GOLD PRICE WEEK AHEAD OUTLOOK

Gold ticked down this week, however lacked robust conviction, with costs fluctuating aimlessly across the 50-day SMA, an indication of consolidationThe January U.S. inflation report would be the focus of consideration and a possible supply of market volatility within the week forwardThis text appears at XAU/USD’s technical outlook, analyzing vital worth thresholds value watching within the close to time period

Most Learn: US Greenback Eyes US CPI for Contemporary Alerts, Setups on EUR/USD, GBP/USD, Gold

Gold costs (XAU/USD) closed the week down roughly 0.75%, settling barely under the $2,025 mark, dragged decrease by the sharp bounce in U.S. Treasury yields seen in current days following a string of robust U.S. financial information, together with the January nonfarm payrolls report. For context, the yield on the 10-year U.S. bond was buying and selling under 3.9% final Thursday, however has now surpassed 4.15% in lower than seven periods.

GOLD, US YIELDS & US DOLLAR PERFORMANCE

Supply: TradingView

Earlier within the 12 months, the prospects for bullion appeared extra optimistic. Nonetheless, the bullish outlook has weakened, significantly after Federal Reserve officers started to coalesce across the stance that further strides in controlling inflation are vital earlier than starting to cut back borrowing prices, which presently stand at their highest degree in additional than 20 years.

For an intensive evaluation of gold’s basic and technical outlook, obtain our complimentary Q1 buying and selling forecast now!

