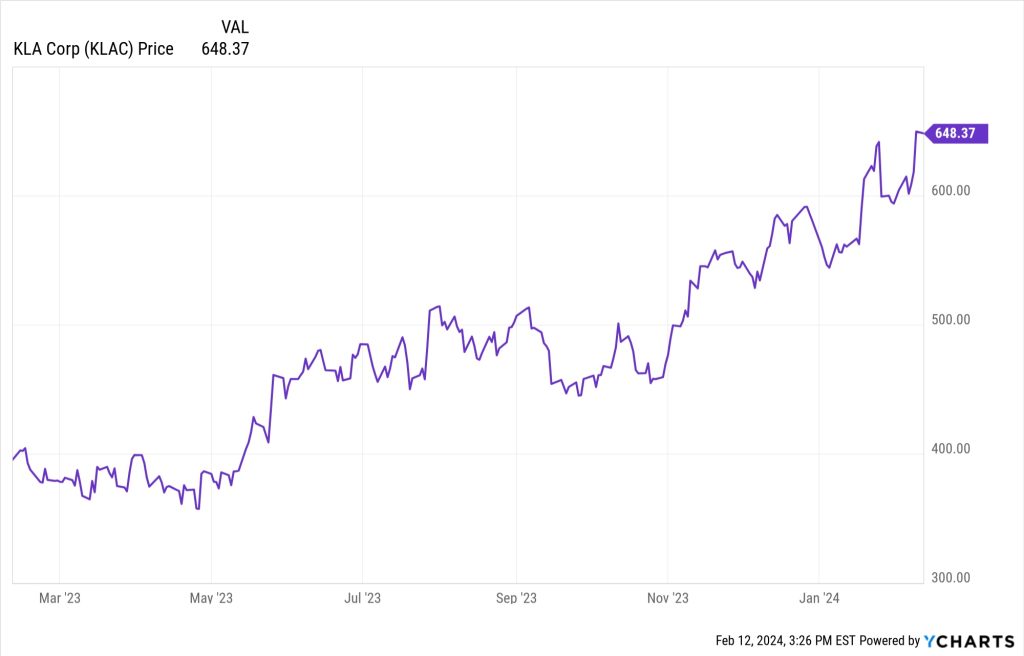

KLA Tencor (KLAC) was teased by Louis Navellier in December as an “AI Blueprint” play on the semiconductor market, largely as a result of the necessity for extra advanced AI chips will enhance the demand for KLAC’s chip testing gear.

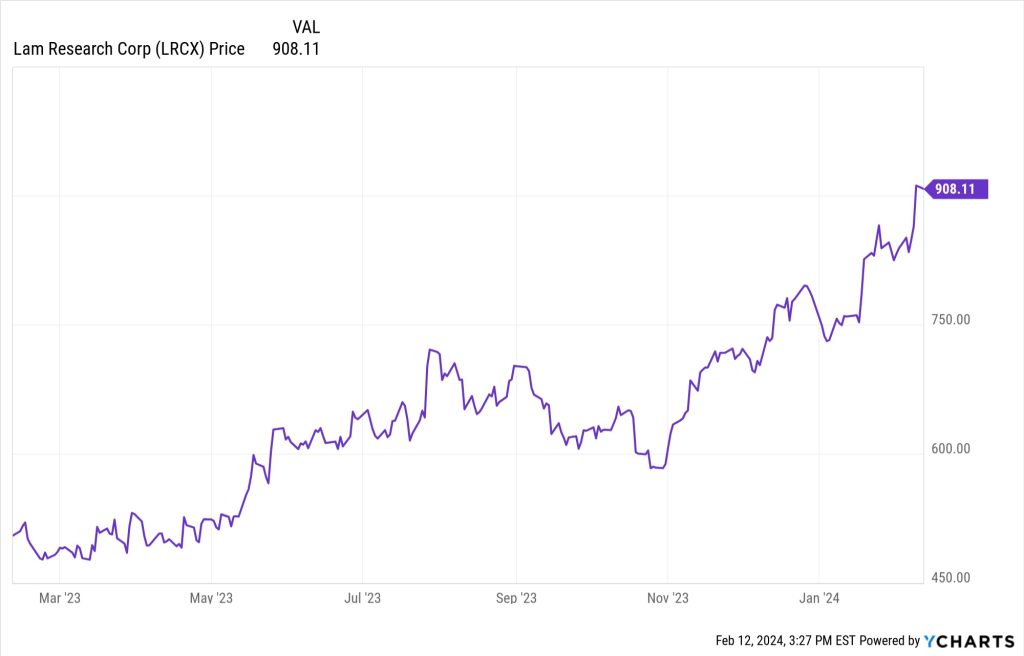

Lam Analysis (LRCX) is an gear maker for the semiconductor trade (as is ASML, famous above), and like most such firms Taiwan Semiconductor (TSM) is certainly one of their most vital prospects… they had been teased because the “Cisco of AI” by Teeka Tiwari as a secondary choose in his “Elon’s provider” pitch for TSM, in adverts that began operating again in September.

Meta Platforms (META) is among the leaders of AI however hasn’t been one of many most-teased names in that area over the previous 12 months — the one closely promoted teaser advert that targeted on META lately was the Motley Idiot’s “AI Disruption Playbook” advert for Motley Idiot Inventory Advisor.

META has been in that “playbook” for years (it was initially NVDA, GOOG and META, then they began gifting away NVDA totally free and added AMZN as the opposite “secret” inventory. And among the many very giant cap firms, META has been the largest non-NVDA winner over the previous 12 months… although which will primarily be as a result of it was fairly beaten-down and hated earlier than that. It’s additionally arguably the most affordable or second-cheapest of the mega-cap tech shares (relying on the day, GOOG could be cheaper).

