Article up to date on February 1st, 2024 by Bob Ciura

Spreadsheet knowledge up to date day by day

Retirees face distinctive challenges with regards to investing. First amongst these is the will to generate month-to-month revenue that is still comparatively secure every month. Mentioned one other means, retirees goal to create a passive revenue stream that may be very constant in nature.

One strategy to obtain that is by making a portfolio of dividend shares that generates the identical dividend revenue every month. This requires intentionally allocating a specific quantity of capital to securities whose dividends are paid in every calendar month.

With this in thoughts, we’ve compiled a database of all shares that pay dividends in February. You may obtain this listing under:

The listing of shares that pay dividends in February accessible for obtain above accommodates the next metrics for every inventory within the database:

Title

Ticker

Inventory worth

Dividend yield

Market capitalization

P/E Ratio

Payout Ratio

Beta

Preserve studying this text to be taught extra about utilizing the February dividend shares listing to enhance your investing outcomes.

Word: Constituents for the spreadsheet and desk above are from the Wilshire 5000 index, with knowledge offered by Ycharts and up to date yearly. Securities exterior the Wilshire 5000 index are usually not included within the spreadsheet and desk.

How To Use The February Dividend Shares Record to Discover Funding Concepts

Having a spreadsheet database with the names, tickers, and monetary traits of each inventory that pays dividends within the month of February may be extraordinarily highly effective.

This doc turns into much more helpful when mixed with a rudimentary information of Microsoft Excel.

With that in thoughts, this tutorial will exhibit how you should utilize the February dividend shares listing to use quantitative monetary screens to this database of dividend shares.

The primary display screen that we are going to implement is for shares that pay dividends in February with price-to-earnings ratios under 15 and returns on fairness above 20%.

Display 1: Worth-to-Earnings Ratios Beneath 15 and Dividend Yields Above 4%

Step 1: Obtain your listing of shares that pay dividends in February by clicking right here. Apply Excel’s filter operate to each column within the spreadsheet.

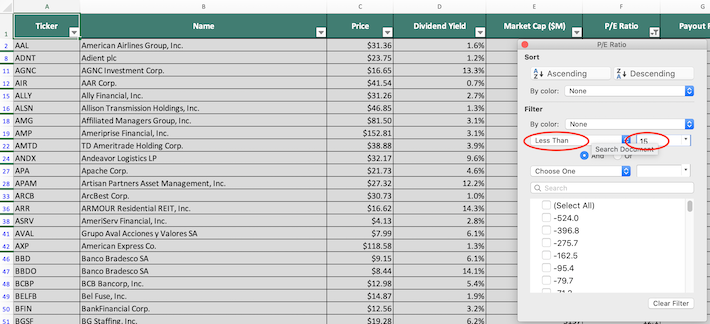

Step 2: Click on on the filter icon on the prime of the price-to-earnings ratio column, as proven under.

Step 3: Change the filter setting to “Much less Than” and enter 15 into the sector beside it. This may filter for shares that pay dividends in February that commerce with price-to-earnings ratios under 15.

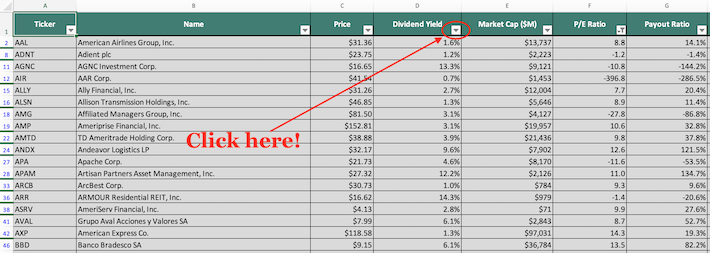

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on the filter icon on the prime of the dividend yield column, as proven under.

Step 5: Change the filter setting to “Larger Than” and enter 0.04 into the sector beside it. Since dividend yield is measured in share factors, that is equal to filtering for shares that pay dividends in February with dividend yields above 4%.

The remaining securities on this spreadsheet are shares that pay dividends in February with price-to-earnings ratios under 15 and dividend yields above 4%

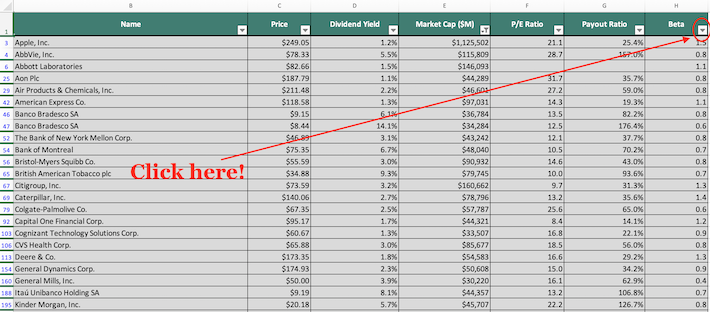

The following display screen that we’ll exhibit is for shares that pay dividends in February with market capitalizations above $25 billion and 3-year betas under 1.