Really useful by Diego Colman

Find out how to Commerce Gold

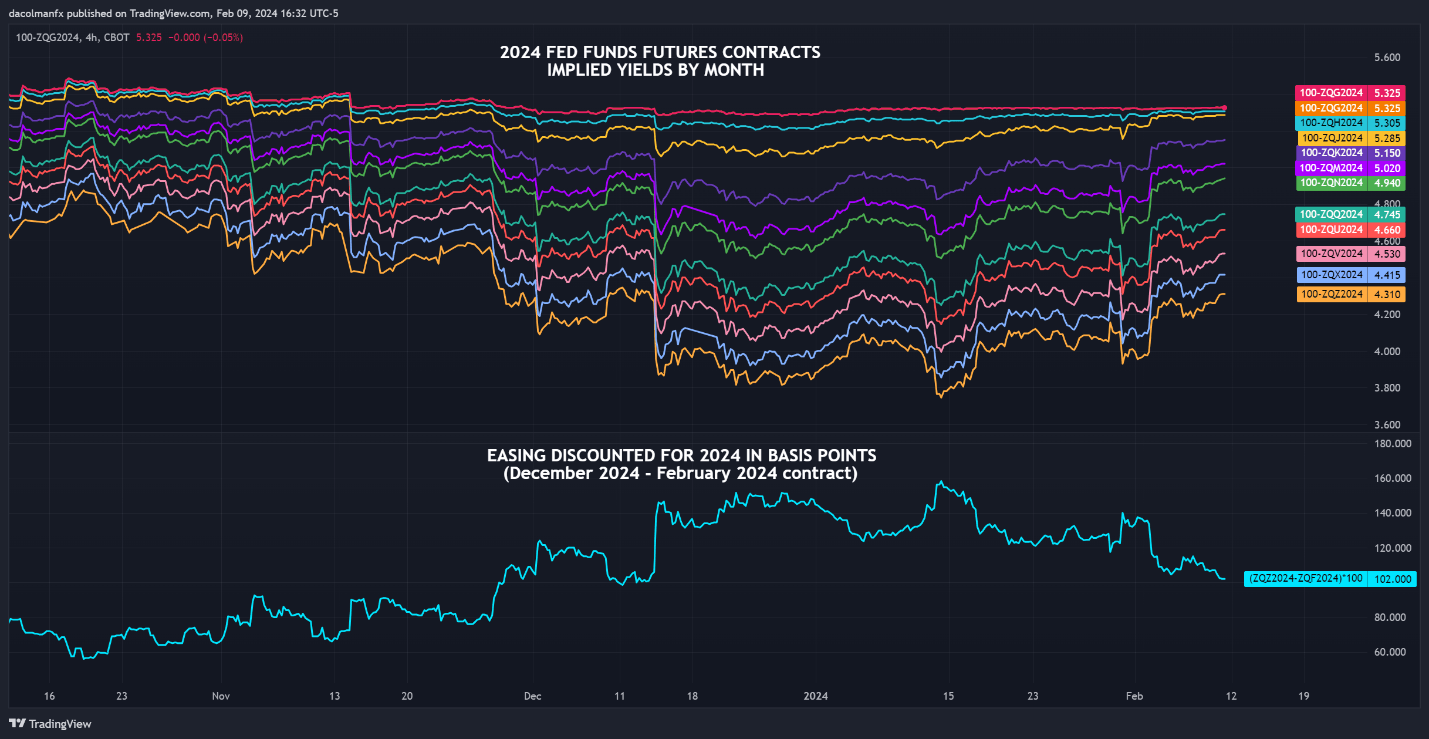

The central financial institution’s steerage has prompted the unwinding of overly dovish bets on the financial coverage path, as seen within the chart under. Merchants now low cost simply 102 foundation factors of easing for 2024, a pointy discount from the almost 160 foundation factors anticipated mere weeks earlier. The shift in market pricing has boosted the U.S. greenback throughout the board, creating an unfriendly setting for treasured metals.

FED FUNDS FUTURES – IMPLIED YIELD BY MONTH

Supply: TradingView

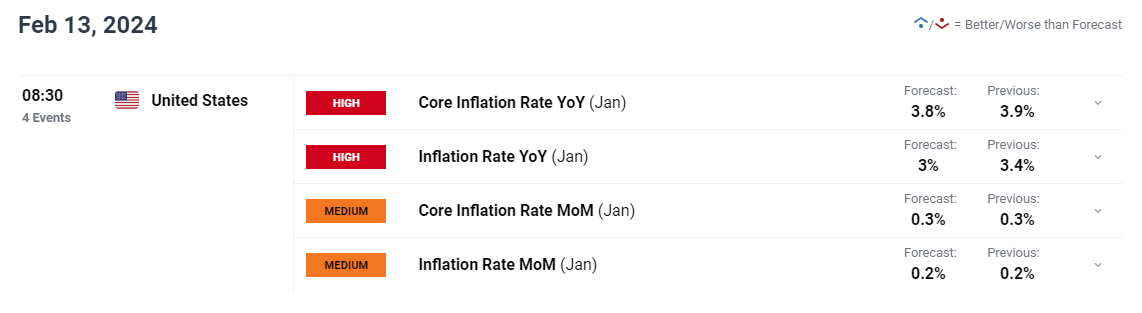

The FOMC’s present place to attend a bit longer earlier than eradicating coverage restriction may very well be validated if January inflation numbers, due for launch on Tuesday, reveal restricted inroads towards worth stability. When it comes to estimates, headline CPI is forecast to have cooled to three.0% y/y from 3.3% y/y beforehand. The core gauge can also be seen moderating however in a extra gradual vogue, slowing solely to three.8% y/y from 3.9% y/y in December.

UPCOMING US CPI REPORT

Supply: DailyFX Financial Calendar

If progress on disinflation falters or proceeds much less favorably than anticipated, U.S. Treasury yields are more likely to push increased, reinforcing the dollar’s restoration witnessed just lately. This needs to be bearish for treasured metals, not less than within the close to time period.

Conversely, if CPI figures shock to the draw back, the other state of affairs might play out, significantly if the miss is critical. This might result in decrease yields and a softer U.S. greenback, boosting gold costs within the course of. Whatever the end result, volatility ought to make an look within the coming week.

Questioning how retail positioning can form gold costs? Our sentiment information offers the solutions you’re on the lookout for—do not miss out, get the information now!