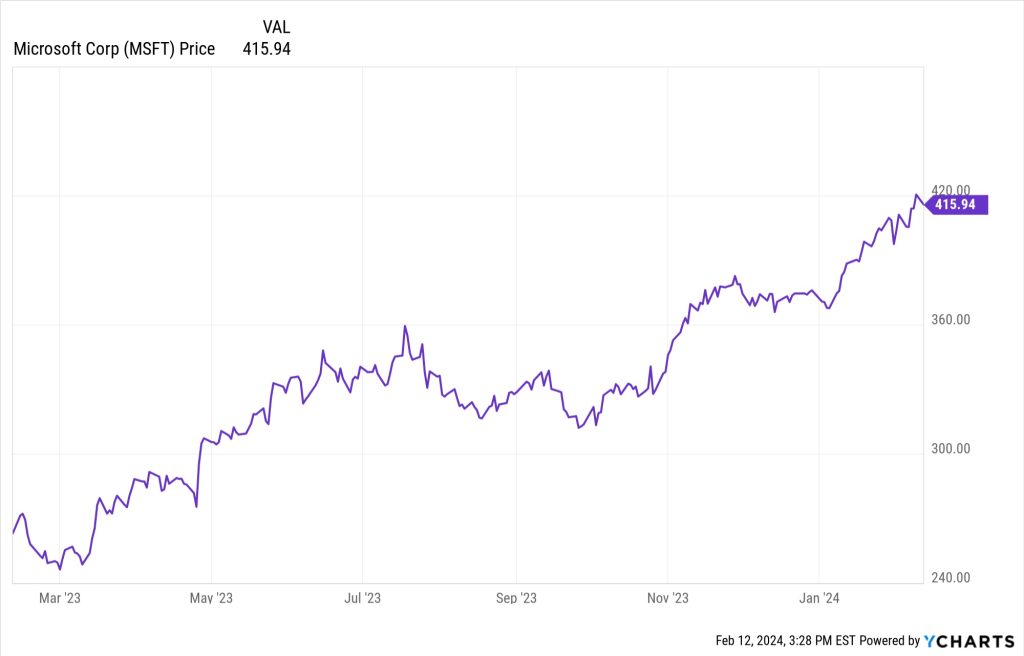

Microsoft (MSFT) has been, in fact, the poster baby for AI over the previous 12 months, largely as a result of they’re the largest financier behind OpenAI, which launched ChatGPT. The inventory was one of many first to surge in January, because the desires of AI-fueled Bing taking over Google search received everybody excited, and it stays properly above the place it was in January — it’s additionally an apparent story, so not many newsletters tried to “tease” it, however Luke Lango’s teaser pitch recommending Microsoft (MSFT) in mid-July known as it the “ChatGPT loophole” and implied that in some way shopping for Microsoft for that OpenAI publicity can be a “100X story”, and that looks as if fairly a stretch, but it surely’s not less than a stable firm with out the small (by MSFT requirements) funding they made in OpenAI. Right here’s what I stated on the time Lango pitched Microsoft:

“Sure, you can purchase MSFT for that OpenAI publicity — however the impression will virtually definitely be minimal within the subsequent few years. If OpenAI will increase in worth by 500%, that may imply a one-time $50-100 billion enhance for Microsoft, and that’s actual cash… but it surely’s additionally about what they make in revenue in a traditional 12 months. Perhaps it does higher than that, however even a 100% acquire for MSFT shares at this level can be a wild increase, we’re not speaking about life-altering 10,000% returns (100X) for MSFT shareholders being in any respect possible. Microsoft is clearly a fantastic firm, with a massively profitable and high-margin enterprise as they dominate company computing in so some ways, however I’m not notably thinking about investing at this valuation (PEG ratio of about 3.0), and it’s exhausting to see any urgency to purchase as a result of the impression of OpenAI is unlikely to be dramatic on their shareholder returns from this level.”

Mitek (MITK) was pitched as a part of the Motley Idiot Canada’s “Small-Cap Sleeper shares for the AI Increase” pitch in mid-December, promoting their expensive Market Go service — the corporate primarily sells software program for processing cellular test deposits, however their hope-to-grow enterprise is digital ID verification… and that does use some AI, although I wouldn’t anticipate a mega-boom in consequence. They’re nonetheless making an attempt to dig themselves out of some accounting quicksand, so their numbers will not be updated and there’s some comprehensible investor trepidation… however they’re in higher form now than they had been final Summer time, and are in all probability fairly valued once more if we are able to belief the numbers.

Mobileye (MBLY), which was purchased out by Intel years in the past after which resurfaced once they spun it out as an IPO late final 12 months, was, based on a number of Gumshoe readers, one of many Luke Lango “SUPRMAN” AI picks, although I didn’t cowl it on the time (he didn’t actually drop clues in regards to the “MAN” a part of that acronym, I had guessed that his “M” in that acronym could be Micron (MU), since AI initiatives and chipsets want numerous fast-retrieval information storage along with the “considering” chips). They’re primarily a play on {hardware} and software program to help autonomous driving, which was one of many first sorts of AI to get numerous consideration in recent times, and that’s a really aggressive area (although they’re the biggest present participant). They commerce at about 50X adjusted earnings in the mean time, which is a reasonably stiff valuation for a corporation that’s anticipated by analysts to develop earnings at 15-20% per 12 months, and the largest driver for the foreseeable future is prone to be automobile gross sales.