Display 2: Market Capitalizations Above $25 Billion and 3-Yr Betas Beneath 1

Step 1: Obtain your listing of shares that pay dividends in February by clicking right here. Apply Excel’s filter operate to each column within the spreadsheet.

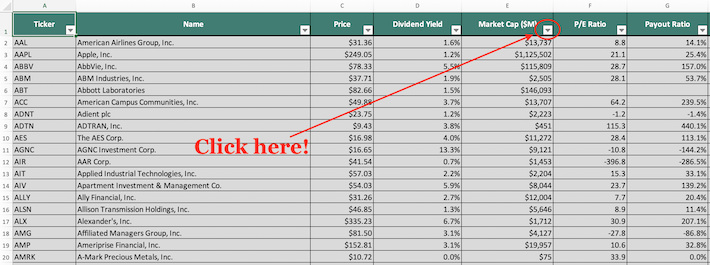

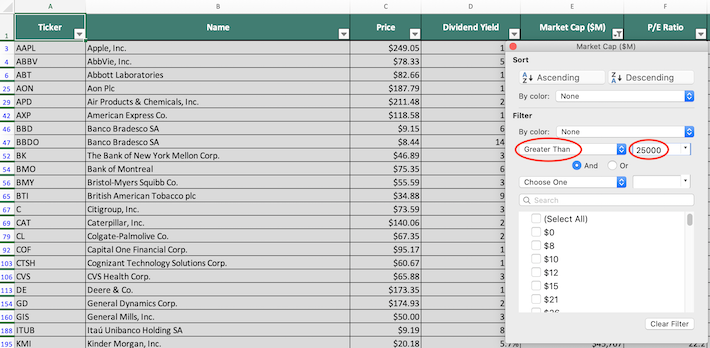

Step 2: Click on the filter icon on the prime of the market capitalization column, as proven under.

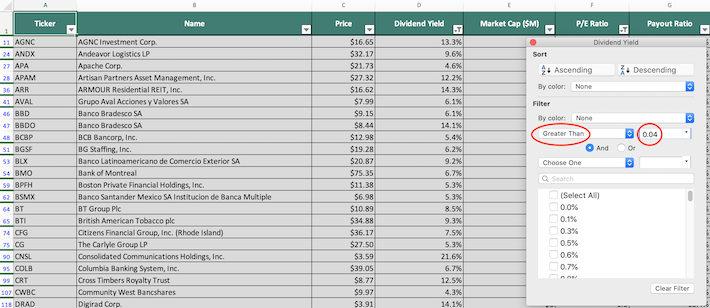

Step 3: Change the filter setting to “Larger Than” and enter 25000 into the sector beside it. Since market capitalization is measured in thousands and thousands of {dollars} on this database, that is equal to filtering for shares with market capitalizations above $25 billion.

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on on the filter icon on the prime of the beta column, as proven under.

Step 5: Change the filter setting to “Much less Than” and enter 1 into the sector beside it. This may filter for shares that pay dividends in February with 3-year betas under 1.

The remaining shares on this spreadsheet are shares that pay dividends in February which have market capitalizations above $25 billion and 3-year betas under 1.

You now have a strong, elementary understanding of easy methods to use the February dividend shares listing to search out funding concepts.

To conclude this text, we’ll advocate a number of various locations to search out high-quality dividend development funding alternatives.

Closing Ideas: Different Helpful Investing Databases

Having an Excel doc that accommodates the identify, tickers, and monetary data for all shares that pay dividends in February is kind of helpful – but it surely turns into way more helpful when mixed with different databases for the non-February months of the calendar 12 months.

Fortuitously, Positive Dividend additionally maintains related databases for the opposite 11 months of the 12 months. You may entry these databases under:

Having an funding portfolio that generates a roughly equal quantity of dividend revenue every month is essential for retirees.

It is usually essential to be diversified by sector. With this in thoughts, Positive Dividend maintains (and updates month-to-month) a free database for all 10 sectors of the inventory market. You may entry these databases under:

You might also be seeking to spend money on dividend development shares with excessive chances of continuous to boost their dividends every year into the long run.

The next Positive Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

The Dividend Aristocrats: S&P 500 shares with 25+ years of consecutive dividend will increase.

The Dividend Achievers: dividend shares with 10+ years of consecutive dividend will increase.

The Dividend Kings: thought-about to be the final word dividend development shares, the Dividend Kings listing is comprised of shares with 50+ years of consecutive dividend will increase

Should you’re searching for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

A final (and really complete) technique for locating funding alternatives is by wanting inside the key home inventory market indices. With this in thoughts, the next databases are helpful for the investor who’s prepared to roll up their sleeves and carry out some critical due diligence:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].