Change in

Longs

Shorts

OI

Day by day

13%

-15%

3%

Weekly

6%

-7%

1%

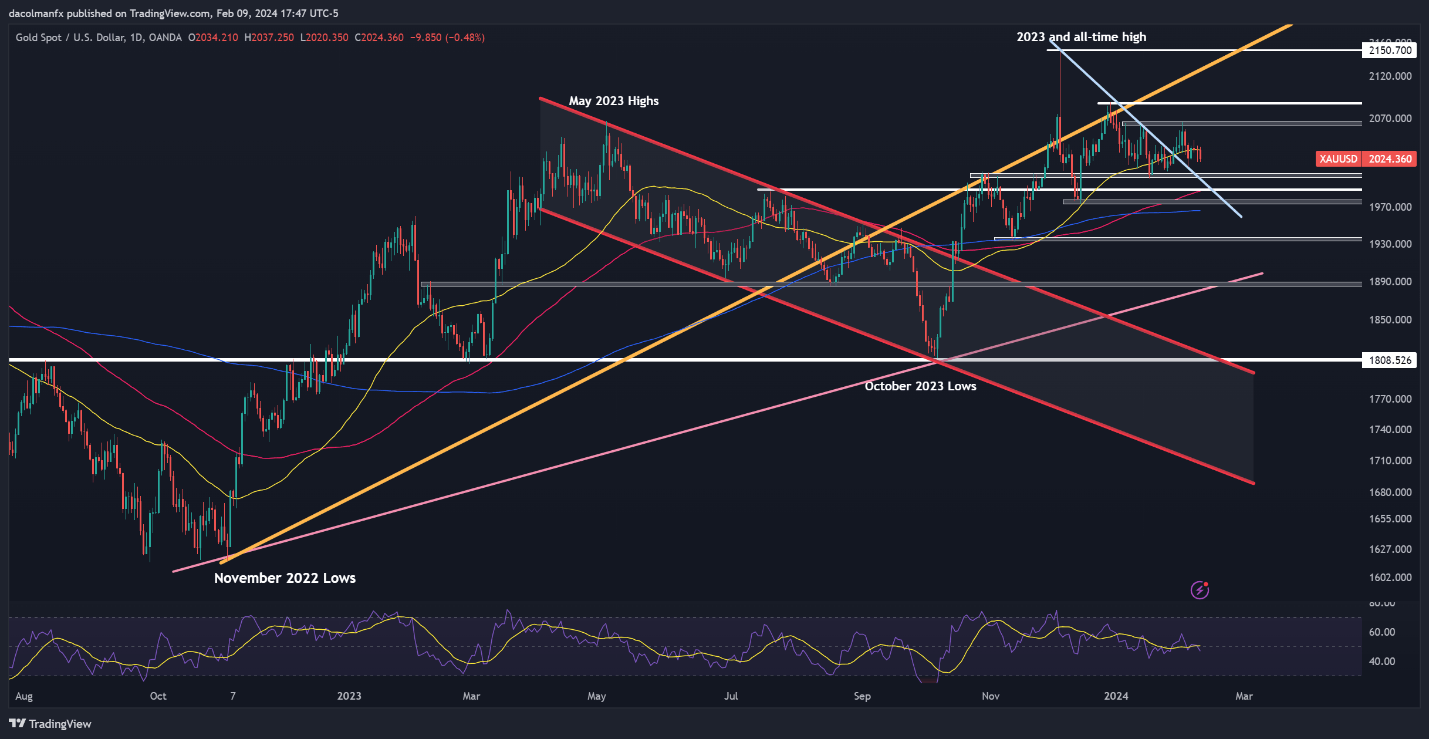

GOLD PRICE TECHNICAL ANALYSIS

Gold (XAU/USD) fell modestly this previous week, however lacked a robust directional bias, with the steel shifting up and down across the 50-day easy shifting common, a transparent signal of consolidation. The market’s lack of conviction just isn’t more likely to finish till costs both breach resistance round $2,065 or assist close to $2,005.

As for potential outcomes, a resistance breakout may set off a rally in the direction of $2,085 and presumably even $2,150 in case of sustained power. Then again, a assist breakdown may increase downward impetus, setting the stage for a drop in the direction of $1,990. On additional weak point, the highlight will probably be on $1,975.

GOLD PRICE (XAU/USD) TECHNICAL CHART

Gold Value Chart Created Utilizing TradingView

factor contained in the factor. That is most likely not what you meant to do!

Load your software’s JavaScript bundle contained in the factor as a substitute.

Source link