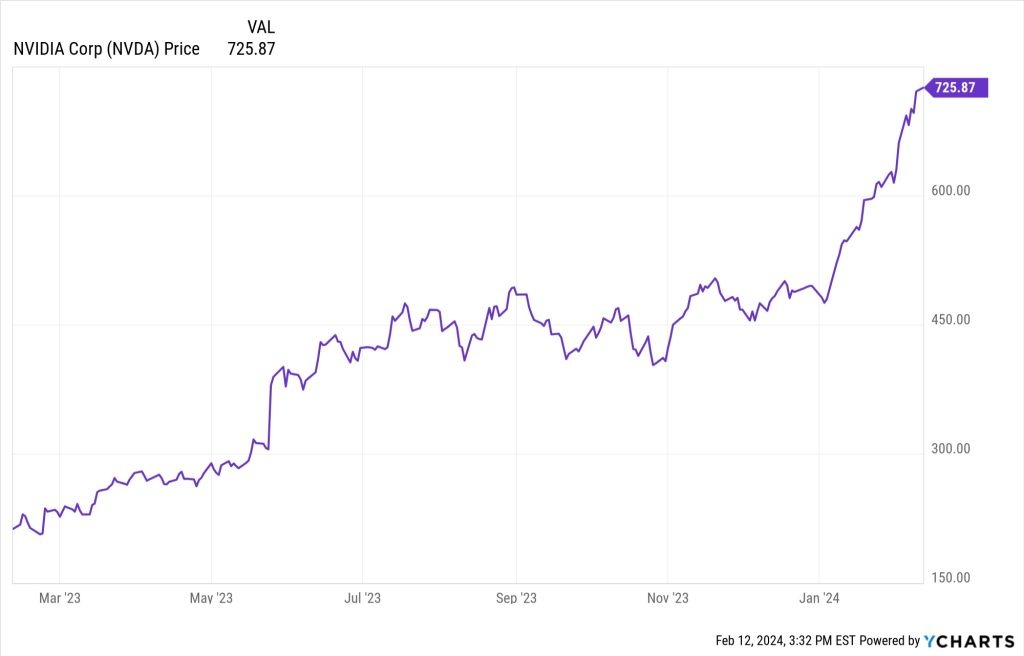

NVIDIA (NVDA) is, in fact, the actual poster baby for AI — and the inventory that put the entire market into hyperdrive once they introduced simply how absurd the demand was for his or her AI chips of their first quarter report, again in Could. The inventory has been beneficial by numerous newsletters through the years, with lots of them keying on the AI market as an enormous future demand driver, with the Motley Idiot the primary huge teaser of NVDA shares again in 2014 and has persistently teased this as an AI inventory for a few years, a part of their “AI Disruption Toolbox” extra lately, but when we solely return to the post-ChatGPT days these are the oldsters who pitched the present market chief:

Whitney Tilson teased NVDA in January, although that was technically for his “EoD” teaser advert, which was largely about e-commerce and the on-demand world. The inventory was only a hair beneath $200 on the time. He additionally pitched NVDA as certainly one of his 4 A.I. shares after issues heated up a bit extra, in April at about $270. Each have clearly accomplished properly, with NVDA hovering so excessive this 12 months.

And Louis Navellier pitched NVIDIA once more in July of this 12 months because the “A.I. Grasp Key”, which was in all probability the final word assertion of the plain, although, like many pundits, he has additionally touted the inventory many instances prior to now (his first teaser pitch for NVIDIA that I noticed was in late 2017, although that was targeted on NVIDIA GPUs being the “grasp key” for cryptocurrency miners, not AI initiatives).

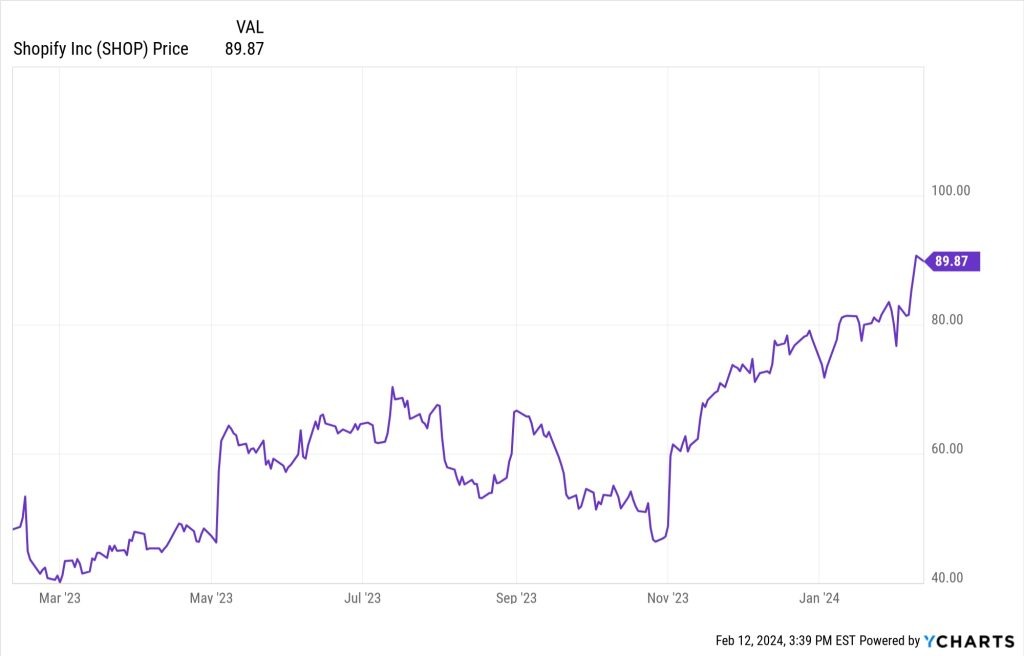

If we return a bit previous the flip of the 12 months, to late December of 2022, Andy Snyder at Manward Letter was additionally pitching NVIDIA as certainly one of his “metaverse” shares when it was round $150 — that advert will need to have been written earlier than ChatGPT was launched and fired everybody up, however he did point out AI within the advert, so he will get a spot on the listing (his different metaverse picks on the time had been Shopify (SHOP) and Unity (U), that are additionally on our listing in the present day however weren’t actually talked about as AI-specific concepts in his advert). For what it’s price, I’ve owned NVIDIA for years, and it has been a favourite choose of a fantastic many newsletters since not less than 2016-2017, however I additionally bought some within the run-up earlier within the 12 months because the valuation received (and stays) fairly nutty (my timing with NVIDIA has by no means been good, however the inventory has been an enormous winner within the Actual Cash Portfolio anyway).

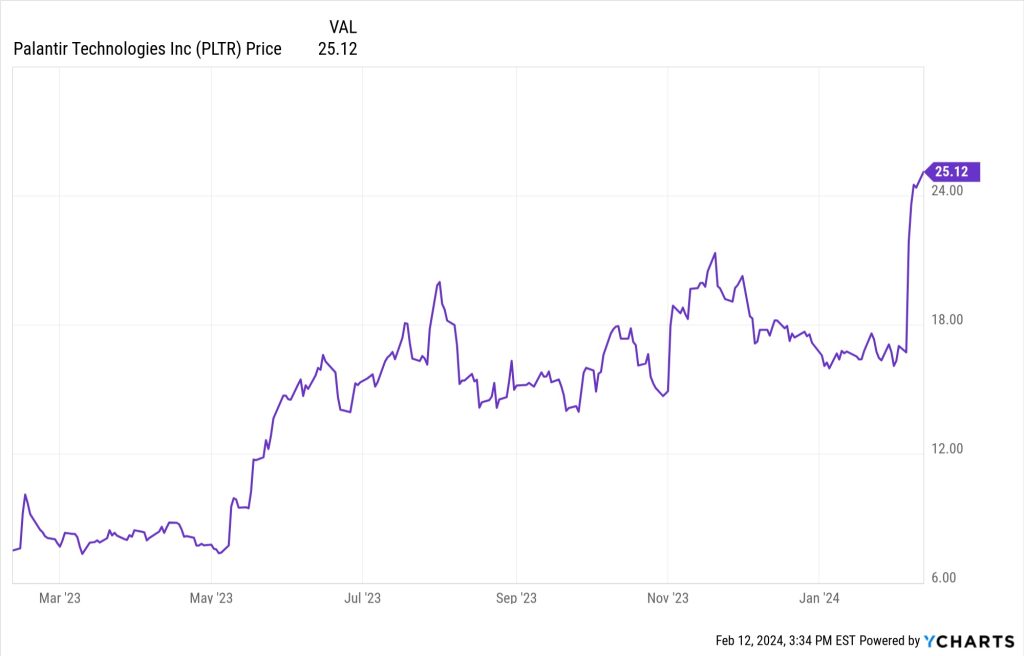

Palantir (PLTR) has lengthy been widespread as a “huge information” firm and a key contractor for presidency intelligence companies (and more and more for personal enterprise), however that’s not likely so totally different from an “AI” firm nowadays, the phrases all mix collectively while you’re making an attempt to push computer systems to make sense of big information units. It was touted because the “dwelling software program” secret weapon serving to Ukraine by Dylan Jovine beginning again in March, at round $8, and he was nonetheless pushing it with primarily the identical language and the identical advert with the inventory round $19 in early August.

Shah Gilani has been pitching Palantir, too, although I haven’t written about that specific spiel… and Luke Lango included Palantir as certainly one of his “SUPRMAN” AI shares that he teased in June. The inventory dropped to my “affordable” vary close to $15 for some time (I by no means purchased it, personally), however has lately soared a lot increased after a really well-received “beat and lift” earnings report in early February.

PayPal (PYPL) was pitched by Porter Stansberry for his Large Secret on Wall Road e-newsletter in late November, it was certainly one of his “perpetually firms” that additionally advantages from AI, so it fell beneath his “AI Railroads” tease (his particular report known as it, “The $1 Trillion Powerhouse”). The argument from Porter was largely that PYPL is affordable and owns an unbelievable group of fintech firms, together with Braintree — a budget half is undoubtedly true, PYPL nonetheless trades at a steep low cost to the broader market (about 12X ahead earnings), regardless of being a long-time fintech survivor and an trade chief.

Propel Holdings (PRL.TO, PRLPF) was pitched as a part of Motley Idiot Canada’s “A.I. Disruption Playbook” promo in November (which hinted at a number of small AI shares). Considerably much like Upstart Holdings (UPST), although a lot smaller, Propel is a fintech that claims it makes use of A.I. to facilitate lending to lower-income debtors.

Recursion Prescribed drugs (RXRX) was, I guessed, included in Luke Lango’s SUPRMAN tease in June, it’s certainly one of a handful of publicly traded firms targeted on utilizing synthetic intelligence for “drug discovery” to hurry up the seek for new remedies. The inventory briefly went bonkers a month or so later, largely as a result of NVIDIA partnered with them and purchased a small stake within the firm, however that has settled down dramatically since. It is a $1.4 billion firm that trades at 25X revenues, so it’s not for the faint of coronary heart — and their income isn’t prone to develop into something significant throughout the subsequent few years, so that is actually all in regards to the potential that their techniques might develop medication that flip into giant royalty windfalls within the extra distant future (AI drug discovery could be dashing up so much, however the precise FDA approval course of and the very long time lag of testing for security and efficacy in human beings, utilizing medical trials, isn’t going to speed up as dramatically, so any medication found by their system nonetheless must slog by approvals).

Shopify (SHOP) is clearly not likely a “pure play” AI choose, however Whitney Tilson included it in his “4 A.I. shares” pitch in mid-April at about $48, and it’s a inventory he had pitched prior to now as properly — they’re utilizing some generative AI to assist their e-retailer prospects create higher retailer experiences.

SkyWater Expertise (SKYT) was teased as a winner of the “A.I. Wars of 2024” by Eric Fry in adverts for The Speculator — extra particularly he seemingly beneficial choices on SKYT, largely due to rising curiosity in constructing semiconductor manufacturing amenities within the US, and due to the chance that SKYT will likely be one of many beneficiaries of CHIPS Act funding when that lastly begins to move from the federal government later this 12 months.

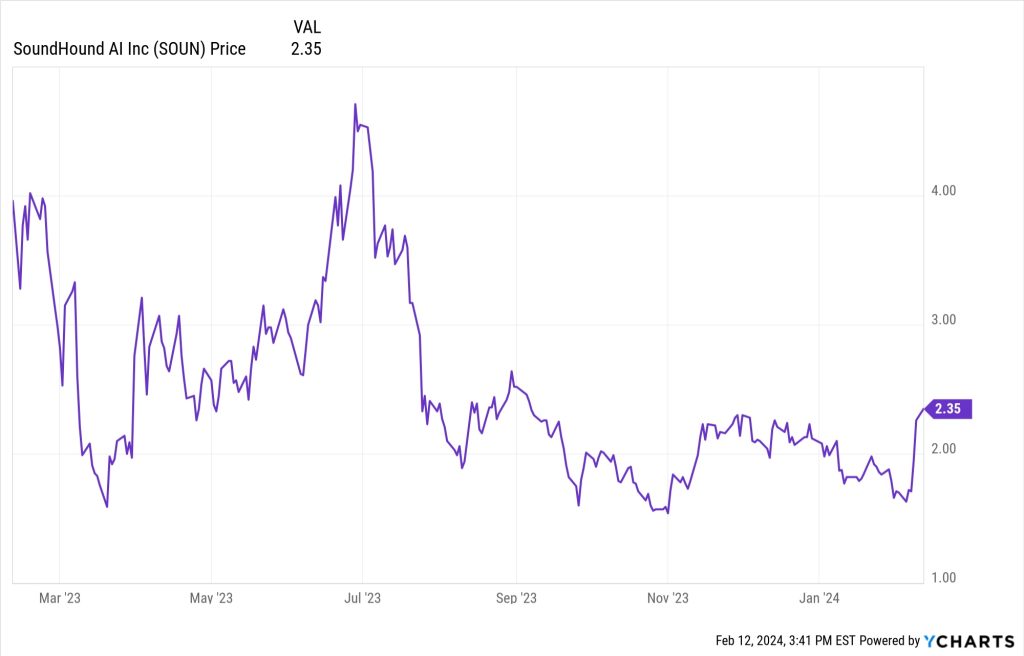

SoundHound AI (SOUN), previously referred to as SoundHound, has been teased by a pair of us this 12 months as a low-priced inventory with AI publicity — Ross Givens pitched it because the “$3 AI Marvel Inventory that May Make You 75X Richer” in early Could, and Jason Williams pitched that that purchasing the “tiny $2 inventory” SOUN in late June can be “like shopping for Google in 2004”. Right here’s what I stated about HOUN on June 26:

“We’ve checked out SOUN earlier than and my opinion hasn’t actually modified — they assume they’ll be near break-even by the top of this 12 months as new contracts are available in, and so they’re slicing prices and restructuring, however the income is simply so low that it’s exhausting to show the nook into changing into a viable enterprise except their partnership offers speed up a bit. Not unimaginable, however not so attention-grabbing to me at 20X gross sales.”

Tremendous Micro Laptop (SMCI) comes up usually as a sizzling AI inventory, and as a inventory that pundits declare to have beneficial as a result of it has gone up a lot — Louis Navellier has pitched the inventory within the extra distant previous, however most lately it was featured within the “NVIDIA’s Silent Companions” tease from Weiss Analysis, coated right here in January as a “saving A.I.” play on “NVIDIA’s crash” that they predict might occur by February 28, and Ian King might need teased it as his liquid cooling thought again in December.

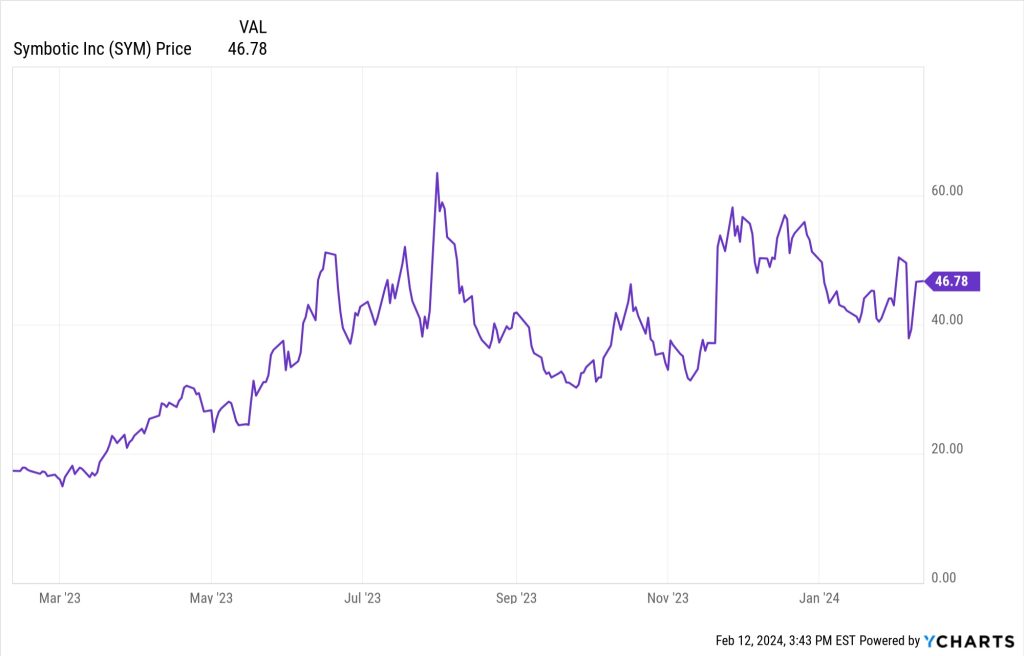

Symbotic (SYM) has been pitched a number of instances by Luke Lango over the previous 12 months, largely as certainly one of a package deal of AI picks (he known as it his “#1 AI Inventory to Purchase Proper Now” in early June, but it surely was additionally the “S” in his SUPRMAN listing of AI inventory picks that was teased a bit afterward, and, although I haven’t written about Lango lately, it seems to be prefer it may also be in his more moderen “acronym” pitches, like, based on certainly one of our readers, his “Hyperscale AI to Purchase Now” concepts.

Right here’s how I summed it up in June:

“They’re partnered with some giant grocery and mass market retail firms for administration of distribution facilities, with a system of proprietary robots and software program that successfully manages and breaks up pallets into items and strikes them to the precise place. The keystone buyer is Walmart, which is committing to automating all 42 of their distribution facilities, in order that undertaking, which is able to in all probability take 6-8 years, present some visibility into future income and earnings. Comparatively interesting as an actual enterprise, not simply AI hype, although in all probability a bit too inflated by the AI hype and a few enormous income development numbers in current quarters.”

Symbotic was additionally hinted at as a choose by Ian King for Strategic Fortunes in December.

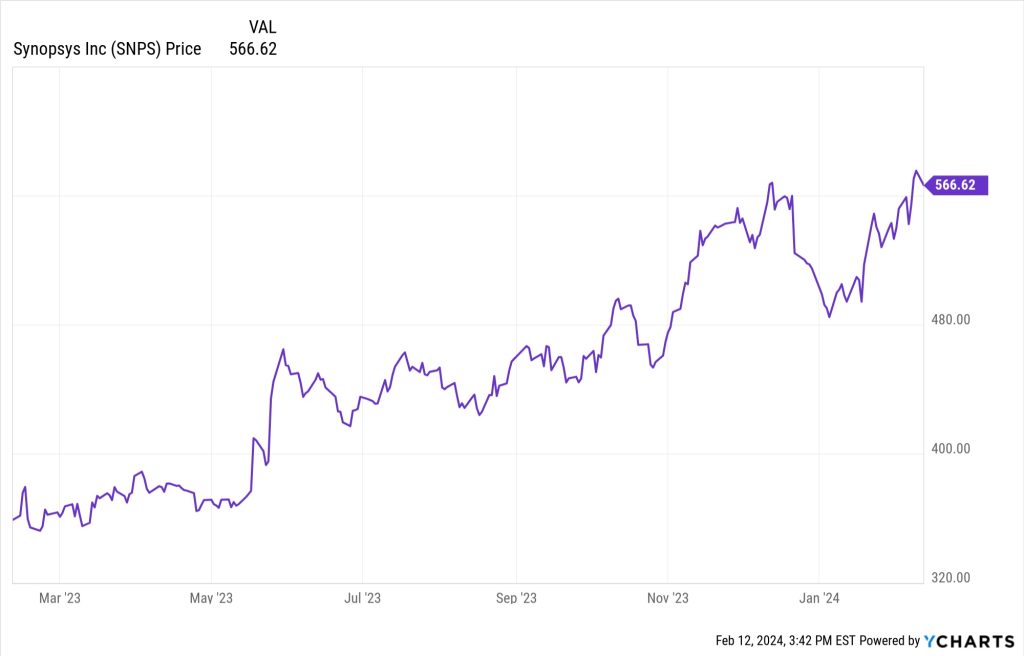

Synopsys (SNPS) was a freebie inventory advice made by Luke Lango in certainly one of his “AI Moonshots” adverts in November. They’re one of many two dominant suppliers of semiconductor design software program, together with Cadence Design Methods (CDNS), and each are robust development shares and are valued as such. SNPS and CDNS are primarily a play on the development of quicker improvement of semiconductor designs to fulfill the AI problem and of increasingly more firms designing their very own chips (and presumably outsourcing the manufacture of them to foundry suppliers like Taiwan Semiconductor, International Foundries, and many others.)

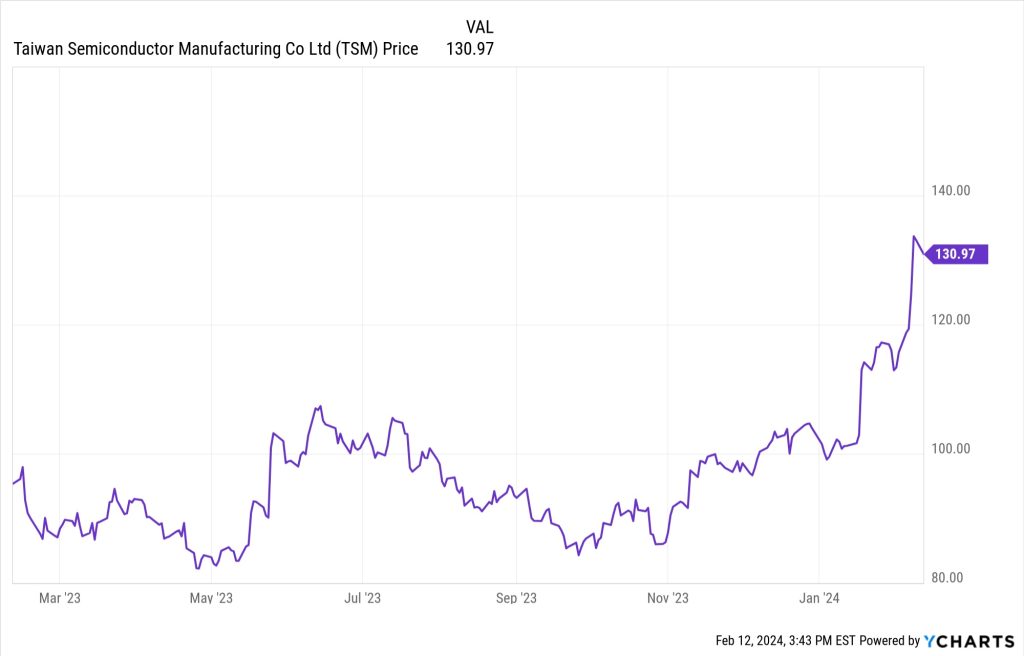

Taiwan Semiconductor (TSM) has been teased a number of instances as an A.I. choose, largely as a result of they’re the biggest and most superior foundry operator on this planet and, extra particularly, as a result of they make primarily all the high-end GPUs which can be at the moment used for synthetic intelligence initiatives (TSM is the first producer for each NVIDIA and AMD, in addition to for Tesla’s AI chips and plenty of others). The corporate has been beneath some stress as a result of in addition they make numerous much-lower-demand semiconductors, (their greatest buyer is Apple and so they’ve been damage by falling iPhone quantity, for instance), and is feared by many due to geopolitics and China’s saber-rattling over the Taiwan Strait… the loudest proponents final 12 months had been Teeka Tiwari, who pitched TSM beginning in September in his “neglect NVIDIA, purchase Elon’s provider” adverts (filmed on web site in Arizona, close to TSM’s advanced that’s being in-built that state), and in October by James Altucher, who teased TSM because the maker of “The A.I. Crown Jewel” (as a result of they construct these NVDA chips), and TSM additionally featured as the important thing “NVIDIA silent companion” teased by Jon Markman in January.

Thinkific Labs (THNC.TO, THNCF) was teased by Motley Idiot Canada’s Microcap Mission as certainly one of their “Microcap AI Sleepers” (the others had been Docebo and Propel Holdings, which we’ve famous above, Thinkific was the one new inventory in that mid-November teaser advert). This “holy grail of AI sleeper shares” sells a platform that lets social media creators develop digital merchandise to promote, like on-line programs… kind of an e-commerce intermediary, so much like Shopify in some methods, however for digital merchandise as an alternative of bodily ones.

UIPath (PATH) was one of many more moderen “new” AI inventory teases to start out this 12 months, we coated it in January as Eric Wade’s “#1 AI Inventory for 2024” (it was hinted at within the “Mission Dojo” adverts for Stansberry Improvements Report) — I described that as “an attention-grabbing SaaS firm in enterprise automation, simply rising into regular profitability now and with the potential to be a little bit of a breakthrough story if AI enthusiasm heats up once more.”

Ulta Magnificence (ULTA) was one other of Porter Stansberry’s “AI Railroads” inventory picks, teased in late November because the “prettiest inventory on Wall Road”— as with most of these “AI Railroads” picks (Deere and PayPal had been the others), the thought was that AI may assist the enterprise of this market-leading retailer… not likely that ULTA is in any approach a pure “AI Play”.

Unity Software program (U) was one other of Luke Lango’s “SUPRMAN” picks in June, when it was within the excessive $30s. The overall thought was that as Adobe (ADBE) is including generative AI instruments to its inventive software program suite (Photoshop, and many others.), Unity is doing one thing comparable with its inventive suite of real-time 3D video instruments (used for immersive 3D video, largely, however not fully, for video gaming and leisure prospects). Right here’s how I summed up my ideas on that inventory on the time (I do personal a small place):

“Unity isn’t actually instantly an ‘AI inventory’ within the public consciousness, although I assume it might turn into one…

“Unity screwed up their monetization platform final 12 months, what they now name Develop Options, by successfully shedding the information and having to rebuild it and in addition rebuild investor confidence. That put a pause on their march to profitability, and means they reporting odd professional forma development numbers this 12 months, however they do seem like again on observe now.”

They’ve had additional challenges since then, with surprisingly giant layoff bulletins and a bit hype about their potential connection to the Apple Imaginative and prescient Professional augmented actuality headset, so the inventory has been fairly risky, however is now again to about the place it was in June when Lango pitched it.

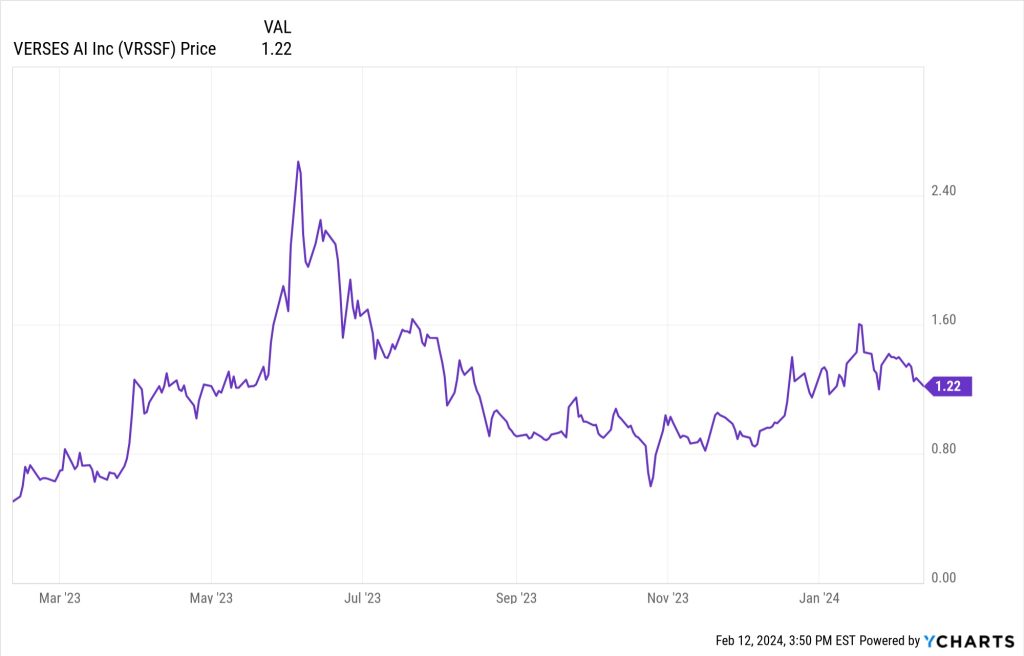

Verses AI (VERS.NEO, VRSSF) was one of many extra self-promotional AI “story shares” early in 2023, and is an actual penny inventory — I checked out it in June as a result of it was additionally teased by Tobin Smith at about $2, and Smith is a blast from our hype-filled previous. Right here’s how I summed up my ideas on that one:

“Verses AI is a cool story about an organization making an attempt to construct an working system for AI, creating an app store-like infrastructure, although they’ve thus far accomplished only a couple pilot initiatives, largely in warehouse administration, so numerous the story is using on merchandise that haven’t but been publicly launched. They’re nonetheless primarily pre-revenue, chewing by numerous money and sure needing to lift much more, and I don’t typically belief extremely promotional firms that spend extra on investor relations than they absorb as income, notably earlier than they’ve received some stable prospects and a transparent product “hit,” so I gained’t get entangled with this one. I’ll give them one other look in the event that they construct the income up within the subsequent few quarters and have some actual merchandise to debate. Good story, not sufficient substance but for my style.”

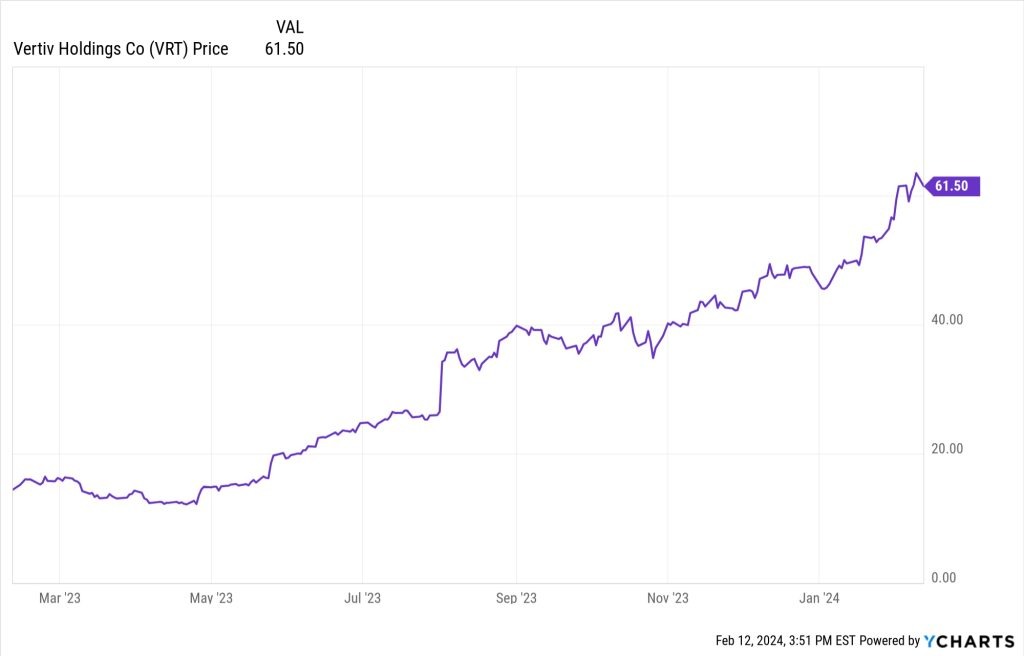

Vertiv (VRT) was in all probability one of many shares teased by Ian King as his “liquid cooling” performs in adverts in December, although he wasn’t particular sufficient to make sure. That’s an information heart providers firm which does certainly present cooling gear (in addition to providers to assist meet different information heart wants, together with energy, racks, monitoring gear, and many others.), and it’s each extra of a “pure play” than the final HVAC firms (Service, and many others.) and way more ambitiously valued because it began to get the “sizzling inventory” therapy from its AI connection beginning final summer time.

And that’s it for our A.I. alphabet over the previous 12 months… I assume we have to get some “Z” names teased by the e-newsletter brahmins so we are able to flesh out the previous few slots and actually get to an “A to Z” protection, however that’s loads to consider for now. These are the 50+ shares we’ve seen teased over the previous 12 months or in order synthetic intelligence performs, or have coated on this area as we’ve reviewed picks by varied newsletters — may you’ve gotten others that you simply’ve seen of us suggest and which we should always embody on the following replace to this listing, or favorites you need to speak or ask about? Our glad little remark field under awaits your enter… don’t fear, we don’t chew.

Disclosure: Of the businesses talked about above, I personal shares of and/or name choices on Alphabet, Amazon, NVIDIA, Shopify, Symbotic, UIPath, and Unity Software program. I cannot commerce in any coated inventory for not less than three days after publication, per Inventory Gumshoe’s buying and selling guidelines.

Irregulars Fast Take

Paid members get a fast abstract of the shares teased and our ideas right here. Be part of as a Inventory Gumshoe Irregular in the present day (already a member? Log in)